Roaring US stocks save USDJPY yet again. EURUSD recovers. USDCAD bid continues with traders now eyeing the Cdn GDP on Cdn jobs reports.

Summary

-

CME OPEN INTEREST CHANGES 11/30: AUD -3315, GBP +13405, CAD +1434, EUR +8814, JPY -507

-

AUDUSD: The Aussie continues to waffle around in the 0.7550-0.7600 range we defined yesterday. The market’s inability to hold gains despite intra-day rallies in EURUSD and GBPUSD yesterday is a bit disconcerting, suggesting that sellers are still in control. We also note an increased inverse correlation between AUDUSD and its “commodity cousin” USDCAD in recent weeks. Given our bullish USDCAD outlook, it would suggest lower prices for AUDUSD near term if the correlation holds. Fundamentally speaking, the Aussie continues to have little to support it. Inflation data continues to track lower than the RBA wants and so rate hike expectations keep getting pushed back (now for late 2018), and with the US Fed still on a rate hike trajectory, the relative monetary policy outlooks between the US and Australia continue to favor the USD. This is causing the AU/US 10yr yield spread to continue to trend lower (now just 12bp) and that fundamentally puts pressure on AUDUSD. Technically speaking, we’re still in a downtrend so long the we trade below 0.7625-0.7650. From a positioning standpoint, the market is still net long AUDUSD, albeit much less so now given the decline in recent months.

-

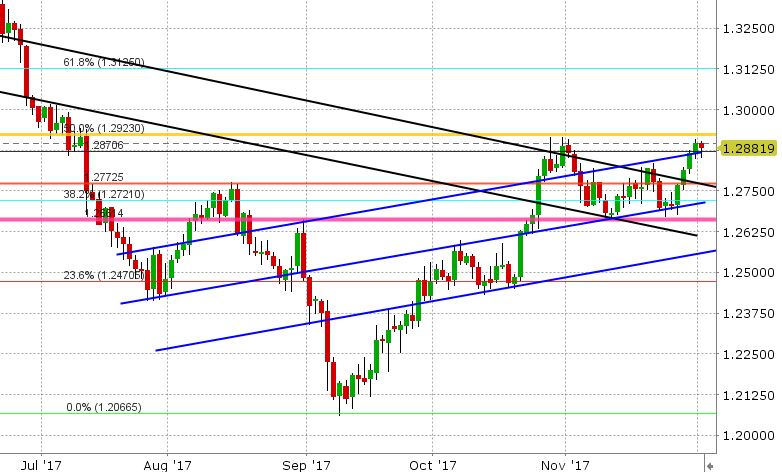

USDCAD: So the OPEC meeting was a dud, offering up no surprises for oil traders and therefore USDCAD traders. The massive option expiry yesterday at 1.2850 did have a magnetic effect on the market (as these events usually do). Broad USD selling around the 9am hour drew USDCAD back into Wednesday range. Then we saw selling into the 10am expiry and as soon as that was out of the way, the market bounced back up for the remainder of the day. Technically speaking, yesterday’s trading pattern was what you would want to see if you’re a bull. This morning we sit just above resistance in the 1.2870s, and we are trading above the upper bound of our blue trend-line extensions. The US/CAD 2yr yield spread continue to trade higher, now at 36bp. All this is positive and suggests higher prices for USDCAD. It’s a big day today from a Canadian data perspective, with Sep GDP and Oct employment figures. GDP is expected +3.3% and traders are expected +10k new jobs created for Nov. A sustained break above the 1.2920s (50% Fibo of the May-Sep down move) would be very bullish. A spike higher and reversal lower into the mid to low 1.28s would be negative technically, although we’d expect buyers on dips if that were to happen. GBPCAD and EURCAD cross are exerting a bit of downward pressure as we go to press.

