Portfolio managers still apparently short of USD into month/quarter end

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- USD gets bought across the board, despite steady overall risk tone and ample dollar liquidity.

- USDCAD breaks above 1.4170-90s. AUDUSD reversing lower with 4th upside buyer failure in 0.6190s.

- EURUSD slumps for the second straight day. Sterling outperforming euro as 1.2290s hold.

- China’s Manufacturing PMI for March beats expectations. Trump & Putin talk oil market stabilization.

- Canada reports +0.1% MoM GDP growth for January, in-line with expectations.

- BREAKING: FED OFFERS REPO FACILITY TO FOREIGN CENTRAL BANKS WITH ACCOUNTS AT THE NEW YORK FED.

- Fed says move provides “alternative temporary source of USD other than sales of securities in the open market”.

ANALYSIS

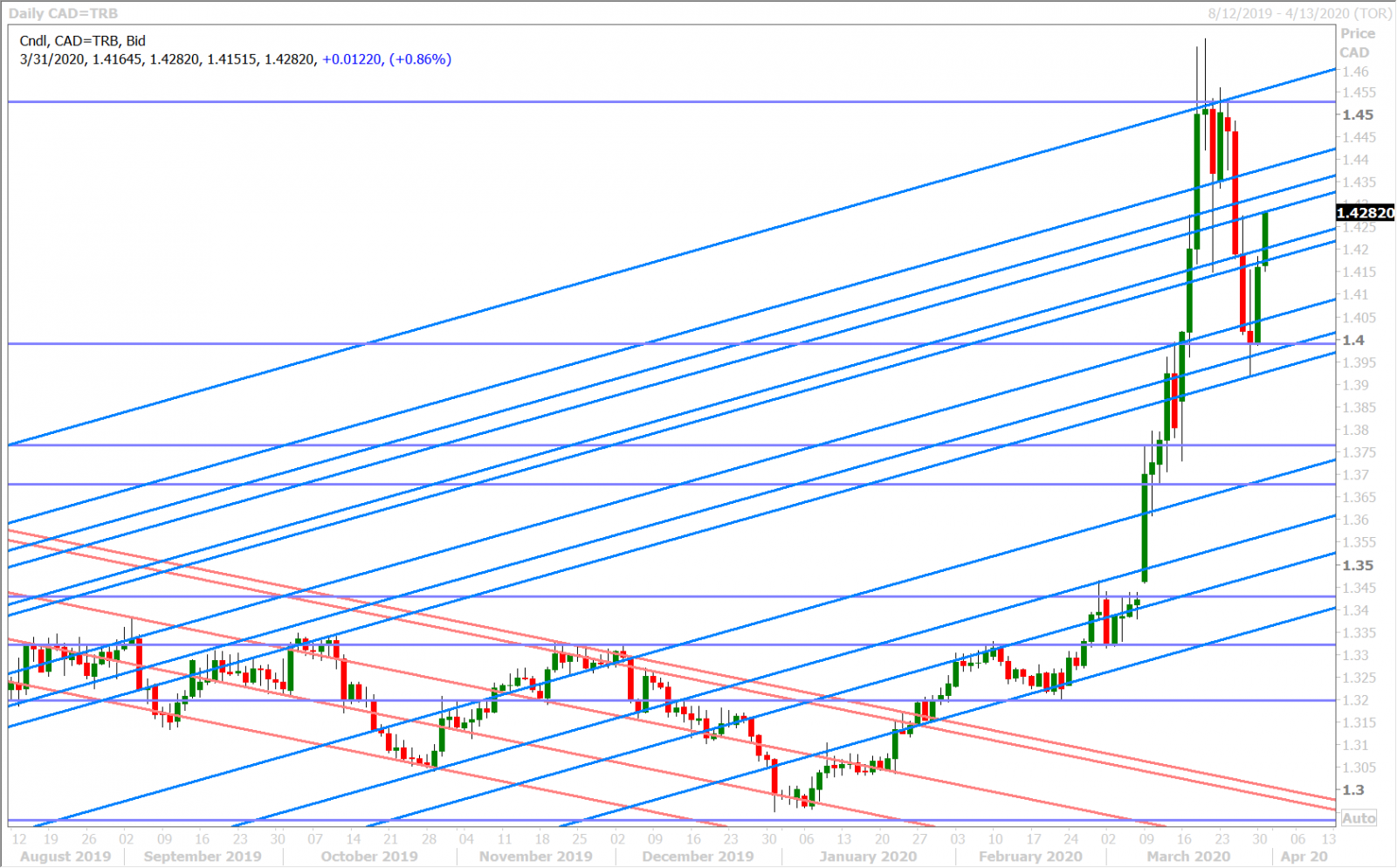

USDCAD

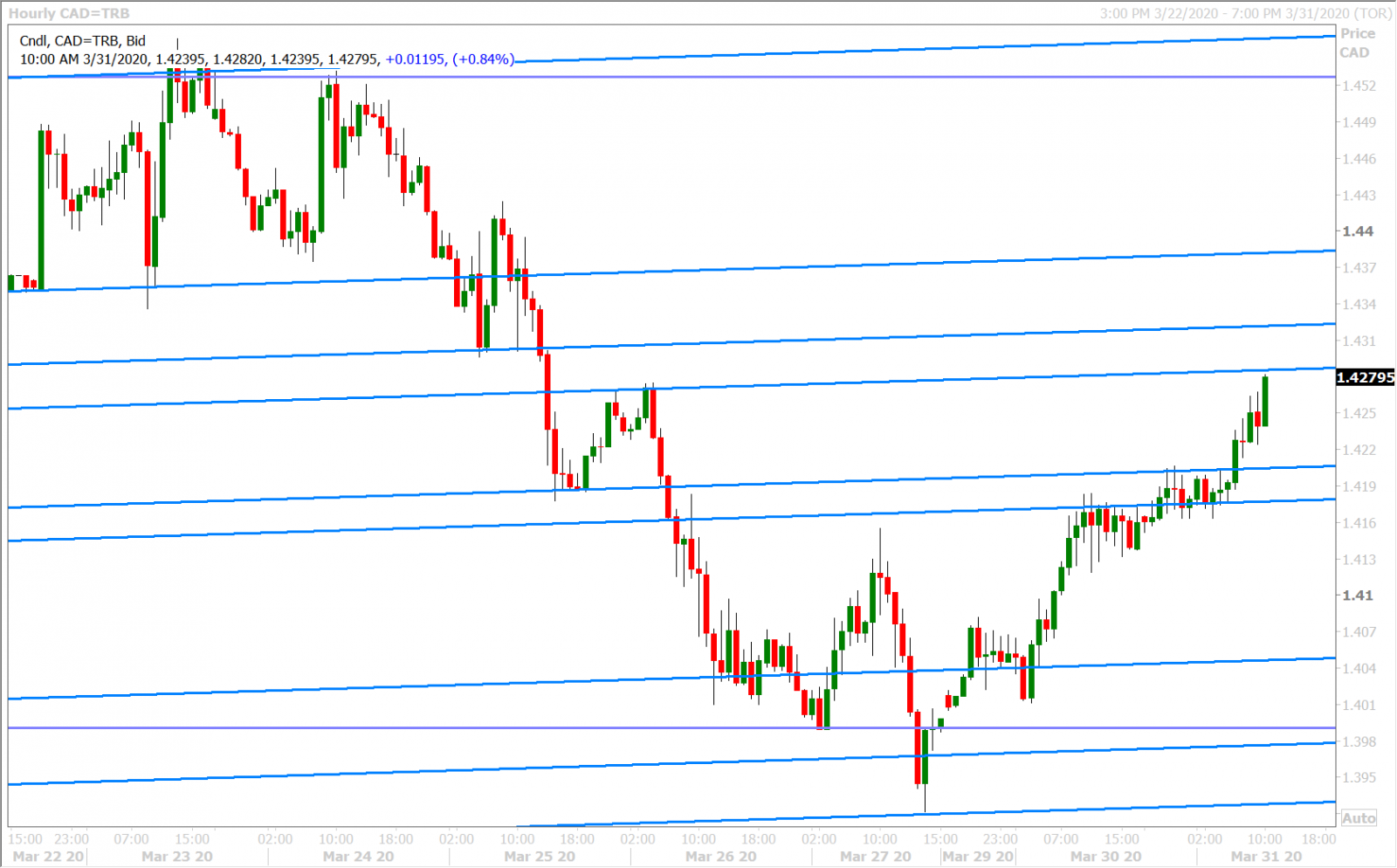

So apparently portfolio managers still needed to buy dollars overnight for month-end and quarter-end rebalancing purposes. This the only explanation we can gather from market chatter this morning to explain today’s relentless bid. The 3-month EURUSD cross currency swap basis swap is trading at +34.5bp, which is now showing a glut of USD balance sheet capacity…so it’s hard to argue the USD strength is coming from perceived dollar funding stress. China’s Manufacturing PMI for March massively beat expectations overnight (52.0 vs 45.0); and May oil prices are jumping 8% higher after Trump and Putin agreed during a phone call to have their top energy officials discuss stabilizing energy markets…so it’s hard to argue that we’re seeing a “risk-off” USD bid here. June gold futures showed an unexplainable drop during the 5amET hour…perhaps someone’s expressing their USD view more pronouncedly this morning by leaning on the much more illiquid gold market?

It’s all a little hard to explain, but this incessant bid for dollars is ruining our 1.3900-1.4200 range thesis for USDCAD to start the month of April. We’re prepared to abandon this view should the market close NY trade today above the 1.4170-90s. The next major chart resistance zone is the 1.4280-1.4320s. Canada reported +0.1% MoM GDP growth for January, which was in-line with consensus.

