Risk sentiment takes a hit into NY trade

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- EU’s Barnier says Brexit deal “at this point unlikely”. UK’s Frost: “the gaps are still significant”.

- US Jobless Claims for the week ending July 18 show first week-over-week rise since March.

- US Treasury’s Mnuchin says “WE WILL PROTECT DOLLAR, WORLD'S RESERVE CURRENCY”.

- US Secretary of State Pompeo to deliver China speech at 4:40pmET, USDCNH bid over 7.00.

- Spot silver and Sep WTI pulling back with risk tone, after leading in early European trade.

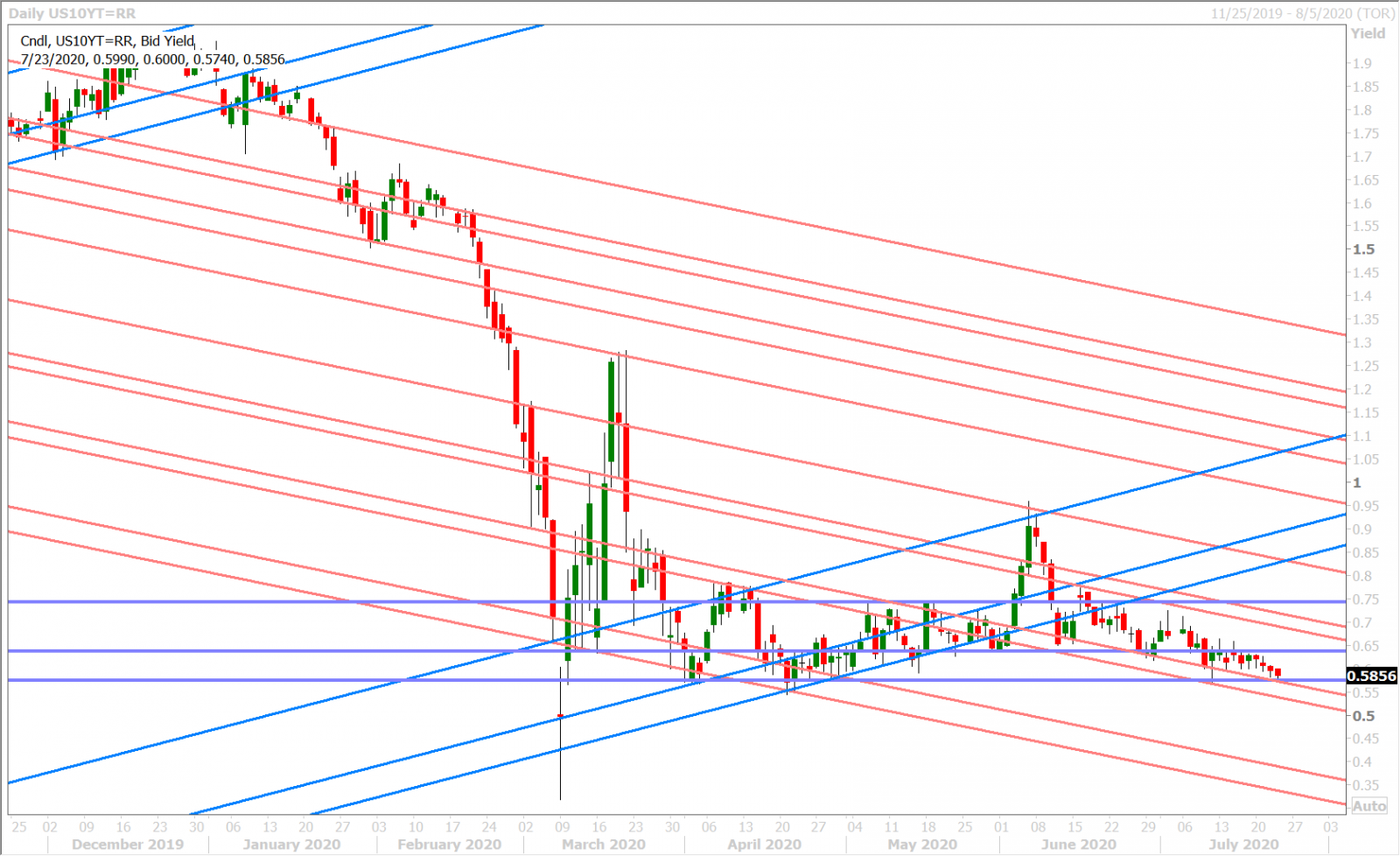

- USD now broadly bid into NY trade. US yields softer. USDJPY stuck due to Japanese holidays.