-

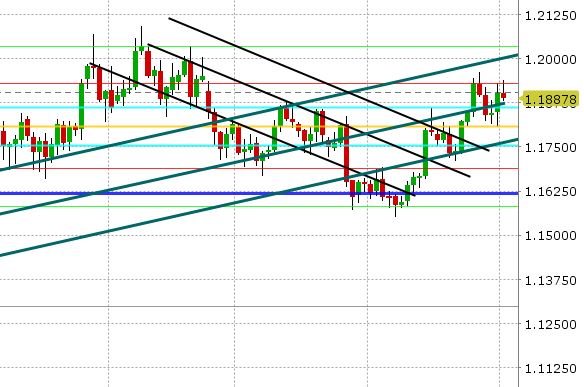

EURUSD: Euro/dollar traders got some love yesterday despite the rumored immanent passage of US tax reform, a roaring US stock market, and strong US yields. Some traders said it was month-end flow related. Others are mentioning support from EURJPY, which blasted higher through 133 as US stocks surged. The intra-day spike lower and reversal higher in EURUSD was a bit of a head scratcher to say the least, but it was technically significant because we scored a bullish outside reversal day on the charts. The market also managed to close back above the 61.8% Fibo of the Sep-Nov down move (1.1860s). It also closed back above mid-channel support in the 1.1870-80s. The US/GE 10yr yield spread does not support this move higher, blowing out to 205bp after yesterday’s trade, so we remain a little cautious here. We’re calling EURUSD range-bound here, with the 1.1860-80 region supported and the 1.1930s capping. The selling in EURGBP has finally stopped this week but EURJPY looks like it could be a drag today as USDJPY hits resistance. Futures traders added a healthy 8814 contracts yesterday, while option traders continue to report interest in upside strikes (hearing today interest in 2mth 1.23s)

-

GBPUSD: Sterling traders had a massive day yesterday with the intra-day blip lower for the broader USD triggering stop loss buying in GBPUSD. The market blasted into the 1.35s, and the level held into the NY close, which is very positive technically. Futures open interest was up a whopping 13,405 contracts, suggesting new longs. The market is off a bit now, which is not surprising given the recent run, but we see continued support on dips. Support today 1.3460-70. Resistance 1.3550, then 1.3590. Note the event risk for Monday: Theresa May’s meeting with the EU’s Juncker.

-

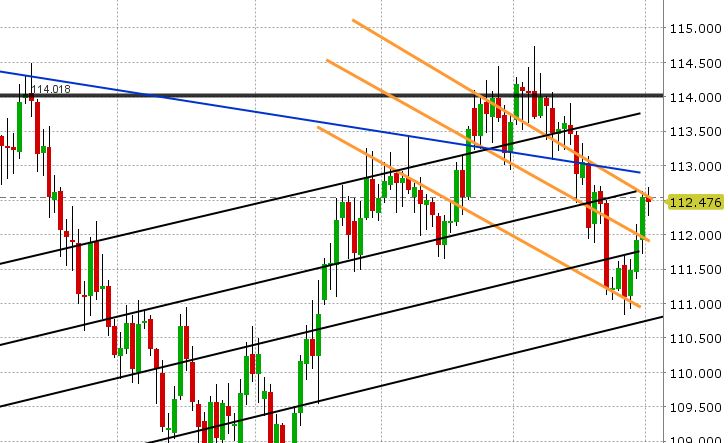

USDJPY: The roaring US stock market and strong US yields has saved the USDJPY market yet again this week. We mentioned in Wednesday’s note that the near-term attack of resistance in 111.80 was positive and that there has already been a significant purge in long USD (short JPY) positioning, but we’ve been a bit taken aback by what has turned out to be an all out assault on the negative chart structure that’s been the theme for a number of weeks now. With the market smashed back above 112, we technically now have a range-trade as opposed to a lower trending market. And it’s not just USDJPY that has recovered, but the other JPY crosses too. EURJPY blasted through the 133s yesterday on the US stock surge. GBPJPY has been on an absolute tear this week, albeit some of it is GBP driven. US equity traders continue to go bonkers over US tax reform, and so whether we like it or not, we have to respect USDJPY’s tendency to trade in lockstep. Japan reported Oct CPI of +0.2% YoY overnight, which was depressing, but as expected. We’re now calling USDJPY range-bound with the 112.20s supporting and the 112.80s capping.

Market Analysis Charts

AUD/USD Chart

USD/CAD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.