EUR & GBP bouncing following plunge on dovish ECB press conference. CAD and AUD lagging as US/China trade war rhetoric heats up. Some option expiries in play at week's end.

Summary

-

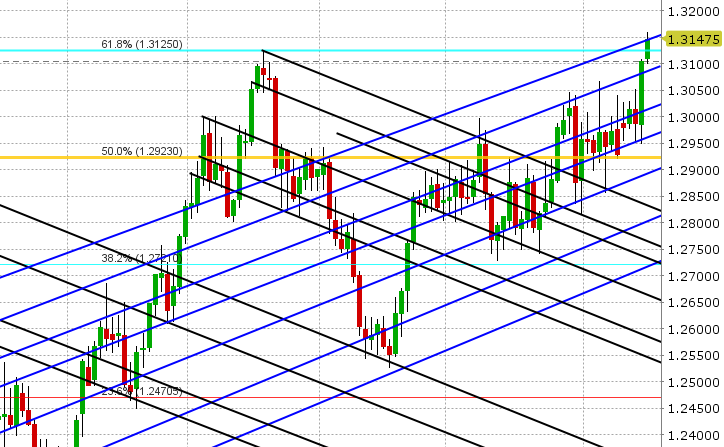

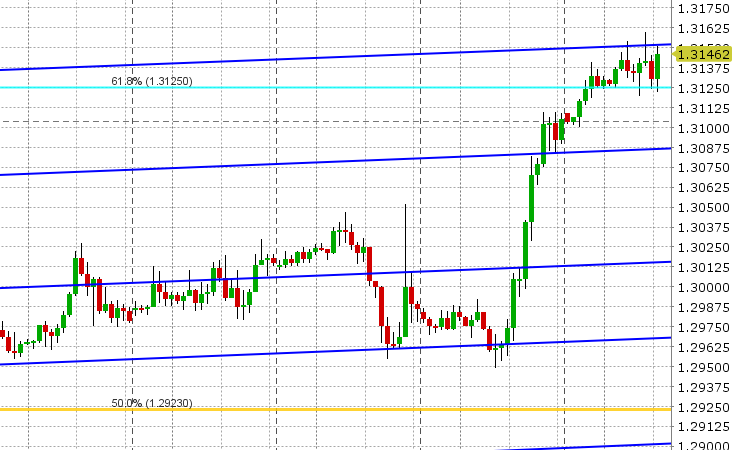

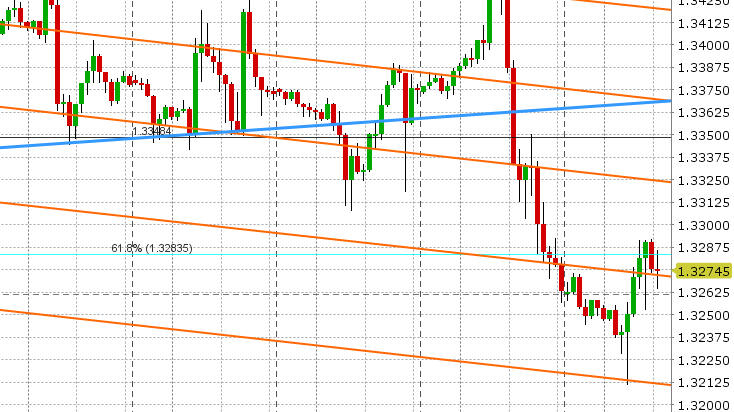

USDCAD: Dollar/CAD has exploded higher in the last 24hrs and we really have the ECB’s Mario Draghi to blame for that. Sure we saw some weak oil prices for a brief stretch and some less than heartening NAFTA comments from Canada’s Freeland yesterday, but the USD party got started after a less than hawkish press release from the ECB following their monetary policy meeting yesterday and then a shockingly dovish Mario Draghi when he spoke to reporters. EURUSD plunged lower and never looked back and USDCAD rallied in a similar fashion. Chart resistance at the 1.3075 level was taken out going into the NY close, which has led to further gains overnight. Trade war rhetoric took a dial up overnight with talk of Chinese retaliation to the $50bln of Chinese goods that Trump is said to put into effect today, plus it’s now being reported that the Trump administration is considering tariffs on another $100bln of Chinese imports. This is sort of explaining why commodity currencies (AUD and CAD) are not bouncing with EUR and GBP this morning. So we have an overall mixed tone to the broader USD going into the final trading day of the week. Today’s calendar features Canadian Manufacturing Sales (just reported -1.3% vs. +0.6% expected for April), Canadian Existing Home Sales (9:00amET), US Industrial Production (9:15amET) and the US UofM survey (10:00amET). USDCAD has failed at trend-line resistance in the 1.3150s twice over the last few hours but traders are blowing through it now after the weak Canadian manufacturing numbers. We think we could very see some longs unwind in USDCAD today, but the bounce in EURUSD needs to extend further, July crude oil needs to break back above the 67 handle, and the 1.3150s need to give way to the downside. Otherwise, expect further gains as USDCAD now enters uncharted territory with very little in terms of chart resistance until the high 1.33s.

