Gold leads EUR & AUD higher while GBP fills Sunday opening chart gap

Summary

-

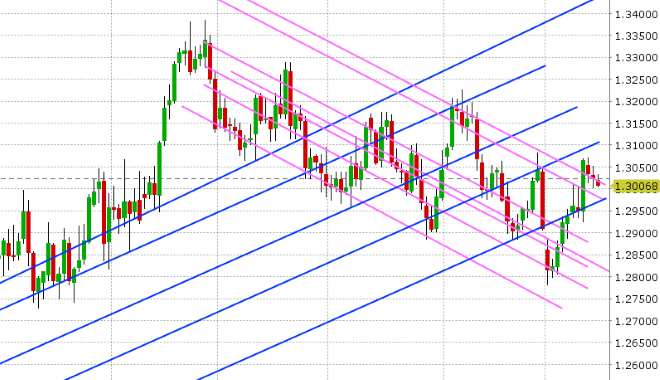

USDCAD: Dollar/CAD is starting the week with a slow, defensive tone as the USD broadly trades lower. This comes despite the uneasy tone to global markets this morning and has us asking if the USD is starting to lose its “safe haven” status. Asian equities continued lower today; US/Saudi political tensions flared up over the weekend; we didn’t get any real progress on Brexit negotiations since Friday, and we have the EU budget deadline for Italy today…all "risk off" type factors that traditionally would lead traders to sell equities and hold some USD, but the correlation is starting to break down. USDCAD could not manage to stay above trend-line resistance in the 1.3020s for very long Friday afternoon, and so this level has acted as near-term resistance so far today and part and parcel explains the slow start to the week. The funds trimmed their net long USD (short CAD) position for the 3rd week in a row as of Oct 9 by liquidating long positions predominantly. US Retail Sales for September was just reported +0.1% MoM vs +0.5% expected, and -0.1% ex. Autos vs +0.4% expected. This is a big miss and leading to some broad USD sales here. Next up is the Bank of Canada’s Business Outlook Survey (10:30amET). Later this week brings US Industrial Production (Tuesday), US Housing Starts/Canadian Manufacturing Shipments/FOMC Minutes (Wednesday), US Philly Fed survey (Thursday), and finally the Canadian Retail Sales/CPI reports on Friday. We think USDCAD takes its queue from the BOS report today. Something positive will likely keep the pressure on, leaving support at 1.2960-80 exposed. Something negative will likely see the market regain the 1.3030s with confidence and repair the chart.

-

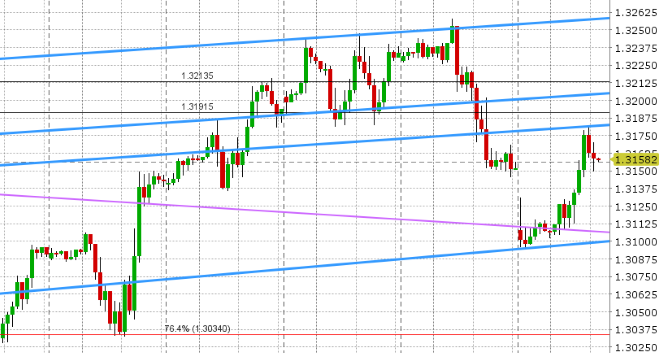

EURUSD: Euro/dollar has a nice bid tone to it this morning and, as we mentioned above, it comes in the face of some a “risk off” tone to global markets earlier this morning. Gold has continued higher today, after pausing on Friday, and seems to be leading since taking out $1200 to the upside last week. We also saw GBPUSD quickly retrace a Sunday opening gap lower, which seems to be helping EUR here as well. USDCNH is trading very quietly to start the week. BTP/Bunds are trading steady at +306bp, but near recent high wides. An Italian cabinet meeting will occur today around 11amET, as the deadline to submit Italy's budget to the EU looms. With the funds adding to their net short position as of Oct 9 and the market regaining 1.1580 today, we still think the market still looks vulnerable to short covering. The next chart resistance after 1.1610 is 1.1690-1.1700.

-

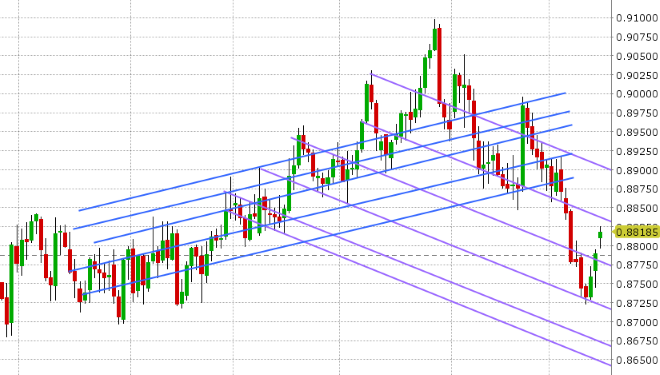

GBPUSD: Sterling gapped strongly lower at the start of Sunday trade yesterday after the UK and the EU came to yet another temporary impasse on Brexit negotiations. Word is now that these talks will be pushed to Wednesday’s EU summit in Brussels, and while these weekend developments hurt GBPUSD initially yesterday, the market has rallied all the way back up to trend-line resistance in the 1.3180s and has filled its chart gap in the process. We’re now hearing that Theresa May will address parliament later this morning (10:30amET). The next chart resistance levels are 1.3210-20, then 1.3260. Support is 1.3100-1.3110. The funds barely changed their net short position for the week ending Oct 9. This week’s UK calendar also features UK jobs (tomorrow), UK CPI (Wed) and UK Retail Sales (Thursday).