ANALYSIS

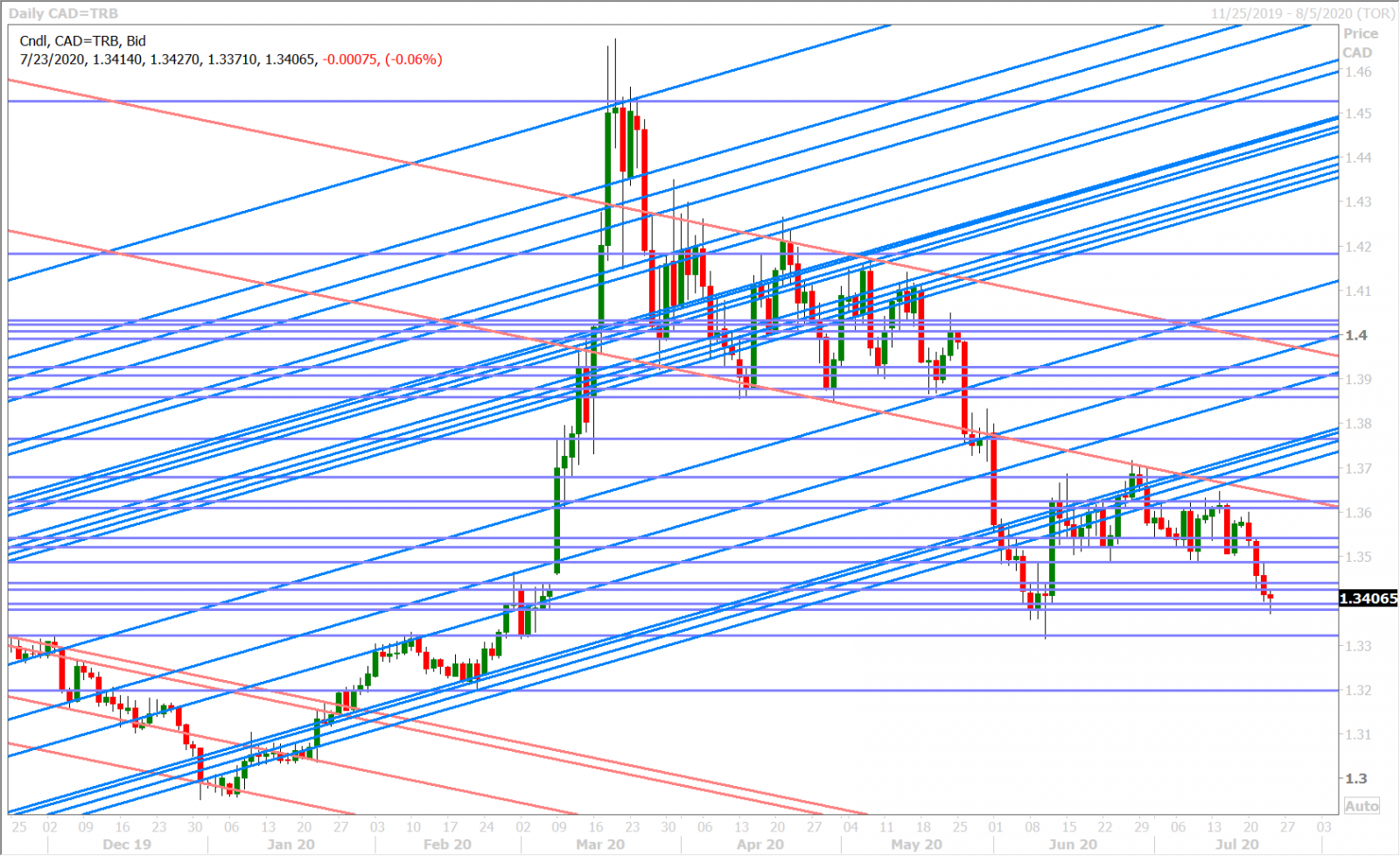

USDCAD

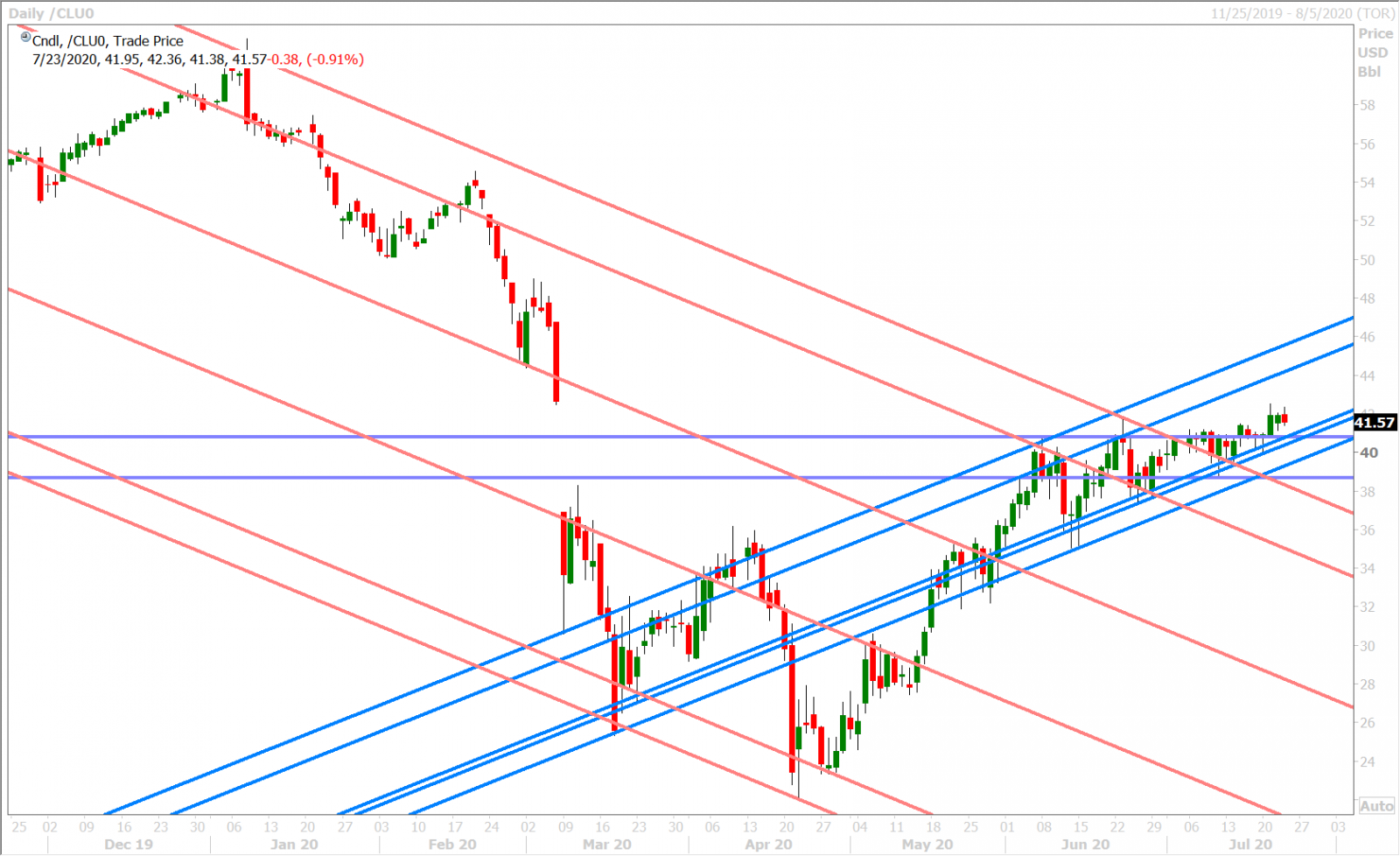

Spot silver prices recovered from their early NY morning wobble yesterday to close another 8% higher by the end of the trading session. September WTI oil prices also rebounded after the EIA reported just a 4.892M barrel increase in inventories for the week ending July 17, versus the 7.54M build announced by the API the evening before. We felt both these factors contributed to USDCAD’s ultimate loss of the 1.3430-40 support level by the London close yesterday, and this negative technical development made it easy for the market to continue its slide lower overnight as both commodities found buyers once again in early European trade.

The broader USD has since bounced and, while the move felt technical at first with GBPUSD rejecting the 1.2750s and EURUSD buyers failing again at 1.1600, we’ve now seen a bunch of negative Brexit and US/China headlines to support it…not to mention the first week-over-week increase for US Jobless Claims since March (1,416,000 JUL 18 WEEK (CONSENSUS 1,300,000) FROM 1,307,000 PRIOR WEEK (PREVIOUS 1,300,000)). US Treasury Secretary Stevin Mnuchin is now trying to jawbone the USD higher on CNBC by saying “WE WILL PROTECT DOLLAR, WORLD'S RESERVE CURRENCY”. Headlines have also just crossed saying that US Secretary of State Mike Pompeo will be delivering a speech titled “Communist China and the futures of the free world” at 4:40pmET today, which seems to be adding fuel to the market’s risk-off, USD-bid, tone since the NY open.

