Risk sentiment mildly recovers ahead of US market closure

Summary

-

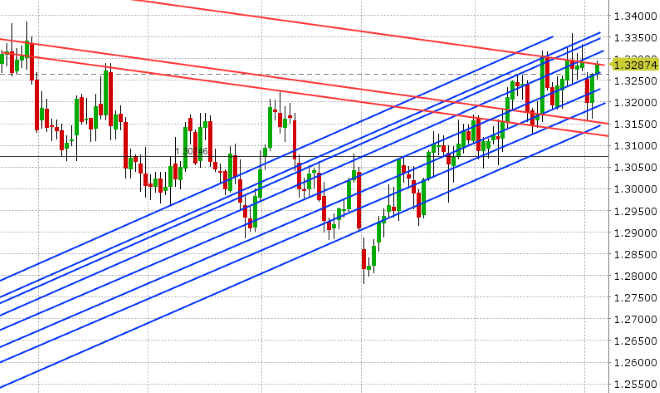

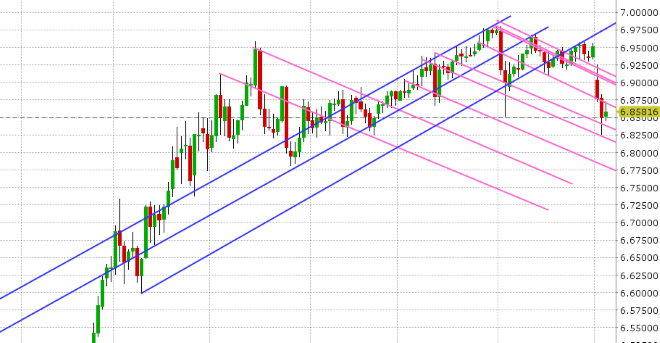

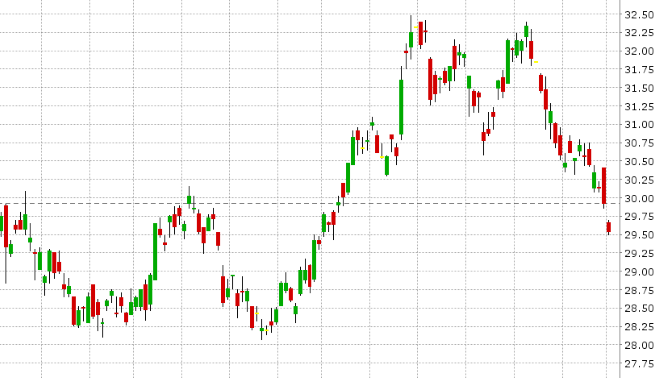

USDCAD: Dollar/CAD rallied strongly yesterday after the some panic selling in US stocks saw FX traders flock to the relative safety of the US dollar. The floor fell out from the stock market when chart support at the 2760s in the S&Ps gave way in early NY trade, and then we just cascaded lower through support levels. The continued fall in US treasury yields below 3%, the contraction of the 2s10s yield spread below 10bp, the appointment of US trade representative Lighthizer to US/China trade talks, and the deafening silence from China post G20 all contributed to the fears of a looming recession and further difficulties with regard to US trade negotiations with China. The risk off mood also saw oil prices pull back a little bit ahead of tomorrow’s big OPEC meeting in Vienna. All this combined to see USDCAD extend its early morning bounce and, before we knew it, traders were eyeing the Sunday opening chart gap in the 1.3270-80s. This gap has since filled in overnight trading, and the market is now taking a breather at chart resistance in the 1.3290s as the broader risk tone recovers a bit. China finally hit the wires overnight, with its Ministry of Finance saying it will quickly implement trade agreements with the US. The Chinese also denied any confusion or negativity surrounding the media’s interpretation of this weekend’s “truce” with the US. The news flow out of the US should be very light today, as the US stock and bond markets will be closed in observance of the national day of mourning for former President George H.W. Bush. We may get some volatility around 10amET, when the Bank of Canada announces it latest decision on interest rates. No changes are expected however by market participants and no press conference will be held. The weekly EIA oil inventory report will be delayed until tomorrow. The Fed’s Beige book report will still be released at 2pmET today.

