Markets brace for another 25bp rate hike from the Fed this Wednesday

Summary

-

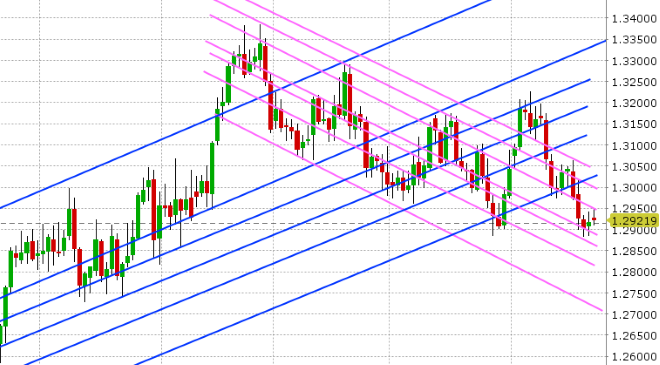

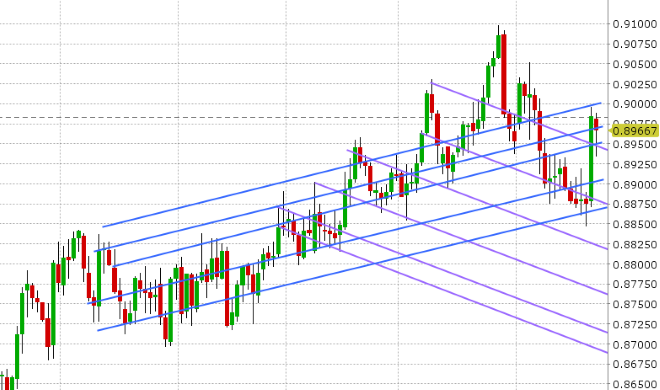

USDCAD: Dollar/CAD is drifting higher to start the week after Friday’s beat on Canadian Retail Sales failed to lead the market to new lows. The broader USD is trading mixed this morning, with the commodity currencies lagging after the US officially imposed new 10% tariffs on $200bln of Chinese imports at midnight and China called off planned talks with the US. November crude oil is trading up 1.7% after OPEC didn’t signal any rush to increase supply at the Algiers summit this weekend. The net long USD (short CAD) fund position increased slightly during the week ending Sep 18 as shorts covered on the move back down below 1.3000. This week’s main event is the FOMC meeting on Wednesday, where the Fed is expected to raise interest rates by 25bp for the 3rd time this year. Thursday features the US Durable Goods and Trade figures for August, and speeches from the Fed’s Powell and the BoC’s Poloz late in the session. Finally on Friday we’ll get the US PCE Index, the US Chicago PMI, Canadian Raw Material Prices and Canadian GDP for July. We think USDCAD continues to trade on the defensive here, with the 1.2950s resisting and the 1.2280s supporting.

-

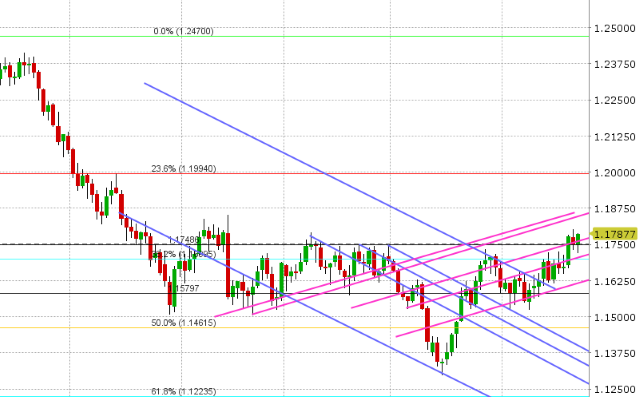

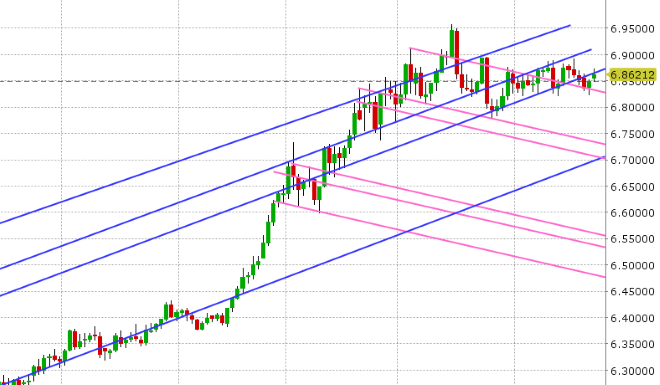

EURUSD: Euro/dollar is mildly bid this morning, with a beat on the German IFO survey and a bounce in GBPUSD helping the market regain support in the 1.1760s. USDCNH has inched higher in holiday trade following its regain of the 6.84s on Friday and the BTP/Bund spread has edged higher into the +240s ahead of Thursday’s preliminary announcement on the 2019 Italian budget, but neither development appears to be concerning EUR traders for the moment. The funds added to short positions during the week ending Sep 18, bringing the net position at CME back to pretty much flat. This week’s European calendar kicks off with a speech from Mario Draghi at 9amET this morning at the ECON hearing of the EU Parliament. Tomorrow we’ll get two ECB members speeches (Praet & Coeure). Thursday features the Italian budget news, a BTP auction, German CPI for September, and two more ECB speeches (Draghi and Praet). Finally on Friday we’ll get the German employment report and Eurozone CPI figures for September. We think EURUSD bulls remain in charge above 1.1760. JUST CROSSING: DRAGHI SEES RELATIVELY VIGOROUS PICK-UP IN UNDERLYING INFLATION

