Powell says "more" likely needs to be done. ECB press conference begins.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Fed keeps interest rates/asset purchases on hold, but concedes “more” likely needs to be done by Fed or Congress.

- Trump threatens retaliation against China for handling of coronavirus; leads to broad USD bid during 8pmET hour.

- Traders largely ignore China’s April Manufacturing PMI, 50.8 vs 51.0 expected vs 52.0 in March.

- ECB keeps rates on hold, relaxes TLTRO III terms, creates new PELTRO, but doesn’t increase PEPP and APP purchases.

- Christine Lagarde’s press conference, US Jobless Claims and Canadian GDP (February) on deck at 8:30amET.

- Large AUDUSD and USDJPY option expiries on deck for 10amET. Europe closed for May Day holiday tomorrow.

ANALYSIS

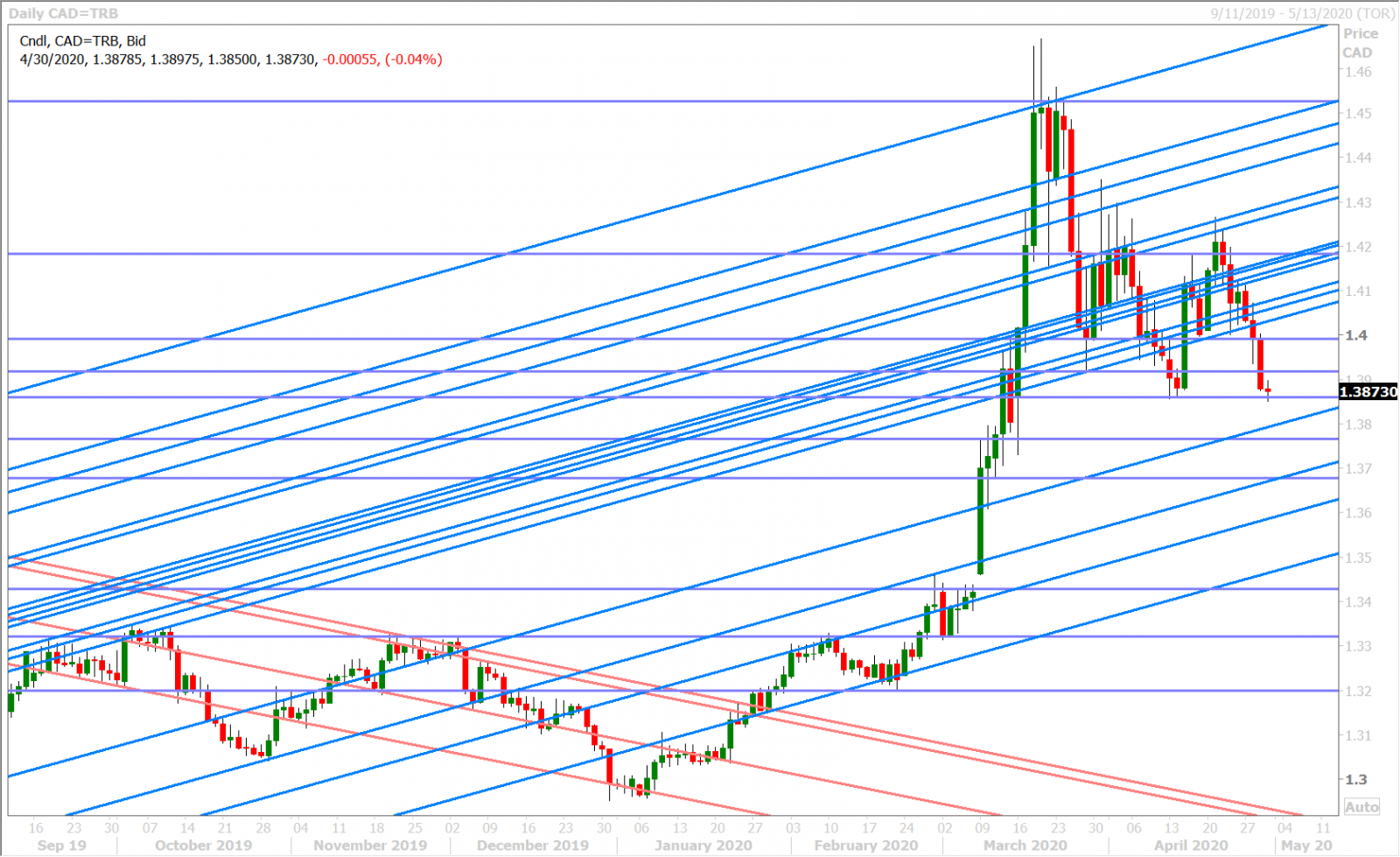

USDCAD

Dollar/CAD is trading with a subdued tone just above the lower bound of its April price range (1.3850s) as traders await the main events of this morning. ECB President Christine Lagarde is expected to take center stage at 8:30amET and she’ll be under immense pressure to explain today’s rather lackluster ECB statement following its 7:45amET policy meeting. The US will report its Jobless Claims figures for the week ending April 25 (+3.5M expected). Canada will release its February GDP data as well (+0.1% MoM expected).

The FX option market priced yesterday non-eventful FOMC meeting to a tee. The Fed kept interest rates and all its new asset purchase/loan programs in place as expected, and chairman Powell championed the central banks’ recent effort to help restore credit market functionality, however, we didn’t think he sounded confident at all about the future. Powell talked about some very real risks that are making it difficult to predict when the economy can get back to normal and he conceded that “MORE LIKELY NEEDS TO BE DONE IN RESPONSE TO CRISIS WHETHER BY FED OR CONGRESS”. This headline was the only real takeaway from the meeting in our opinion, and explains the modest extension of positive risk sentiment and USD selling that we saw following it.

