FX markets quiet ahead of key Brexit "meaningful vote" amendment vote in UK today. Four central bankers speaking shortly in Portugal. BoE meets tomorrow.

Summary

-

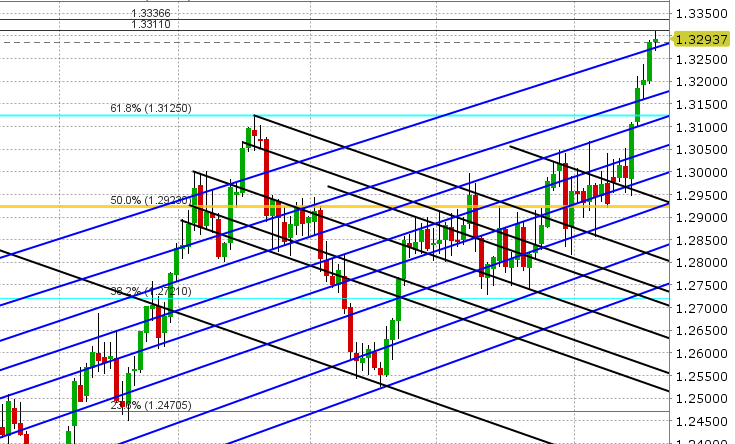

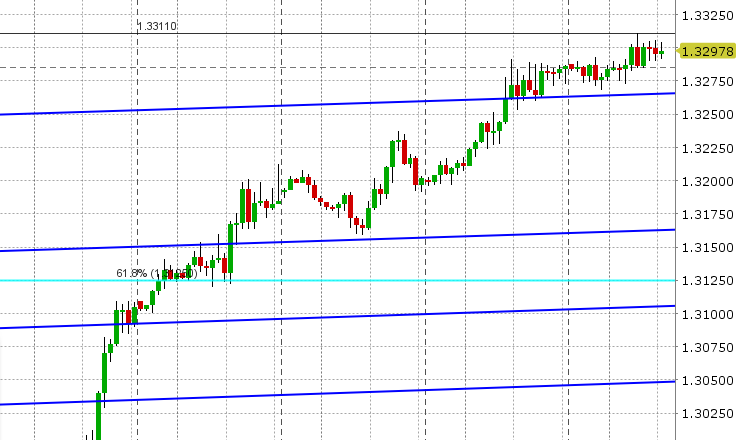

USDCAD: A relatively quieter overnight session for news flow sees the major FX pairings trade in narrow ranges so far today, USDCAD included. The market inched higher in early European trade to test the lower bound of chart resistance in the 1.3310-1.3330 area and has since backed off a bit. Today’s calendar features a panel of central bankers speaking at the Sintra conference in Portugal at 9:30amET (Draghi, Powell, Kuroda, Lowe), the weekly DOE oil inventory data at 10:30amET and more headlines from the OPEC conference in Vienna as markets brace for a potential rise in output to be announced on Friday. While USDCAD continues to hold gains, we’d be wary of a pull back here as the chart technicals for EURUSD, AUDUSD and crude oil improve ever so slightly intra-day. Support continues to lie in the 1.3260s while resistance remains 1.3310-1.3330.

