Risk rebounds further to start the week, with Italian bonds leading the charge

Summary

-

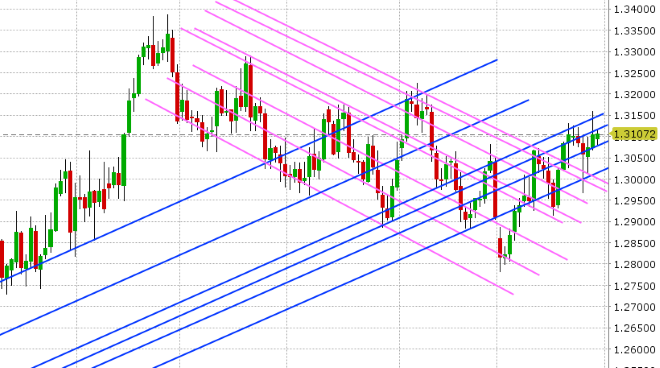

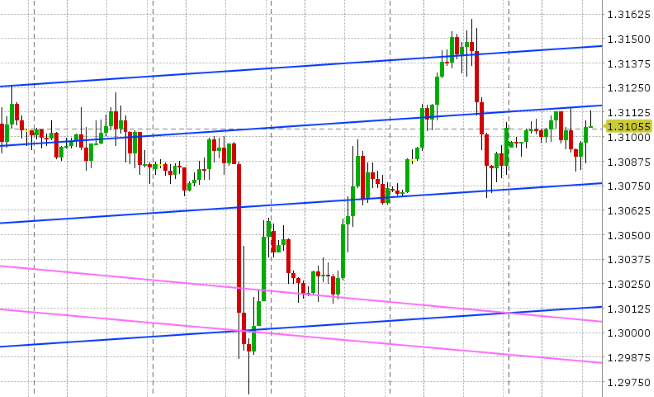

USDCAD: Dollar/CAD trades with a soft tone this morning as the broader USD succumbs to a bit of global “risk-on” sentiment to start the week. We think most of this has been driven by the rally in Italian bond today, as investors breathe a sigh of relief that Italy avoided a credit rating downgrade from S&P on Friday. The BTP/Bund spread has fallen to +289bp, the S&Ps are up 28pts and the JPY is being sold broadly. USDCAD broke swiftly below Friday’s pivot of 1.3140 when EURUSD and crude oil bounced. The market now sits above trend-line support in the 1.3070s, but below resistance in the 1.3110s, which means we may range trade a bit here. This week’s calendar features the US PCE Price Index for Sep (just reported in-line with expectations of +2% YoY), a speech from BoC Governor Poloz before the House (tomorrow), US ADP employment for October, Canadian Raw Material Prices for September, Canadian GDP for August and a speech from Poloz before the Senate (all on Wednesday), US ISM (Thursday) and finally a barrage of data on Friday (US & Canadian October employment reports, US & Canadian September trade reports, US Services ISM and US Factory Orders). The funds scaled back bullish USD bets for the 4th week in a row during the week ending Oct 23rd, leaving the net fund position the least long it has been since March. Corporates, on the other hand, continue to scale into USD long hedges, which has keep overall open interest steady.

-

EURUSD: Euro/dollar recovered nicely from its depths on Friday after some upside option expiries and a pop in gold prices seemed to prompt some short covering (open interest -1019 contracts). The move, allowed the market to close above trend-line resistance in the 1.1380s and appears to be the pivot for price action so far today. We saw some selling back down to this level in Asian dealings overnight and then a bounce higher after Italian bonds began their rally. Reports of Angela Merkel “not” running for re-election as CDU party leader come December then saw EURUSD swiftly break this level, but the market has since recovered when the German leader said she’d serve out her term as Chancellor until 2021. This news follows poor weekend election results in the German state of Hesse, where both Merkel’s CDU party and coalition party SDU lost support. German bonds are underperforming today, and oddly enough partly explains the contraction in the BTP/Bund spread we’re witnessing. The funds and corporate hedgers were busy adding new positions during the week ending Oct 23rd, but the accumulation was evenly distributed; leaving the new fund short position (4 weeks old) at the same level than then week prior. The PBOC fixed the Yuan higher today, which has kept USDCNH from retesting Friday’s highs. Around 1.5bln in options expire today at the 1.1350 strike. We think EURUSD chops around the 1.1370-80 level today. This week’s European calendar features the German employment report for October, German CPI for October, Eurozone GDP for Q3 and an Italian 10yr bond auction (tomorrow), German Retail Sales for September and Eurozone CPI for October (Wednesday), and the pan-European October manufacturing PMIs (Friday).