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

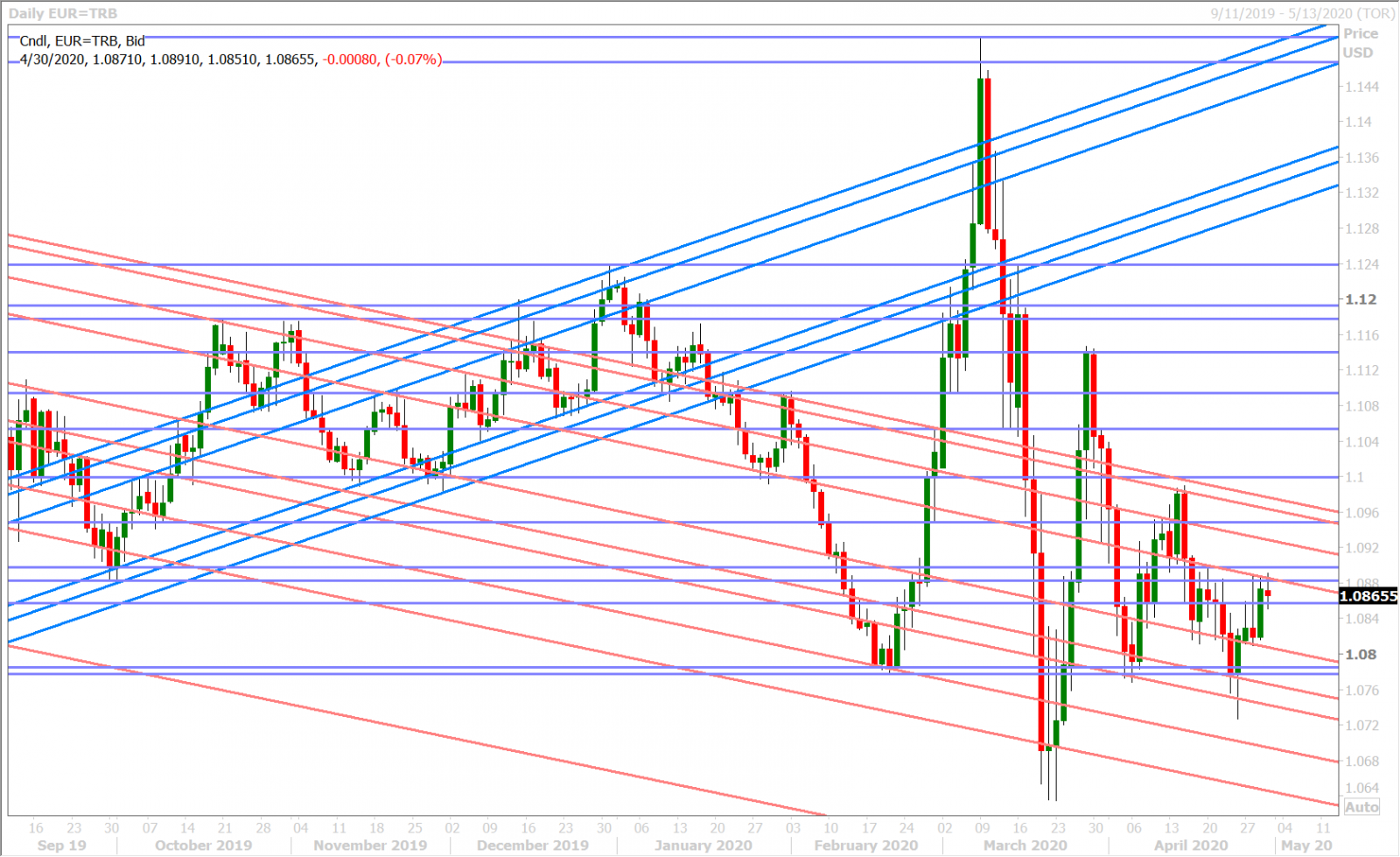

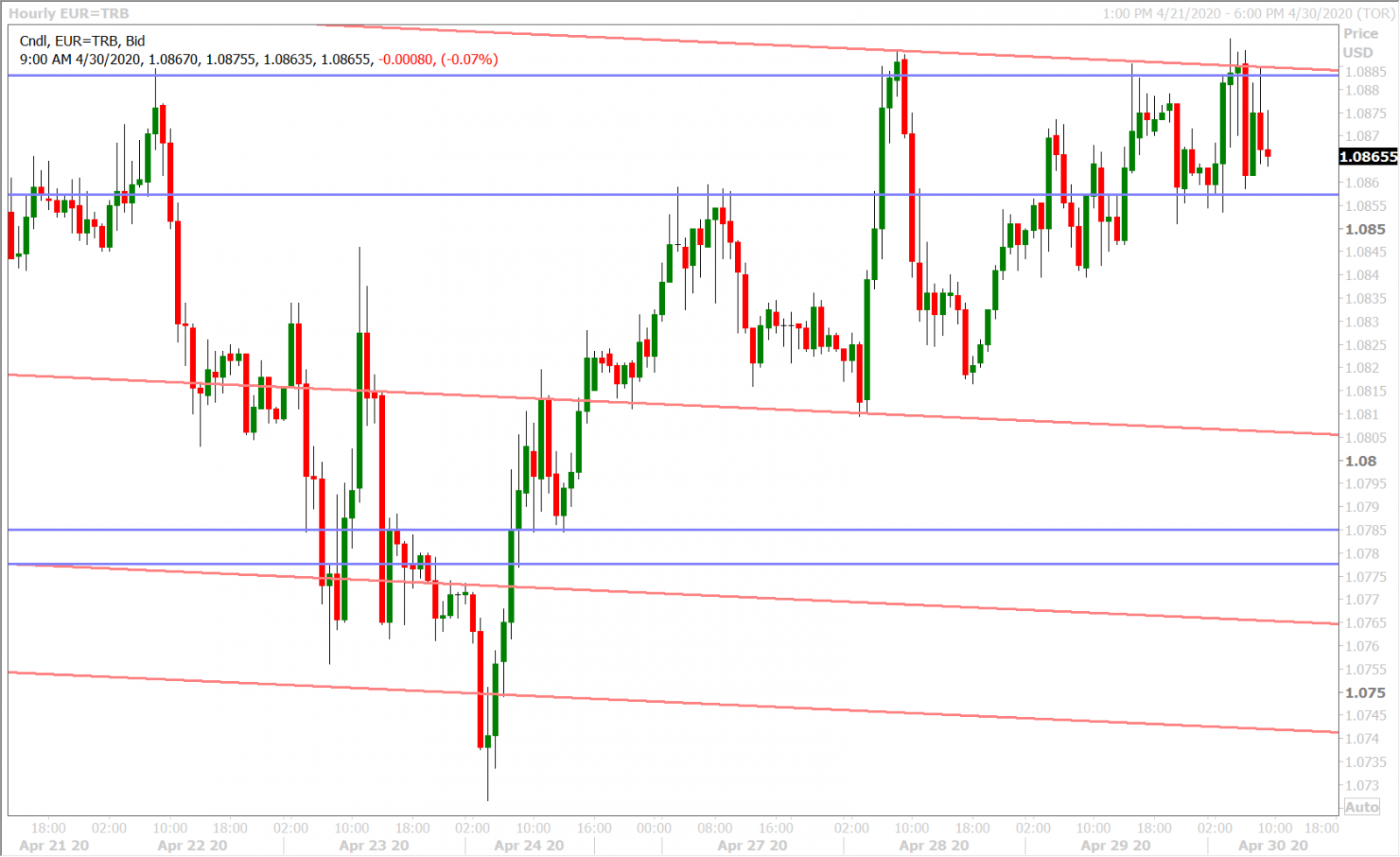

EURUSD

The European Central Bank kept interest rates on hold this morning (as expected) and while it relaxed the terms on its TLTRO III program and created a new pandemic emergency longer-term refinancing operation (helpful), it didn’t announce any increase to its 750blnEUR Pandemic Emergency Purchase Program or its 20blnEUR/month Asset Purchase Program (which was a bit disappointing).

Full press release here. LIVE LINK to Christine Lagarde’s press conference here.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND SPREAD DAILY