-

AUDUSD: The Aussie is enjoying gains again this morning as EURUSD, copper, and gold trade higher. The funds were busy adding new positions during the week ending Oct 9, but shorts and longs added in almost equal amounts, leaving the market slightly more short for the 4th week in a row now. We think this helps improves the prospects for an AUD rally even more here. The next chart resistance zone lies in the 0.7150-60s, then the 0.7210-20 area. We’ll get the Chinese CPI numbers tonight at 9:30pmET and the Australian jobs report on Wednesday night at 8:30pmET.

-

USDJPY: Dollar/yen is having a tough start to the week after Friday’s late bounce in US equities could not get the market comfortably back above chart support in the 112.20s. This negative chart setup spilled over into Asian trade last night and when Asian stocks extended their declines, so too did USDJPY. The market broke below the 111.90s, which then led to further selling, and while some buying in EURJPY and the S&P futures has been helping over the last few hours, the disappointing US Retail Sales number just out is not making the attempt back above 111.90 easy. Fund longs liquidated positions during the swift decline back down to the 112s, but so too did shorts, which means the overall net long USD (short JPY) position didn’t change all that much going into Oct 9. We think this development will continue to be a drag for USDJPY here, and will likely lead to selling on any rallies back to the mid 112s.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

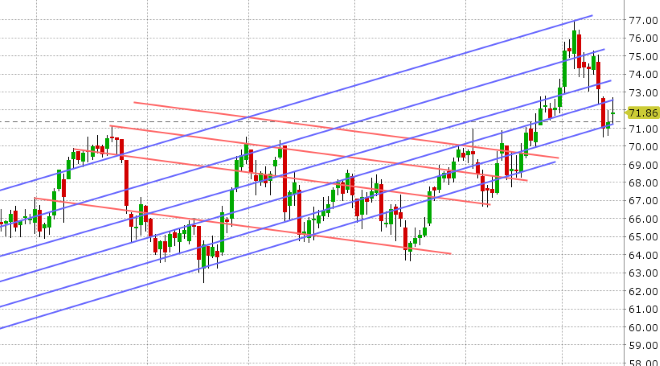

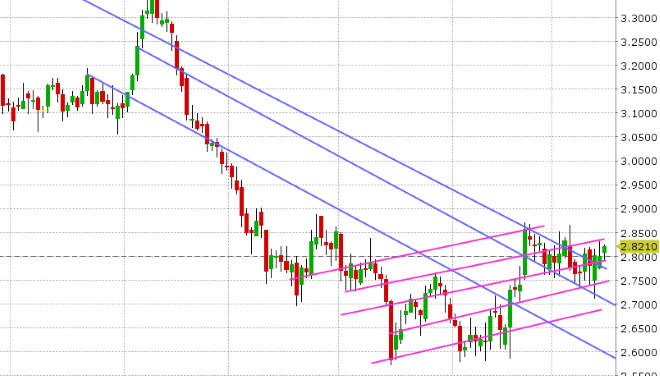

November Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

December Gold Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

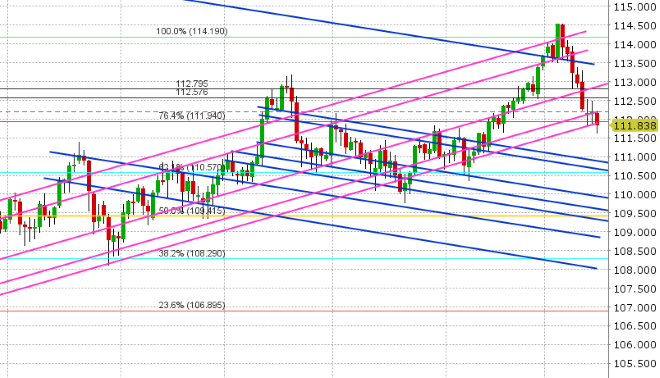

USD/JPY Daily Chart

USD/JPY Hourly Chart

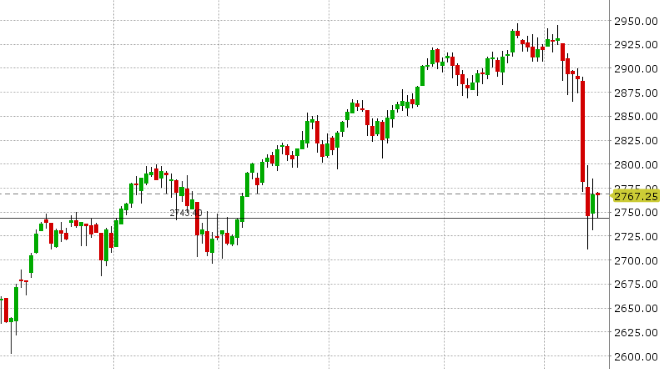

Decembere S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.