FX markets quiet to start week. Central bankers gathering in Portugal. BoE and OPEC in focus for later this week.

Summary

-

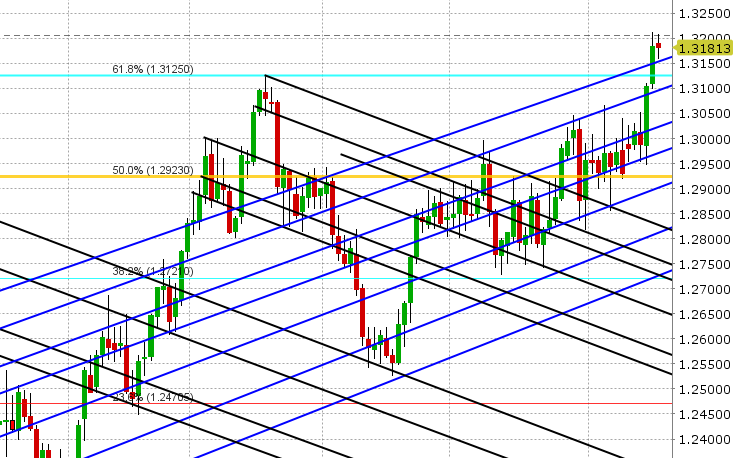

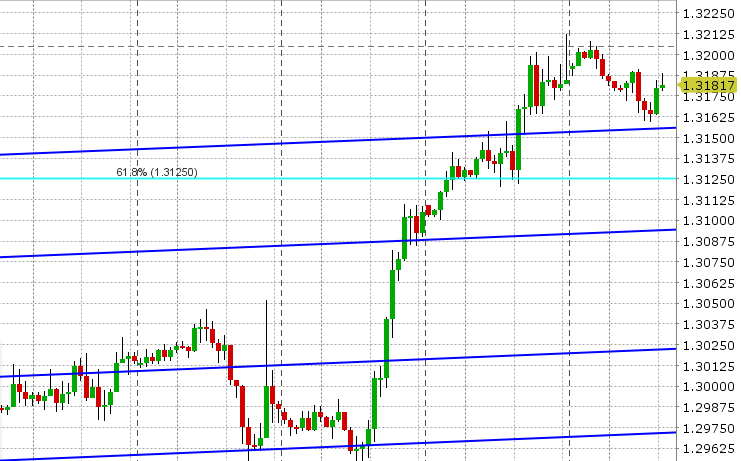

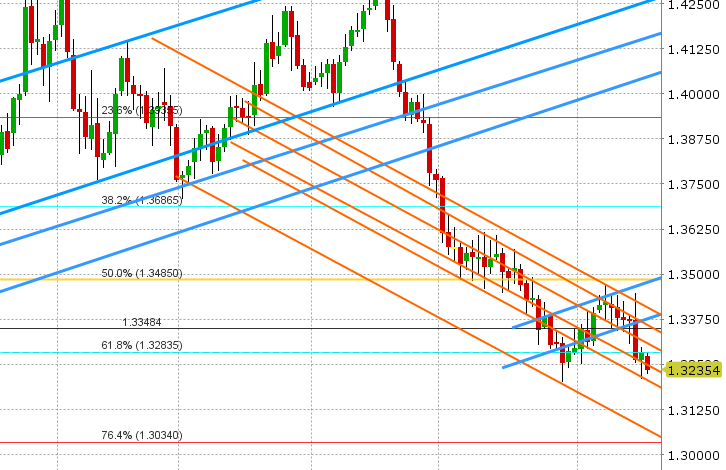

USDCAD: Dollar/CAD is looking a tad tired this morning after a strong, commodity driven rally on Friday. The market wasn’t able to benefit from further losses in crude oil overnight (China threatening tariffs on US crude imports) and is now trading lower as crude oil rebounds on some OPEC headlines (talk of output hike now just 300k to 600k bpd vs. 1-1.5mln bpd earlier rumored). This week’s calendar will be lighter relatively speaking with regard to economic data, with US Housing Starts being the key feature on Tuesday. Wednesday will see central bankers Draghi, Powell, Kuroda and Lowe speaking in Portugal at the conclusion of the Sintra conference. Finally on Friday we’ll get Canadian Retail Sales and CPI for May, along with the much awaited decision from OPEC on oil production output. Speculative Canadian dollar futures traders trimmed positions in the week ending June 12, but still continue to ride a net USD long (CAD short) position to the tune of 15k contracts. We think the rally in USDCAD still has legs so long as the market stays above the 1.3150s, and we would continue to note the lack of meaningful chart resistance until the mid 1.33s.