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

EURUSD

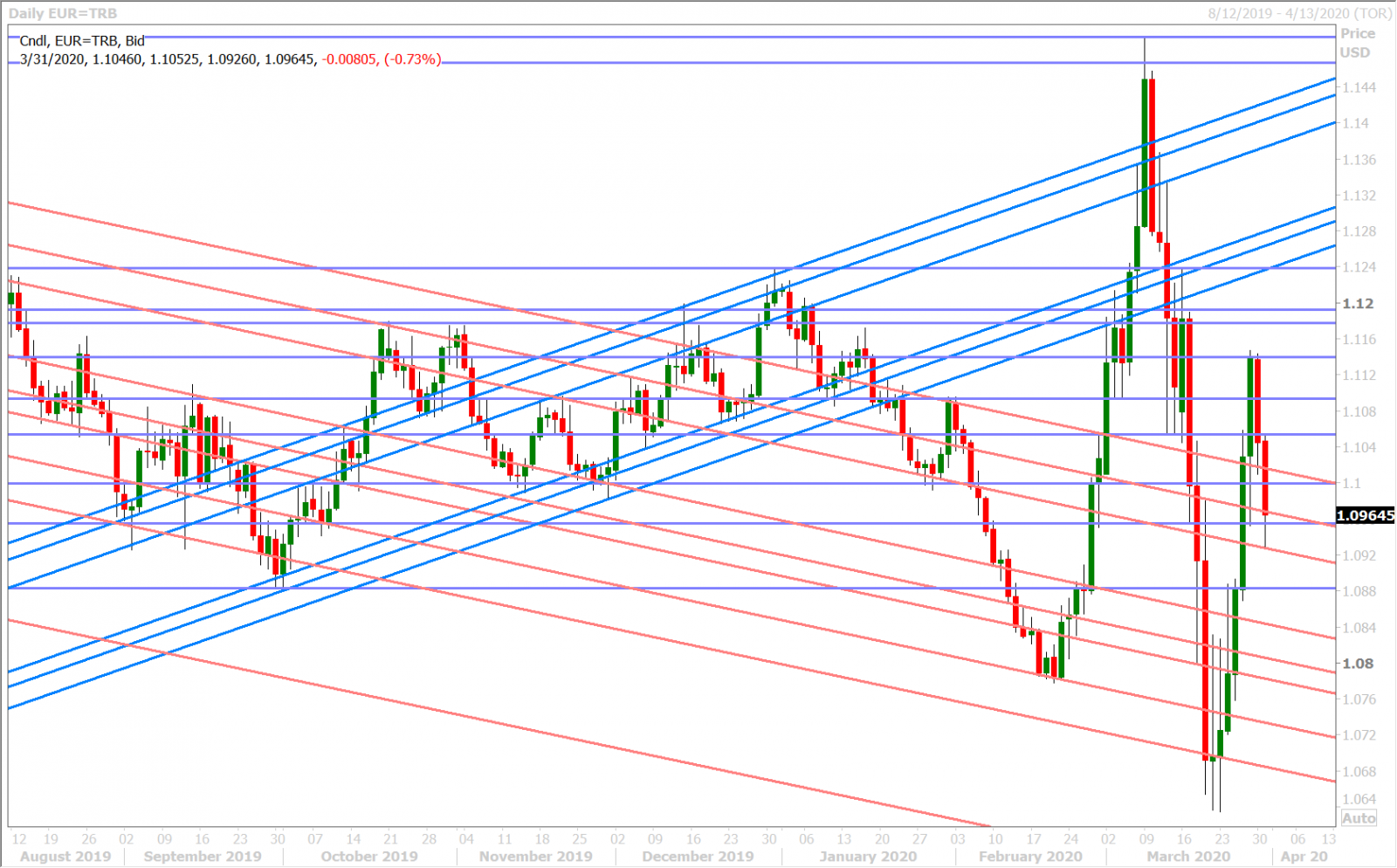

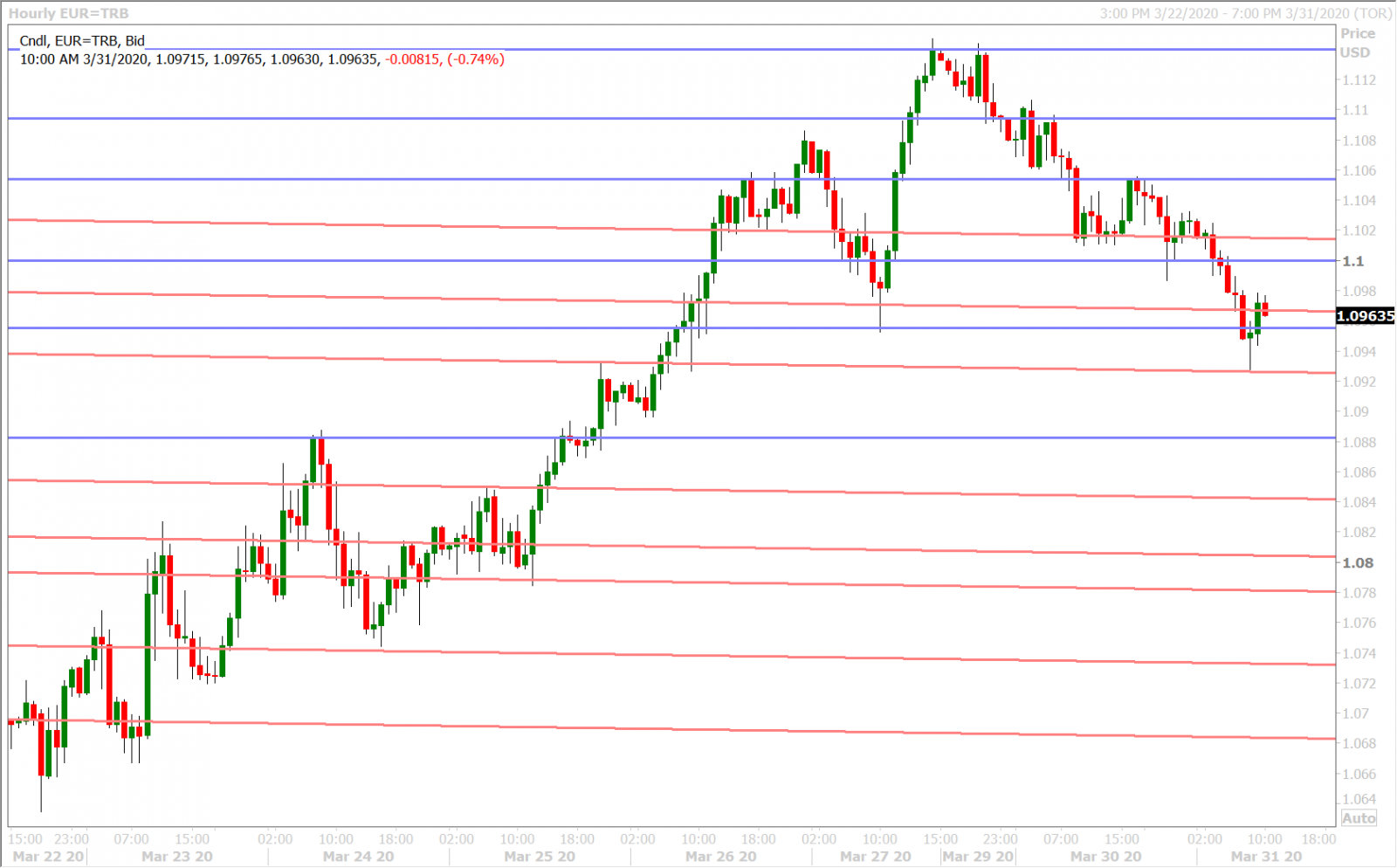

Euro/dollar slumped another 1% lower overnight, and this comes after yesterday’s 1% fall…all this on continued talk of portfolio manager demand for dollars heading into month and quarter end. Today’s 2blnEUR+ of EURUSD option expiries between the 1.1000 and 1.1035 strikes appear to be a complete non-factor (which is a bit unexpected in our opinion). Trend-line chart support in the 1.0920s are containing the market’s losses for now, and we’re starting to get a much more neutral technical outlook on the daily charts heading into April.

