Sterling rebounds after Theresa May loses meaningful Brexit vote in UK Parliament

Summary

-

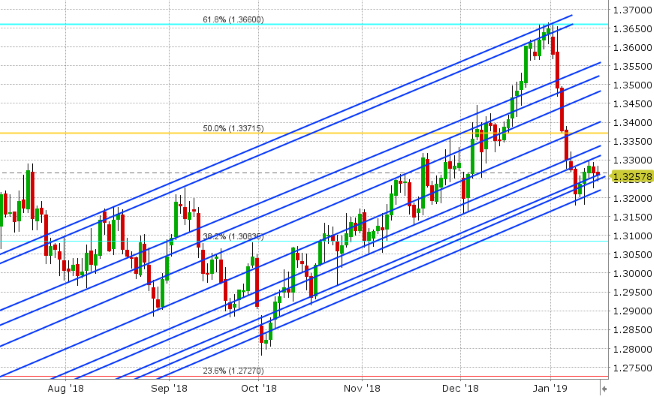

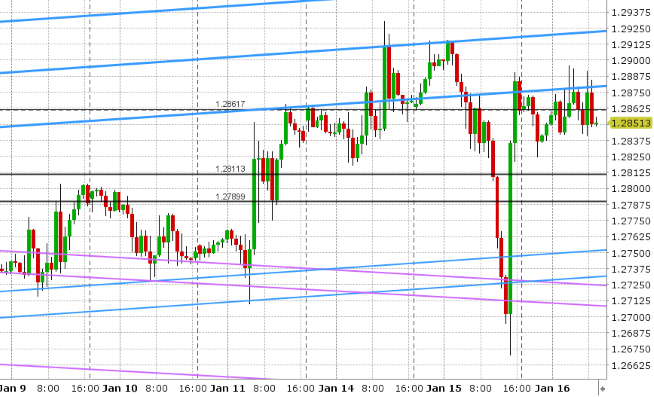

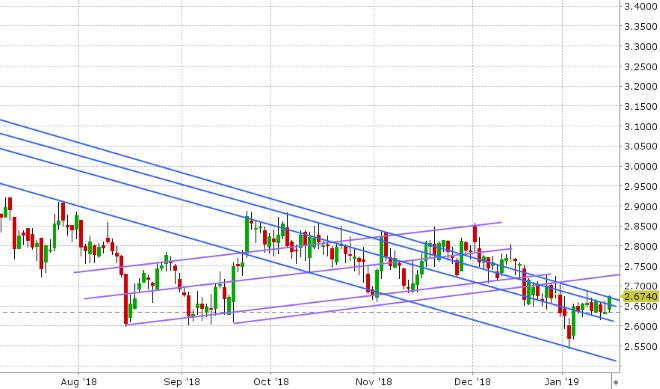

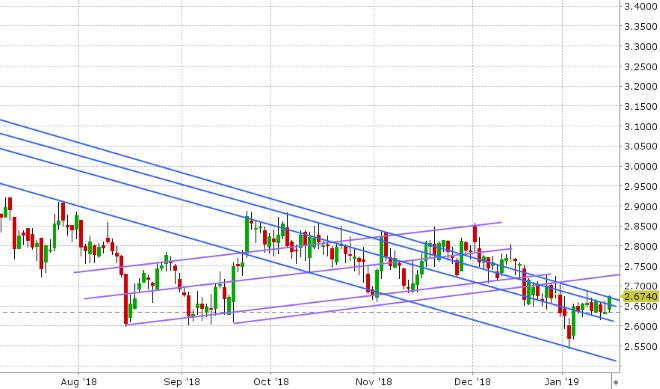

USDCAD: The range trade continues in USDCAD this morning after the market recovered back over the 1.3250s yesterday’s. The dip below this level was largely oil driven, as February crude made a run for the $52 mark, but the quick recovery was led by broad USD flows after GBPUSD succumbed to Brexit selling and EURUSD fell victim to more dovish talk from Mario Draghi. Today’s calendar is light once again, and so we don’t see a catalyst for USDCAD to break out of its range just yet, but with the upward sloping nature of our key trend-line levels, we see 1.3240-60 as chart support today and 1.3310 as resistance. The liquidation of CAD futures positions at CME continued for the 8th day in a row yesterday, leaving the market now over 22,500 contracts lighter since the beginning of last week (more at @EBCTradeDesk). The last update on COT positioning showed that the leveraged funds were net long USDCAD as of Dec 18th, and while the ongoing US government shutdown has delayed further updates to these figures, we postulate that liquidation we’ve been seeing in CAD futures is largely CAD shorts covering (USD longs getting out), and therefore odds are the fund community is now net short the market. The weekly EIA oil inventory numbers come out today at 10:30amET as usual, with traders expecting a draw of 1.5M barrels. Today is also when February options expire against the WTI crude oil contract, so we wouldn’t be surprised to see some volatility. Canada reports its December CPI figures on Friday.

-

EURUSD: The bounce in EURUSD was short lived yesterday after ECB President Mario Draghi drew further attention to slowing growth in Europe when he spoke yesterday. More here. These comments, along with chart resistance at the 1.1450 level, capped prices going into the London close. The swift wave of GBPUSD selling into yesterday’s Brexit vote didn’t help either we might add. The market has been choppy ever since…bouncing off support in the 1.1380s, hitting new resistance at the 1.1410-20 level, and is now bouncing off the 1.1380s once again. The European data points today haven’t been anything to cheer about if you’re long (an in-line read on December CPI from Germany [+1.7% YoY] and a 0.2% MoM slip in Italian Industrial Orders for November). We think sellers remain in charge here sub 1.1450.

-