-

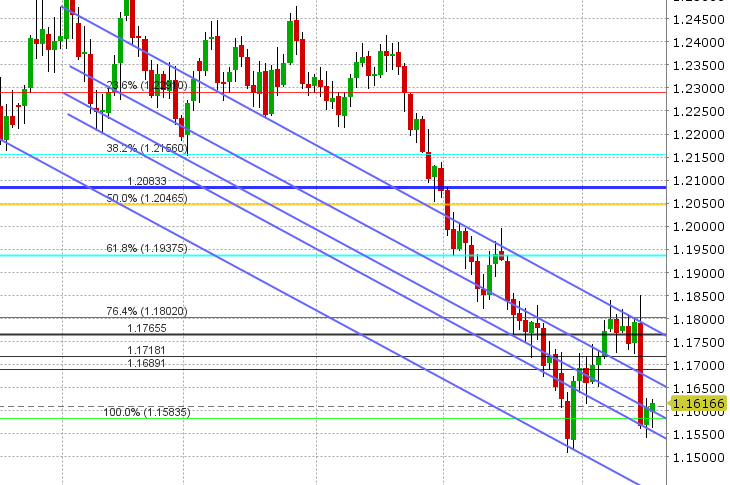

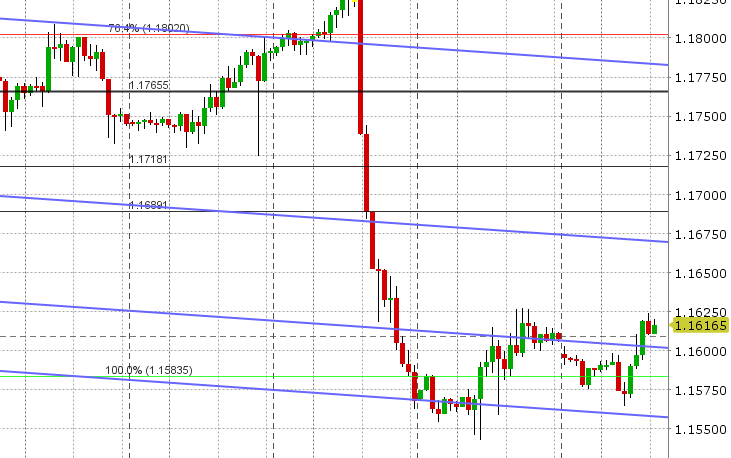

EURUSD: The Euro is moderately bid this morning following a technically constructive NY close on Friday. The market has also been able to shake of some “risk off” tones in Asia overnight and even some less than favorable political headlines for Germany’s Merkel this morning. More here: https://www.cnbc.com/2018/06/18/immigration-fight-has-handed-germany-merkel-her-worst-crisis-in-more-than-a-decade.html. This week will feature speeches from Mario Draghi on three occasions at the Sintra conference (today at 1:30pmET, tomorrow at 4amET and Wednesday at 9:30amET alongside a panel of the other central bankers). The economic calendar is light this week, with just German PPI on Wednesday and the Markit PMI data on Friday. Spain auctions off 3,5 and 10 yr bonds on Thursday. We think EURUSD could see some short covering today should the market punch above the 1.1620s, otherwise expect range bound trading around a range of support levels between 1.1580 and 1.1600.

-

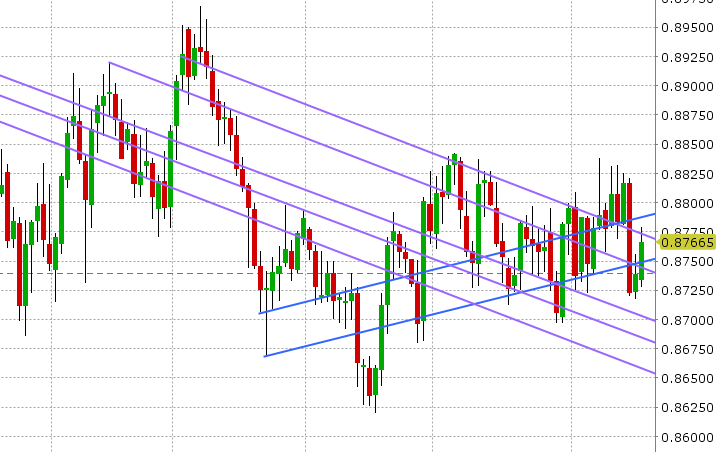

GBPUSD: Sterling is trading softer this morning after a wave of EURGBP buying in the London AM took the cross back above key resistance in the 0.8750 area. This week features the Bank of England meeting on Thursday, where traders are expecting no change to interest rates. Expect more Brexit headlines this week as the amendment vote battle resumes. More here: https://www.bbc.com/news/uk-politics-44518702. Technically speaking, the pound’s downtrend remains intact so long as we stay below the 1.3320-50s.

