Rumored Yuan intervention sees USDCNH reverse lower, USD now broadly lower. EUR sentiment aided by Merkel comprimise with CSU. RBA keeps rate unchanged.

Summary

-

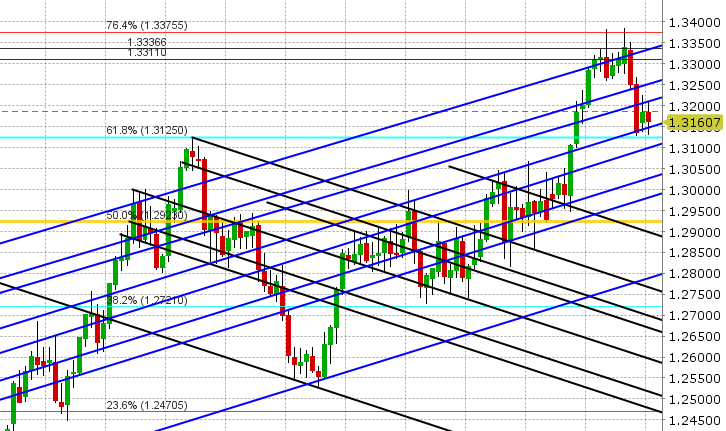

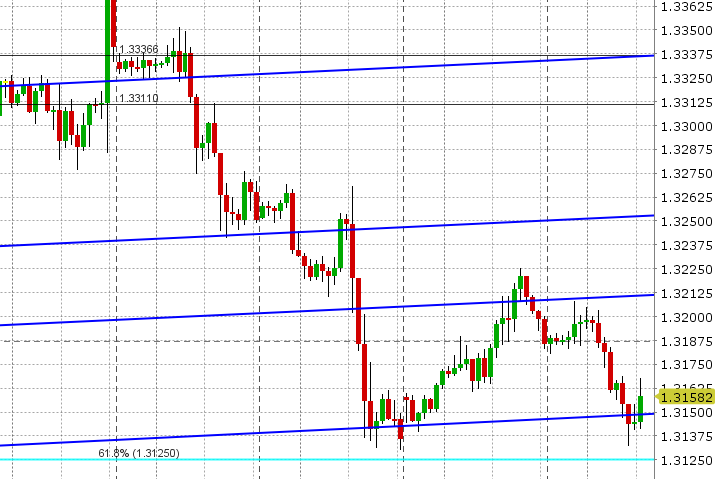

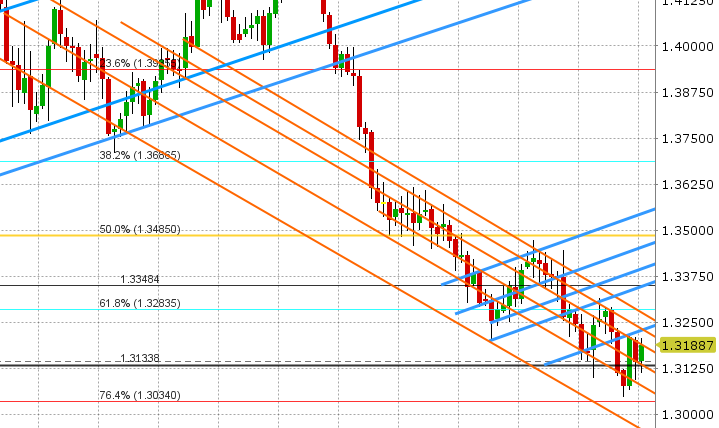

USDCAD: Dollar/CAD bounced higher yesterday to start a holiday shortened week of trading, but the move is unravelling this morning as EURUSD traders enjoy some positive German political developments and USDCNH reverses lower after rumored intervention by Chinese authorities. Friday’s swift move lower, after the upbeat Bank of Canada Business Outlook Survey, tested chart support in the 1.3140-50 area, and it is this level that is being tested again at this hour. Next support is 1.3125 (March 2017 highs). Resistance is 1.3215, then 1.3250. This week could still potentially be eventful for traders as we have some key data points coming up, plus less liquidity than normal due to the July 4th holiday. Today sees US Factory Orders at 10amET, and then we’ll get US Services ISM, crude oil inventory data, and the FOMC Minutes when US traders return on Thursday. Friday then brings the June employments for both the US and Canada. Friday’s update on speculative futures positioning as of June 26th confirmed our suspicion last week that a bulk of USD shorts did not roll their positions from June to September. The CFTC report also showed USD longs chasing the move higher en masse in USDCAD, which can partially explain how easily the market came off its highs last week. August crude oil is 1% again this morning. We think USDCAD trades with a neutral to weak tone today.