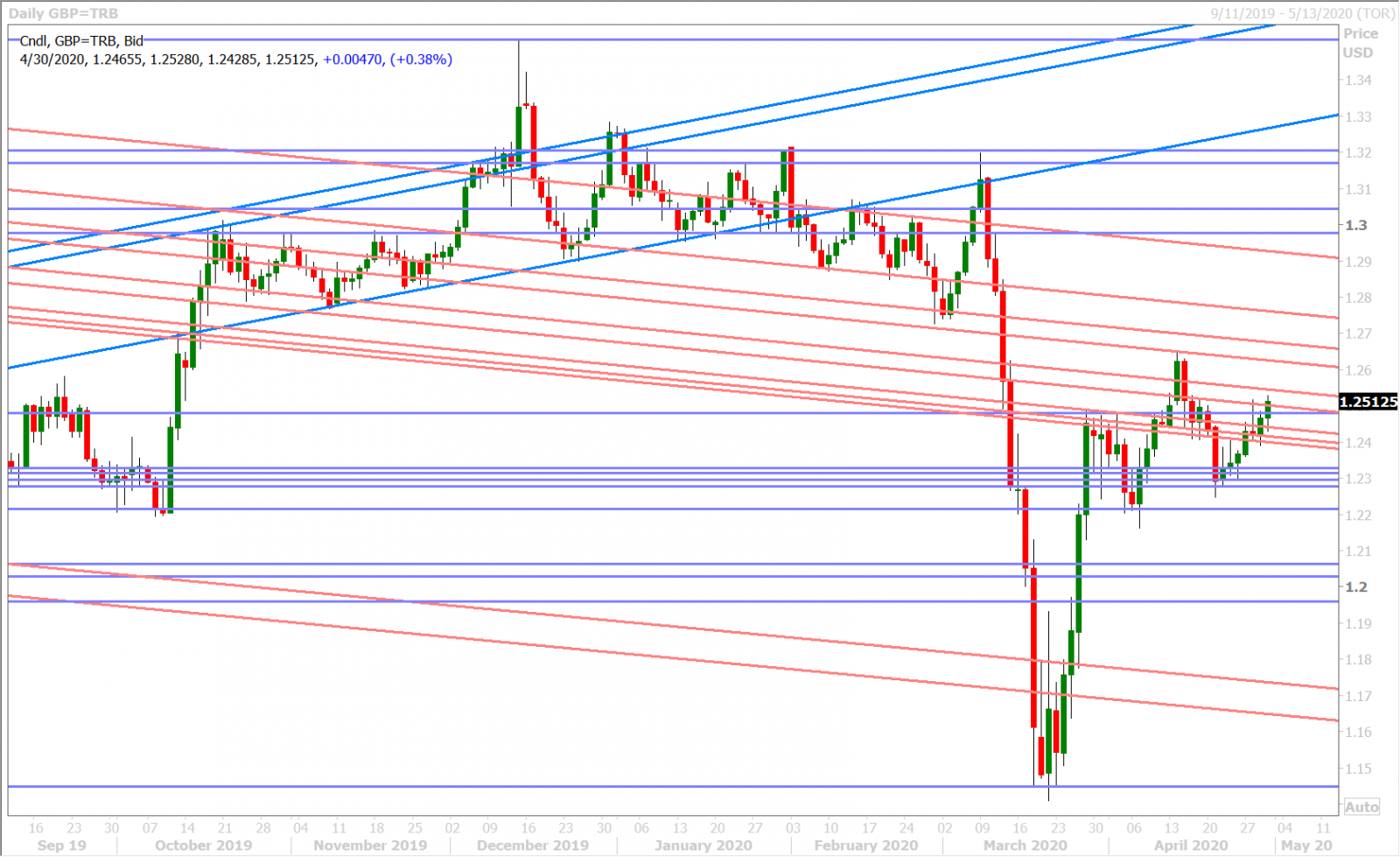

GBPUSD

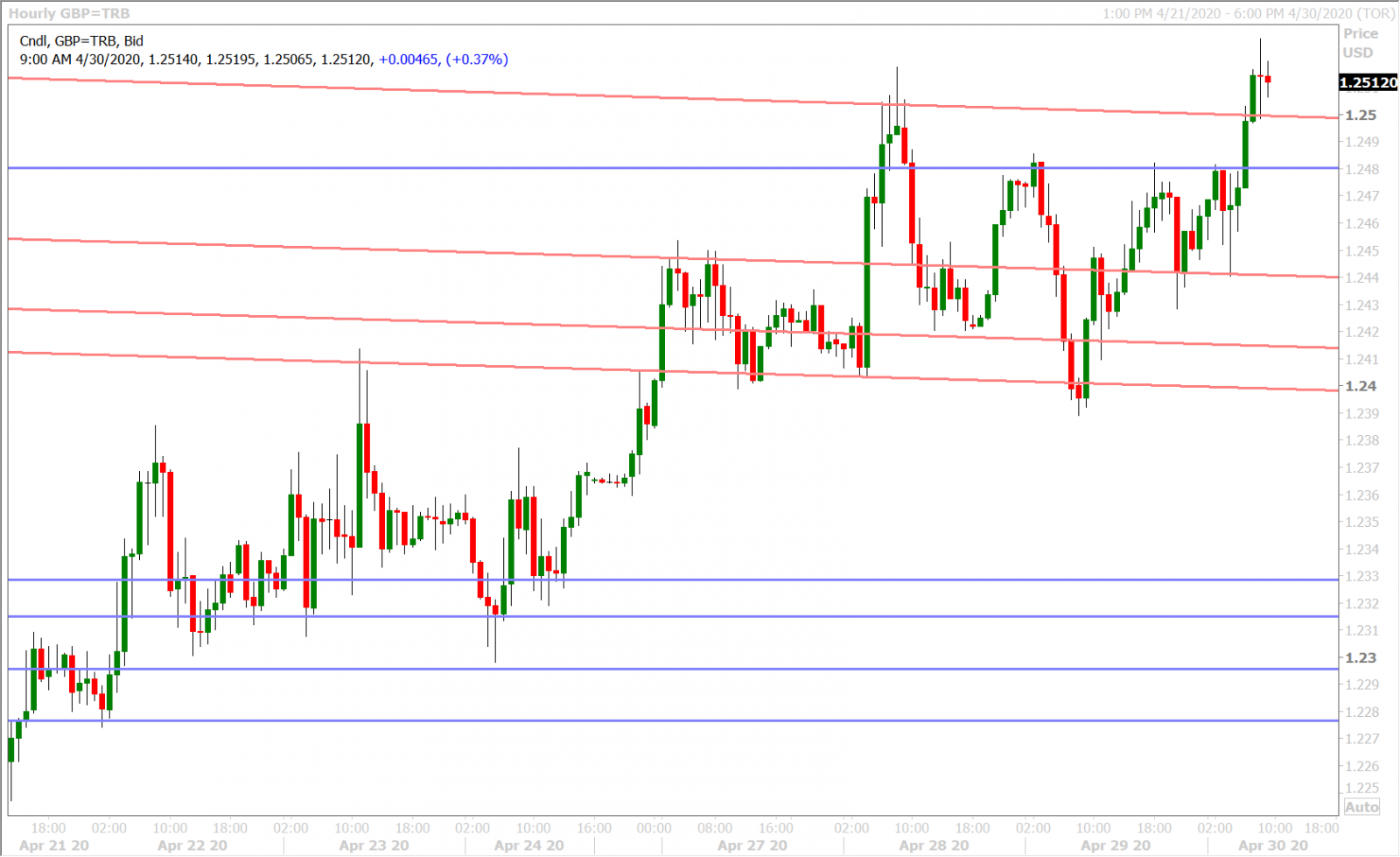

Sterling charged back above the 1.2500 resistance level in London trade this morning as continued talk of month end flows made the rounds. Many month-end models are still forecasting broad USD sales this April, and what we could also be seeing today is simply the conclusion/absence of those artificial month-end EURGBP buying flows that pressured the pound yesterday. The bearish head and shoulders pattern, that we talked about early yesterday as a potentially bearish technical development for the daily GBPUSD chart, never got confirmed by virtue of the market closing NY trade decisively back above 1.2440. All this, in our opinion, has helped sterling recover today, and then some.

We think a NY close above the 1.2500 mark today would be technically positive and signal the market’s intention to re-challenge April’s highs in the 1.2640s. The UK will report its final April Manufacturing PMI tomorrow, while the UK is on holiday for May Day, at 4:30amET. The consensus expectation for 32.8, versus the flash estimate of 32.9.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar took a little knock lower last night following President Trump’s comments about potential retaliation against China regarding their handling of the coronavirus. More here from Reuters.

Chart resistance (turned support) in the 0.6530s continues to hold however ahead of this morning’s upcoming economic headlines. Over 2.7blnAUD of options will expire at the 0.6570 strike at 10amET this morning.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

