Markets fade hawkish Fed rate hike. ECB delivers mixed hold on rates, dissapointing hawks. All eyes on Mario Draghi presser at 8:30amET + US Retail Sales.

Summary

-

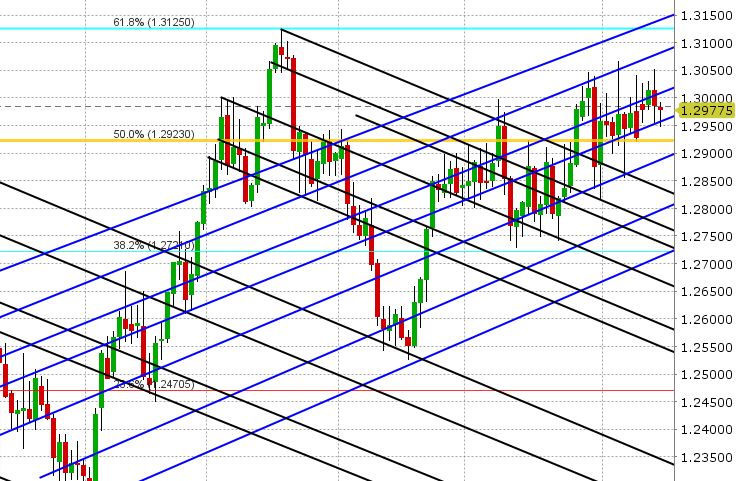

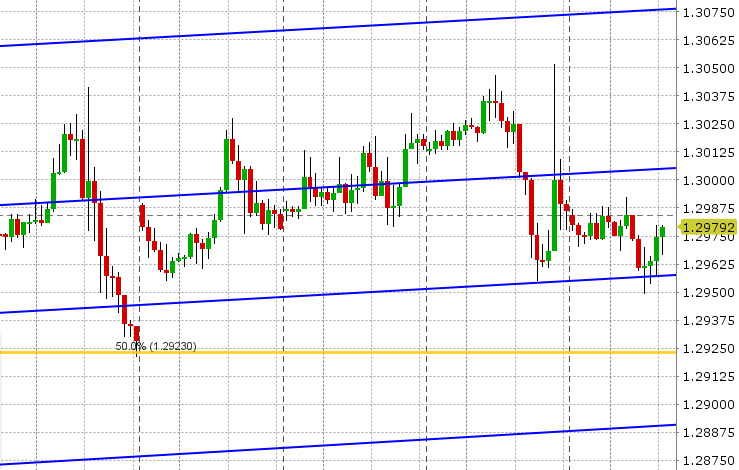

USDCAD: Dollar/CAD is trading with a softer tone this morning as yesterday’s pre-Fed and post-Fed price action couldn’t hold gains above the key 1.3000 trend-line level. The FOMC raised interest rates by 25bp, which was expected, and the tone of their press release was undoubtedly hawkish. The Fed had an upbeat tone on GDP, unemployment and core PCE, and more importantly it signaled two more hikes for 2018 and three for 2019 by way of its “dot-plot”. The USD saw an immediate spike higher across the board but the gains fizzled and then some as Fed chairman Powell spoke to reporters. Some talk made the rounds that the Q&A portion of the press conference was a touch less hawkish “slow pace of wage gains a bit of a puzzle” and we also had a report out of the White House around that time confirming that the US would slap tariffs on billions of Chinese imports starting Friday. USDCAD swiftly moved back below the 1.3000 level and struggled into the NY close. This has allowed the market to drip further in overnight action, and we now sit just above trend-line support in the 1.2950-60 area, and Sunday’s opening gap. Early price action in North American trading will likely be dictated by US Retail Sales and the ECB’s press conference today at 8:30amET.

-

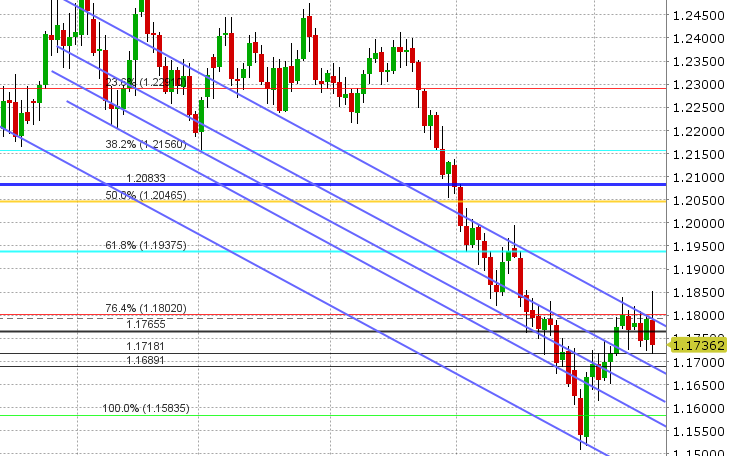

EURUSD: Euro/dollar is trading higher morning, following a bullish technical reversal higher after the Fed announcement yesterday. Chart resistance in the 1.1800-1.1810 level has given way in early European trade and all eyes are now glued on what’s expected to be a hawkish ECB, when it announces it latest decision on monetary policy. The ECB just announced no change to interest rates (expected), a firm end to QE in December (expected, but sounds hawkish), but no change to rate guidance until the summer of 2019 (also somewhat expected, but sounds dovish). EURUSD initially spiked higher, but has now crashed lower into the mid to low 1.17s as there’s really nothing NEW here to get hawks excited about. Chart support lies at 1.1720, then 1.1690-1.1700. Next up is Mario Draghi’s press conference at 8:30amET. More at @EBCTradeDesk on Twitter.

