Mild risk off tone in markets to start week. Futures traders aggresively bail USD shorts during June/Sep roll. EU summit in focus this week for EUR and GBP traders.

Summary

-

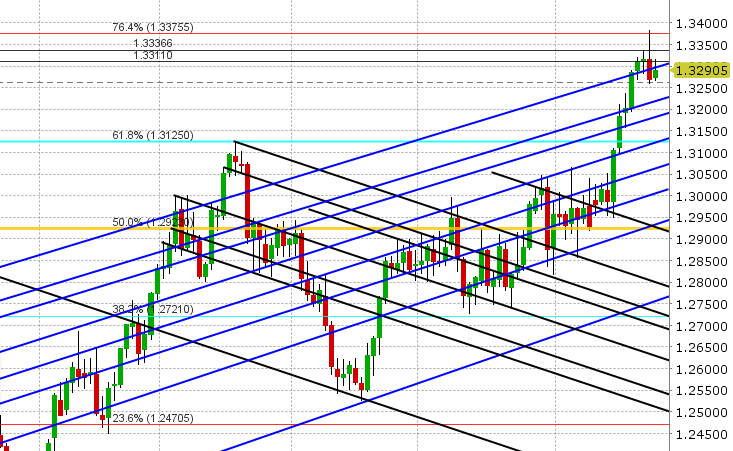

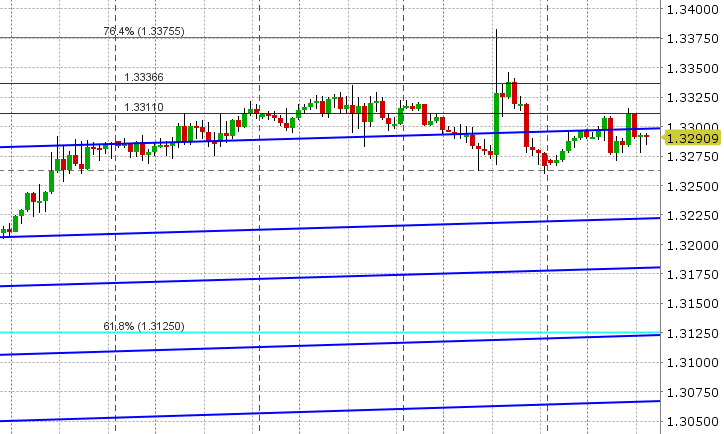

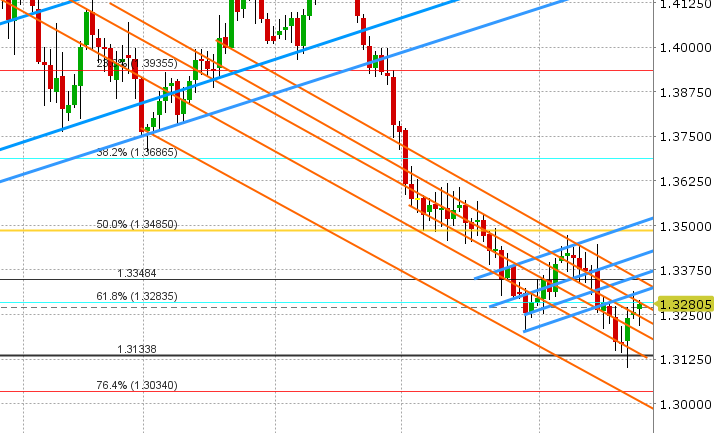

USDCAD: Dollar/CAD is starting the week bid after a roller coaster ride on Friday that saw the market spike higher following weak Canadian data and then fall lower during the crude oil rally that followed the OPEC meeting. A bearish outside day was logged on the daily chart as a result and Friday’s close was dampened further by prices closing well below support in the 1.3290s. This is the level that traders have been trying to regain in overnight action as the broader USD starts the week with a “risk-off” bid. The catalyst for the “risk off” tone seems to be Trump’s latest threat to impose restrictions on Chinese investment in the US (http://money.cnn.com/2018/06/25/investing/chinese-investment-in-us-restrictions/index.html), China’s stealth currency devaluation response by continuing to set higher USDCNY fixes higher despite a short term top in the broader USD since last Thursday and China’s RRR cut over the weekend (https://www.reuters.com/article/us-china-economy-rrr-cut/as-trade-war-looms-china-cuts-some-banks-reserve-requirements-to-boost-lending-idUSKBN1JK094). This week’s North American calendar is light to start with just a couple of Fed speakers tomorrow (Bostic and Kaplan). Wednesday features US Durable Goods, two more Fed speakers (Quarles and Rosengren), the weekly DOE oil inventory report, and a speech from the BoC’s Poloz in Victoria. On Thursday we’ll get another look at US Q1 GDP along with two more Fed speakers (Bullard and Bostic). Finally on Friday, traders will be watching Canadian GDP for April, the US core PCE inflation gauge, Chicago PMI and the Bank of Canada’s Business Outlook Survey for Q2. Friday’s weekly release of CME futures positioning from the CFTC shows a Canadian dollar market where the net spec USD long (CAD short) position barely changed in the week ending June 19. This is mainly because June contracts didn’t go off the board yet. If we look at Friday’s closing open interest of 152k contracts vs. 190k on June 19 however, we suspect a large number of June contract USD shorts (CAD longs) did not roll their positions to September, and should this be the case (as was the case with EUR and GBP during their rolls), we think this makes the overall USD long position look a tad stretched here. Given this development in positioning, the negative turn in chart technicals, and EURUSD’s ability to resume higher into today’s NY open, we think USDCAD risks pulling back further near term. Next support is the 1.3230s.