-

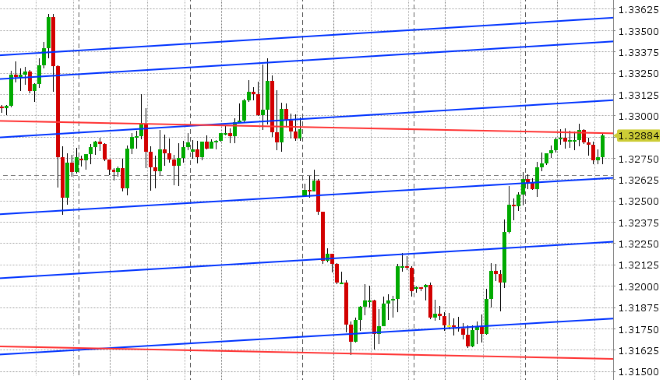

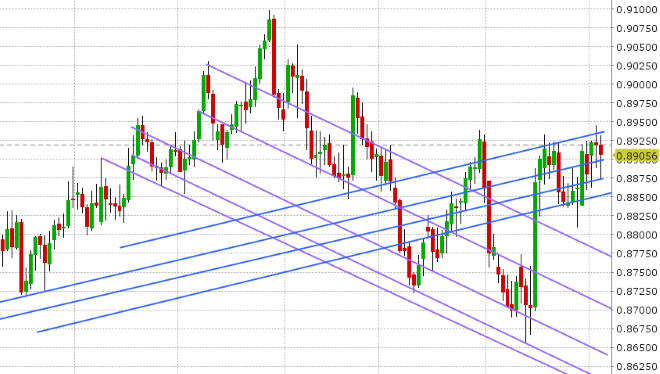

EURUSD: Euro/dollar is bouncing this morning, but the news flow has been light. Traders are still awaiting an update from Italy on its budget revision and the BTP/Bund spread has inched lower to +280bp with positive anticipation. There’s been some market chatter about the ECB debating how to withdrawal monetary policy stimulus next year. The Chinese yuan is trading steady today after bouncing with the broader USD rally in NY trade yesterday. With EURUSD now regaining the 1.1330s, we think the market could drift higher during today's quiet session.

-

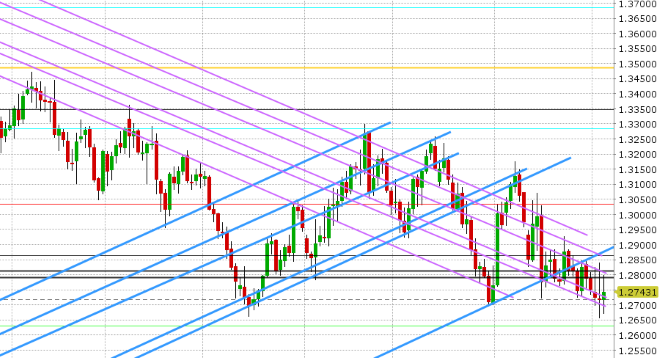

GBPUSD: Sterling is leading the G7 FX space higher today, but we continue to trade in the 1.2700-1.2800 range we talked about yesterday. The full legal advice on Brexit, which the UK government was forced to publish today in light of yesterday’s contempt of parliament, reiterated the market’s fears about the UK potentially being stuck with the EU. More here. Parliament continues to debate Theresa May’s Brexit draft ahead of next Tuesday’s historic vote. The live debate between Theresa May and Jeremy Corbyn, tentatively scheduled for Dec 9th, has now been cancelled.