-

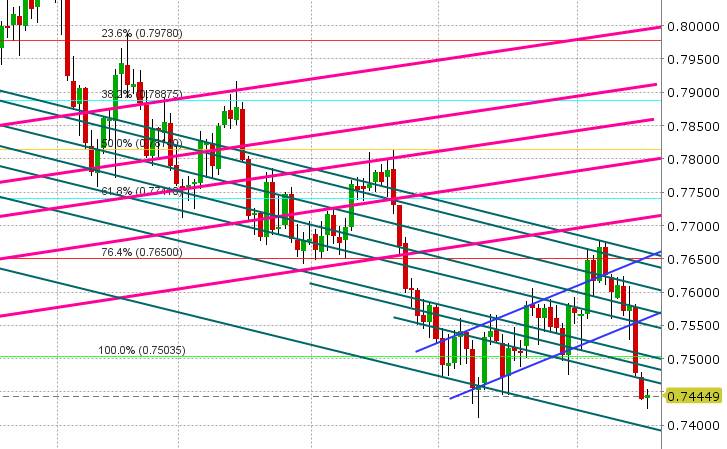

AUDUSD: The Aussie is trading with a neutral tone this morning after Friday’s plunge in commodity prices and AUDUSD’s failure to regain the 0.7470s. Rising US/China trade war rhetoric continues to hurt commodity currencies and so we think AUDUSD underperforms here again this week. We would also continue to note the lack of technical support beneath prices right now (next meaningful level comes in at 0.7390-0.7400). This week will be quiet on Australian data front, with just the June RBA Minutes out tonight.

-

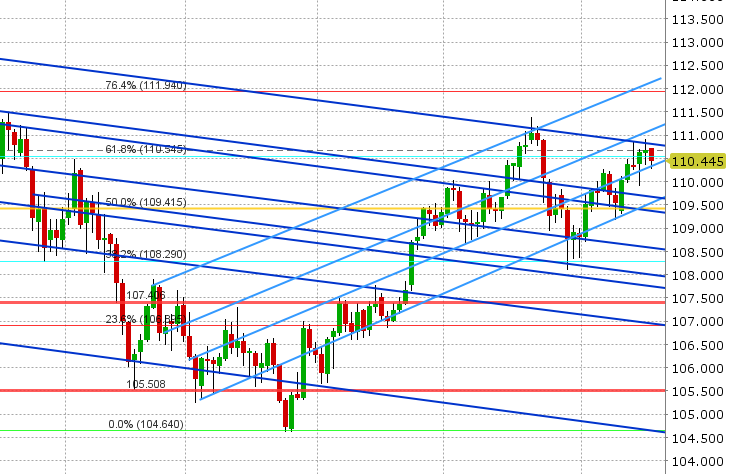

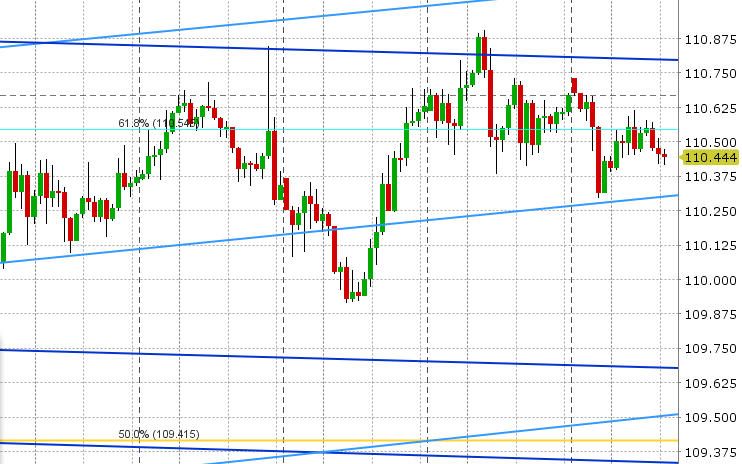

USDJPY:Dollar/yen saw a bit of “risk off” flows to start the week as Asian markets had a chance to react to Friday’s US/China trade war headlines and China’s latest threat on US crude imports. This action reversed course in European trade as oil prices rebounded and European equities opened higher. The market now sits stuck between chart support in the 110.30s and resistance in the 110.80s. US yields are opening weaker for the third day in a row, which may lean on USDJPY early here. This week features the BoJ Minutes tomorrow and Japanese May CPI on Thursday.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.