-

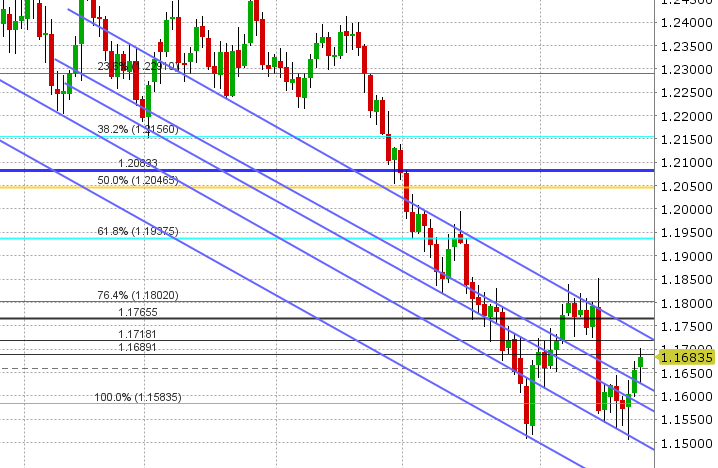

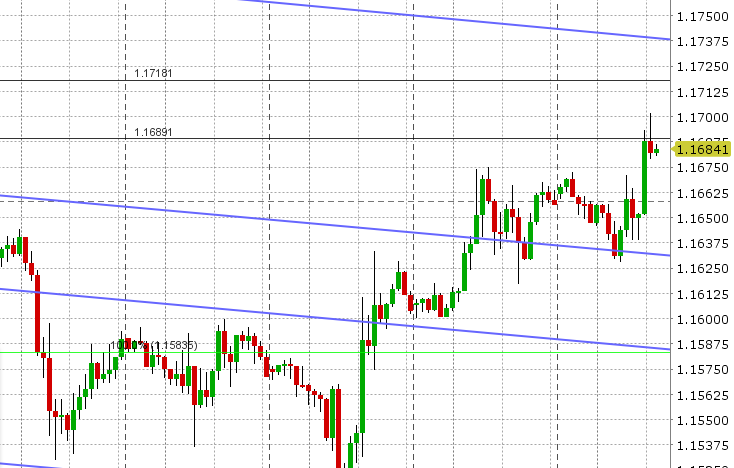

EURUSD: Euro/dollar started the week with a soft tone, but has now resumed its rally higher following a successful test of chart support in the 1.1630s. European equities opened lower (following Asian equities), but are now trading higher as well and this is helping the recovery in “risk”. Today’s move builds upon Thursday’s bullish outside day pattern and puts the chart resistance zone of 1.1690-1.1720 in focus to start the week. This week’s European calendar features the German Ifo survey (out earlier today, but was a mixed report), German CPI and an Italian 10yr bond auction on Thursday, followed by the German employment and retail sales reports on Friday. The EU summit (Thursday/Friday) is also a key event for this week. Germany’s Angela Merkel will be looking for support from fellow EU members with regard to the migrant crisis, but if Sunday’s emergency meeting was any indication, she may have a tough time coming up with something to appease her coalition partners in Germany. More here: https://www.ft.com/content/bc42c746-77c3-11e8-bc55-50daf11b720d. Friday’s futures positioning update from the CFTC shows a net spec long EUR position that reduced significantly in the week ending June 19 as a large number of June contract longs didn’t roll their positions to September. This sizable change in positioning removes a weight over the market in our opinion and, when combined with improving chart technicals from last week, gives EURUSD a shot of moving higher still. Be on guard for headlines from the EU summit later this week however as we feel the market is not really pricing in any risk of Merkel’s government unravelling in July.

-

GBPUSD: Sterling is trading more or less flat this morning after following EURUSD lower earlier and now higher. Friday’s NY close wasn’t great in that an inverted hammer close was logged, but traders have managed to keep prices above trend-line support in the 1.3250s to start the week. This week should be eventful for GBP traders as well, with a couple BoE speakers getting things started tomorrow (Haskel and McCafferty) along with some UK bond auctions (10s and 30s). Wednesday features the BoE’s Financial Stability Report, followed by a speech from governor Mark Carney. More here: https://www.bankofengland.co.uk/financial-stability-report/2018/june-2018. The EU summit later this week may also prove important for Theresa May’s Brexit negotiation as well. More here: https://www.theguardian.com/commentisfree/2018/jun/21/eu-summit-theresa-may-brexit-decision. Friday’s futures positioning update from the CFTC shows net positioning flipping aggressively to short in the week ending June 19 as short positions were added and, similar to the case for EURUSD, a large number of June contract longs didn’t roll their positions to September. Given this large change in positioning and the seemingly poor timing of it given the bullish outside day scored on Thursday, we think this bodes well for further short covering in GBPUSD to start the week.

