Rumors of Theresa May no-confidence vote rattles GBP

Summary

-

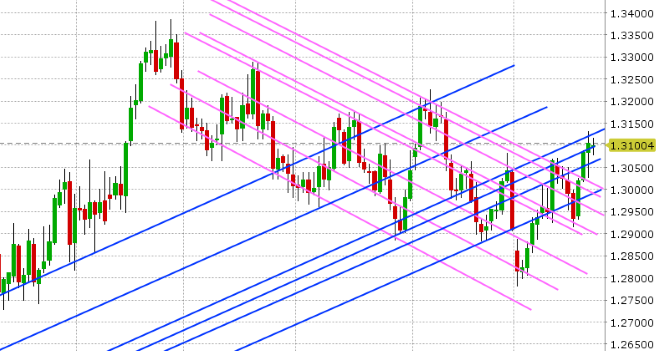

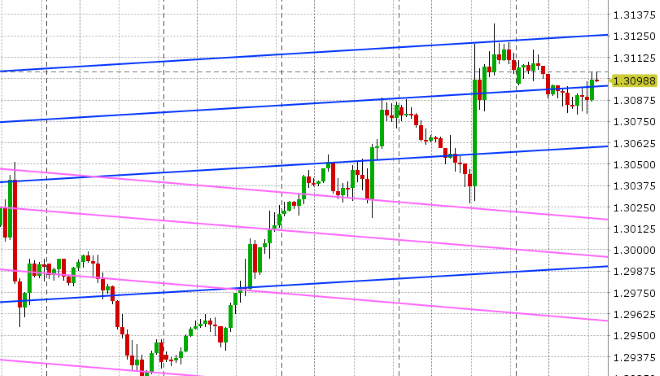

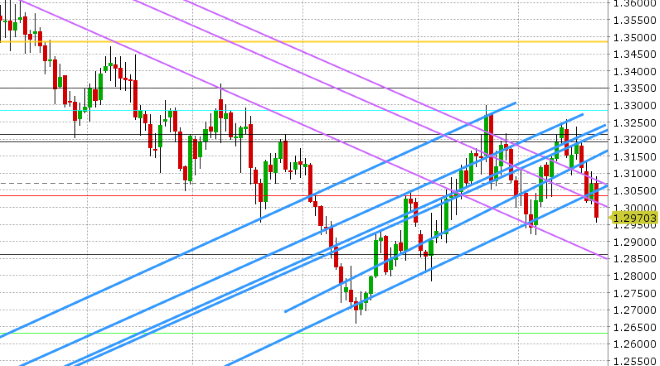

USDCAD: Dollar/CAD is starting the week with a quiet tone, as traders continue to fade chart resistance in the 1.3120s, that was quickly tested after weaker than expected Canadian retail sales and CPI data out Friday morning. Some profit taking from the fund longs seems normal here, but we’re seeing some broad USD buying/crude oil selling reemerge in Europe now and this is helping the market regain the 1.3090s at this hour. This week’s focus will be the Bank of Canada’s expected 25bp interest rate hike on Wednesday. We’ll also get the first look at US Q3 GDP on Friday. Canada just reported August Wholesale Sales -0.1% MoM vs +0.0% expected. The funds continued to liquidate longs during the week ending Oct 16, bringing their net USD long (CAD short) position down to its lowest level since June of this year. We think USDCAD coasts here and possibly drifts to resistance at 1.3125 or support in the 1.3060s. December crude oil is trading steady at support in the 69.00-69.10 area.

