Equity volatility markets break as stock market collapses. USD enjoying controlled safe-haven bid. US cash open nervously awaited.

Summary

-

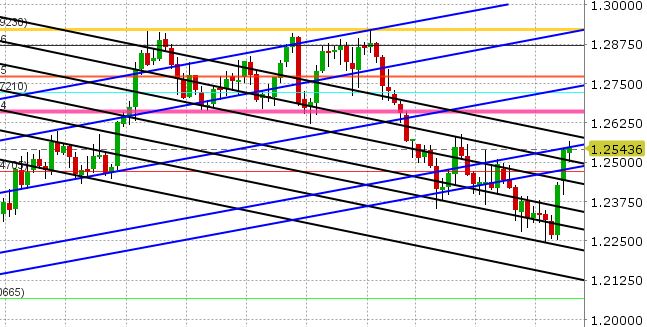

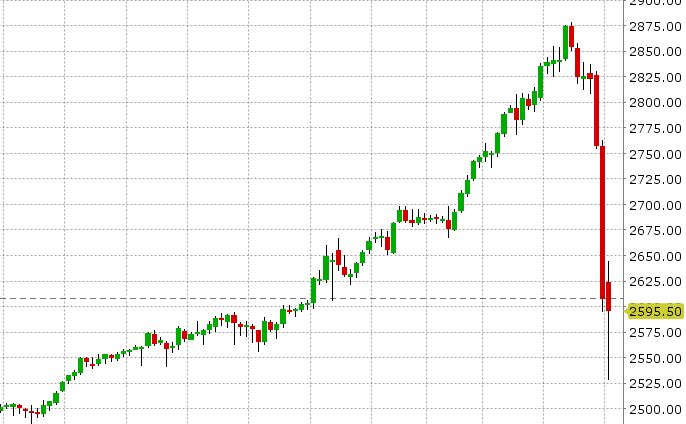

USDCAD: Dollar/CAD made quick work of chart resistance at 1.2450 and 1.2475 yesterday as the plunge in global equities ignited a safe-haven bid in the broader USD. Yes, a safe haven bid! Think 2008, the financial crisis and how well the USD performed when the markets were scrambling for liquidity. While yesterday was not 2008 by any stretch, parts of the equity market (especially the volatility sector) showed panic yesterday and this helped the broader USD extend its gains from the positive US payroll data on Friday. The move higher in USDCAD was controlled however, and after 1.2500 was taken out, traders pushed the market up calmly to the next resistance level, which was 1.2540-1.2560. The market made repeated attempts to trade above it in overnight trade, despite another 2% drop in the S&P futures during Asian trade, and when the S&Ps traded all the way back into the green during early European trade, a sense of calm emerged and USDCAD backed off further. All this is reversing course as NY traders roll in. The VIX just printed 50, the S&Ps have dropped 40-50pts from their European highs and the broader USD is once again bid. This, in our opinion, puts the 1.2540-60 level to the test again. Should this resistance level give way, we could see a quick pop higher to the 1.2580s (light resistance here – Jan highs) and even a move back into mid 1.26s. This would be a very bullish development from a technical perspective, because it would arrest the downward trend we’ve seen since the holidays in our opinion. Today’s session will see the release of the US Trade Balance for December and Canadian Merchandise Trade figures, but none of this will matter in our opinion. Traders will be glued on the S&P futures and the broader “risk off” theme that has taken over markets in the last 24hrs. There are also rumors circulating over massive margin calls this morning and further fallout from the catastrophic collapse of the XIV (Credit Suisse short volatility ETN) in after hours trading last night (see chart).

-

AUDUSD: The Aussie held in surprisingly well during most of the NY session yesterday, but it succumbed to selling with all other risk assets into the close as the S&Ps collapsed and the VIX exploded. Australian Retail Sales and Trade Balance were reported weaker than expected last night, and the RBA kept interest rates unchanged as expected. Combine this with a further 2% drop in the S&P futures during Asian trading and the AUDUSD couldn’t keep it together. The market tested yet another trend-line support level at the start of European trade (0.7840-0.7850), and the market bounced higher as the S&Ps rebounded, but as we mentioned above, all this is reversing now as the S&Ps back off again and the VIX prints 50. Should 0.7840-0.7850 give way, the next support level is 0.7815-0.7820. Copper is surprisingly range-bound despite the risk off theme in markets right now.

-

EURUSD: The Euro traded lower too as the stock market plunged yesterday afternoon, but like USDCAD and AUDUSD, the move was not panicky by any stretch. The NY close was a bit rough (closing right on trend-line support in the 1.2370s), and while the market attempted a rebound higher above 1.2400 in Europe following the S&Ps, all this has reversed course in the last 2 hours and we’ve now plunged below 1.2350 as we write. Technically speaking, this is not great for the EURUSD chart and invites a test of support in the 1.2280-1.2310 region in our opinion. USDCNH, despite a swift move back lower in early European trading, is still managing to hold the 6.2850 support level, and this could negatively weigh on EURUSD as well given recent correlations. EURJPY completed feel apart late yesterday, ruining its weekly uptrend. EURGBP is the only bright spot for the Euro right now as it extends higher for a third straight day, but this seems to be Brexit related (GBP driven) more than anything else. All traders here will be glued on the S&Ps today as well. Expect further broad based USD strength with equity selling and vice versa should equities muster a recovery.

-

GBPUSD: Sterling is getting whacked again today after getting thumped lower in yesterday’s trade. It started with the weak UK Composite PMIs and then snowballed as stocks plunged. The NY close was anything but pretty on the charts (a low of day print right into trend-line support in the 1.3970s). While GBPUSD made an attempt to recover, like EURUSD and the S&Ps in early European trade, all that has reversed course here as well as everyone appears nervous about the US equity open today. Compounding the pain now for GBP longs is the fact that trend-line support at 1.3970 has broken, and we now have a market scrambling for support. The market blew through the next trend-line support level at 1.3910. Next support is 1.3840. While there’s nothing to really point to say why GBP is getting hit harder than EUR, AUD and CAD at this hour (perhaps some renewed Brexit angst), we would note that GBP has been more volatile of late and has had the bigger run comparatively speaking...so we’re not surprised to see it suffer a bit more here in a broad “risk off” environment. The rally in EURGBP is certainly not helping GBPUSD here. The cross has made quick work of chart resistance at 0.8875 and 0.8885 overnight, and now looks poised to 0.8920 to 0.8950 area.

-

USDJPY: Dollar/yen was one of the biggest victims in the broad based equity sell-off yesterday afternoon. When “risk-off” takes centre stage like it did yesterday, the market traditional flocks to the JPY first, then the broader USD. US bond yields also plunged, as traders scrambled back into safer assets. Yesterday’s move saw USDJPY smash through trend-line support in the 109.60-70 level, and a bit of panic ensued during Asia as the selling in the S&Ps continued. Buyers stepped in however at the 108.50 level, and we’ve now seen a rally back to 109.50 (which is trend-line resistance at this hour). Interestingly, USDJPY has not seen a resumption of the safe-haven flows that seem to be going through all other currency pairs in the last couple hours. This tells us the market might have legs for a technical recovery today (double-bottom on the daily chart). A firm close back above 109.60-70 would be needed to confirm that.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

March S&P500

XIV - Credit Suisse Inverse VIX Short ETN

VIX

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.