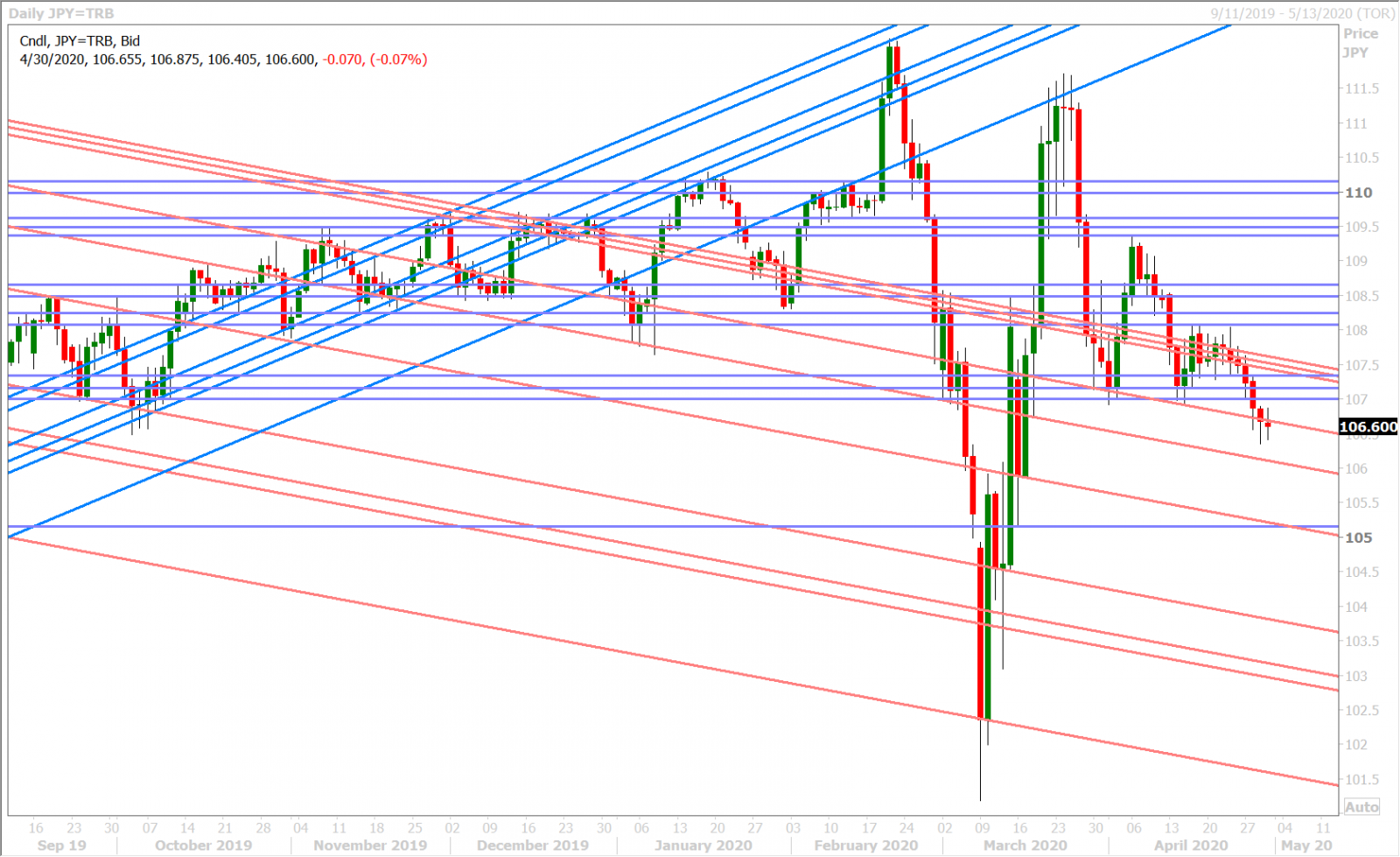

Dollar/yen is hanging in there this morning, despite widely reported USD selling elsewhere. We think the raft of topside option expiries on deck for 10amET today could be helping to stem the slide for now. Over 2.4blnUSD rolls off between the 106.60 and 107.00 strikes. We think any hope for a sustainable USDJPY bounce into next week’s Golden Week holidays hinges upon the market regaining the 106.60s on a closing basis.

USDJPY DAILY

USDJPY HOURLY

US 10 YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.