OPEC can't yet agree on size of production cuts. US & Canadian November job reports in focus.

Summary

-

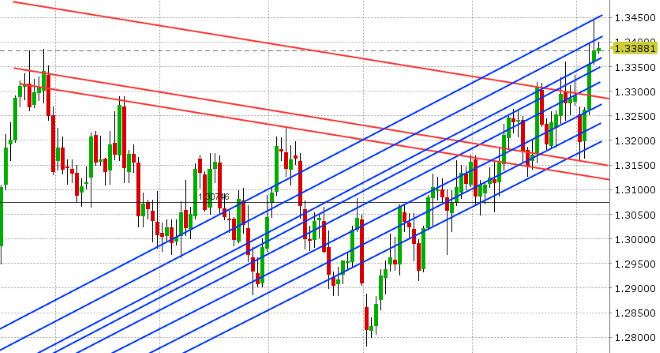

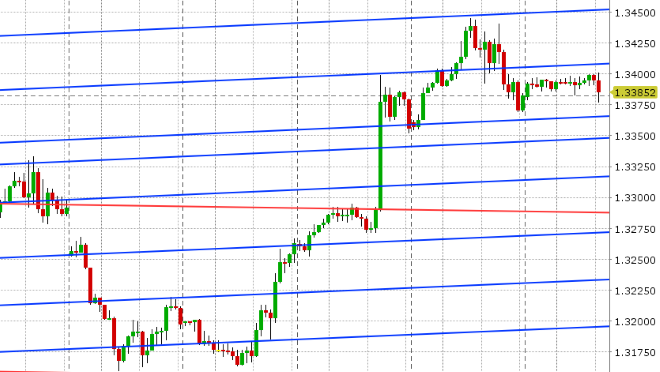

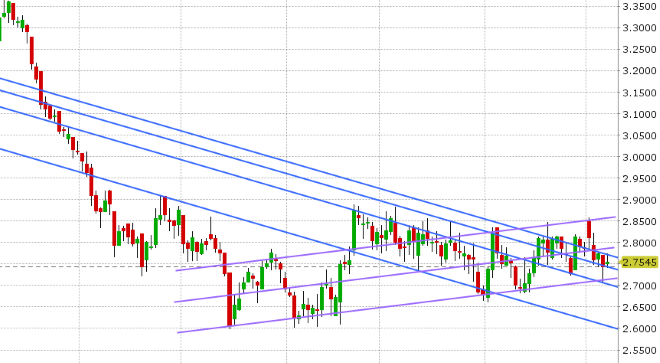

USDCAD: Dollar/CAD is marking time this morning as traders await the November employment reports out of the US and Canada at 8:30amET. The consensus estimate for US payrolls is +200k on the headline job gain, +3.1% YoY and +0.3% MoM on wage growth, and 3.7% on the unemployment rate. Market participants are expecting just +11k job gained in Canada, +1.8% YoY on wage growth, and 5.8% on the unemployment rate. OPEC and non-OPEC (most Russia) still cannot agree on the size of the combined oil production cut. The latest reports suggest 650k bpd will be shut off from OPEC and 350k bpd from non-OPEC (for a combined total of 1mln bpd), which disappointed oil markets yesterday. There’s also chatter than Iran wants an exemption because of US sanctions. Another meeting is now scheduled for 9amET, and in the meantime January crude oil prices have regained trend-line support in the 51.50s.

-

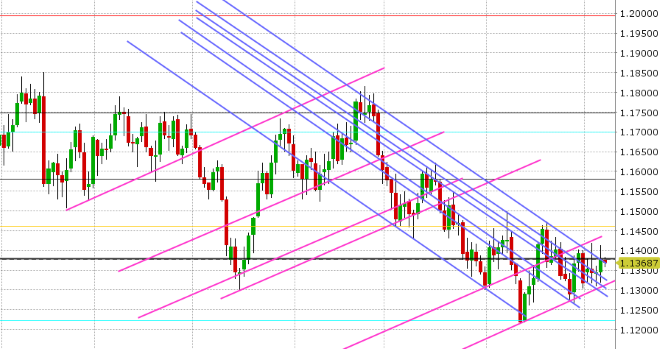

EURUSD:Euro/dollar has been very quiet in overnight trade as well, as traders brace themselves for the latest read on the US employment situation. The market continues to hug the 1.1370s, after yesterday’s bout of intra-day risk aversion in US stocks derailed the rally above 1.1400. Today’s session features two large option expiries (3.1blnEUR at 1.1300 and 1.9blnEUR at 1.1400), which could act as magnets for price depending on the results of the jobs report. It now looks like Italy will be looking to send its revised budget to the EU on Wednesday next week, just before the Dec 13-14 EU summit. Italy’s Finance Minister Tria has had to quell rumors of his resignation today. German Industrial Production data for October missed expectations (-0.5% vs +0.3%).