-

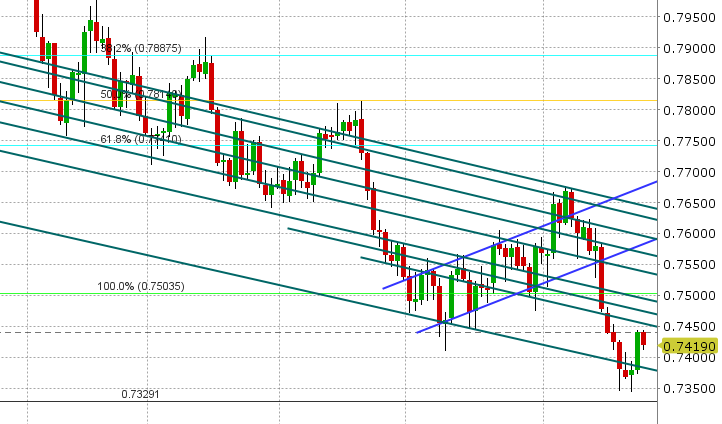

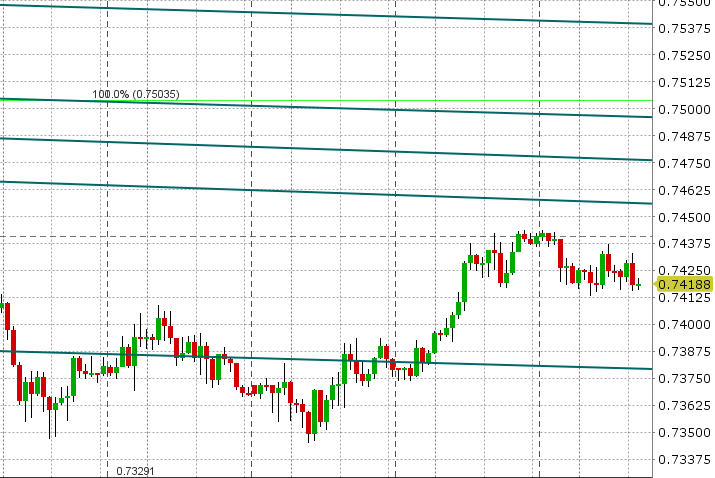

AUDUSD: The Aussie is starting the week with a soft tone, following EURUSD and Asian equities lower overnight. The market hasn’t be able to benefit much from the EURUSD rally into the NY open, as copper prices leak lower again. This week will not feature any important Australian data points, and so the focus will be on the broader USD theme, copper prices and the overall tone with regard US trade rhetoric. Support today lies at 0.7410 while resistance sits at 0.7450. Friday’s futures positioning update from the CFTC shows the net short position in AUDUSD growing significantly in the week ending June 19 as longs bailed and shorts added during the June/September roll. Similar to the positioning update in GBP, we think the size and timing of this change puts recent shorts at risk to start the week.

-

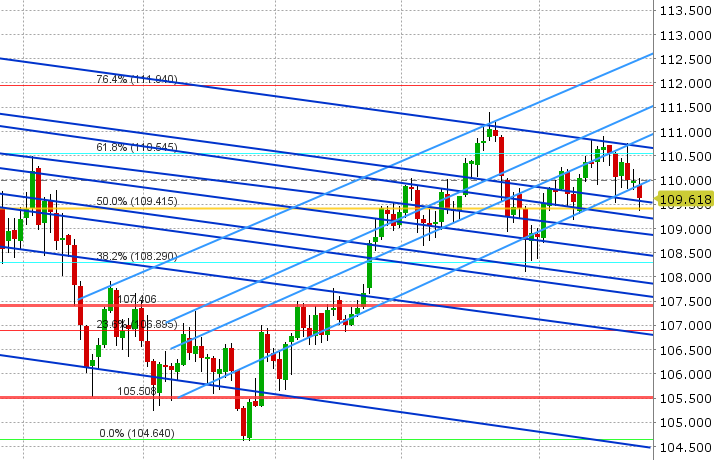

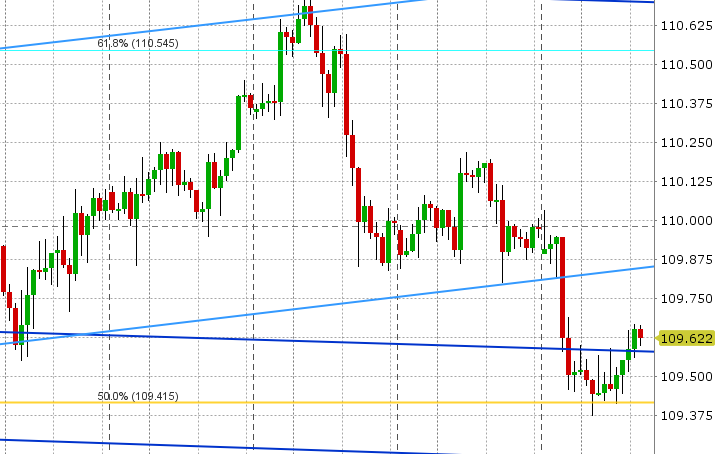

USDJPY:Dollar/yen took the brunt of the “risk off” theme to start the week in Asia, bounced off support in the 109.40s and is now trading slightly above trend-line resistance in the 109.50s (formally support) as US yields inch higher. The net futures spec position flipped aggressively to net long USD (short JPY) in the week ending June 19 as shorts liquidated and longs added during the June/September roll. We think this could prove troublesome for USDJPY here, especially considering a key trend-line broke on the chart overnight (109.80s).

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.