-

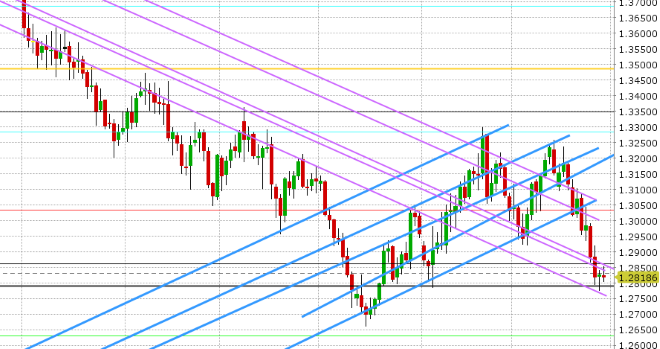

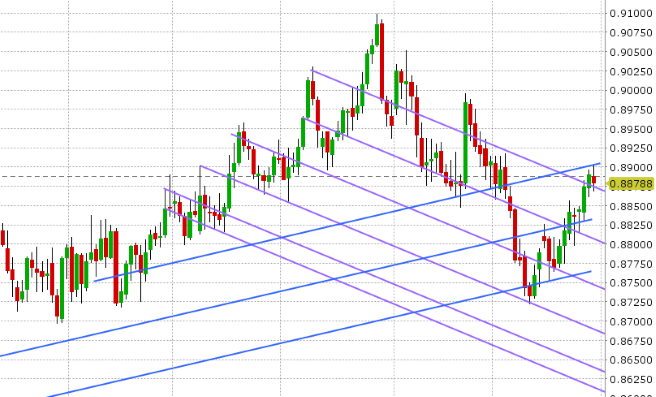

GBPUSD: Sterling is coasting to start the week, takings its overnight cues from swings in EURUSD, but chart resistance in the 1.2830s continues to cap. The UK’s finance minister Philip Hammond is set to announce the nation’s 2019 budget today at 11:30amET. Brexit anxiety continues to loom, which is keeping GBPUSD shorts in charge of this market. The funds trimmed short positions for the 3rd week in a row during the week ending Oct 23rd, with corporate hedgers continuing to take the baton instead. This week brings the Bank of England’s latest rate decision on Thursday, but with Brexit still at the forefront of the national discussion, traders are not expecting any changes. EURGBP continues to chug higher and now attempts to hold the 0.8870 level it broke above on Friday. We think GBPUSD stays on the defensive here sub 1.2860, but we’d be wary of some short covering if this chart resistance level gives way.

-

AUDUSD: The Aussie is trading with a quiet, range-bound tone this morning, but this comes after a rip roaring recovery to close out last week’s trading. Friday’s reversal higher in EURUSD and copper allowed AUDUSD to regain chart support in the 0.7080s, which we feel now repairs the chart once again and arrests the downward momentum. This week’s Australian calendar features September Building Permits (tonight at 8:30pmET), CPI for Q3 (tomorrow night ET), September Trade Balance (Wednesday night ET), and September Retail Sales (Thursday night ET). Copper prices are starting the week bid up 1%, and while we think we were a bit early in talking about the bullish, inverted head & shoulders pattern on the daily chart, we think the pattern still has a chance of playing out (so long as the 2.70 level holds). We think AUDUSD chops around with EURUSD for the mean-time though.