-

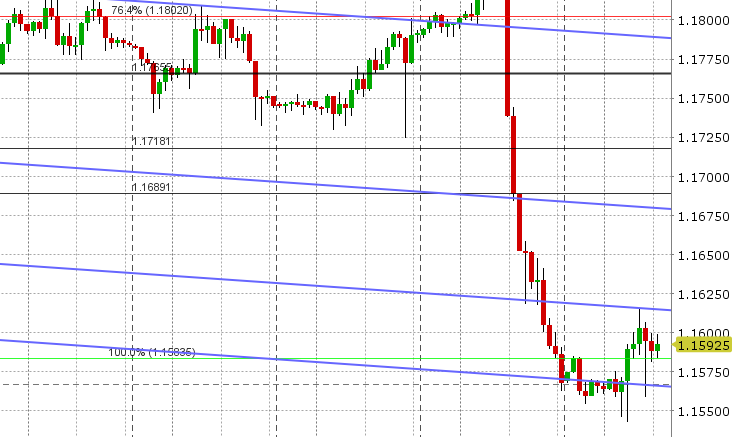

EURUSD: Euro/dollar got crushed yesterday following an ECB press conference from Mario Draghi that seemed to get more and more dovish in tone as the hour wore on. Market hawks from last week were disappointed because while they got a firm date for the end of QE, it’s going to be pushed back a couple months now (to December 2018), and more importantly there won’t be any talk of rate guidance until at least the summer of 2019. Mario Draghi also harped on risks to the outlook and how some ECB members wanted to keep their options open. With that, EURUSD took out support level after support level in a downhill plunge to mid-high 1.15s, where it found support late yesterday and in overnight action. EURUSD bounced higher to trend-line resistance in the 1.1610 area during early European trade, spiked lower and has since reversed higher after a bogus tweet about Merkel’s coalition in Germany falling apart and is now wrestling with horizontal support in the 1.1580s. We think gravitates higher today as we have over 2blnEUR in options expiring today between the 1.1600 and 1.1615 strikes. There is also another 1blnEUR rolling off at 1.1650 as well. Euro dollar futures traders added 32k in new positions, suggesting new shorts drove the move lower.

-

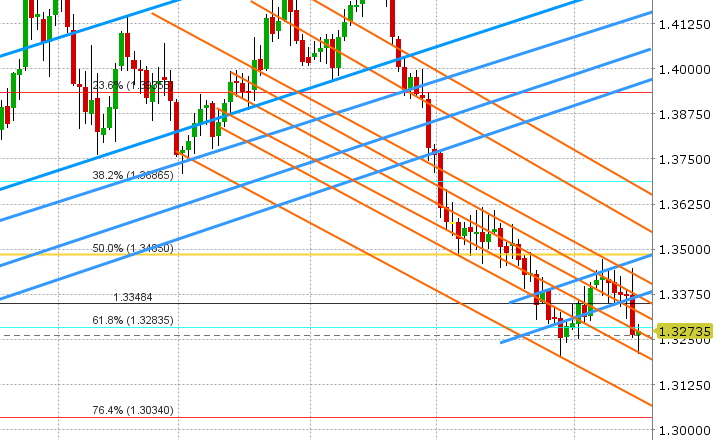

GBPUSD: Sterling plunged lower with EURUSD yesterday and the NY close was anything but pretty (closing well below support in the 1.3280s). This led to further selling overnight into trend-line support at the 1.3210s but the market has bounced strongly off that level and is now trying to regain the 1.3280 level. The Brexit amendment vote drama continues to confuse the best of analysts, but needless to say it’s not helping the overall GBP tone at this point. A large option expiry at 1.3250 might weigh going into 10amET today. Sterling traders have the Bank of England monetary policy meeting to look forward to next Thursday.

