Risk-off sentiment sweeping across markets into NY open

Summary

-

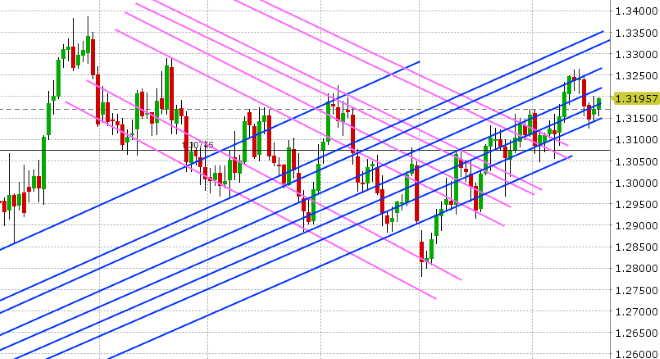

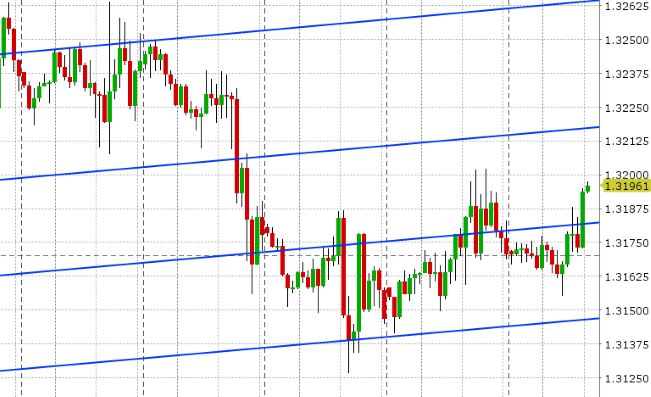

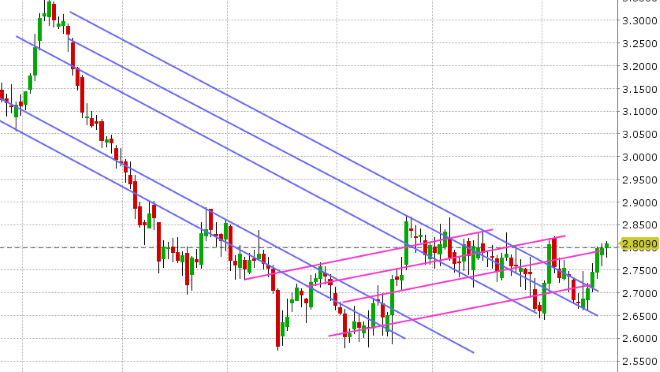

USDCAD: Dollar/CAD continues to wander in the high 1.31s this morning as liquidity starts to thin ahead of the US Thanksgiving holiday. Today’s calendar features US Housing Starts for October (8:30amET), a speech from senior deputy BoC governor Wilkins at the Max Bell School of Public Policy (1pmET), the weekly API oil inventory data (4:30pmET) and a speech from deputy BoC governor Lane at the Internet Society Canada Chapter (5pmET). We think USDCAD could take another stab at the upside today if the bout of “risk-off” selling in US tech stocks hits oil prices today. We feel today’s pivot is the 1.3180s. Stay above and it opens the market up for a bullish close above the 1.3210s. Trade back below and we’ll likely continue to wander into the 1.3150s.

