Lighthizer "tariffs on hold" headlines get dialed back

Summary

-

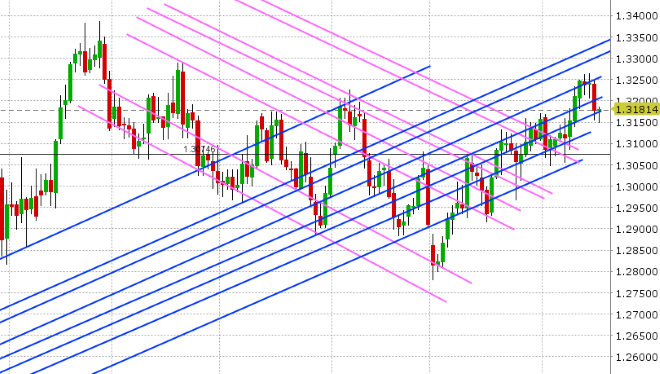

USDCAD: So we got our expected decline yesterday in USDCAD, but the move was a little more pronounced than we initially thought after headlines crossed about US Trade Representative Lighthizer putting the next round of China tariffs on hold. This saw a broad wave of equity buying and USD selling in the early afternoon, causing USDCAD to slip to the next support level in the 1.3160-70s. The market lost this level in Asian trading overnight as EURUSD challenged recent highs, but USDCAD is trying to regain the 1.3160-70s now as EURUSD falters in the 1.1350-60s once again. Today’s North American session doesn’t have any notable economic releases on the horizon. Crude oil prices are drifting higher this morning despite another build in EIA oil inventory data yesterday as it appears a whole lot of negativity has been priced in at this point, and we’re done and clear with all the delta-hedging which exacerbated the selling leading into Tuesday’s December options expiry. We think USDCAD can bounce here, so long as the 1.3160-70s are regained, but we think the 1.3210s need to be regained as well before the upward momentum from earlier this month returns.

