OPEC driven crude oil selling allows USDCAD to break higher. EURUSD mared by Italian and now Spain political drama. USD broadly higher ahead of US long weekend.

Summary

-

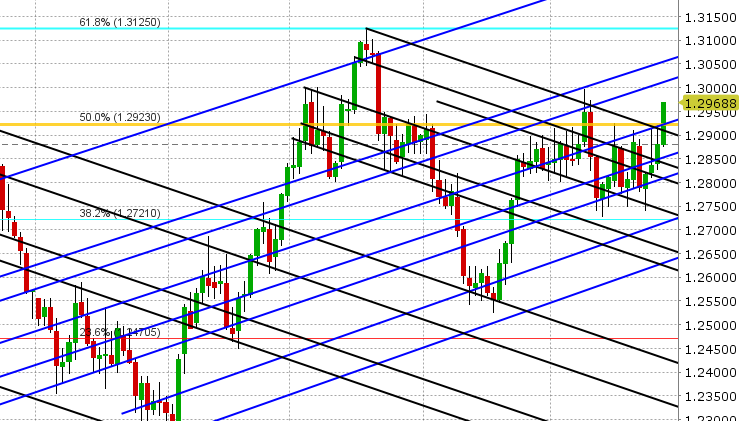

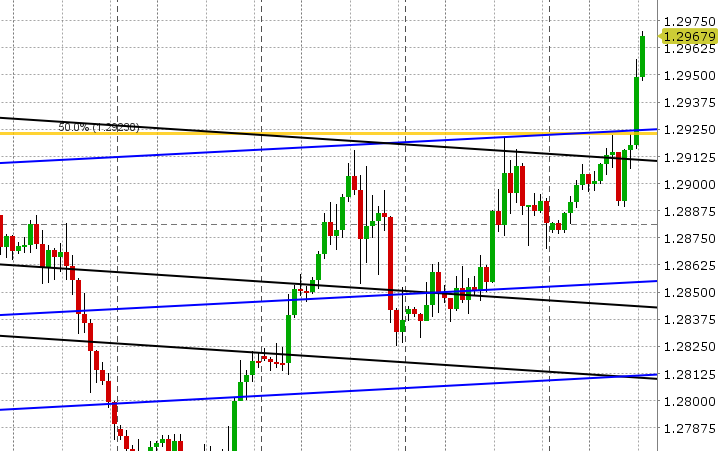

USDCAD: Dollar/CAD is rallying higher again this morning after a mixed performance yesterday and today’s gains are all about crude oil. Reuters and other sources are reporting that OPEC is considering a 1mln bpd increase in supply following record over-compliance (152%) with agreed supply cuts in April. The final decision comes in late June when OPEC meets again, but the headlines were enough to knock crude over 2% lower this morning. USDCAD is naturally benefitting from this, and has now broken topside resistance (1.2925) on the charts. This opens the door for the market to extend to the 1.3010-20 level in our opinion. Broad USD strength is helping the cause this morning as well, with EURUSD losing support once again. The US just reported Durable Goods for April, which came in mixed (weaker on the headline, but stronger ex-transportation). The Fed’s Powell will participate in a panel discussion in Sweden today at 9:20amET. We’ll also have Fed speak from Bostic, Evans and Kaplan today. We think USDCAD moves higher here so long as the market stays above the 1.2920s.

-

EURUSD: Nothing is going right for EUR traders this morning. Yesterday’s NY close was mediocre in that the market couldn’t close above the 1.1720s, and while the German IFO beat expectations this morning, this has been overshadowed by continued selling in Italian bonds (BTP over Bunds now +200bp wide) and what now appears to be a political crisis in Spain (PM Rajoy facing no-confidence vote). EURUSD has collapsed through the 1.17 handle and is now looking rather precarious going into the US long weekend. Traders are glued to the wires now as Spain’s Rajoy speaks to reporters. We think EURUSD remains on the defensive. USDTRY is relatively quiet for a change.

-

GBPUSD: Sterling traders have been content to follow EURUSD lower again in overnight action. The UK’s 2nd read on Q1 GDP was released earlier, but it was reported in-line with expectations (+1.2% YoY and +0.1% QoQ). The BoE’s Carney will also be speaking at the panel discussion in Sweden today, so be on the lookout for any comments there. The topic is “Financial Stability and Central Bank Transparency”. EURGBP continues to struggle with the high 87 handle. We think GBPUSD remains on the defensive so long as the market remains below resistance (which today checks in at 1.34 even)

-

AUDUSD: The Aussie has been trading in a tight range bound pattern for the last 48hrs. There’s nothing to report on the Australian data front and copper prices continue to try and claw back losses from Wednesday’s session. We think AUDUSD still remains in good shape technically because support in the low 75s has held on two occasions this week, but the continued erosion in EURUSD and now CAD is preventing the market from tackling the next resistance level. We would note the growing net short AUD position at CME as a potentially bullish set up (shorts have been adding for 3 weeks now but price has been moving against them).

-

USDJPY: Dollar/yen is recouping some of yesterday’s Trump/NK driven losses today, after conciliatory remarks from North Korea overnight. USDJPY effectively erased yesterday’s NY session losses, but then it ran into chart resistance in the 109.60 area. US 10yr yields are weaker for the 5th session in a row this morning (2.95), and this is dragging USDJPY lower at this hour. We think USDJPY wanders here ahead of the US long weekend.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.