EURUSD plunges following ECB's announcement of new TLTROs and no rate hikes for 2019

Summary

-

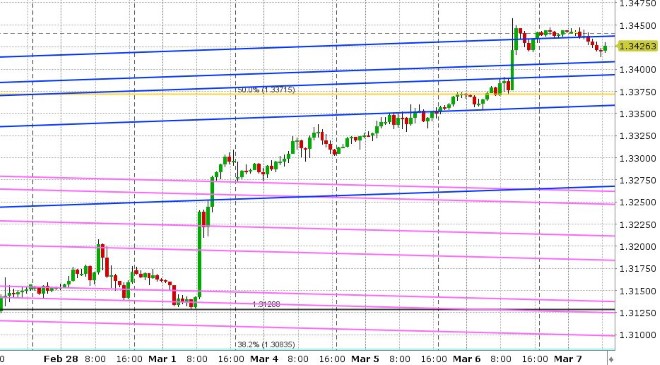

USDCAD: Dollar/CAD is dripping lower from trend-line resistance in the 1.3430s this morning as rising crude oil prices and EURCAD cross sales weigh. Yesterday’s hold on interest rates by the Bank of Canada was way more dovish than the market was expecting. The Canadian central bank said the slowdown in Q4 growth was sharper and more broadly based than forecast. The economy will now likely be weaker in the second half of 2019 compared to prior expectations. There is now increased uncertainty on the timing of future rate increases. And more importantly, the BOC dropped its reference to interest rates needing to “rise over time” and said instead that the “outlook continues to warrant a policy interest rate that is below its neutral range”. This lit a fire under USDCAD and Canadian bond prices as one might expect, but chart resistance in the 1.3430s proved formidable for the market yesterday. With April crude prices bouncing off the 55.70s and now making a run for the $57 mark again this morning, it was not surprising to see USDCAD come off in European trade a bit. However, Canadian Building Permits for January were just reported -5.5% MoM vs -5.0% expected, and this disappointment has invited some USDCAD buyers back in. Next up is a speech from BOC deputy governor Patterson at 12:45pmET before the Hamilton Chamber of Commerce titled “Economic Progress Report”. We’ll be watching Patterson’s comments closely as it might be a chance for the Bank of Canada to clarify yesterday’s press release, in light of the fact that there wasn't a press conference. Chart support today comes in at the 1.3390-1.3410 range.

-

EURUSD: The European Central Bank has just released its latest decision on monetary policy, and it is was yet again more dovish than the market was expecting. While interest rates were kept on hold as usual, the ECB signaled this policy would now remain in place “at least through 2019” (vs through the summer of 2019 as previously stated). More importantly however, the central bank shot its liquidity bazooka again by announcing a new series of 2yr Targeted Longer Term Loans (TLTROs) to help European banks (think Italy). While the S&P futures and European stocks up ticked on these headlines, EUR traders are not buying it as the ECB has effectively admitted something is still wrong in European money markets (why else would they need to do this?). EURUSD has broken down through trend-line support in the 1.1280s. Mario Draghi is now going into more detail at his press conference.

-

GBPUSD: Sterling is falling back lower this morning to trend-line support in the 1.3110s as reports circulate today about Theresa May likely losing next week’s meaningful Brexit vote. None of this should come as a surprise to traders in our opinion because the deadlock with Brussels on the Irish backstop still remains. We think some of today’s pullback could also be related to EURGBP’s attempted push to regain the 0.8610 level (which has now failed funny enough). We think GBPUSD buyers might try to step in again today during North American trade.

-

AUDUSD: The Aussie is hanging in there today as traders managed to regain the 0.7030 support level overnight, despite arguably mixed Australian economic data. Australia’s Trade Balance figure for January beat expectations (4.5bln surplus vs 2.7bln) but Retail Sales missed (+0.1% MoM for January vs +0.3% expected). The EURUSD selling we’re now seeing post the ECB press release is now taking its toll on AUDUSD a little bit. Expect the market to range trade here for a bit so long as the 0.7030s hold. Chart resistance today comes in at the 0.7060s.

-

USDJPY: Dollar/yen is trying to bounce this morning as S&P futures traders oddly celebrate the ECB’s latest measure to reassure/stimulate European banks. Chart support in the 111.60s continues to hold. We think the fund longs remain in charge here above this level.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

April Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.