-

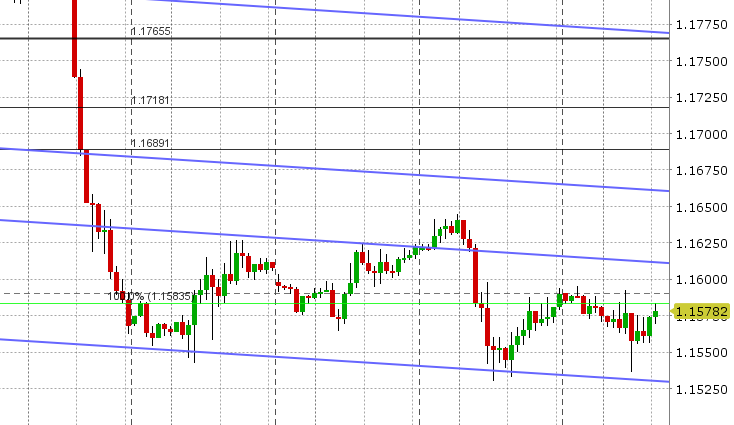

EURUSD: Euro/dollar bounced off chart support in the 1.1530s yesterday and had a mediocre NY close by way of finishing the session between support and resistance in the 1.1610 area. EURUSD spiked lower in the 4am hour after comments from the ECB’s Nowotny, who outright talked down the EUR when he said he sees the currency depreciating because of differences in interest rate policies. Support in the 1.1530s held the 50pt dip that ensued and we’re now trading back higher but still within yesterday’s NY range. We’d be wary of some short covering here in EURUSD. The EU has announced 2.8blnEUR worth of duties on US imports as of Friday, but the markets are largely ignoring this.

-

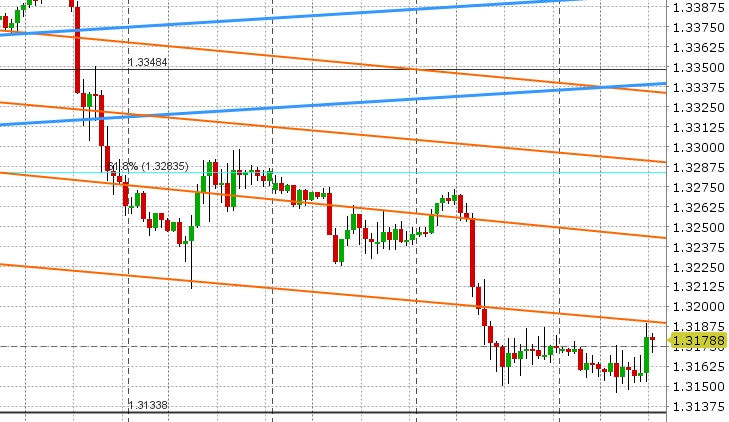

GBPUSD: Sterling extended slightly lower in overnight trade after a poor NY close yesterday that saw spot prices finish well below chart support in the 1.3180s. We’ve seen a modest bounce over the last hour that has taken the market back up to try and regain this level, but the momentum is not convincing. We see this as likely short covering ahead of a big day for the UK’s Theresa May. The House of Commons will be having a final vote on the so called Brexit “meaningful vote” amendment. More here: http://www.businessinsider.com/explained-dominic-grieve-meaningful-vote-brexit-amendment-2018-6. Expect headlines around the London close. A reminder that the Bank of England policy announcement is tomorrow at 7amET. Markets are not expecting any change to interest rates.