-

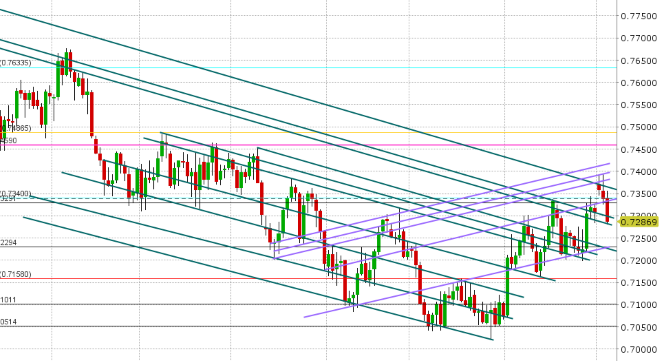

AUDUSD: The Aussie is trading on the back foot this morning after Australia’s Q3 GDP figures missed expectations by a wide margin last night (+0.3% QoQ vs +0.6%, and +2.8% YoY vs +3.3%). This saw traders fill Sunday’s opening chart gap completely, and while we saw some further selling as European traders came in today, the bounce in EURUSD and GBPUSD since then is helping to stem the AUD selling for now. Australia reports its October Retail Sales and Trade Balance figures at 7:30pmET tonight. We think last night’s poor GDP print may force the Reserve Bank of Australia to lower some inflation projections when it meets next in February 2019.

-

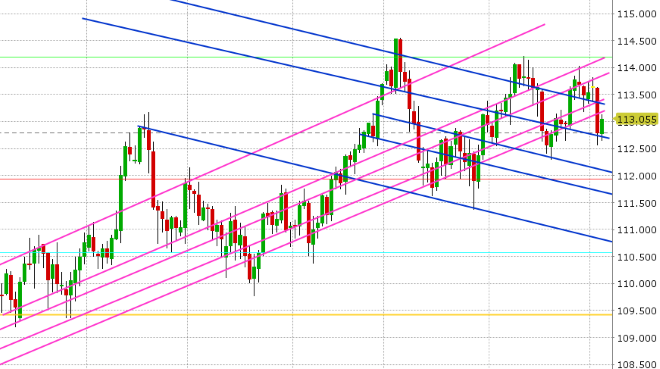

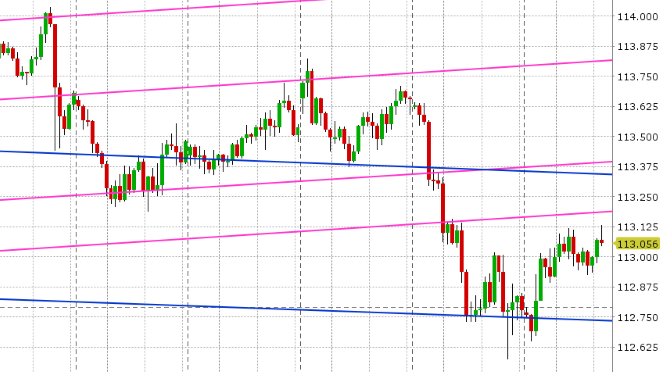

USDJPY: Dollar/yen bounced higher with the S&P futures in overnight trade, and chart support in the 112.70s held. The two big drivers of USDJPY price action (US stock and bond futures) are now closed for the day, and so we think the market follows the broader USD tone for the rest of today’s session. We would not be surprised to see the market look for sellers in the 113.20-30 area.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

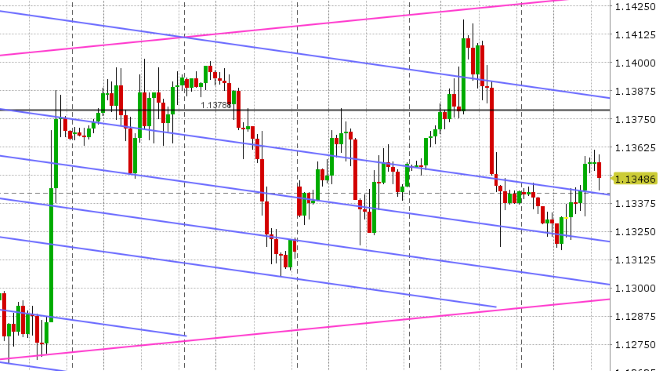

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

DEC S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.