Markets panicking. Traders expecting Fed to cut at least another 75bp on March 18.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Implied Fed funds trading at 0.48%. US 10s below 0.70%. S&Ps -3%. EUR and JPY surging.

- U.S. FEB PAYROLLS +273,000 (CONSENSUS +175,000). CANADA FEB EMPLOYMENT +30.3K (+10K exp)

- Russia does not agree to OPEC’s proposed 1.5M bpd production cut. Crude oil prices crater 7%.

- USDCAD struggling again to benefit from broad risk-off flows, 1.3430s pivotal after repeated buyer failure.

- GBP and AUD benefit from relatively less dovish rate cut expectations vis a vis the Fed.

- Bank of Japan rumored to be checking prices, USDJPY holding the 105s. Leveraged funds likely capitulating.

- Global number of confirmed coronavirus cases tops 100,000. The US now has 234 infections and 14 deaths.

ANALYSIS

USDCAD

Traders are trying to focus on the positives this morning after both the US and Canadian reported higher than expected headline job gains for the month of February, but they’re having a tough time given all the risk-off flows that have remerged in the overnight session. The S&P futures are falling another 3%, US 10yr yields are plunging below 0.70%, USDJPY collapsed through 106.10s support and EURUSD surged past 1.1230-40s resistance. Implied Fed funds for March 18th is now trading at 0.48%, which suggests the Fed will cut at least another 75bp in just under two weeks’ time! All this as the coronavirus headlines keep coming in and the number of confirmed cases worldwide officially tops 100k. To make matters worse, there’s been no love from Russia today as Moscow has reportedly not agreed to participating in OPEC’s proposed 1.5M bpd deepening of oil production cuts…and so April crude oil prices are plunging another 7%. WSJ and EnergyIntel reporters are posting headlines like this:

- Russian High-Level Source: Moscow Only Agrees To Extend Existing OPEC+ Oil Cuts, No Extra Cuts And Its Position Won’t Change - RTRS Source

- Russia Disagreement 'A Serious Deadlock, Not Normal' -- Delegates *OPEC+ “No Deal In Sight” - Senior OPEC Delegate

- One OPEC+ delegate said Russia's concerns about further cuts are linked to its belief that falling global oil demand growth can be resolved through financial stimulus packages, and not reactionary oil market measures.

- Saudi, OPEC Insist They Won't Deploy New Cuts Alone -Delegates

- It’s not even clear yet if the actual meeting will take place or not!!

- We’re at a deadlock

Holy cow! This morning’s North American jobs data almost feels like a non-event given everything else that’s going on. Yes they’re good numbers, but they’re old now and it feels like the bond markets are already expecting these employment numbers will turn negative in the coming months as conoravirus fears further impact economic activity. USDCAD is struggling once again to benefit materially from all the risk-off sentiment today, which is a bit concerning. We think the 1.3430s will be absolutely pivotal heading into the weekend.

USDCAD DAILY

USDCAD HOURLY

APR CRUDE OIL DAILY

EURUSD

Euro/dollar has shattered our expectations for any sort of trading range to start the month of March. The downtrend ended on February 27th following the market’s surge above the 1.0890s, but it has made quick work of almost every single chart resistance level since then. We finally started to observe buyer failure in the 1.1160-80s earlier this week as US 10yr yields tried to regain the 1% level and, while this technical development tried to sow the seeds for some EURUSD price consolidation, all of this analysis has been thrown out the window following the 35bp puke-fest we witnessed in US 10s since Wednesday night. The plunge in bond yields continues and the surge in Fed rate cut expectations has reached an almost unbelievable fever pitch. Markets are now expecting the Fed to cut at least another 75bp on March 18! The FOMC may as well do another emergency rate cut and go straight to zero at this point.

The move above the 1.1160-80s post London yesterday triggered more buying in EURUSD to 1.1230-40 in Asia. The early European move through this level today has since prompted yet even more buying up to the next chart resistance level (1.1320s). What are the next targets for price, should the risk-off flows keeping coming? We’d say 1.1350-70 at the very least. A move above there however could usher in a panicking scramble to the 1.15 handle. We wouldn’t fight this EURUSD rally until we see clear signs of buyer failure at a known resistance level.

EURUSD DAILY

EURUSD HOURLY

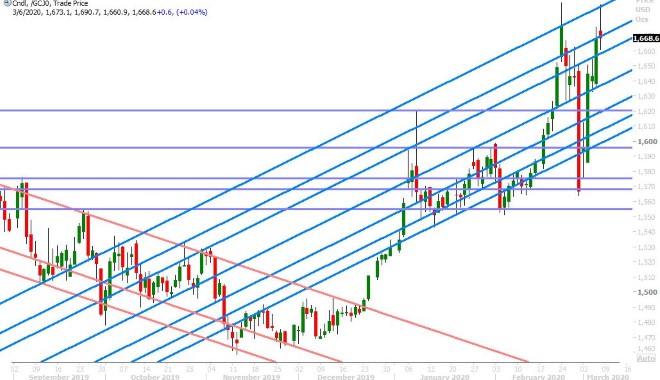

APRIL GOLD DAILY

GBPUSD

Sterling has rallied back above the 1.3000 mark this morning and we think what we’re seeing is a continuation of yesterday’s theme of the UK’s monetary policy outlook not looking as dovish as the Fed’s. Yes, the markets are now expecting a 50% chance (increased odds) that the Bank of England will cut rates by 50bp on March 26th, but they’re now expecting 100% that the Fed will cut by 75bp on March 18th. Nothing else seems to matter right now...not even the nervous start to UK/EU 2020 trade talks. Everyone’s focused on plunging US interest rates/interest rate expectations and it’s killing the dollar against the euro. We think a NY close above the 1.3040s (February highs) would be perversely positive for GBPUSD’s chart structure.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

Today’s unprecedented surge in Fed rate expectations is helping the Aussie as well. One could argue that this is counterintuitive given that the Australian dollar is a risk proxy and that risk sentiment is in the toilet this morning. We understand that argument but we feel as if today’s risk-off is more US yield/oil driven than coronavirus driven. There are probably a lot of panicky flows going on in the wider interest rate markets just because of the “off the chart” levels we’re trading at, and so we think there’s a greater focus on yield differentials this morning (AUD vs USD) if that makes sense.

The Australian dollar’s rally though the 0.6620s is a positive technical development for the market this morning but we think the market needs to close NY trade firmly above it in order to confirm. Some mild selling has emerged at trend-line chart resistance in the 0.6650s.

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen puked yesterday after it lost trend-line chart support in the 106.90s, and it’s imploding again today following last night’s fall below the 106.10s. The leveraged funds at CME, who collectively increased their net long USDJPY position during the week ending February 25to a new one year high, must have absolutely capitulated by now and gone net short...since the market is now 500pts lower! We’ll get the latest read on their positioning at 3:30pmET today, when the CFTC releases its weekly Commitment of Traders report.

The Bank of Japan was rumored to be calling banks asking for prices this morning, which is fueling gossip that they're not happy about the swift rise in the yen and may want to intervene.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.