-

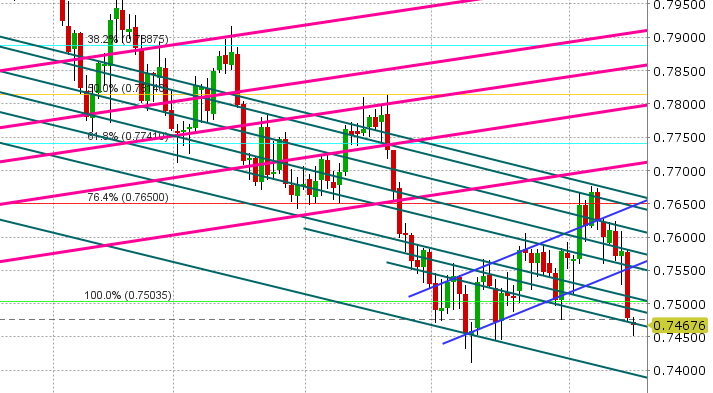

AUDUSD: The Aussie was crushed lower with EURUSD yesterday as well, but unlike EURUSD and GBPUSD, the market is struggling to bounce this morning as the trade war rhetoric gets dialed up a notch today between the US and China. Copper prices after soft again following yesterday’s losses as well. The 0.7470 level will be pivotal for AUDUSD today as a recovery above invites some short covering to the 75 handle, while another push below will have traders focused on the lack of support below the market.

-

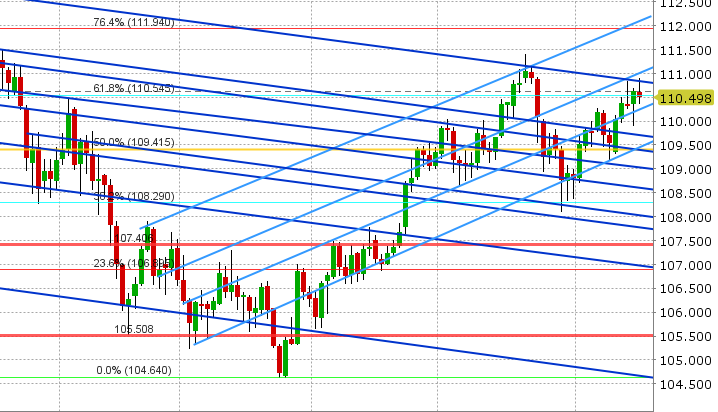

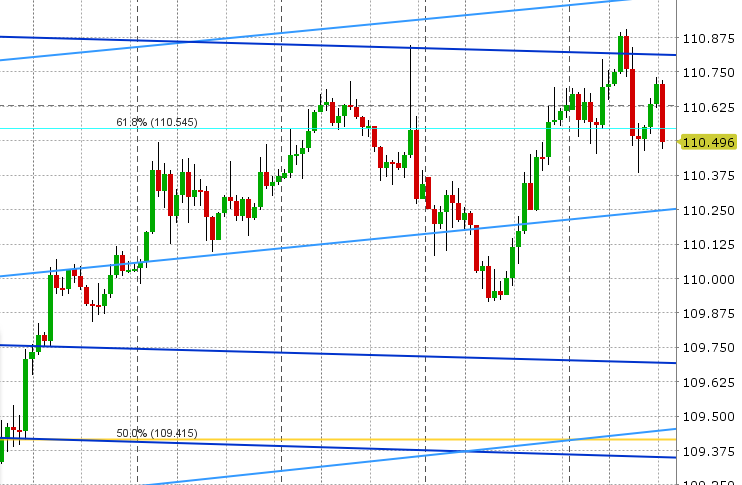

USDJPY:Dollar/yen is trading mixed following an dovish hold on monetary policy from the Bank of Japan overnight. This was largely expected and so the markets haven’t moved around all that much. Trend-line resistance in the 110.80s was tested again, but it failed again like yesterday. Support in the 110.50s has survived a downward test as well, but this probably has more to do with the 1blnUSD option expiry at 110.50 today. We’d pay close attention to US equities today (S&P futures -15) given additional Chinese tariffs that the White House says it’s considering. Any broad “risk-off” tones will likely see JPY safe-haven demand go into effect.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.