EURUSD DAILY

EURUSD HOURLY

JUNE GOLD DAILY

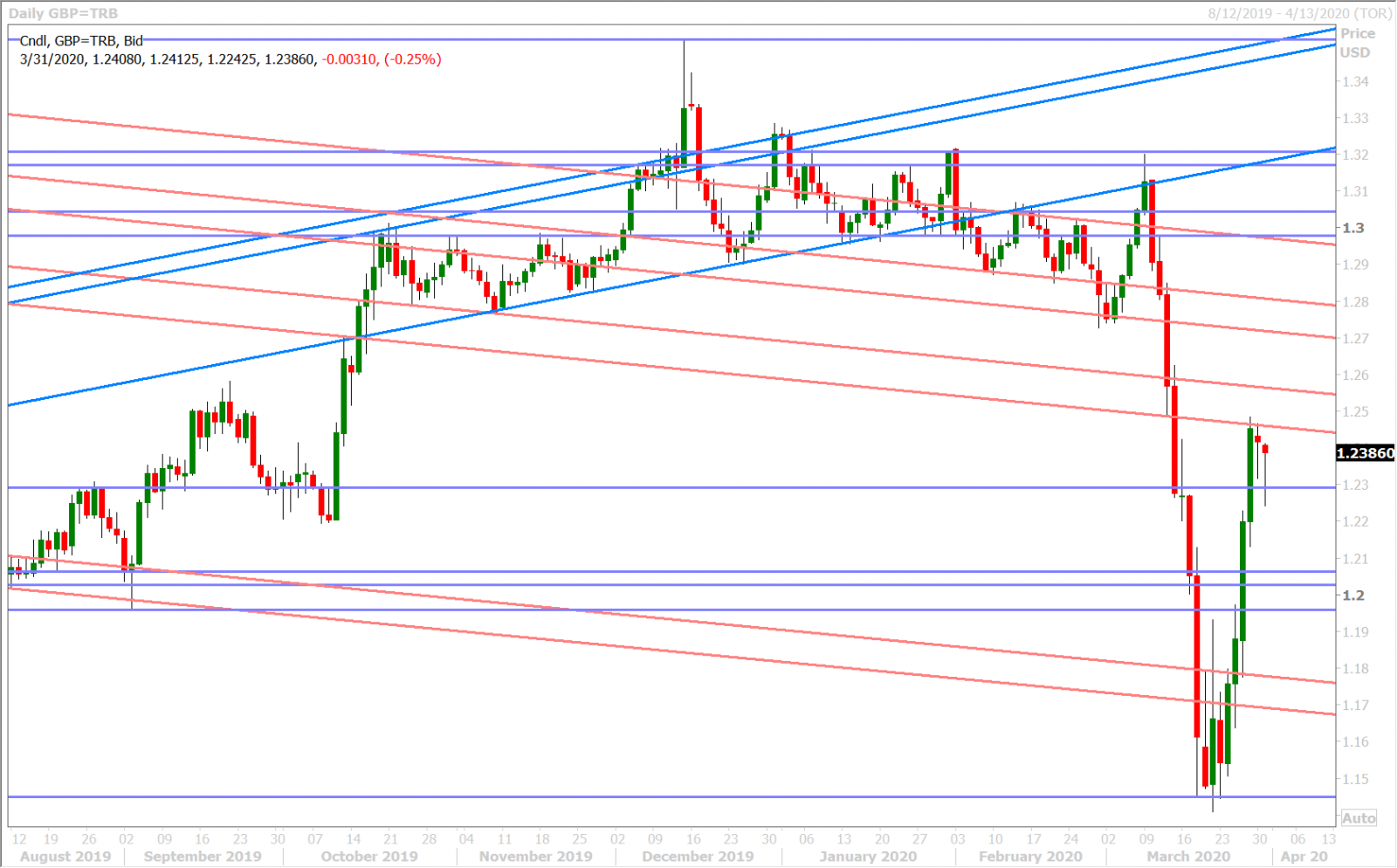

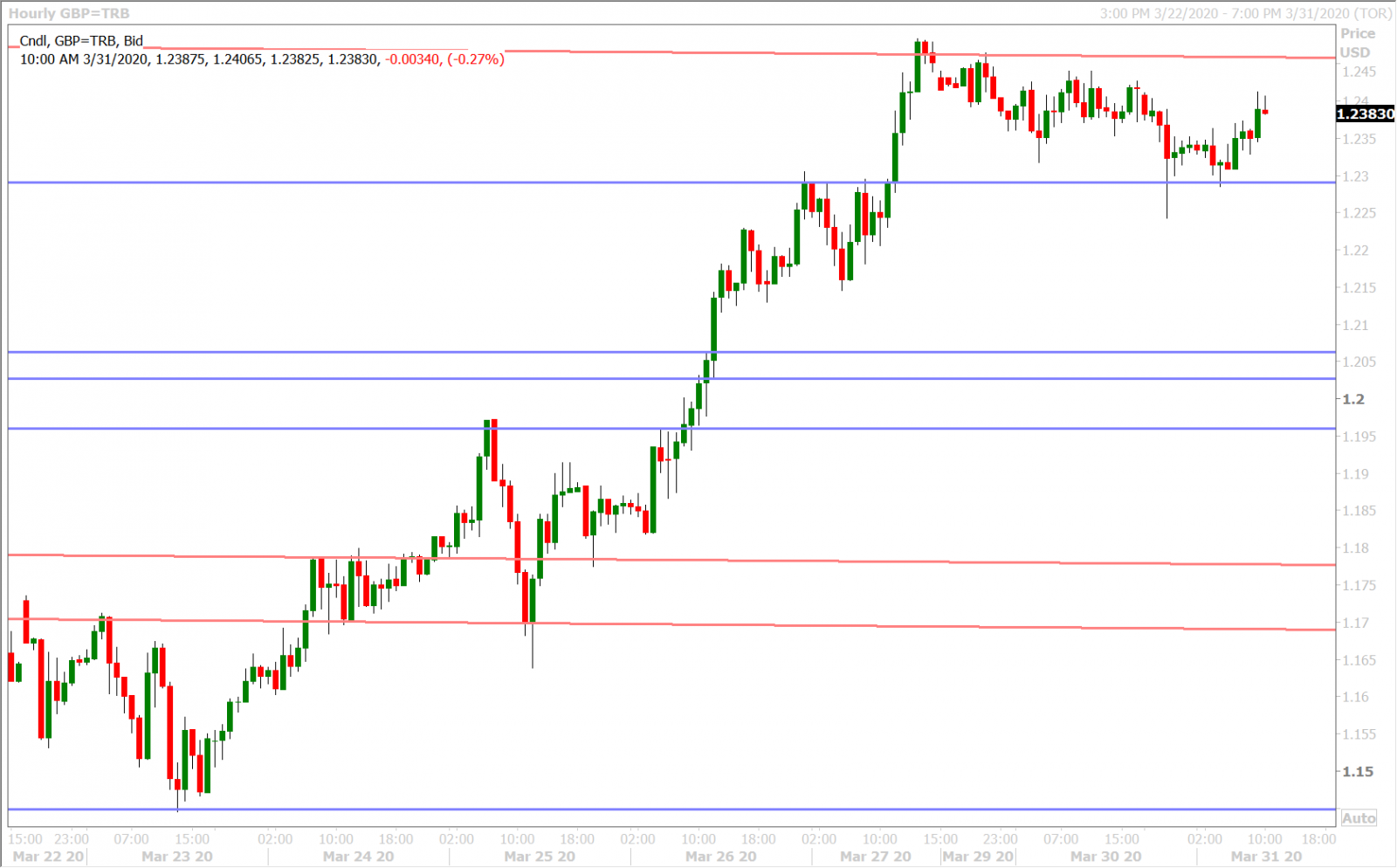

GBPUSD

Sterling is holding up much better vis a vis the euro this morning as traders defend Friday’s resistance level (now turned support) in the 1.2290s. Some chatter is making the rounds that the UK will be forced to ask the EU to delay the post-Brexit transition period by a year or two, because trade talks have apparently “ground to a halt” amid the coronavirus pandemic. One could argue this is GBP bullish and perhaps explains a large part of EURGBP’s decline since the broad USD funding issues began to abate over a week ago.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is showing concerning signs of technical weakness today. While some Tokyo-fix related demand for dollars saw a mini-flash crash in AUDUSD during Asian trade last night, it was really early London’s 4th failed upside breakout attempt above the 0.6190s that sowed the seeds for this morning’s bearish reversal lower in our opinion. We think a NY close today below the 0.6110s would confirm the negative price pattern, but we think we also have to be prepared for a more neutral close should the markets give up their month-end USD bid after the London fix.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