-

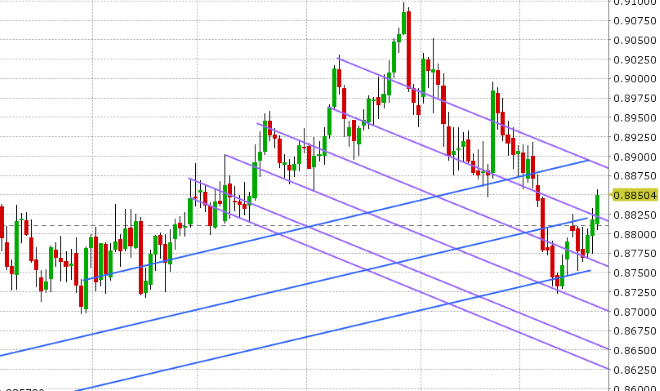

EURUSD: Euro/dollar has had a volatile start to the week. Italian bond traders initially celebrated Moody’s downgrade of Italian debit late Friday to one notch above junk (seemingly because Italy avoided junk status and the outlook is now stable as opposed to negative). This saw the BTP/Bund spread contract and EURUSD rally above chart resistance in the 1.1530s, but these gains have quickly faded as the Italian government formally acknowledged the EUs concern about their budget today, but refused to make any amendments. More here. The BTP/Bund spread has widened back to +295 after contracting as low as +282 earlier, and EURUSD is now trading back down to trend-line support in the 1.1490s; ahead of what could now be a showdown week between Italy and the EU. This week will also feature the Eurozone PMIs on Wednesday, the German IFO survey and the ECB meeting on Thursday, as well as S&Ps credit rating update for Italy on Friday. The funds liquidated both long and short positions during the week ending Oct 16, but longs more so, leaving the funds more net short compared to the week prior. We think EURUSD shorts still remain in control sub 1.1560-80. Around 1.6blnEUR in options expire at the 1.1500 strike this morning.

-

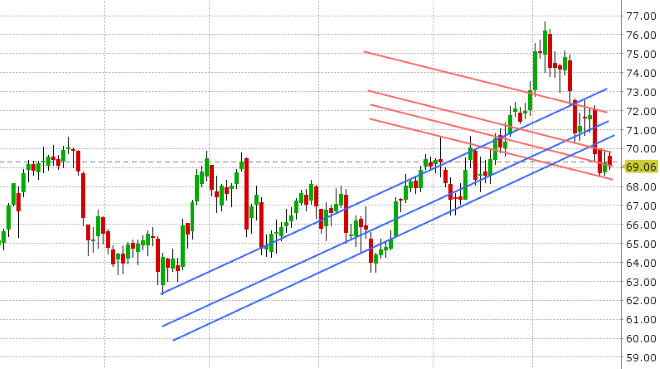

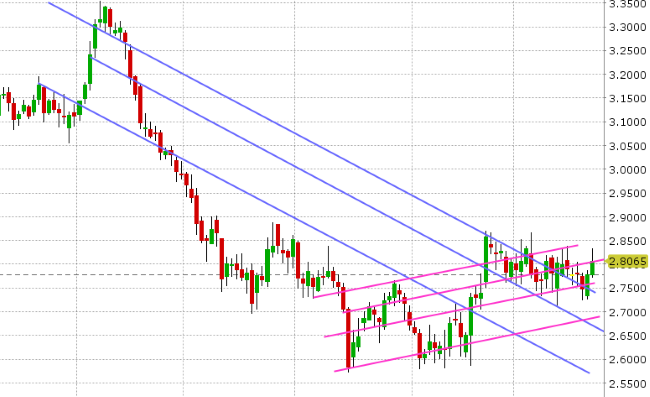

GBPUSD: Sterling shorts are back in action this morning after Friday’s afternoon “Irish backstop time limit” gambit and today’s EURUSD pop failed to propel GBPUSD above trend-line resistance in the 1.3080s. Add to this rumors of a no-confidence vote on Theresa May as early as this week (see here), and GBP shorts appeared to pile on during London trade today. The break of chart support in the 1.3010s further helps the fund shorts here in our opinion, although there are less of them now as CFTC data on Friday showed short liquidation during the week ending Oct 16. This week’s UK economic calendar doesn’t feature anything noteworthy, which means the focus will remain on Theresa May’s future for the time being. The daily chart could get uglier still as we don’t see much support now until the 1.2870s.

