It's crunch time for Brexit negotiations

Summary

-

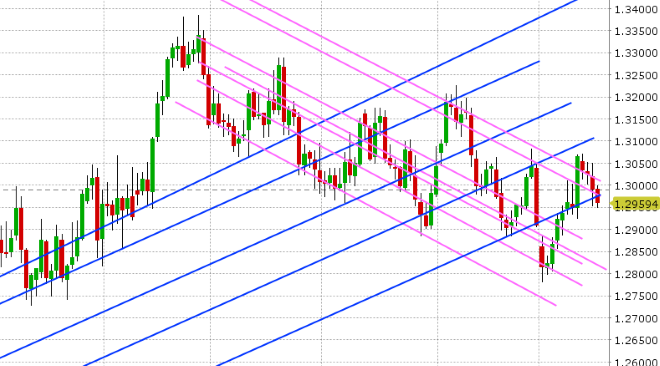

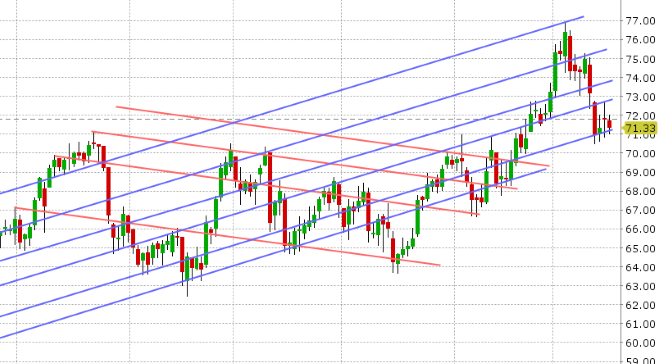

USDCAD: Dollar/CAD trades with a negative tone this morning after yesterday’s upbeat Business Outlook survey knocked the market lower into trend-line support around the 1.2960-80 region. More here. While we saw a mild bounce off this level in late NY/early Asian trade, some broad USD selling is now entering the fray and putting long positions to the test once again. November crude trades steady within the 71.00-72.50 upward sloping channel right now, with the front month option expiry coming up tomorrow. Today’s North American calendar is light, with just US Industrial Production out at 9:15amET. We think USDCAD looks vulnerable to the downside here (sub 1.2970s) as traders now price in another rate hike from the Bank of Canada next week. A strong close today back above the 1.2980s could reverse the downward momentum however.

-

EURUSD: The Euro is trading range-bound this morning after a pause in the gold rally dialed back some of the upward momentum and created a lackluster NY close on the charts. Today’s action has been uninspiring so far, with broad USD weakness being offset by a much weaker than expected German ZEW for October. Downside option expiries appear to be a reoccurring theme of late for EURUSD, and we have another one today at the 1.1550 strike for 1.1blnEUR. That being said, we still think EUR shorts are vulnerable so long as we trade above 1.1550. Italy agreed on its 2019 budget deficit target of 2.4% yesterday and has formally submitted it to the EU. Italy’s finance minister Tria continues to defend it. The BTP/Bund spread has narrowed back below +300bp today, which helps EUR sentiment a little bit.