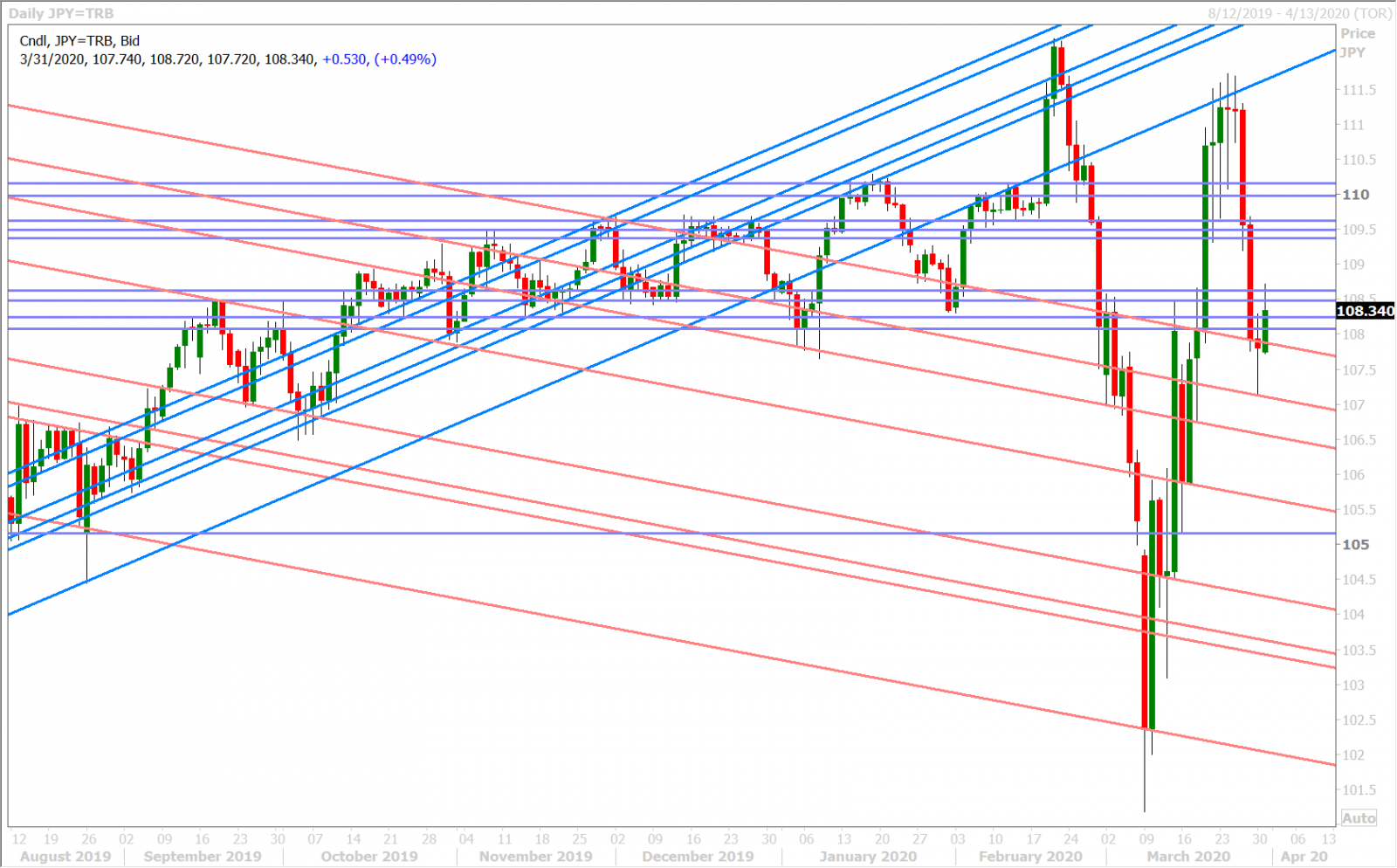

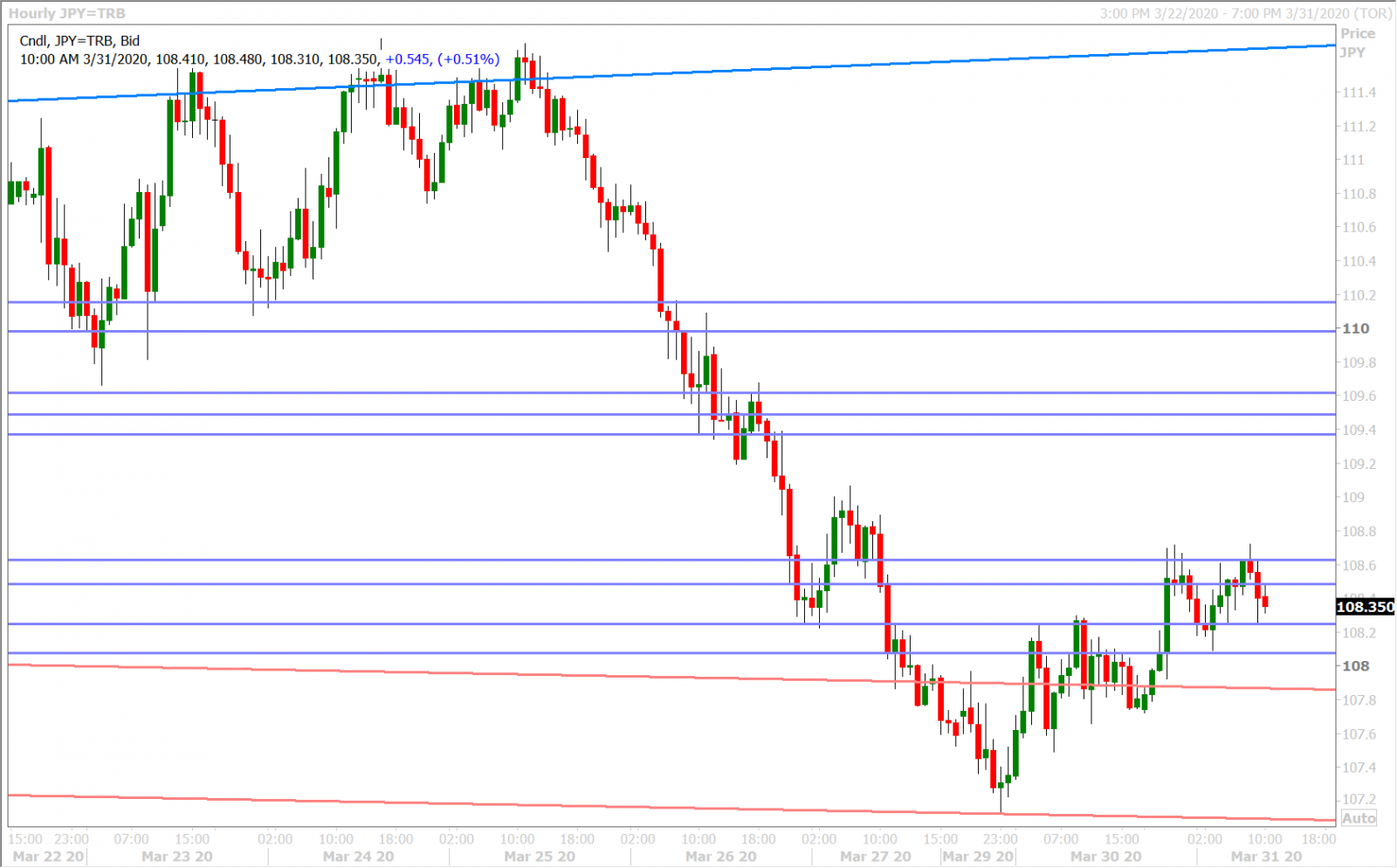

USDJPY

Chatter from Japanese banks today suggested that “Japanese names” were also short of USD going into today’s Tokyo fix…which was not only month-end and quarter-end, but also fiscal-year-end in Japan. We still find it fascinating that large real-money market participants a) leave everything to the last minute like this and b) show their hands to the market by executing at the well-known fixing times. Have they heard of trading algorithms to more discretely execute their flows?

