Fed leaves rates unchanged. BOE hurts doves with rate hold. Coronavirus fears mount.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Fed to keep intervening in overnight/term repo + T-bill markets until “at least April”. Achieving “ample” bank reserves the focus.

- Bank of England disappoints rate cutting doves. OIS markets reprice for no cut in March and GBP rebounds.

- Global economic fears spreading even faster now than the conoravirus itself. USDCNH hits 7.0000. Russia closes its border with China.

- Thirteen Chinese provinces and four Chinese cities to remain effectively closed for another week (CNBC).

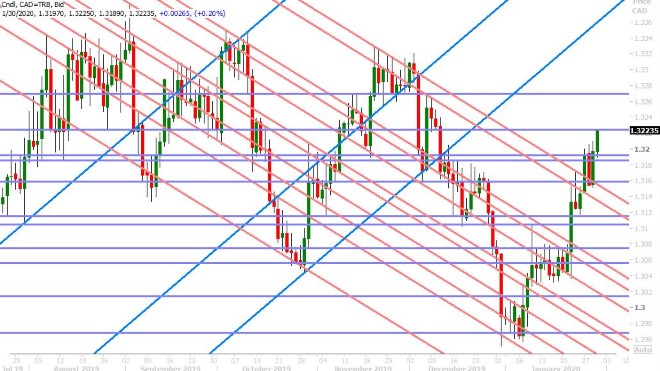

- USDCAD move above 1.3070-1.3170/90 price again opens up start of new uptrend.

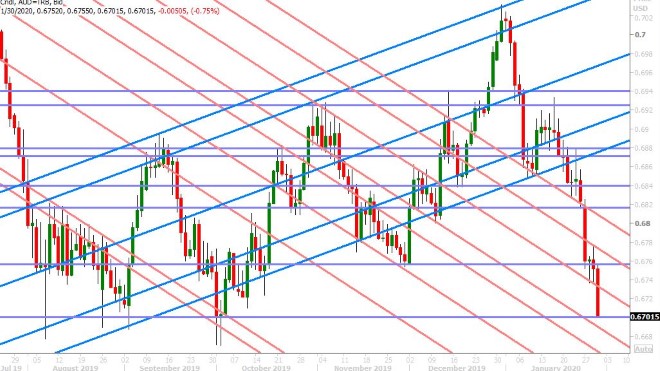

- AUDUSD in even worse technical shape, looking poised to now test 2019 lows ahead of RBA rate decision on Feb 4th.

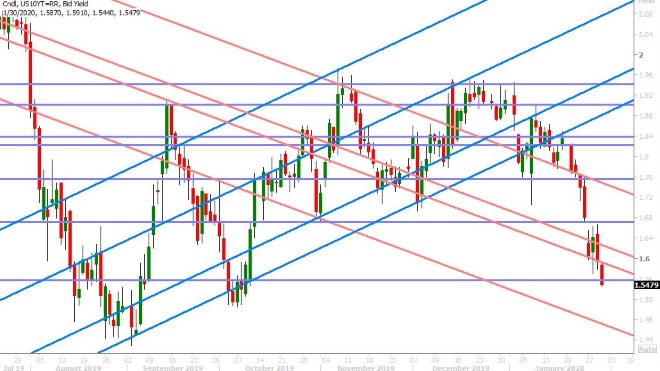

- EURUSD traders eyeing short term bounce if 1.1020s can hold. Weak US yields helping.

- USDJPY clinging to 108.80s support ahead as WHO Emergency Committee reconvenes today.

ANALYSIS

USDCAD

Dollar/CAD broke out to a new uptrend overnight as this week’s familiar coronavirus news cycle delivered more bad news during the Asian and early European time zone. We now have 7,711 confirmed cases in China with 170 deaths, according to Chinese health authorities. Global economic chills are spreading even faster however as reports circulate about more international airlines cutting flights, more Western companies closing stores/offices and more Chinese cities and provinces effectively deciding to extend the Lunar New Year holiday for another week. Russia has closed its border with China in an effort to stop the viral outbreak and of course everybody is wondering what the WHO will say today after its Emergency Committee reconvenes. All this fear saw USDCNH spike briefly higher above the psychological 7.00 level but, as has been the pattern this week, we’re now seeing “risk-off” flows die down once again as we head into NY trade.

The US just reported its Advance GDP report for Q4 and while the headline growth rate met expectations of +2.1% QoQ, the core PCE price index came in softer than expected (+1.3% QoQ vs +1.7%). This could be another reason to sell USD broadly here at the margins. We’re also seeing GBPUSD surge higher following the Bank of England’s hold to interest rates, and we think those USD sales are leaking through into other currency pairs as well as this hour.