GBPUSD: Sterling traders have a bit of hangover this morning after yesterday’s intense market volatility, both before and after the meaningful Brexit vote in UK Parliament. Sells stops appeared to have been tripped heading into the vote, which meant chart support all the way down in the low 1.27s got tested (something we outlined yesterday). The vote then turned out to be a landslide defeat for Theresa May (432-202). GBPUSD immediately fell 50pts lower, but this kneejerk move was short-lived and as soon as the market recovered these 50pts, we got what we call a “sell the rumor, buy the fact” trading scenario. In other words, the market got more or less what it expected, it couldn’t fall further after the bad headline, and so the trader becomes “why not buy it now”. The headlines and the media narrative that has followed the vote seems to have supported the rebound (odds of a no-Brexit scenario now diminishing), but again we think the bounce was more flow driven as opposed to headline driven. Labour leader Jereme Corbyn immediately called for a no-confidence motion against the government, and so traders will have another vote to watch out for today (expected at 2pmET). The positive here is that Theresa May and the Tory’s are expected to win this one, because reports claim the Tory’s and the UDP party (Northern Irish) are in no mood for another election. Once today is over and assuming Theresa May is still in power, the UK prime minister will have just 3 business day to table a “Plan B” for Brexit. This will put the focus on Monday for what happens next. While we think yesterday’s rebound in GBPUSD was technically “not bad” for the long GBP thesis since the AUDJPY flash crash, we don’t think traders did enough to confirm that buyers are back in control. We’d like to see firm close above the 1.2920s to confirm that. The UK reported slightly higher than expected December CPI figures this morning (+1.9% YoY vs +1.8%), but nobody is paying attention to this right now. Bank of England Governor Carney spoke earlier today and he thought the pound’s rebound shows that the prospects of a no-deal Brexit have diminished as well. Pound futures traders added over 6k contracts in new positions yesterday.

-

AUDUSD: The hunt for buyers in the Aussie continues today, after yesterday’s bounce off the 0.7180 chart support level was short lived. This now puts the 0.7150-0.7180 support zone under the radar in our opinion. EURUSD weakness and malaise on the part of US equity futures this morning is not helping the cause we might add. Copper prices are catching our attention this morning though (+1.35%), and so we’re watching to see if an AUD bid reappears. Australian dollar futures traders liquidated 2,370 contracts yesterday.

-

USDJPY: Dollar/yen had a choppy day of trade yesterday, but traders ultimately closed the market above the 108.50s, which boded well for price action heading into today. After a brief dip in Asian trade, USDJPY buyers have come back in and we’re now looking at a market that could very well test the low 109 level. Some broad USD buying in Europe seems to be helping today, as is the relatively calm bid to US equity futures at this hour. We think USDJPY could inch higher here, but it might be a bit of a stair step, and the 2600-2605 level needs to hold for stocks.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

February Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.