These month/quarter/year-end flows allegedly gave USDJPY its bid in the overnight session, but we’d note once again how the market is struggling with the 108 handle. Chart resistance in the 108.60s is now clearly capping prices and we think this could give the bears some momentum heading into some 10amET option expiries at 108.20.

USDJPY DAILY

USDJPY HOURLY

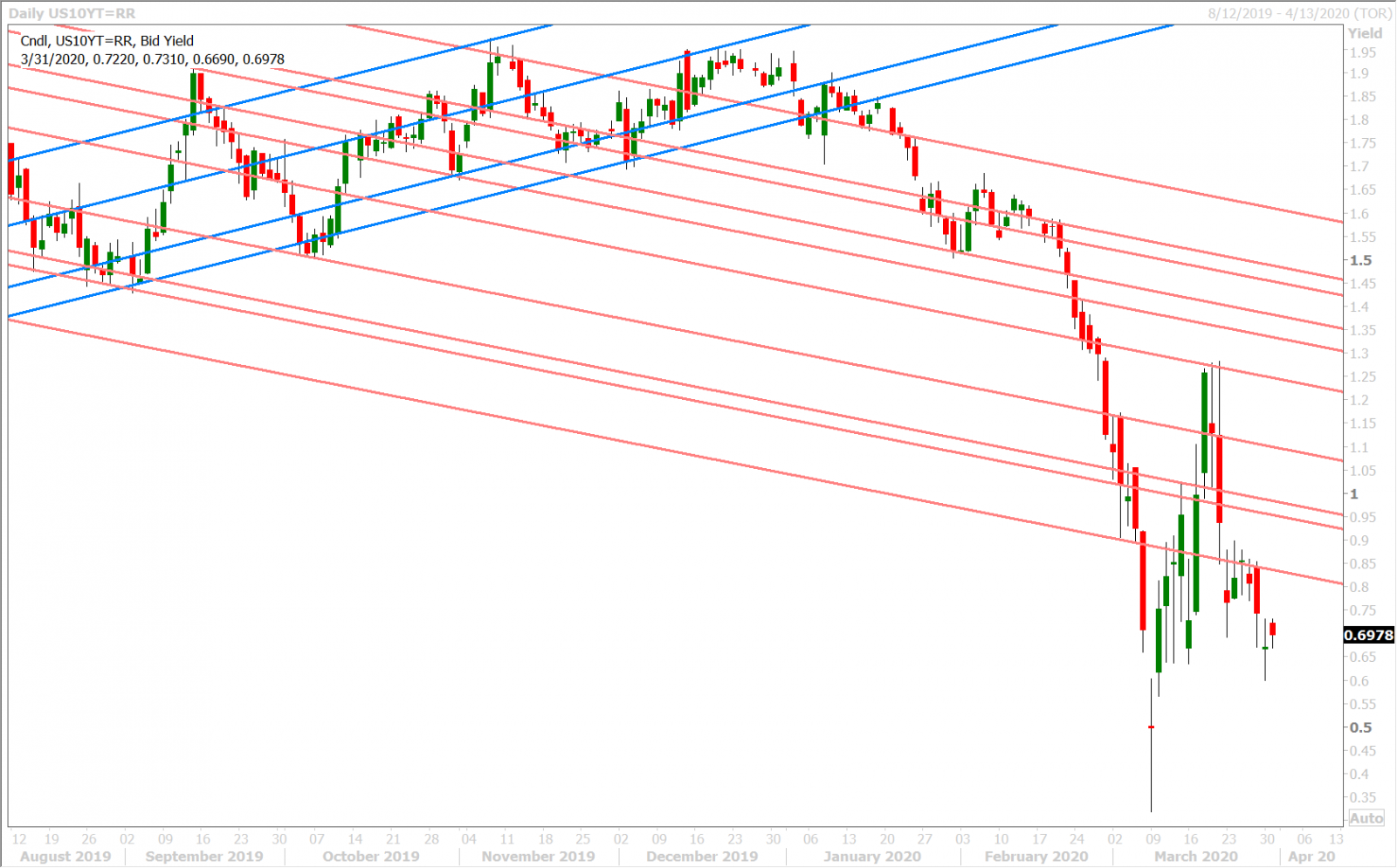

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.