German politics in focus for $EUR traders. $JPY shorts at new high as #USDJPY recedes. Quiet week expected ahead. US Thanksgiving on Thursday.

Summary

-

ECONOMIC DATA HIGHLIGHTS SINCE EARLY NY TRADING FRIDAY: US Housing Starts come in at 1290k or +13.7% MoM (higher than expected). Canadian Oct CPI comes it as expected at 1.4% YoY.

ECONOMIC DATA THIS WEEK: No major data points on tap for today or tomorrow. US Durable Goods and FOMC minutes on Wed. UK GDP and Cdn Retail Sales on Thursday. The US will be out for Thanksgiving on Thursday & Friday.

WEEKEND NEWS: Merkel’s coalition talks break down in Germany. There is a risk now that new elections may need to be called. German President Steinmeier to make statement at 8:30amET today.

UPCOMING CENTRAL BANK SPEAKERS: ECB's Draghi speaks in Brussels at 9amET. RBA’s Lowe speaking at 4amET in Sydney tomorrow.

CFTC COMMITMENTS OF TRADERS REPORT (NET SPECULATIVE POSITIONS AS OF NOV 14) - GBP shorts trim and longs add as the range trade continues, leaving the net position close to flat again. Short USD (long CAD) position liquidation was the theme for the fourth week in a row in USDCAD, leaving the net USD short (CAD long) at its lowest level since August. Both EUR longs and shorts added about 20k contacts in the EURUSDs break back above 1.17, leaving the net EUR long more or less unchanged. Long USD (short JPY) traders were buying on the dip to 113.50 in USDJPY while USD shorts (JPY longs) used the dip to trim positions. The net USD long (net short JPY) is now the largest since December 2013.

CME OPEN INTEREST CHANGES 11/17: AUD +4502, GBP -563, CAD +578, EUR +1247, JPY -1084

-

EURUSD: It’s all been about Germany to start the week as Angela Merkel has now failed to form a coalition government with FDP. EURUSD took a hit out the gates in Sunday opening trade but the market has quickly recovered in Europe now as shorts cover and the market awaits what the German President Steinmeier will say at 8:30amET. Support 1.1750, then 1.1720. Resistance 1.1810-20, then 1.1860s. Technically speaking, we feel this market is now in a range-bound to pattern 1.1810-20 breaks to the upside or 1.1720 breaks to the downside. EURGBP has regained its composure after some early selling and should support EURUSD so long as it can stay above 0.8875.

-

USDCAD: It’s been a very quiet start to the week for USDCAD. Technical failure in the low 1.28s on Friday (the upper bound of our trend-line channel extension from early 2017) was a bit concerning but it looks like the market wants to take another crack at it early this week. Support in the 1.2770s is holding, which is positive as well. If the 1.2810-20 level gives way, we could see a quick resumption of the trend higher for USDCAD with the next stop being 1.29 again very easily. Cross flows from EURCAD and GBPCAD continue to support, as does the 2yr US/CA yield spread (which hasn’t narrowed much at all since USDCAD has come off in November). We continue to call this market range-bound to higher so long as the 1.27s hold. USD net short positioning is now back at August levels.

-

GBPUSD: Sterling is enjoying a bit of rally to start the week, riding higher on the coattails of the recovery this morning in EURUSD. Technically speaking, we’re in much better shape than we were at the start of NY trading on Friday. Friday’s intraday reversal lower was halted at the lower bound of our upward sloping trend-line from the spring (which also coincided with the 50% Fibo retrace of the Aug-Sep rally [yellow line on chart]). The market is still finding sellers however in the mid to high 1.32s, so this level needs to fall before any serious upward momentum can resume.

-

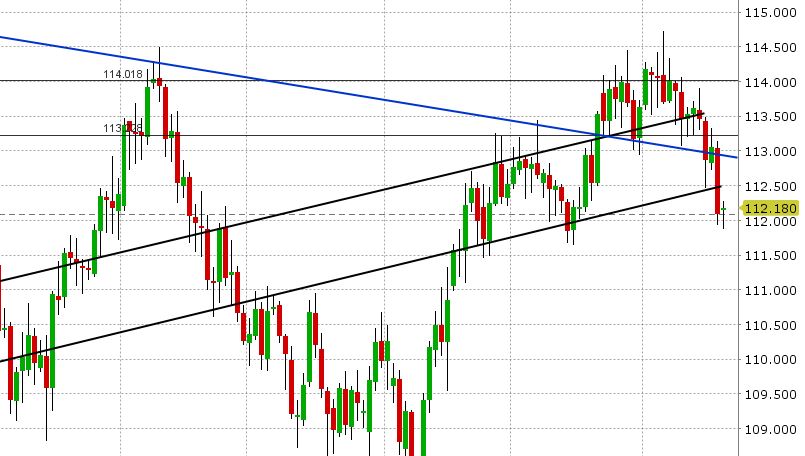

USDJPY: Dollar/yen is in a bit of trouble technically to start the week as key support at 112.50 gave way in Friday’s trade and the market did not try to recover one bit despite the EUR led, USD bid in Asian trading overnight. That broad based USD bid has now fizzled as the EUR recovers. Add to this the latest COT report, which showed USD longs (JPY shorts) at yet another multi-year high, and we have a market that smells blood (USDJPY longs that are underwater and losing money). US 10-year treasury futures now seem to be bottoming and this would not bode well for USDJPY either. This market has now technically shaped up to be a sell on rallies so long as we stay below 112.90. EURJPY bids are supplying a bit of relief as we enter NY trading.

Market Analysis Charts

EUR/USD Chart

USD/CAD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.

| EUR German Gross Domestic Product w.d.a. (YoY) (3Q P) |

| EUR ECB's Draghi Speaks in Frankfurt |