-

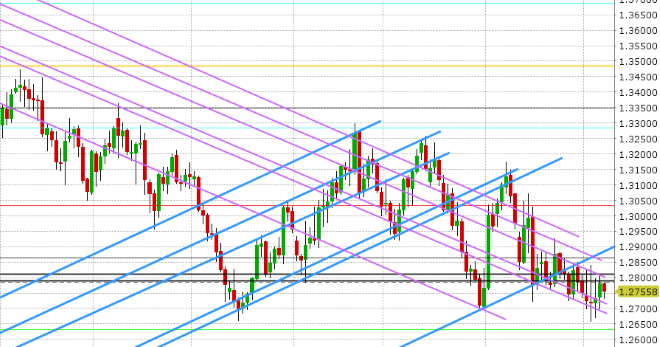

GBPUSD: Sterling continues to chop in the familiar 1.27-1.28 range today as traders await the US non-farm payrolls report. A spokesperson for Theresa May confirmed that Tuesday’s Brexit vote in parliament will go ahead as planned. The time is currently set for 2pmET. Chatter among option traders suggest the market is concerned about GBPUSD upside heading into the vote, and we can also see this by the higher premium paid for slightly out of the money calls vs puts (also known as the skew or risk reversal).

-

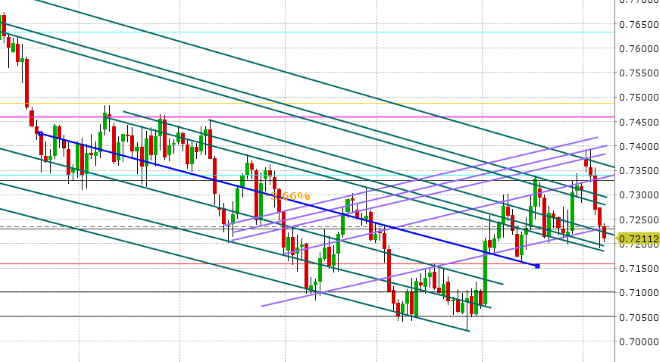

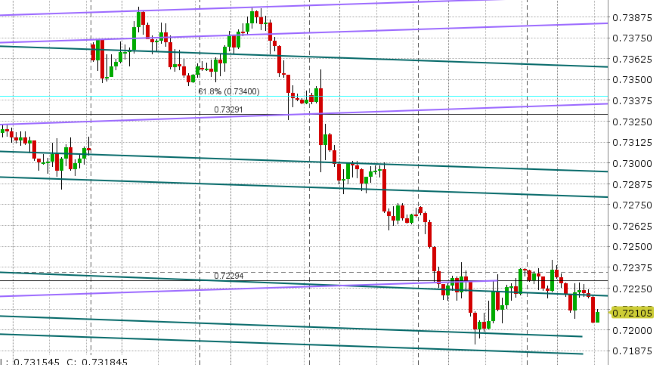

AUDUSD: The Aussie continues to struggle here as a combination of risk off equity flows and weak Australian data this week have killed the upward momentum we saw in November. Today’s session feature some huge option expiries for AUDUSD above the market here (4.5blnAUD at 0.7250, 2bln at 0.7260 and 1.2bln at 0.7300). We think this could help the market bounce strongly today should the US jobs report disappoint.

-

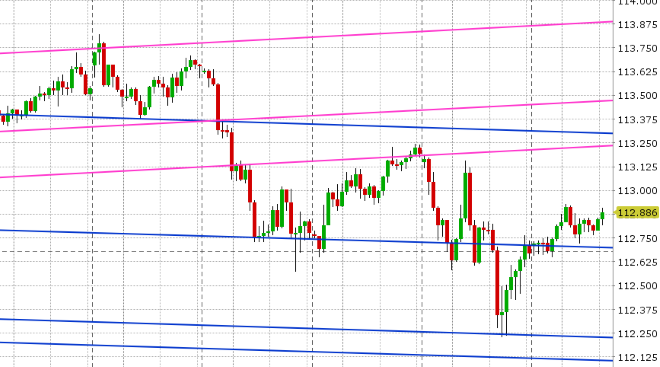

USDJPY: Dollar/yen is also trading very quietly ahead of the US employment report, but it’s doing so from a slightly better technical stance after traders managed to get the market back above the 112.60s into the NY close yesterday. This occurred largely because US stocks and yields rebounded. This stalls the downward momentum we feel and may allow USDJPY to move higher here. Option expiries are plentiful today as well, with over 1blnUSD+ rolling off at 112.50, 113.00 and 113.50.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

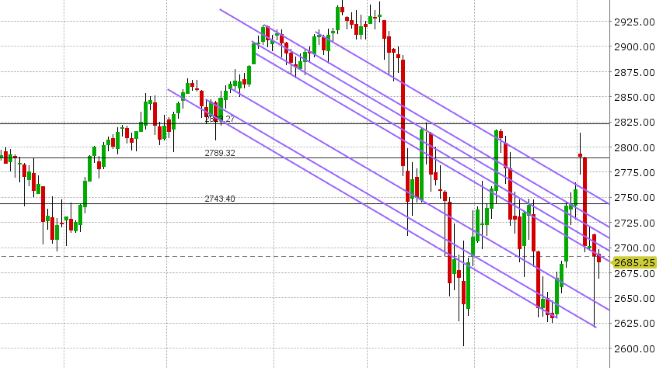

DEC S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.