USDCAD DAILY

USDCAD HOURLY

SEP CRUDE OIL DAILY

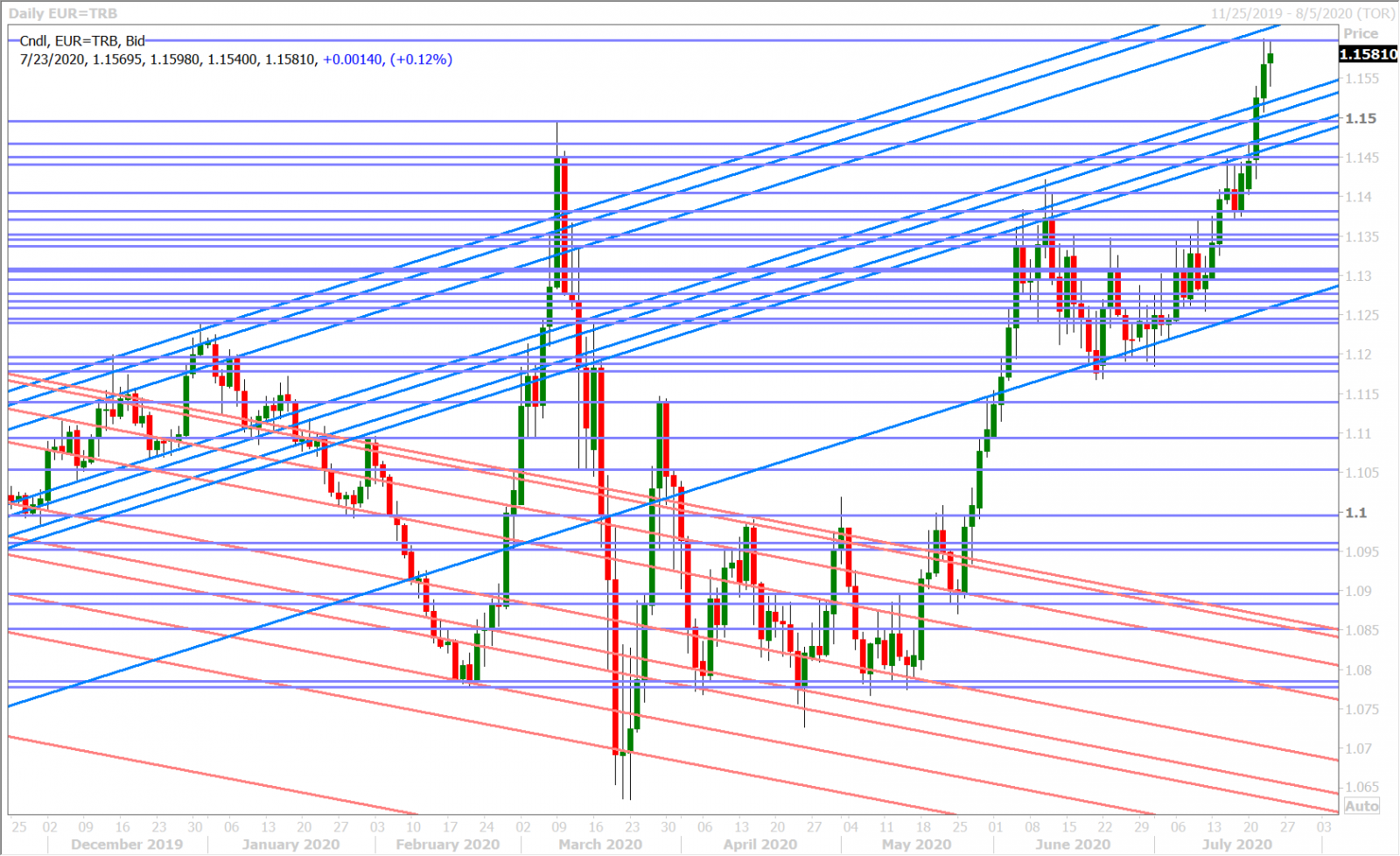

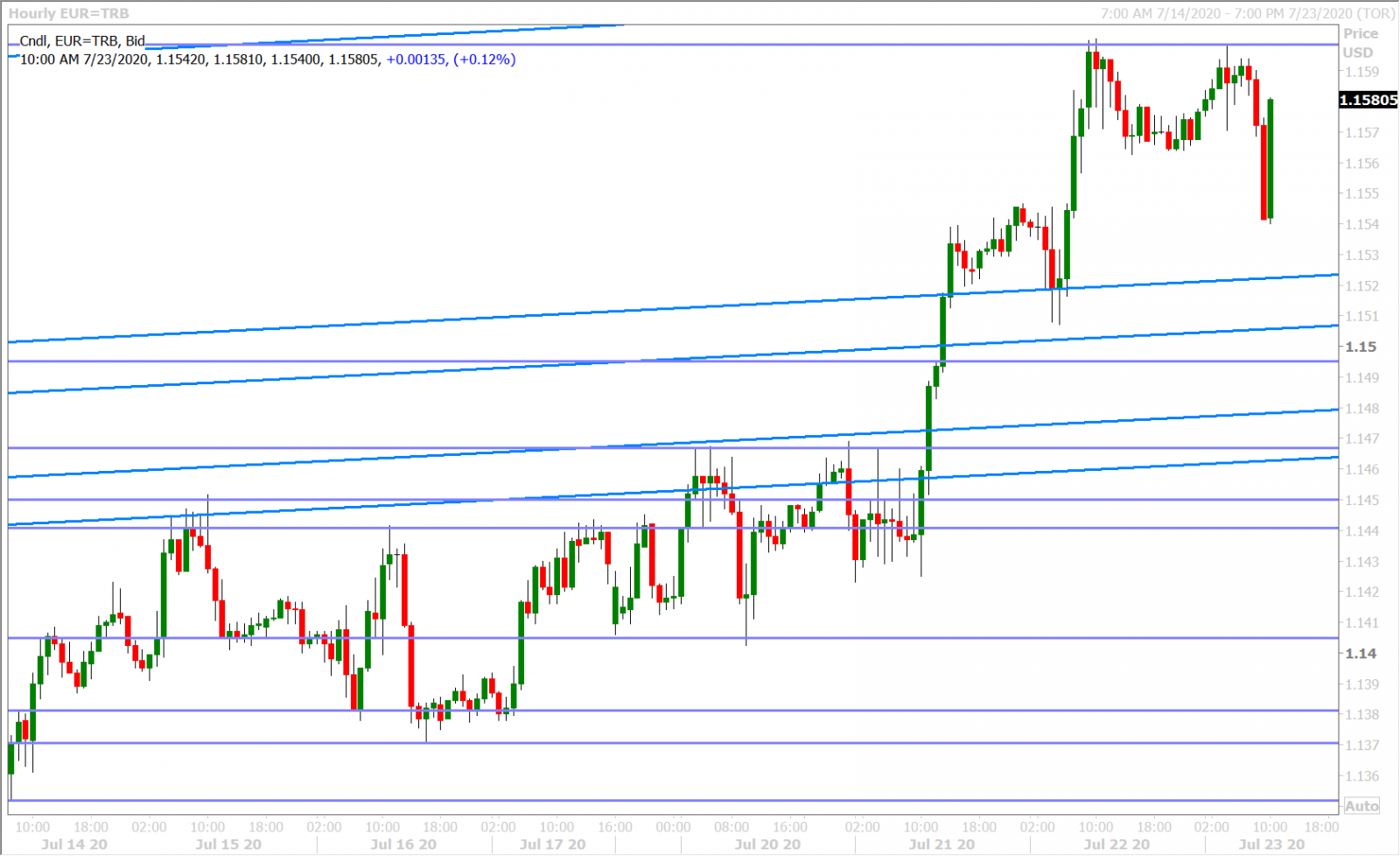

EURUSD

Euro/dollar has come off swiftly since the NY open as negative Brexit headlines/jobless claims data and some “pre-Pompeo China speech” anxiety contribute to a softer risk tone for the broader markets. This morning’s notable buyer failure at the psychological 1.1600 level, which just so happened to be yesterday’s high, was a bit of a negative omen heading into this EURUSD decline. It's "la dolce vita" in Italy today with benchmark 10yr BTP yields falling below 1% (BTPs over Bunds now at just +152bp).