The FOMC kept US interest rates on hold yesterday as well, and while the Fed’s 2pmET statement was truly the non-event we thought it would be, we felt the tone of Jerome Powell’s press conference titled to the dovish side. All the talk about not being satisfied with inflation running below 2%, continuing with overnight & term repo + T-bill interventions into “at least April”, and raising bank reserves to an “ample” yet loosely defined level, told us that the Fed is not going to take its foot off the monetary stimulus pedal any time soon. Frankly, it doesn’t really know what else to do. Money market participants are now addicted to publicly-infused reserves because the private Eurodollar banking system is still not functioning normally and while they may have given Jerome Powell a free pass on the funds rate again yesterday, we believe they will effectively force the Fed’s hand into a cut at some point later this year.

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

Euro/dollar caught a bid into the Fed’s press conference yesterday as some of the dovish tones from chairman Powell crossed the wires. While most of this evaporated into the NY close, we’ve noticed a steady “buy the dip” mentality in overnight trade today as US yields continue to price in global growth fears related to the escalating coronavirus outbreak. Traders seem to be shrugging off the weight of this morning’s sizable option expiries in the 1.0985-1.1005 zone (3blnEUR), and now seem focused on trend-line resistance in the 1.1020s as GBPUSD surges higher. We think this level will be the pivot for NY trade today. A move above will likely invite some short covering into the mid-1.10s while buyer failure will relegate EURUSD to its familiar 1.0990s to 1.1020s range we’ve seen all week. Germany reported decent January employment numbers earlier today and its preliminary CPI read for January met expectations of -0.6% MoM.

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Outgoing Bank of England Governor Mark Carney proved a lot of people wrong this morning by deciding to keep UK interest rates unchanged. The OIS market continued to price coin flips odds ahead of the decision and GBPUSD looked technically weak going into the 7amET press release (firmly below 1.3010s), but the result was a 7-2 vote in favor of keeping rates at 0.75%. The BOE cited signs that Britain’s economy had picked up since December’s election as reasons for not adding more stimulus right now, but Carney said “To be clear, these are still early days. It is less of a case of so far, so good, than so far, good enough” when referring to UK economic data. “It will be important for the hard data on activity to follow through on the recent pick-up in the surveys, and for domestic price inflation to strengthen." More here from Reuters.

We found the communication around forward guidance to be mixed. On the dovish side, the Bank of England said it removed its “limited and gradual” phrasing because it implied multiple rate rises, which is “not the case now”. It also said MONETARY POLICY MAY NEED TO REINFORCE EXPECTED GROWTH RECOVERY IF RECENT SIGNS OF STRONGER GLOBAL AND DOMESTIC ACTIVITY ARE NOT SUSTAINED, OR DOMESTIC INFLATION STAYS RELATIVELY WEAK. However, on the hawkish side, it also said that the OIS markets called it wrong this time around by saying: MARKET PRICING SHOWING A BOE RATE CUT LEADS TO INFLATION OUTCOME ABOVE TARGET, INCONSISTENT WITH BOE REMIT and BOE SAYS "SOME MODEST TIGHTENING" OF MONETARY POLICY MAY BE NEEDED FURTHER OUT IF ECONOMY RECOVERS AS FORECAST. This is typical central bank double-speak in our opinion, but the point we think traders have to deal with today is the fact that markets got a little too excited about rates cuts and that those bets now need to be scaled back.

The OIS market is now showing just a 18% chance that the BOE cuts rates at its next meeting on March 26th. Sterling shorts have been forced to cover, taking GBPUSD all the way back to the 1.31 handle. EURGBP has collapsed back below 0.8450. With GBPUSD now trading back above 1.3010s, we think the market’s downward momentum has now technically been halted. However, we don’t see sustainable upside momentum until the market breaches last Friday’s highs in the 1.3130-40s. In the meantime, we may be forced to live with a range-trade.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The hemorrhaging losses continue for the Australian dollar trade today after another overnight session of negative coronavirus headlines. This morning’s 3amET spike above 7.0000 for USDCNH was enough to see AUDUSD break yesterday’s chart support zone in the 0.6740-50s. This technical breakdown now exposes the market to a re-test of its late September/early October 2019 lows in the 0.6670s in our opinion. We think the Reserve Bank of Australia will welcome this downward move in the Aussie when it meets next Tuesday. The move is coming from China fears, not an OIS market that is pressuring the RBA for another rate cut, and we think they’ll talk about how a lower AUD will help Australia cope with all the recent stress its economy has been facing.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is holding on to chart support in the 108.80s this morning as NY traders are once again fading the overnight negativity on the coronavirus. Off shore dollar/yuan has pulled back from the psychological 7.0000 level; US yields are clinging to trend-line chart support at 1.56%, and even the S&P and crude oil futures are bouncing a little bit. Is this the calm before the next storm? We think so. We think traders need to be on guard for another “risk-off” reaction should the WHO declare an international health emergency.

USDJPY DAILY

USDJPY HOURLY

US 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.