-

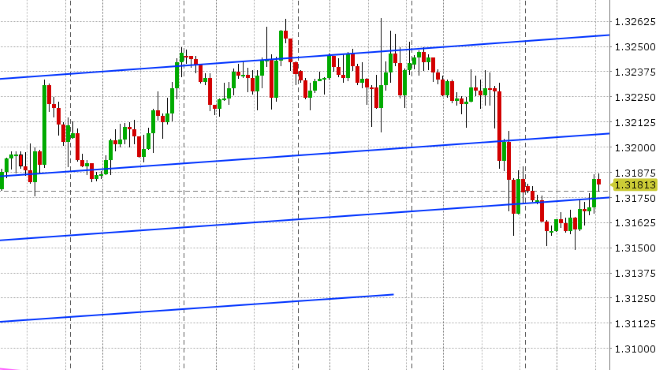

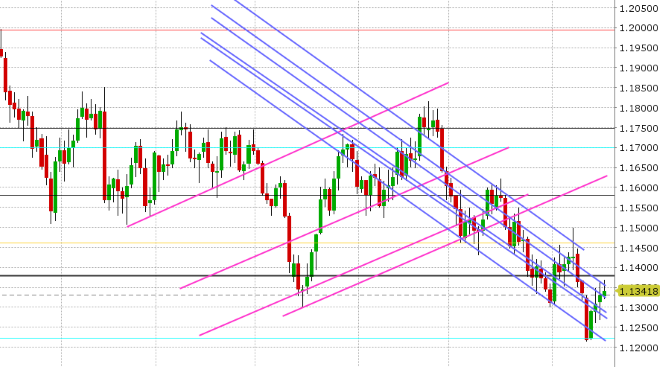

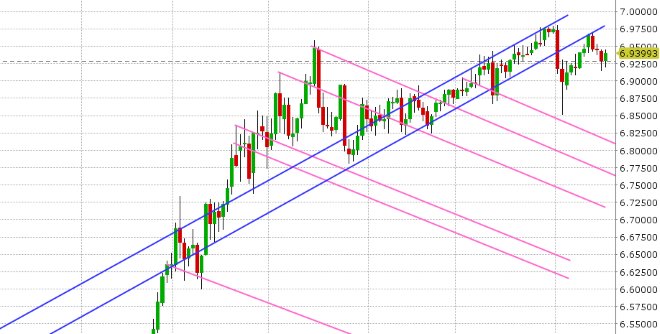

EURUSD: Euro/dollar traders gave a go at trend-line resistance in the 1.1350-60s again overnight, after the Lighthizer headlines from yesterday saw the market test those levels. Unfortunately, this chart level capped prices yet again and we think it was part in parcel due to the US trade rep’s later denial of the “tariffs on hold” story and USDCNH’s rebound back above the 6.93s. So, traders find themselves stuck between support in the 1.1320s and resistance in the 1.1350s at this hour. Mario Draghi spoke earlier today and sounded a tad dovish. More here. Eurozone CPI figures for October were also reported today, and they fell in-line with expectations of +0.2% MoM and +1.1% YoY. Over 1.4blnEUR in options roll off this morning at the 1.1300 strike, which is something to keep note of heading into 10amET. We think EURUSD remains choppy here, but we think the fund short position should become increasingly cautious of a move above the 1.1370s. This would mark a decidedly positive turn in the chart technicals should we close above there.

-

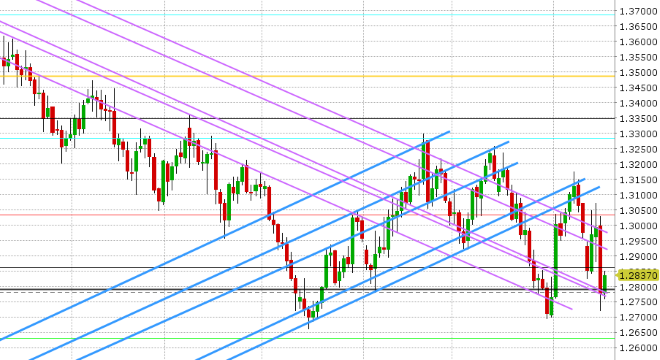

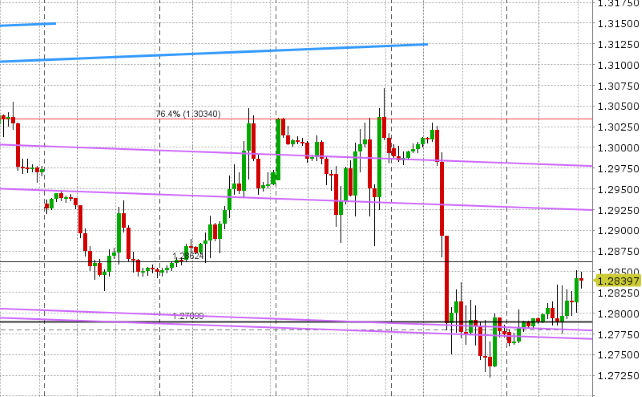

GBPUSD: Sterling appears to be taking a breather this morning, after yesterday’s negative turn in Brexit developments knocked GBPUSD all the way down to the 1.2770s. Futures open interest increased over 2k contracts yesterday, suggesting more fund shorts joined the party, but the NY closing pattern was half decent, allowing the market to drift higher a little bit this morning we feel. Theresa May was on the radio today sounding confident as usual, but there’s still talk of a no-confidence vote, which may now come on Tuesday, according to the Telegraph. There are also reports that a new Brexit minister will be appointed in the coming days. It’s been a popular trade of late to sell GBPUSD on rallies, and while we still think the shorts are in charge here, yesterday’s swift move and the market’s extreme sensitivity to wire headlines right now doesn’t leave us with huge conviction about chart resistance levels right now, ie. we could very easily retrace yesterday’s move completely with some positive headlines.