EURUSD DAILY

EURUSD HOURLY

SPOT SILVER DAILY

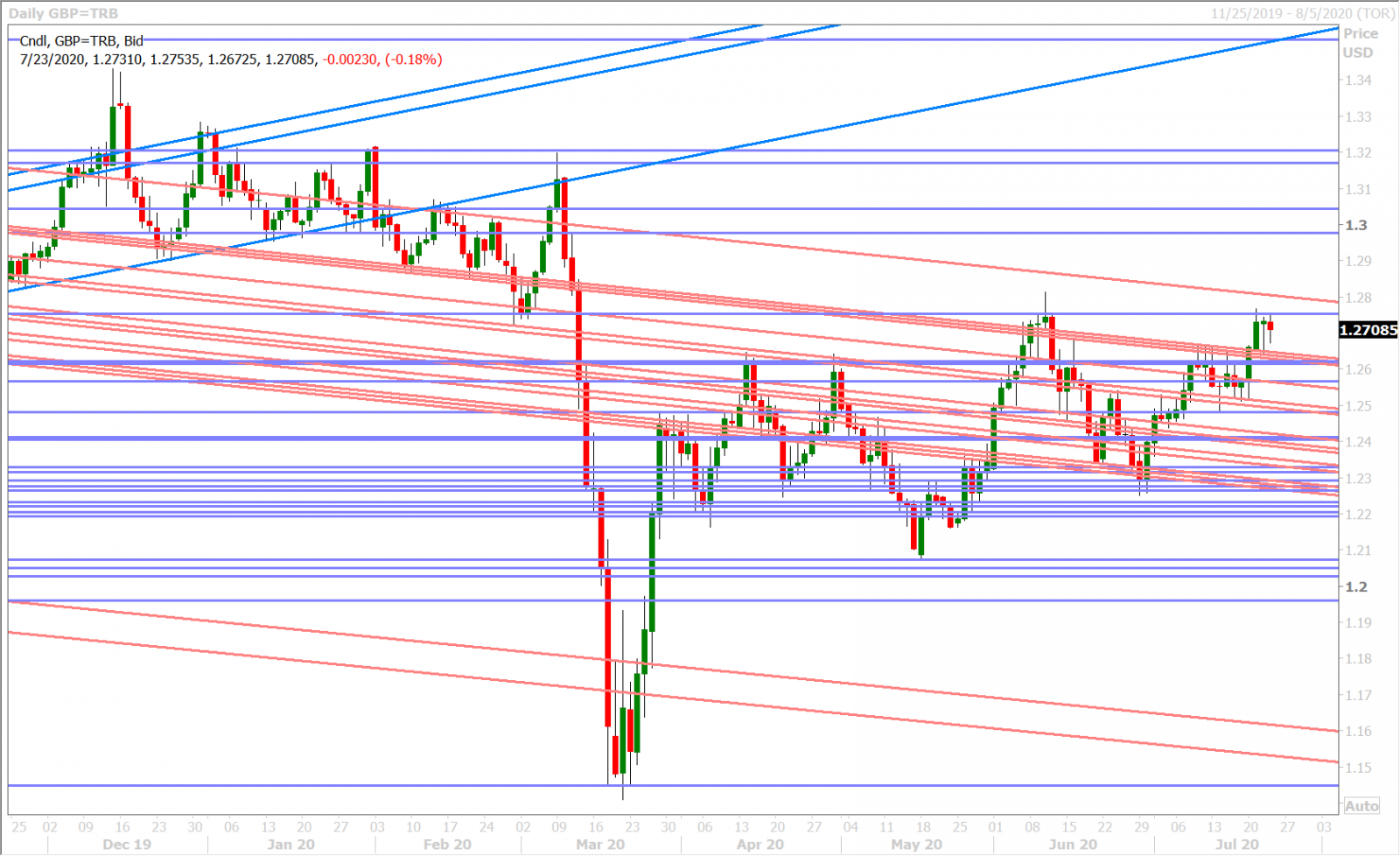

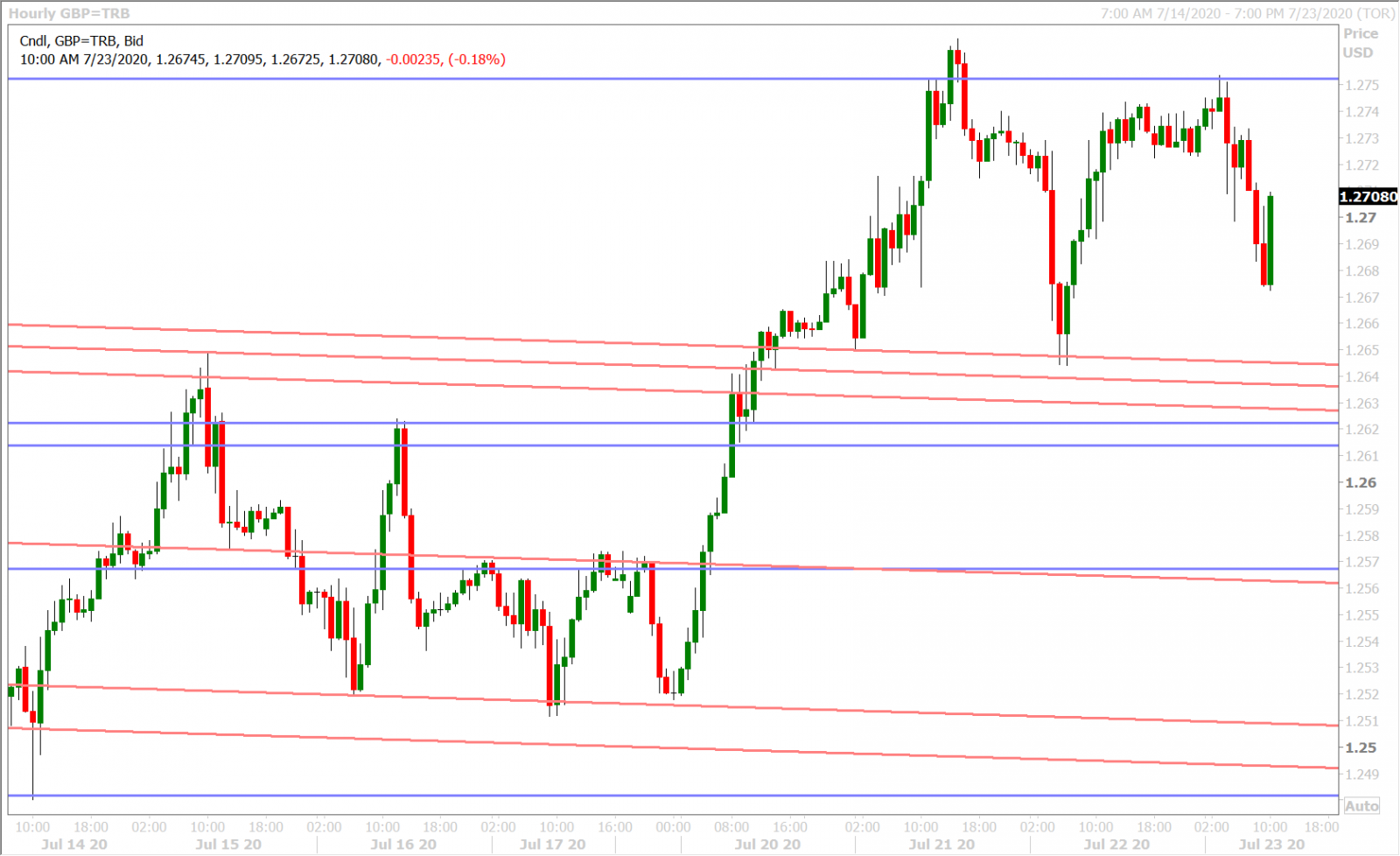

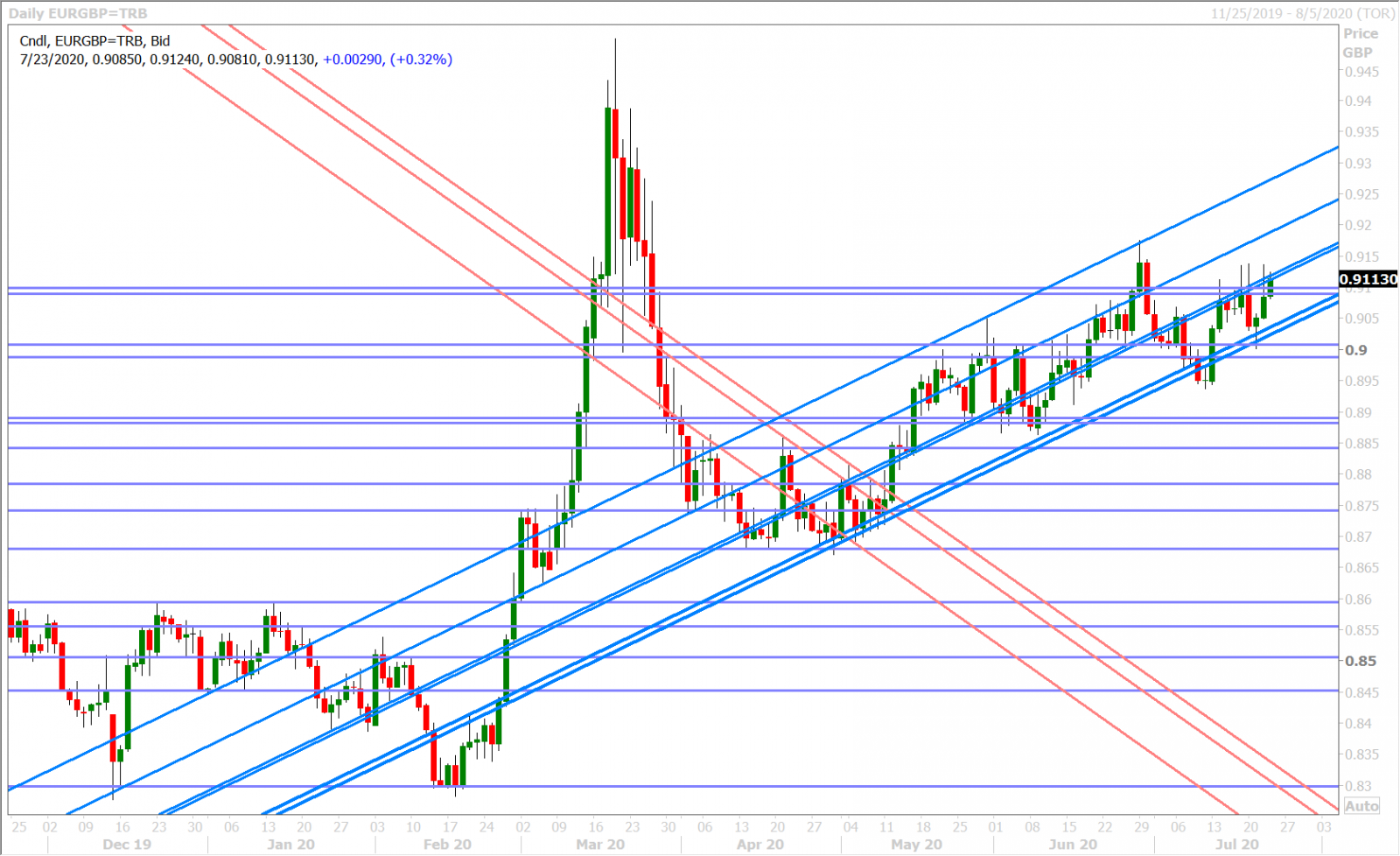

GBPUSD

Traders finally received some meaningful updates on the state of Brexit trade deal negotiations around the NY open, and they weren’t good. UK Brexit negotiator David Frost said “the gaps are still significant” and his EU counterpart Michel Barnier said a deal was “at this point unlikely”. More here from the BBC. Sterling has now slipped below the 1.27 handle after buyers failed to regain the 1.2750s in early London trade, and EURGBP has reclaimed the 0.91 handle. All this is not hugely surprising given how depressed market expectations are when it comes to the state of Brexit negotiations and so we think this explains why sterling is not completely falling apart here.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