-

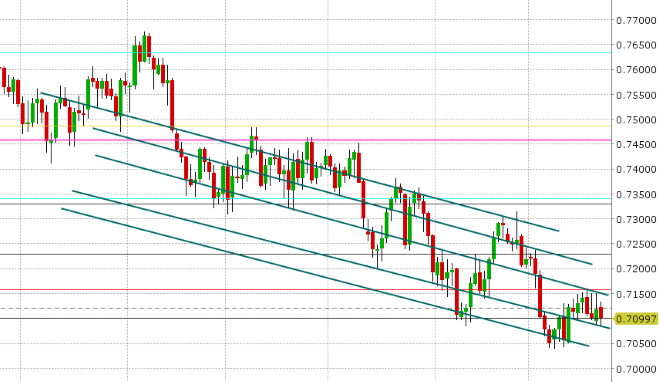

AUDUSD: Aussie/dollar has had a quiet start to the week, like its commodity cousin USDCAD. We’re still trading within the familiar 0.7100-0.7150 range which contained trade for most of last week. Copper is up almost 2% today as it now shows signs of breaking higher; out of a bullish, inverted, head & shoulders pattern on the daily chart. The souring Chinese stock market today, after President Xi vowed unwavering support for the country’s private sector (ie. tax cuts/other measure to support stocks), appears to be helping. The funds liquidated both long and short positions during the week ending Oct 16, but shorts more so, leaving the market slightly less net short. We still think the net fund short position (now at 71k contracts) looks too elevated for comfort and would still not be surprised to see a rally should 0.7150 give way. This week’s Australian economic calendar doesn’t feature anything notable for markets.

-

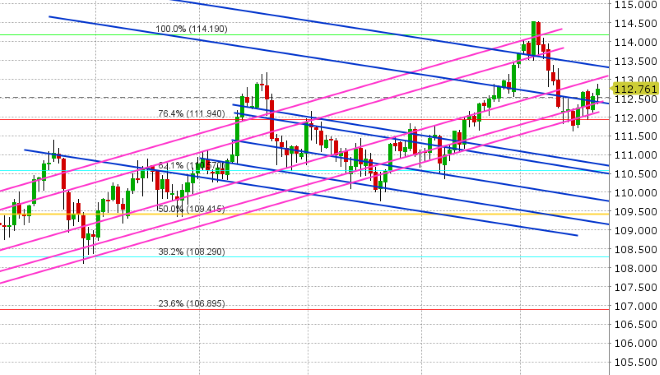

USDJPY: Dollar/yen is enjoying the fruits of a “risk-on” tone to equities this morning, as European stocks and the S&P futures follow the Shanghai higher. Friday’s staunch defense of chart support in the 112.30s definitely helped with today’s setup in our opinion. The funds liquidated USDJPY longs en masse (which we suspected) during the week ending Oct 16, but so too did recent shorts (which were profitable), and so the net USD long (JPY short) position declined…but not by much. We still think longs can breathe a sigh of relief here, but there are some key chart resistance tests ahead at 113.00 and 113.30. This week’s Japanese economic calendar features Tokyo CPI for October on Thursday night ET.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

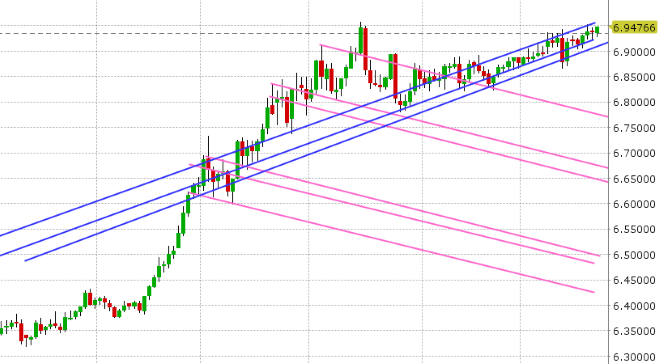

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

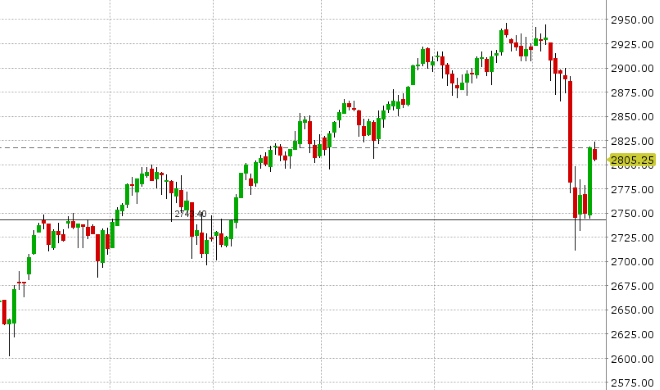

DEC S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.