-

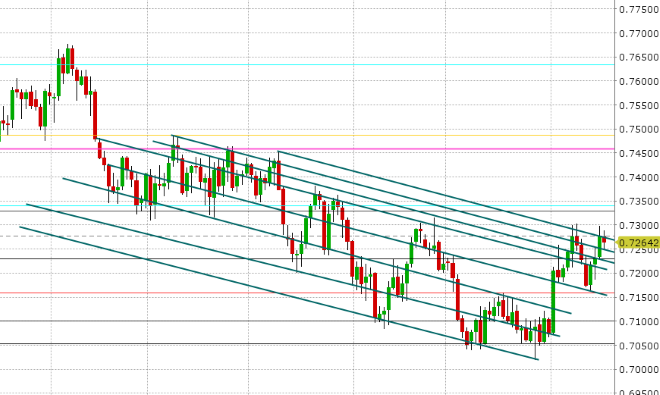

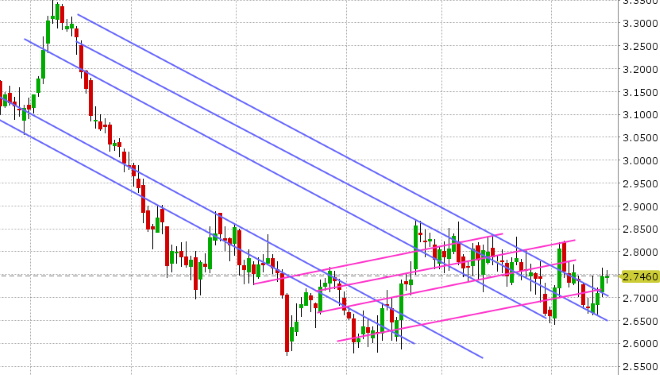

AUDUSD: The Aussie is slipping back this morning as the Lighthizer story fizzles out, USDCNH bounces, and the S&Ps give back half of yesterday’s intra-day pop higher. Chart resistance in the 0.7270s gave way late yesterday, but the market is now trading back below it (which is not great technically). Support in the 0.7250s continues to hold however, which means AUD longs might still give it another shot here. Watch EURUSD as usual.

-

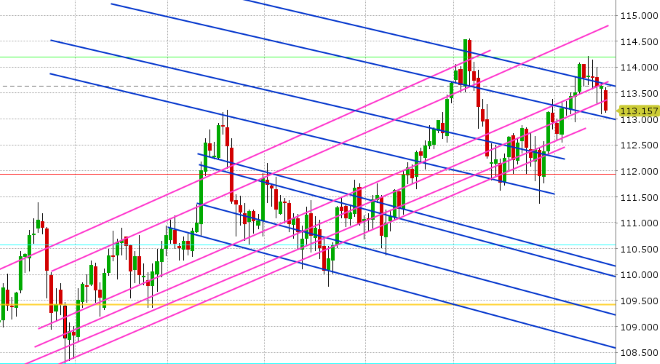

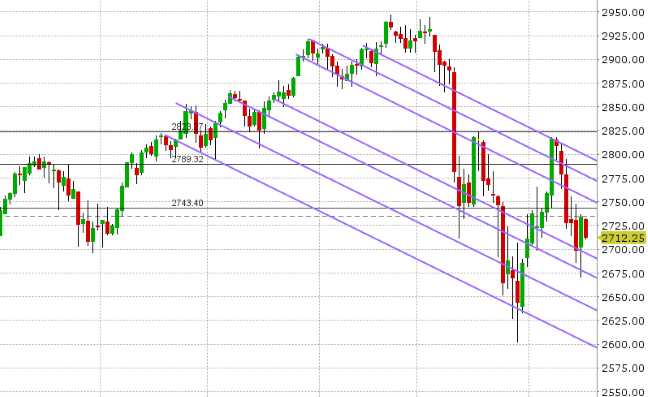

USDJPY: Dollar/yen is not having a fun morning here as the traders who bought the Lighthizer bounce yesterday get shaken out. The S&Ps are down 20, erasing half of the Lighthizer move yesterday and traders have firmly rejected the regain attempt of the 113.60-70 chart level that was lost early yesterday. This increases the risk of further selling now we feel. Futures open interest declined over 3,700 contracts yesterday.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

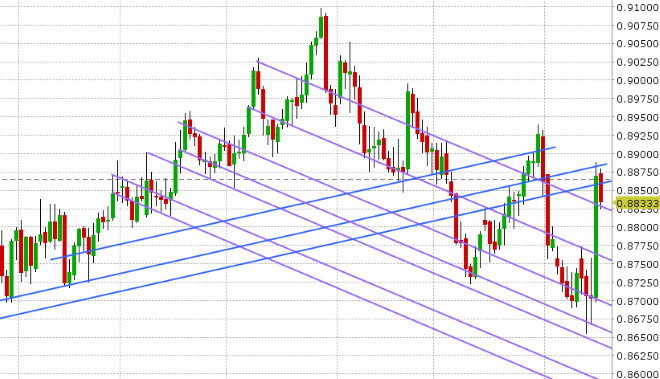

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

December S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.