-

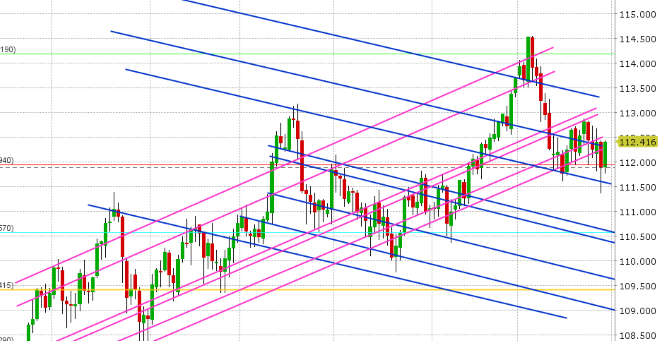

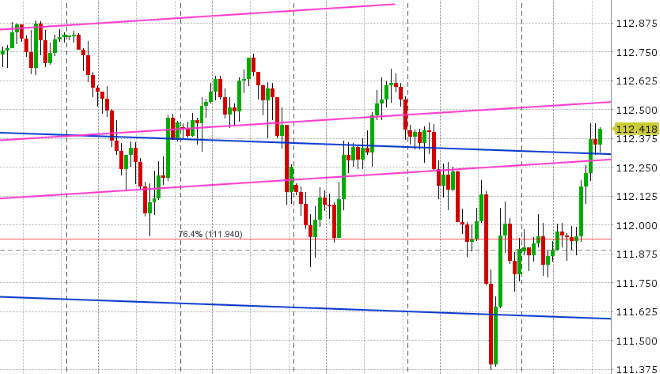

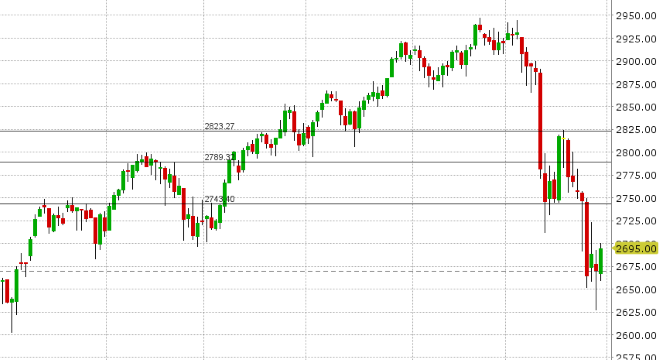

USDJPY: Dollar/yen is extending Friday’s recovery rally in impressive fashion this morning as the world buys equities today. Friday’s action was looking rather precarious for the fund long position after the S&Ps broke 2650 to the downside and USDJPY broke 111.50-60, but another swift recovery in stocks by end of day was the life saver. Overnight price action to start the week has followed the S&Ps yet again, and USDJPY now looks poised to regain the 112.30 level we talked about so much last week. The funds liquidated long positions for the 2nd week in a row during the week ending Oct 23rd, which was not surprising given the bounce in USDJPY back into the high 112s. This week’s Japanese calendar features the nation’s September employment report (tonight at 7:30pmET), the BOJ meeting (tomorrow night) and a holiday on Friday (Culture Day). We don’t think much will come out of the BOJ meeting this week, but we think traders will be on edge as always for any subtle hints at a change from the consistently dovish outlook.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

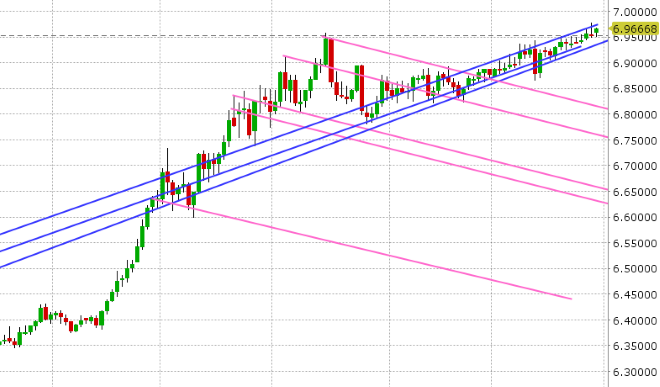

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

December S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.