-

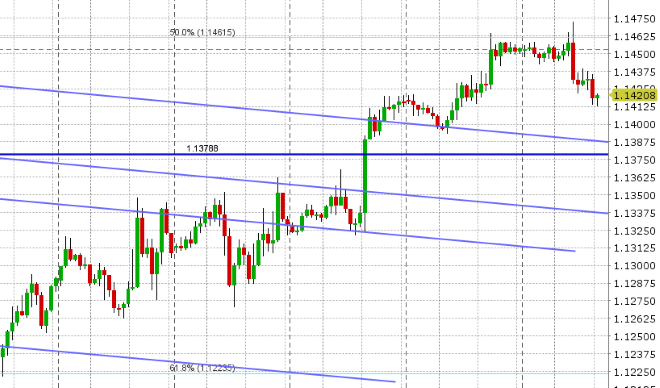

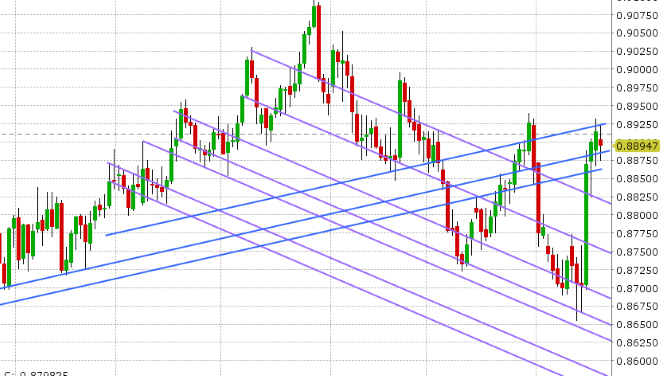

EURUSD: Euro/dollar is pulling back a tad this morning after a breakout attempt above the 1.1460s failed. A blow out in the BTP/Bund yield spread (to a high of +335bp this morning) also didn’t help the situation, as Italy braces for looming disciplinary action from the EU concerning its budget. While this key yield spread has calmed back down at this hour, traders continue to sell EUR here ahead of the NY open as some broader “risk-off” flows hit the S&Ps and EURJPY. We think EURUSD risks retracing all of yesterday’s gains here (down to support at 1.1390-1.1400) should the equity selling continue.

-

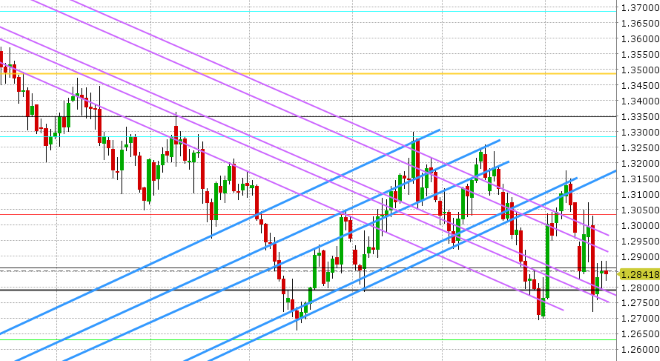

GBPUSD: Sterling is trading nervously quiet this morning as traders digest the latest Brexit headlines. There’s talk now that the Tory’s might not be able to muster the 48 letters necessary to trigger a no-confidence this week, and while this would be GBP positive, nobody knows for certain yet and so traders wait anxiously. We’re also seeing reports that Theresa May will head to Brussels tomorrow to meet EC head Juncker ahead of Sunday’s summit, and while on the surface this sounds positive too, the BBC is reporting that the UK PM won’t get a chance to renegotiate the terms of the draft deal that was announced last week (given the current itinerary of the meeting). And so traders continue to keep GBPUSD glued to the mid 1.28s for the time being.

-

AUDUSD: The Aussie is pulling back further after RBA governor Lowe reiterated some dovish tones about Australian wage growth, housing and credit markets when speaking earlier today. The chart support zone 0.7240-0.7270 is being tested now (something we alluded to happening yesterday). Copper prices continue to defy gravity so far this week, despite the risk-off tone to stocks. We’ll continue to monitor this as it may be a sign of a turn that could help AUD into week’s end.

-

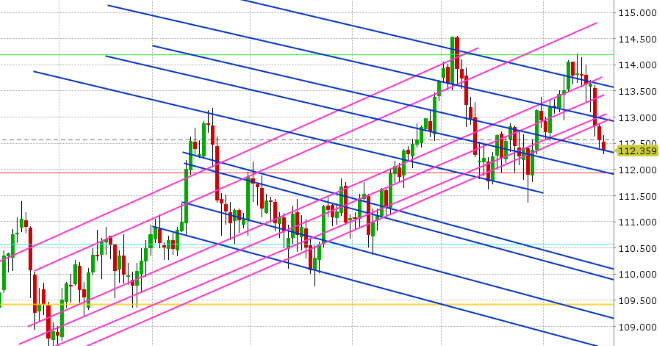

USDJPY: Dollar/yen remains offered this morning as the selloff in US tech stocks intensifies. The Nasdaq futures have now broken below the October lows of 6580, which could continue to spell trouble for the USDJPY fund long position here. Over 1.3blnUSD in options expire at the 112.00 strike tomorrow morning, which seems like the next target for traders should chart support in the 112.30s break today.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

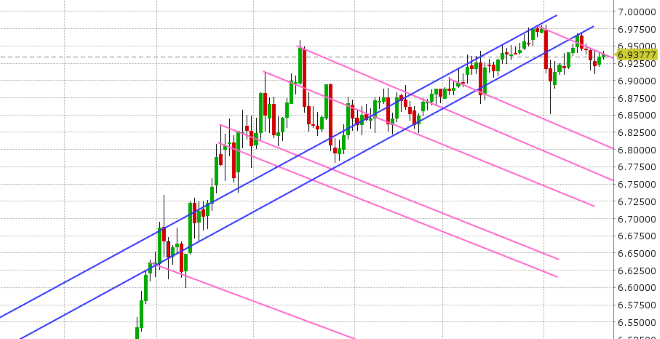

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

December NASDAQ 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.