Schembri reiterates BOC's less dovish tone. China stimulates again. US & Canadian job reports on deck.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

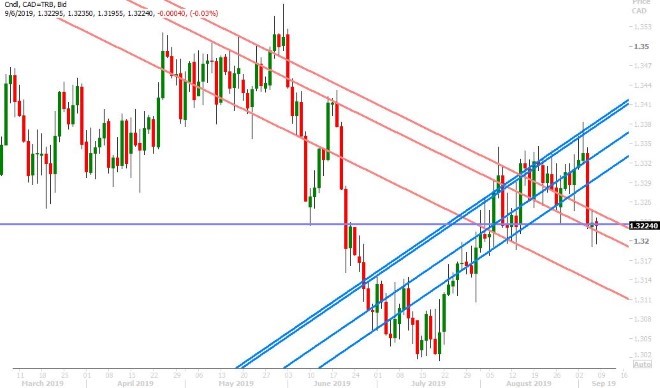

USDCAD

So the Canadian economy is doing just fine, according to the Bank of Canada’s Lawrence Schembri. The Deputy Governor told an audience yesterday that Canada is operating “close to its potential”; inflation has been “well behaved and controlled” and the economy has a “welcome degree of resilience to possible negative economic developments”. He said the biggest downside risk remained the US/China trade war but downplayed the inverted Canadian yield curve recession signal by saying it is “more likely a sign that investors foresee weaker long-term growth” (hmm, we’ll see about that). What is more, at no point did Schembri hint at rates cuts in the coming months, similar to the Bank of Canada’s press release on Wednesday. The OIS market took this as a queue to continue pricing out a 25bp cut on October 31 and so we now stand at just 32% odds. USDCAD, on the other hand, got a break from some better than expected US Non-Manufacturing ISM figures for the month of August (which came out a couple hours before the Schembri speech). This helped the market recover back above the 1.3215-25 level we talked about yesterday, and this seems to be the level traders are comfortable pivoting around now ahead of the August employment reports due from the US and Canada at 8:30amET. The expectations are as follows:

US Non-Farm Payrolls: +158k

Average Hourly Earnings: +0.3% MoM and +3.1% YoY

Unemployment Rate: 3.7%

Canadian Employment Change: +15.0K

Unemployment Rate: 5.7%

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Yesterday’s better than expected US Non-Manufacturing ISM took the wind out the sails for EURUSD, and the timing of the release coincided nicely with buyers failing at trend-line resistance in the 1.1070s. An attempt was made to regain chart support the 1.1040s in early European trade today, but this has failed as well, which means EURUSD trades with a heavy tone now heading into the US Non-Farm Payrolls report. The German bund is hovering around the -0.60% mark this morning. Former ECB Vice President Vitor Constancio told Bloomberg that the markets are expecting too much from the ECB. More here. We’re inclined to believe this, at least for next week’s ECB meeting, especially considering the delicate hand-off we think Mario Draghi is inclined to make for Christine Lagarde.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling is treading water here ahead of the US Non-Farm Payrolls report. Yesterday’s NY close was half decent, by virtue of GBPUSD staying above the 1.2310s, and while we’re seen some mild selling in the European AM, buyers have appeared again at horizontal support right beneath there at 1.2300. UK Prime Minister Boris Johnson is doing his best sound confident this morning by saying “I’ll go to Brussels and get a deal” and “we will get a deal on Oct 17-18 and come out of the EU”.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The rally continues in AUDUSD this morning, with the overnight catalyst coming from a Required Reserve Ratio (RRR) cut announced by China. They say it will unleash 900bln CNY in liquidity into the Chinese economy (which in our opinion needs it) and this is sending the off-shore Chinese yuan (CNH) and the China-sensitive Australian dollar higher. More here from Bloomberg. Traders, however, are trying not to get too ahead of themselves here though as the US Non-Farm Payrolls report looms.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen traders are fighting to keep the market above the 107.00 level after a shaky NY close left the market’s directional tone a bit uncertain heading into overnight trade. Over 2blnUSD in options will be expiring this morning between the 107.00 and 107.25 strikes, which could complicate the market’s post NFP reaction. JGB yields traded higher with US and German yields yesterday, as the whole world seemed to celebrate the better than expected US Non-Manufacturing ISM numbers. December gold prices got crushed too, as the “Fed rate cut trade” felt the need to pare its bets once again. We’re not getting too excited about this better US Non-Manufacturing ISM number just yet, mainly because these numbers see-saw up and down from month to month, the trend is still down from the middle of last year, and Markit’s take on the US Services sector (a competing report to the ISM report) came in weaker than expected for the month of August.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.