-

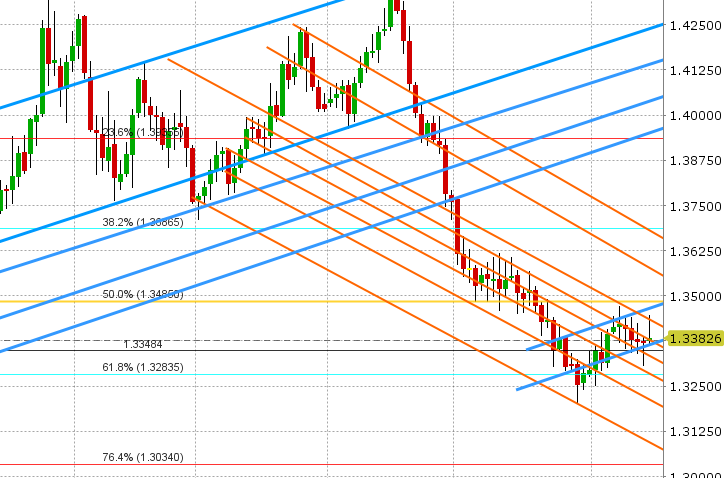

GBPUSD: Sterling is leading the charge higher this morning following a bullish daily hammer close yesterday and a beat this morning on UK Retail Sales. Trend-line resistance at the 1.3400 level has given way overnight and with that GBPUSD has been able to rally higher to test the next resistance level in the 1.3440s. This level has now capped on two occasions over the last few hours and GBPUSD is now plunging with EURUSD after the ECB’s mixed (less hawkish than expected) policy announcement. With the 1.34s now giving way to the downside, it’s time to watch support again in the 1.3360s.

-

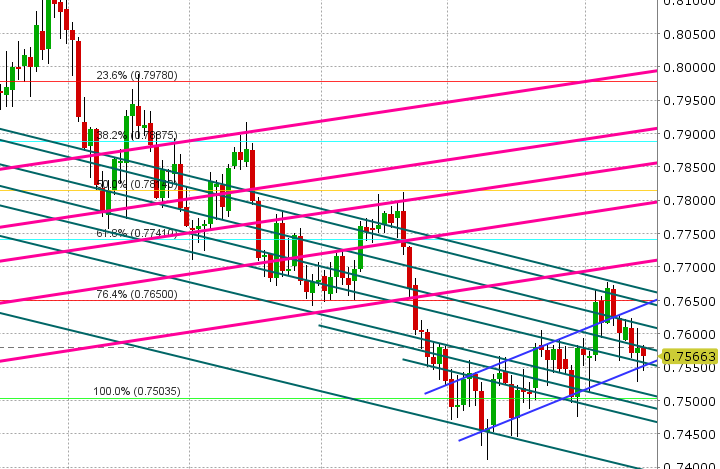

AUDUSD: The Aussie is trading with a weak tone this morning following weaker than expected Australian employment figures last night, softer than expected Chinese Retail Sales and Industrial production data for May, and declines in copper prices. AUDUSD now sits at chart support in the 0.7550-60 area. Next up is US Retail Sales at 8:30amET.

-

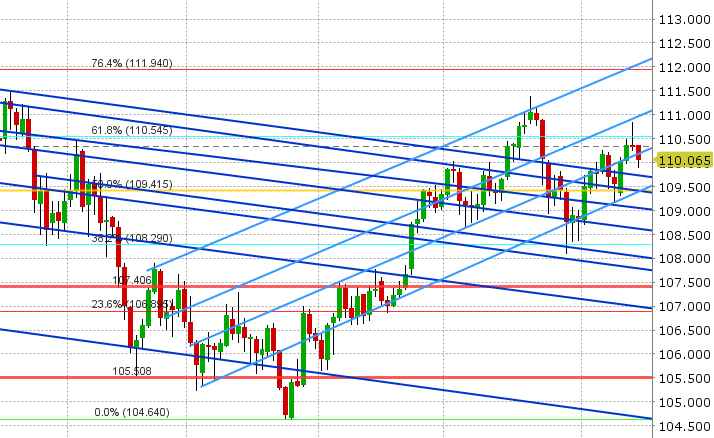

USDJPY:Dollar/yen spiked higher to test chart resistance at the 110.90 level during the initial reaction to the Fed’s hawkish hike yesterday, but it reversed lower and them some as the USD and US yields broadly sold off. Yesterday’s NY close was a bearish inverted hammer candle, which can explain the follow through lower in overnight trade. Trend-line support in the 110.10 area is now being put to the test. Traders pushed the market below it in early European trade but we’re seeing some buying here in USDJPY as EURUSD gets smacked lower. We think this is the key level to watch today. Close above and we could see some renewed momentum higher, but close below and support in the 109.70s will be eyed.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.