-

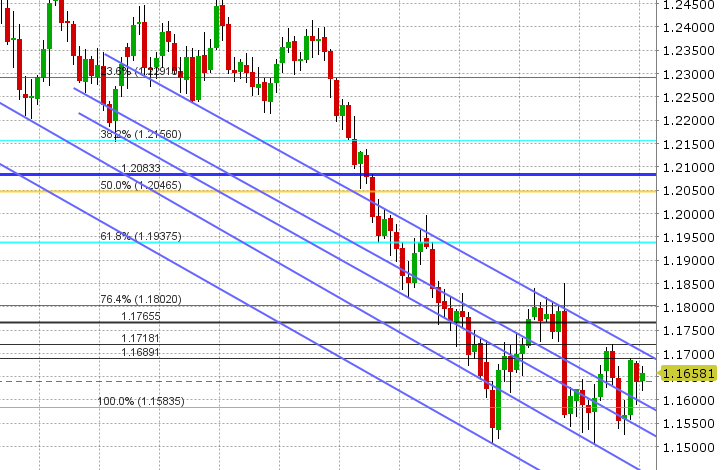

EURUSD: Euro/dollar is bid this morning after it appears Angela Merkel has reached an agreement with her coalition partner CSU regarding immigration policy. More here: https://www.washingtonpost.com/world/europe/germanys-angela-merkel-may-have-won-fight-over-migration-but-her-coalition-is-in-doubt/2018/07/02/d4e02b60-7da2-11e8-a63f-7b5d2aba7ac5_story.html?noredirect=on&utm_term=.e80852dbbb18. This removes uncertainly for the marketplace and helps explains EURUSD’s bounce off trend-line support at the 1.1600 level yesterday. The spike higher and reversal lower in USDCNH is also helping, seeing as the Yuan has been a driver of broad USD moves of late. We think EURUSD now has renewed momentum to retest the 1.1690s or even the 1.1720s. This week will be quiet for European data (with just some Markit Services PMIs on Wednesday and German Industrial Production on Friday), leaving the focus on US headlines and the Yuan. Last night’s rumored Chinese intervention stemmed from PBOC comments that reiterated a commitment to Yuan stability, and reports that major state owned banks had swapped yuan for dollars in the forward market. The net long EUR futures position at CME remained largely unchanged in the week ending June 26.

-

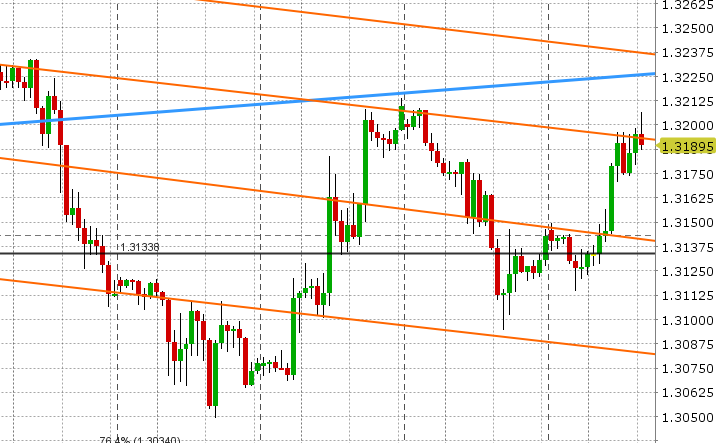

GBPUSD: Sterling is trading higher this morning as well, as it rides the broader theme to sell USD at this hour. Trend-line resistance in the 1.3180s has just given way to the upside, which now paves a path to the 1.3220s in our opinion. This weekend didn’t see much in the way of Brexit developments, but we could have some later this week when Theresa May floats another proposal regarding the customs union with the EU: More here: https://www.theguardian.com/politics/2018/jul/02/may-to-float-third-brexit-customs-model-at-chequers-meeting. The UK data calendar will be light as well, but we will have BoE Governor Carney speaking at an event in Newcastle on Thursday. Pound futures traders liquidated positions a little bit in the week ending June 26, but the market is still decidedly net short GBP since the June/September roll.