-

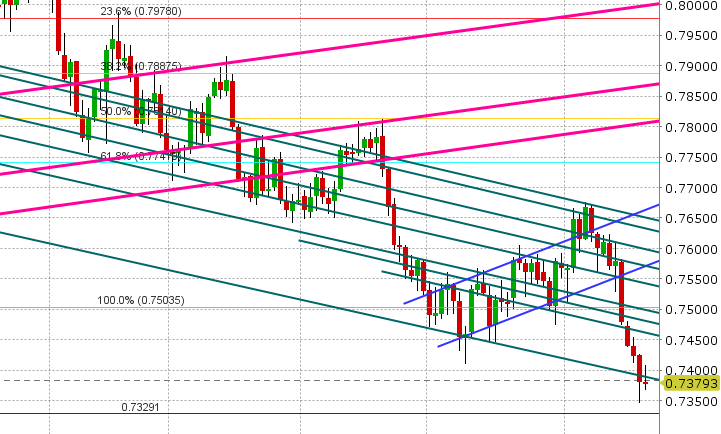

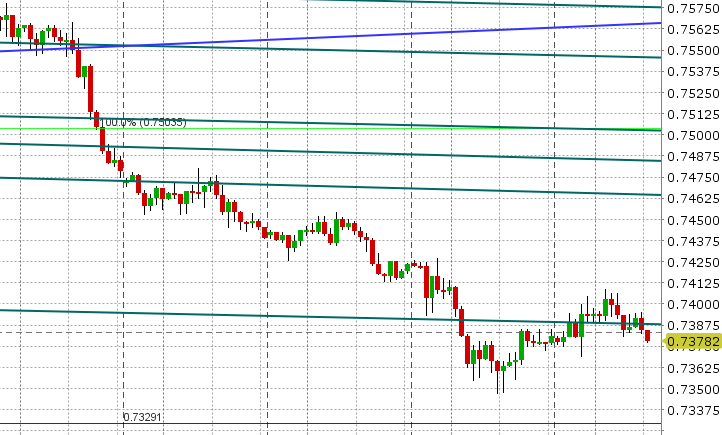

AUDUSD: The Aussie is trading modestly weaker this morning, almost in lockstep with EURUSD, and traders are now wrestling with chart support in the 0.7380s (which was regained in Asian trade last night). Copper prices continue to struggle after a 4-day plunge back lower from the 3.20s. With the technicals for copper still looking weak (not much support until 3.00-3.01), we think AUD will lag EUR gains should we see some liquidation of USD longs more broadly.

-

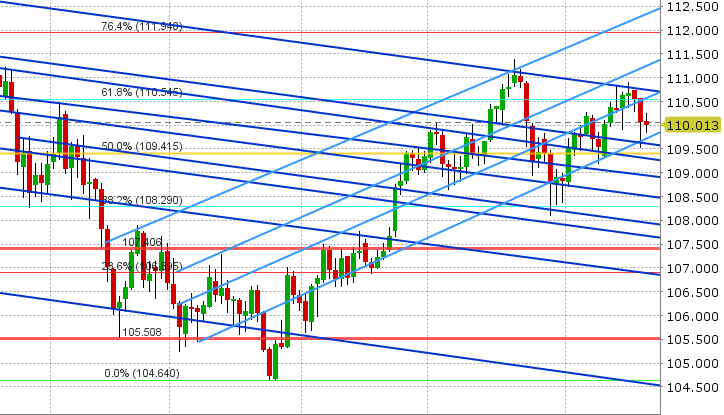

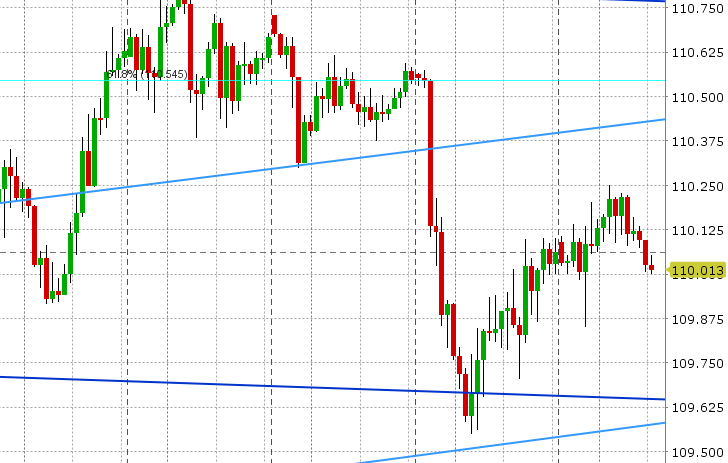

USDJPY:There’s not much going on at all in dollar/yen today after the market bounced off support in the 109.50-60s yesterday. Global equities and developed bond yields continue to tick higher following yesterday’s broad recovery in “risk”. We think USDJPY trades range-bound here with today’s option expiries in the 110.00-110.20 zone acting as an early anchor.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.