-

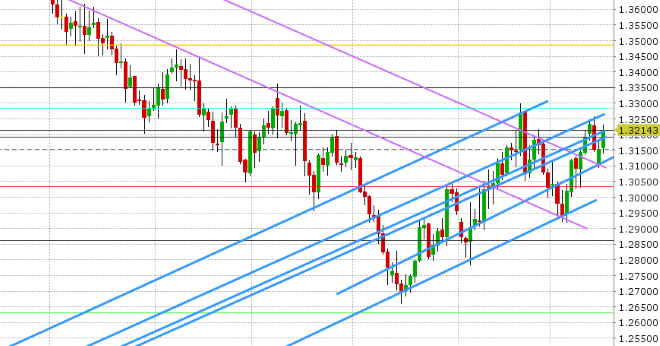

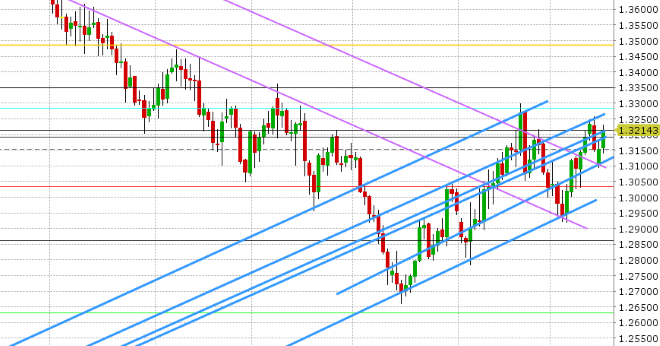

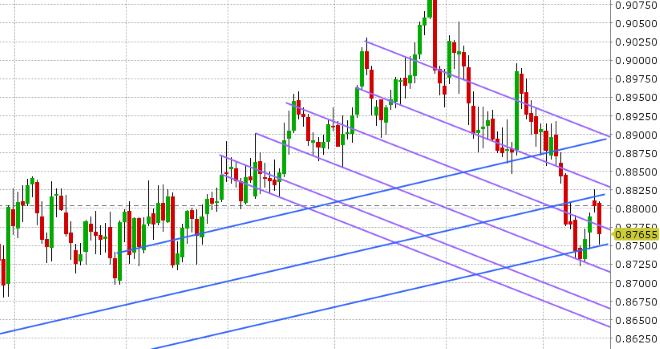

GBPUSD: Sterling is rallying strongly this morning, initially led by JPY cross buying and then by the better than expected wage data in the latest UK jobs report (wages rose +2.7% 3M/Y vs +2.6% expected). We feel some of today's move is also the result of fund shorts paring their bets ahead of the EU summit tomorrow. It’s definitely crunch time now for Theresa May. With GBPUSD now surpassing the 1.3190-1.3210 resistance zone on the charts, we think the market could extend further to test October’s highs. The UK reports September CPI tomorrow.

-

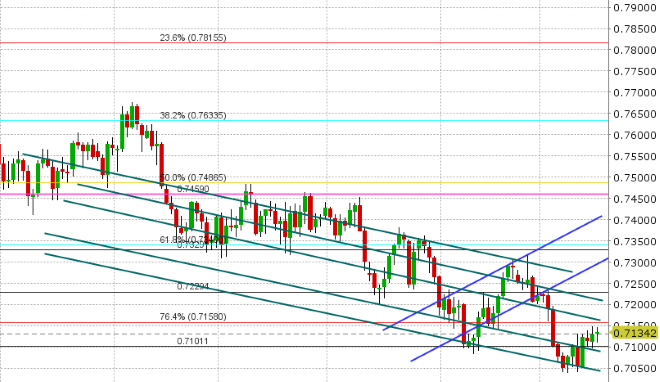

AUDUSD: The Aussie is trading quietly this morning, in a similar fashion to EURUSD. The RBA Minutes released last night were a non-event us usual and the Chinese September inflation data was arguably a bit mixed. December copper pulled back yesterday after rejecting chart resistance in the high 2.83s, but we don’t think the bullish, inverted head & shoulders pattern on the daily chart is dead yet. We think AUDUSD drifts higher here ahead of the Australian jobs report tomorrow night.

-

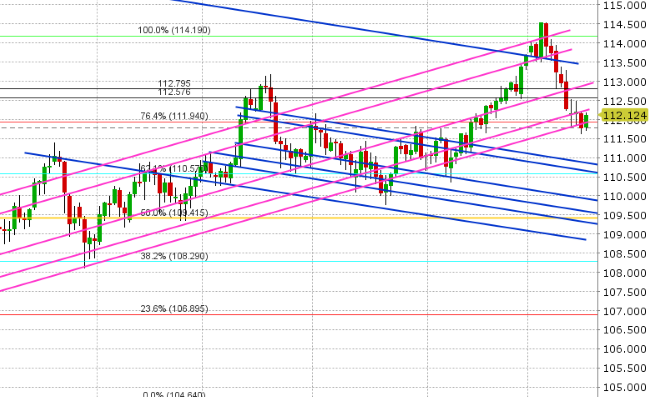

USDJPY: Dollar/yen is bouncing again this morning, and we have global equity market strength, higher US yields, and broad based JPY selling to thank for that. With the market now regaining chart support in the 111.90s, we think USDJPY could bounce higher still, but we would not be surprised to see fund sales in the 112.50-60 region if underwater longs see a chance to liquidate.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

November Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

December Gold Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

GBP/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.