-

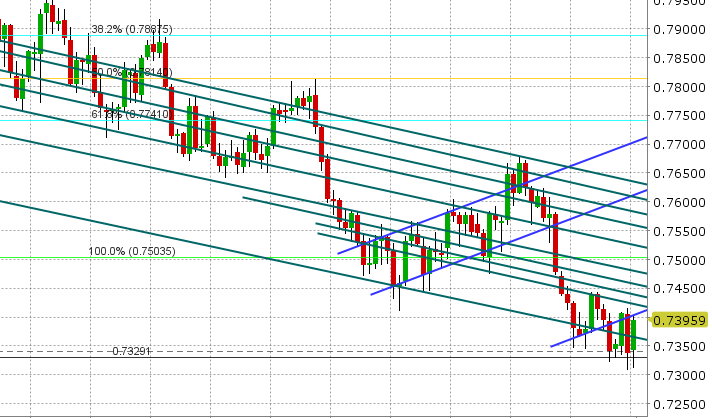

AUDUSD: The Aussie is leading the charge higher today against the USD. Yesterday’s NY close was looking rather precarious for the pairing, but AUDUSD was able to regain support in the 0.7330s and was able to bounce higher off that same level despite weak Australian Building Approvals data and a dovish hold on interest rates from the RBA last night. A sharp reversal lower in USDCNH and the broader USD was the icing on the cake and with that we’ve seen AUDUSD roar back so far today. Chart resistance at the 0.7400 handle is kicking in now, but we see support on dips to 0.7360. The net short AUD position at CME reduced slightly in the week ending June 26th to 41k contracts. We think the prospects for an AUDUSD recovery increase with a strong close above 0.7420.

-

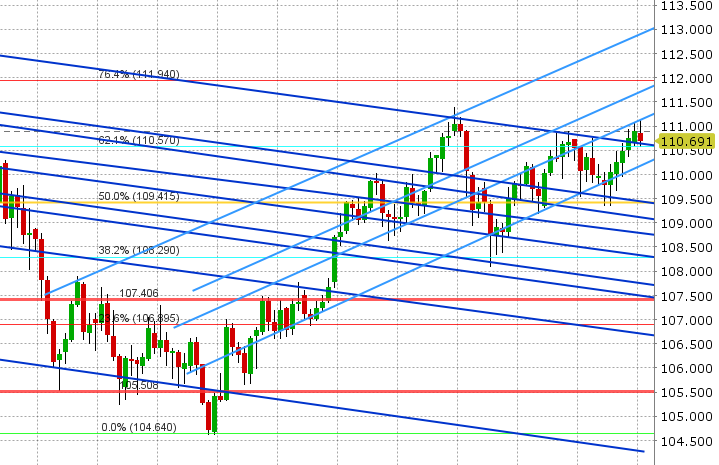

USDJPY:Dollar/yen struggled to break higher earlier this week as upward sloping trend-line resistance in the 111.00-111.10 area continued to cap, and today’s Yuan driven USD selling theme isn’t helping. US yields are opening higher this morning though, so that should stem the selling into 110.50-60 chart support. The new net long USD (short JPY) position at CME remained largely unchanged in the week ending June 26th as both longs and shorts liquidated a bit. We think this positioning may start to weigh on the market should USDJPY not regain the 111s in short order.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

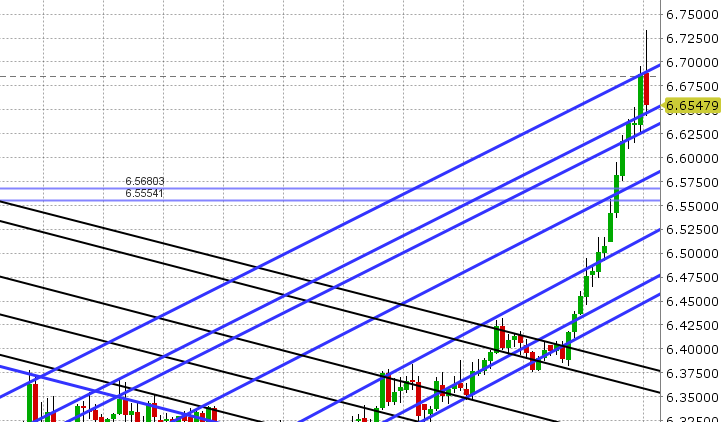

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.