-

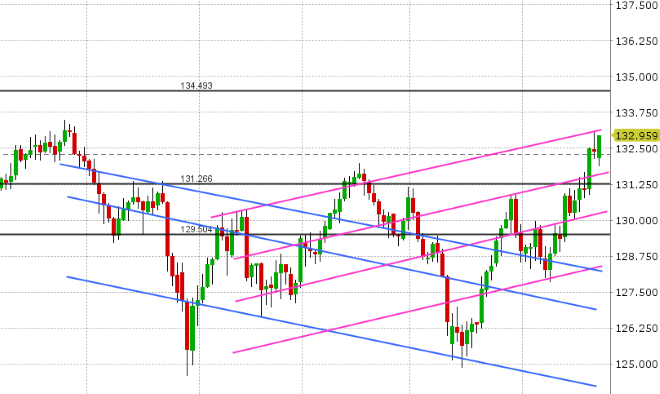

GBPUSD: Sterling is bouncing strongly this morning after Friday’s Brexit massacre as the UK’s Raab said he was still confident in working out a deal with the EU. More here. Futures traders liquidated over 4k contracts in Friday’s action. We postulate that this was more short covering, considering the gift of the negative Brexit headlines from Salzburg last week. The net fund short position still rose to a new high during the week ending Sep 18 though as longs bailed en masse during the Sep/Dec roll (meaning there’s still a crowded short trade despite Friday’s move). This week’s UK economic calendar is light, with just Q2 GDP on Friday. We’ll get some speeches from the BoE’s Haldane and Carney on Thursday, and Ramsden on Friday, but the focus will be Brexit as usual, especially in light of the negative developments from last week. We think GBPUSD struggles at trend-line resistance in the 1.3150s today.

-

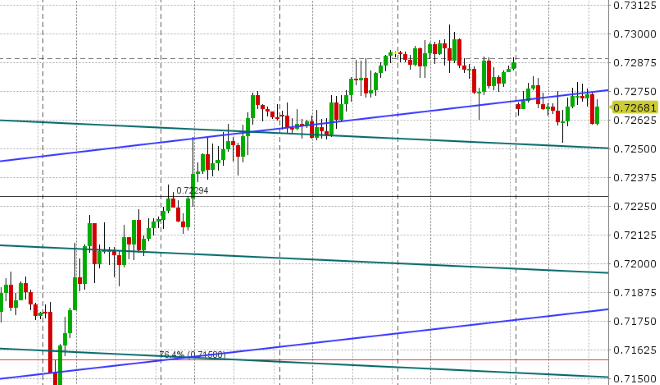

AUDUSD: The Aussie is starting the last week of September with a mixed to offered tone, as the US/China trade war official enters “phase 2”. The market gapped lower below support in the 0.7270s in Sunday trade and hasn’t been able to regain the level since. December copper is trading steady, after Friday’s explosive move through 2.80. The fund net short AUD (long USD) position grew sizably during the week ending Sep 18 as it appears longs bailed during the Sep/Dec roll. This week’s Australian economic calendar has nothing worthy to note. We think AUDUSD find buyers on any dips to 0.7230-50.

-

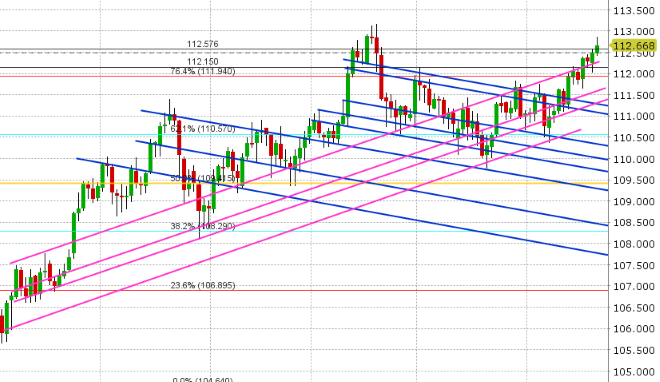

USDJPY: Dollar/yen is bid this morning, despite the soft tone to global equities to start the week. Friday’s rally petered out, leaving a somewhat negative candle formation for the NY close, but horizontal support in the 112.50s (Thursday’s highs) continues to hold. The funds added to long USD (short JPY) positions during the week ending Sep 18 as USDJPY broke above the 111.50s. This week’s Japanese calendar features the BOJ Minutes tonight at 7:50pmET, a speech from the BOJ’s Kuroda early tomorrow morning, another speech from Kuroda early Thursday followed by the Tokyo CPI, Japanese employment, Industrial Production and Retail Trade reports later that day (Thursday night). We think USDJPY continues to ebb and flow with US stocks/yields here, but we’d note another large option expiry at 112.50 on Wednesday (1.5blnUSD) that could keep things range bound near term.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

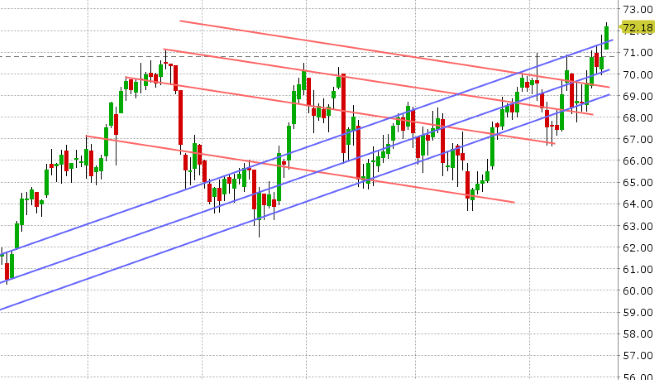

November Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.