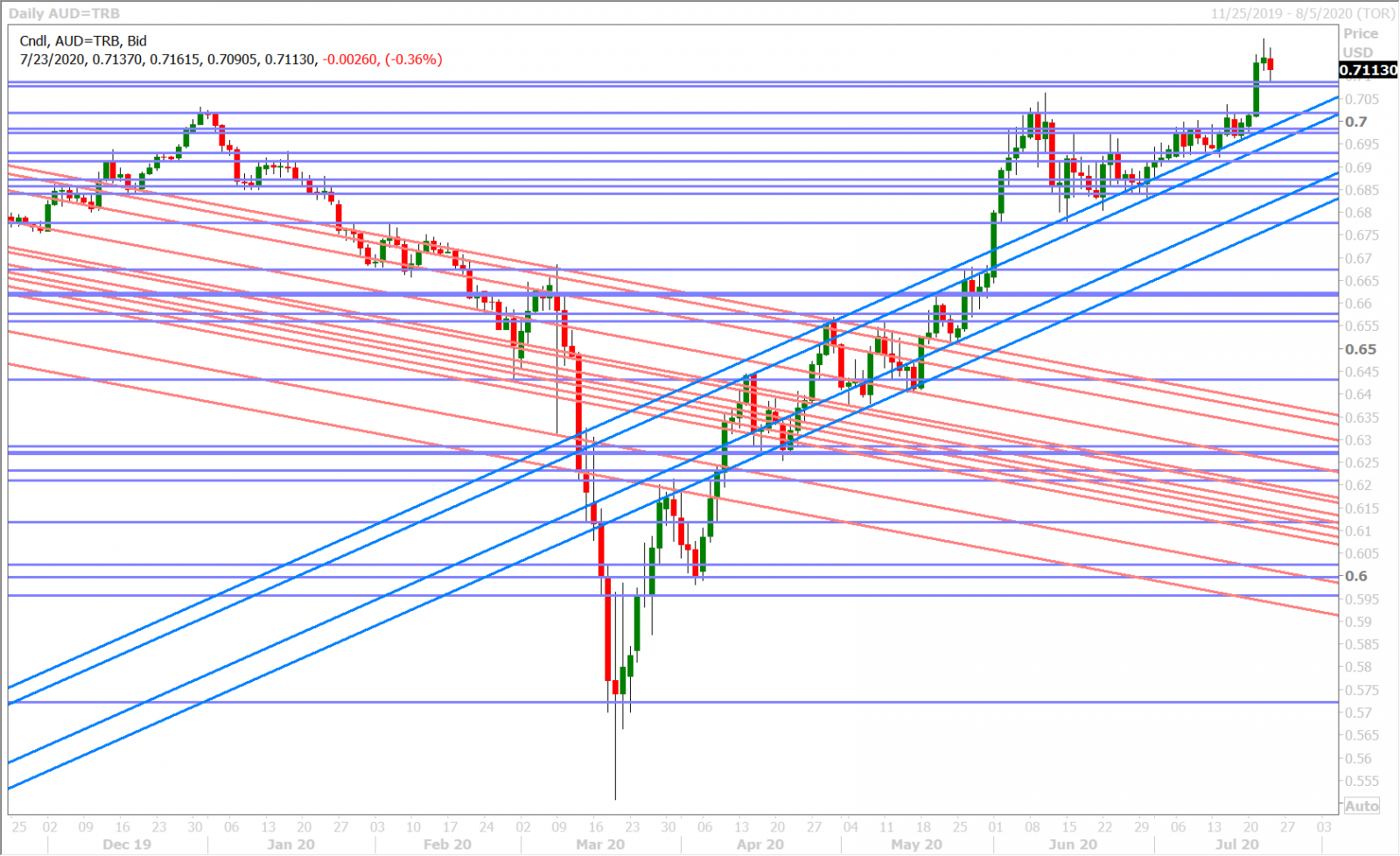

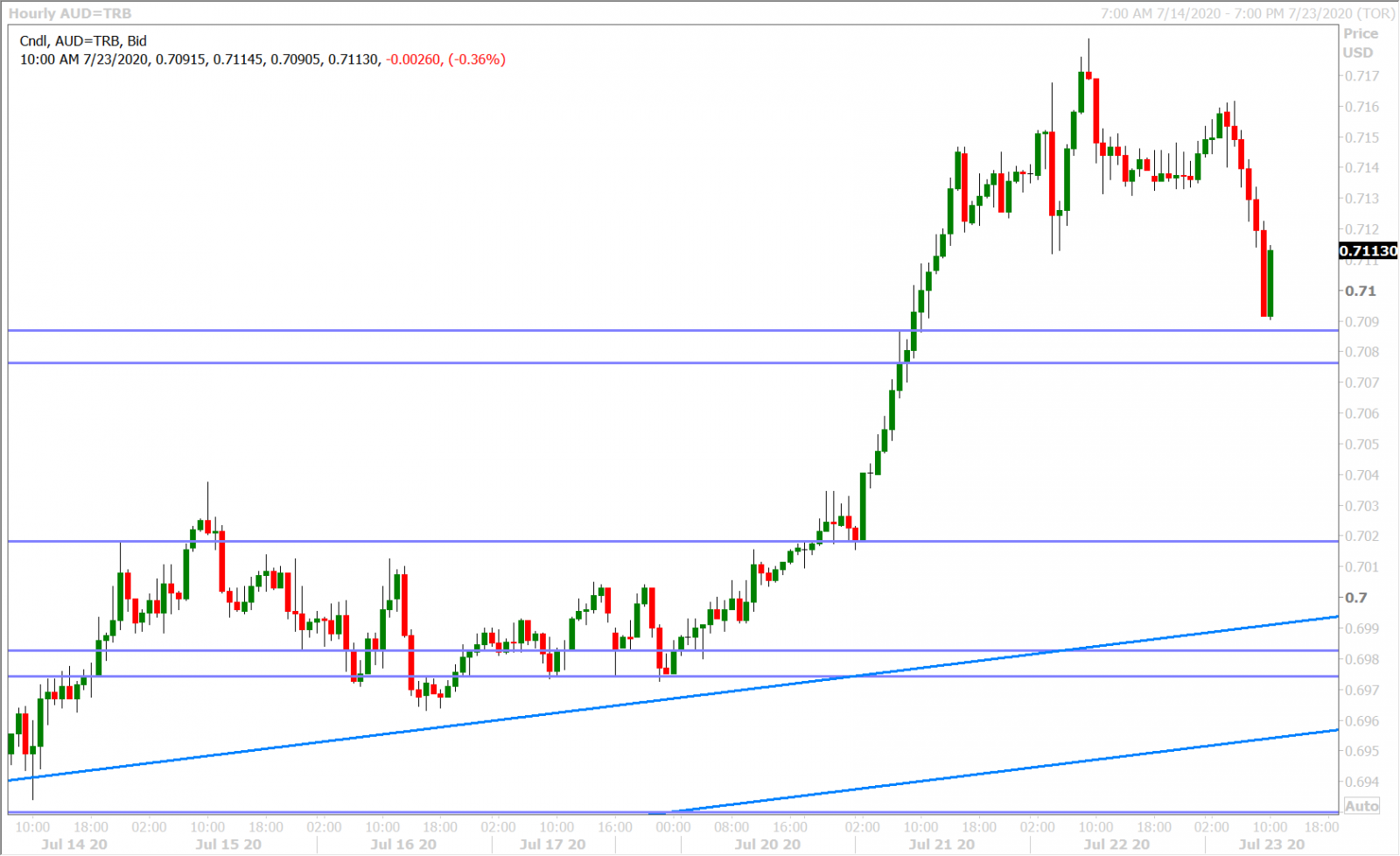

AUDUSD

The Australian dollar is getting smacked lower this morning as traders find a number of reasons to lighten up on risk currencies. We’d note however that the Aussie started under-performing right after the London close yesterday when USDCNH made a bee-line for the 7.00 handle once again. While a higher than expected daily USDCNY fix and a softer tone for Chinese stocks last night didn’t have much effect on off-shore dollar/yuan, it’s second foray above 7.00 this morning seemed to be what started the second wave of AUDUSD selling over the last 24hrs. We wouldn’t be surprised if the market forces recent AUD breakout buyers to test their convictions at the 0.7070-80 level at some point.