Fed fails. Biden succeeds. Bank of Canada cuts rates by 50bp to 1.25%

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

• Bank of Canada cuts rates by 50bp with dovish press release. USDCAD spikes above 1.3400.

• Bond markets shrug off emergency 50bp Fed rate cut. US 10yr yield plunged below 1% yesterday.

• Fed funds futures still pricing in at least another 25bp in cuts for March 18 FOMC meeting.

• ECB AND BOE EXPECTED TO TAKE IMMEDIATE POLICY ACTION ON CORONAVIRUS IMPACT – CNBC

• Joe Biden scores big comeback in last night’s Super Tuesday primaries. S&P futures like it.

• Rumors swirling that OPEC will extend production cuts by more than 1mln bpd on Friday.

• US ADP Employment beats expectations for February, but January numbers revised downward.

• US Non-Manufacturing beats expectations, 57.3 for February vs 54.9.

ANALYSIS

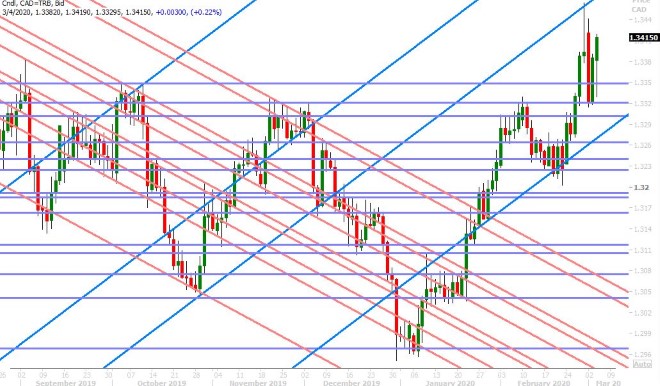

USDCAD

Dollar/CAD spiked above the 1.3400 mark at 10amET this morning after the Bank of Canada cut interest rates by 50bp to 1.25%. A cut of 25bp was largely priced in by the OIS markets earlier this week, but with 50bp odds increasing to 68% going into the release, we think this was the new expectation everybody was watching for. The Canadian central bank indeed delivered a fifty, just like the Fed did yesterday, but we felt the tone of their press release was notably more dovish. Full details here. We’ll have to wait until tomorrow unfortunately to get Stephen Poloz’s interpretation of all this. The Canadian central bank governor will be speaking at 1pmET tomorrow, with the text of his speech titled “Economic Progress Report” to be released at 12:45pmET.

Rumors continue to make the rounds this morning that OPEC will surprise oil markets with a larger than 1mln bpd production cut on Friday, but traders seem more pre-occupied with the April contract’s inability to break above the 48.10-40 resistance area. Not even this morning’s bullish weekly EIA report is helping the market. We think a pullback for oil prices here could add some fuel to the USDCAD long trade currently underway.

USDCAD DAILY

USDCAD HOURLY

APR CRUDE OIL DAILY

EURUSD

Euro/dollar spiked higher yesterday after the bond markets showed a cynical response to the Fed’s emergency rate cut. The US 10yr yield plummeted over 25bp (from session highs to session lows), and this included a quick and scary move below 1% to a new all time low of 0.9059%! Why bond traders reacted this way, when the Fed gave them more or less what they wanted right away, is the question everybody has been debating since then. Some say this sent a signal that the Fed finally panicked, likely knowing full well that economic/liquidity risks are much worse that they portray (and that bonds have had it right all along). Others say the markets wanted more and this was another feeble attempt by the Fed to “stay ahead of the curve”, ie. we didn’t get 75bp and we didn’t get coordinated global rates at the same time. We think it was the disingenuous tone to Powell’s press conference that rubbed everyone the wrong way. The Fed chairman keeps trying to play the confidence game of telling us that the “US economy remains strong” but the Fed’s constant interventionist measures don’t jive with this narrative. What is more, Powell admitted that that the effects of the coronavirus have not shown up in the data yet. So if you claim to be data dependent, what the heck are you overreacting for?

We continue to believe that global central bankers are losing whatever credibility they have left, by the day. We’re told that interest rate cuts and quantitative easing is simulative to the broader economy, but there is no empirical evidence to suggest that this is true. It hasn’t worked in Japan for decades. It’s so ineffective in Europe that Christine Lagarde is trying to come up with a rethink of the ECB’s entire monetary policy strategy. What we think we saw was a collective middle finger towards the Fed yesterday and anything it says going forward. The global bond markets have, and will always be, in charge…and they will react sooner and more rationally that any central banker ever will.

We think this morning’s second retreat off the 1.1160-80s resistance level for EURUSD is technically warranted. The buyers couldn’t hold the market’s brief spike above the 1.1200 level yesterday and they have failed three times since then to probe higher. This morning’s better than expected US Non-Manufacturing ISM report for February (57.3 vs 54.9) is bringing about some USD buying, but it’s very mild.

EURUSD DAILY

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

Sterling is chopping around between support at 1.2750-70 and resistance at 1.2830 as traders digest rumors that the Bank of England will do an emergency rate cut as well, before its March 26th policy meeting. A report from CNBC is making the rounds to this effect and we think that’s probably because the OIS market has now priced in an effective target rate of 0.3315%, which is 34bp reduction from the current rate of 0.75%. The UK’s final Services PMI for February mildly missed expectations this morning (53.2 vs 53.3) but traders are largely ignoring it.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar spiked higher initially after yesterday’s emergency Fed rate cut, but it quickly reversed lower when US bond yields started to plunge. This reversal lower also coincided with AUDUSD hitting trend-line chart resistance in the 0.6620s. Buyers showed up again in Asia though overnight (despite the market’s rather negative NY close) and we think the better than expected Australian GDP numbers were the catalysts. The numbers for Q4 2019 came in at +0.5% QoQ vs +0.3% expected and +2.2% YoY vs +1.9% expected. One could argue that this is old data now in light of the cononavirus’ likely impact on the Australian economy, but we’re not shocked to once again see markets take data at face value.

The S&P futures kept inching higher in Asia too as Joe Biden staged an impressive comeback in the Super Tuesday primaries and we think AUDUSD buyers welcomed the mild improvement is risk tone that resulted from this as well. Biden’s more centrist political stance is seen as more friendly towards the markets or much easier for the Trump campaign to beat (depending on who you talk to).

We think yesterday’s break above the 0.6550-60 resistance level has very much allowed the upward momentum we’ve seen in AUDUSD since the RBA meeting. A firm NY close above the 0.6620s could see this counter-trend AUDUSD rally continue further.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen retested its recent 107 lows yesterday in the aftermath of the Fed’s 50bp cut, but the buyers put up an impressive defense of the 106.90s, despite a rather tumultuous mid-day plunge in US yields to 0.9059%. They showed up again in Asian trade overnight, in and around the time of the better than expected Australian GDP release. However, they’re struggling to build upon this progress now as the US 10yr yield slips 4bp from its session highs.

We think USDJPY has a chance of forging a short term bottom anchored off trend-line support in the 106.90s, but we don’t yet know where the positive fundamental narrative will come from and we’re not yet seeing the type of seller failure we want to see (swiftly fall below support followed by a sharp reversal higher).

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.