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

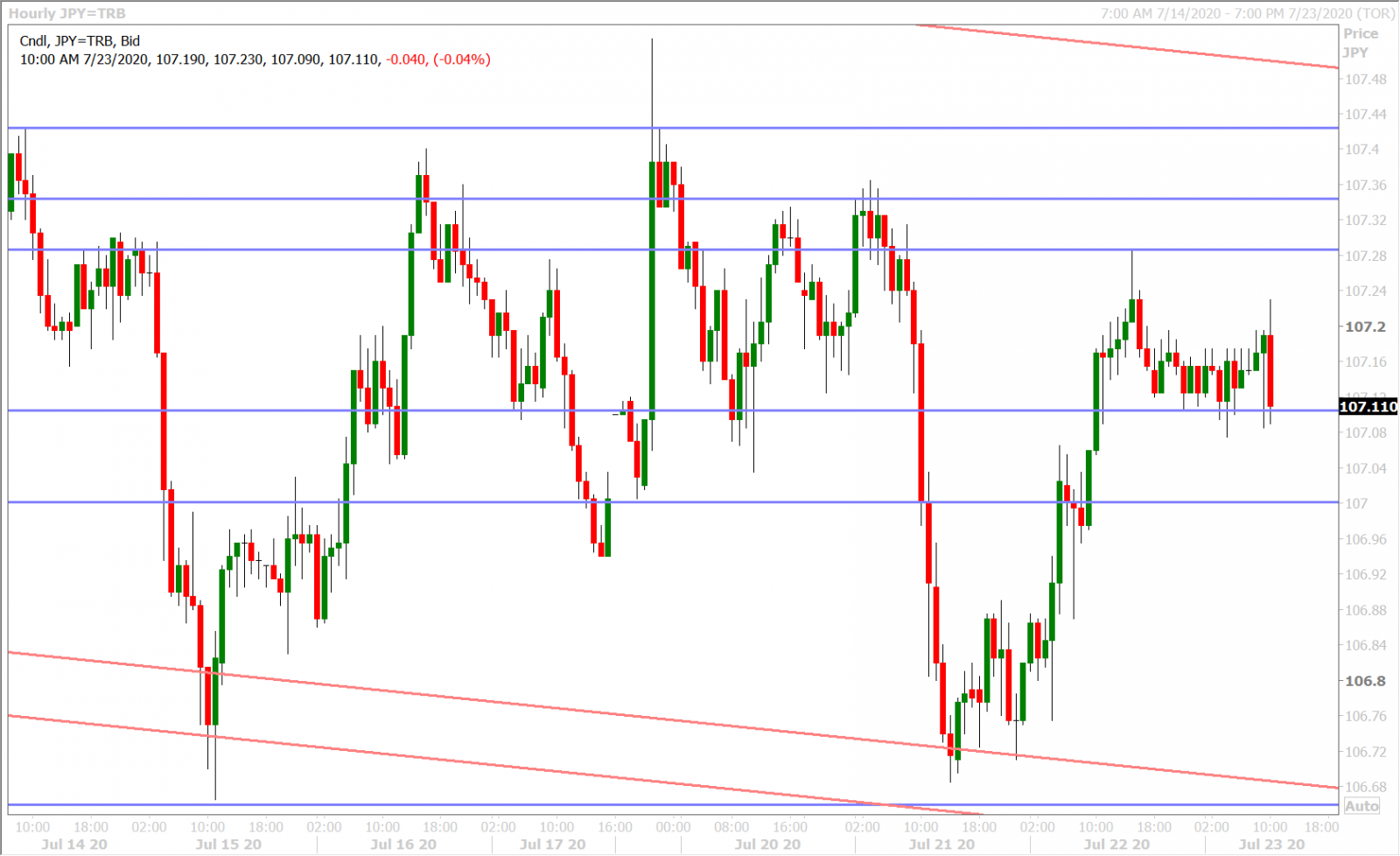

USDJPY

Japanese markets were closed today for the Marine Day holiday. They’ll be closed again tomorrow for “Health and Sports Day”. Dollar/yen has understandably had the volatility sucked right out of it as a result, and so we saw the market meander aimlessly for most of the overnight session. This morning’s softer overall risk tone is seeing US yields slip lower naturally, but it’s having a very muted downside effect on USDJPY.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.