EM FX losses lead broad USD strength into NY trade

Summary

-

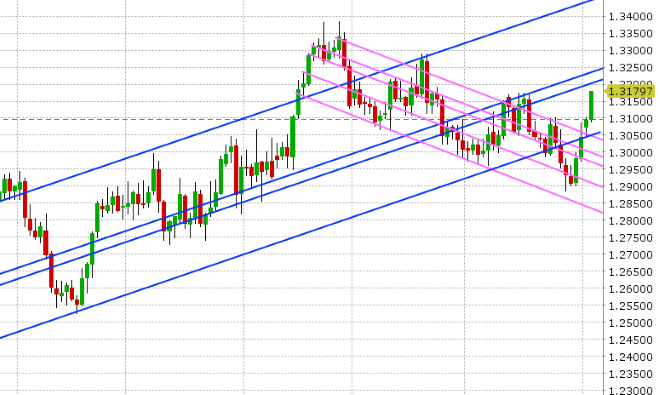

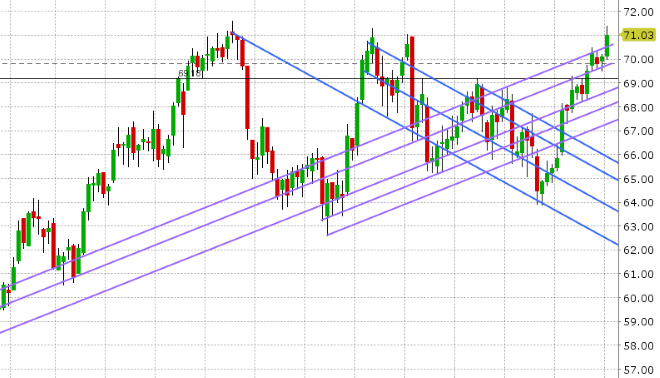

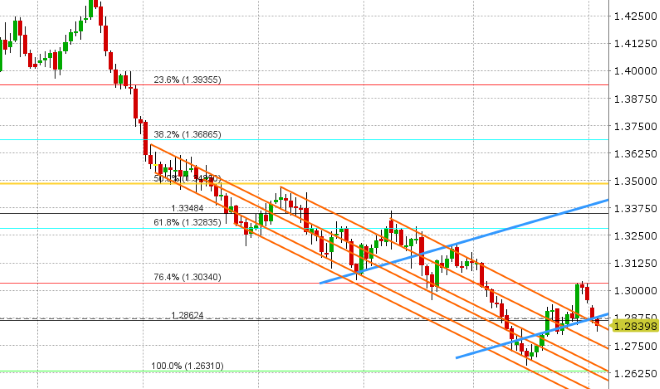

USDCAD: Dollar/CAD is starting the week with a strong bid as emerging market currency weakness leads the way yet again. This time it’s South Africa and its unexpected slip into recession during Q2 (-0.7% QoQ growth reported earlier today vs +0.6% consensus). The rand is down 2.5%, MXN is off 1.3%, TRY 1% and most majors are down 0.5% at this hour. One could argue global trade fears are still on the mind of traders as well, with Trump’s expected launch of further tariffs on China this week and the lack of a NAFTA deal yet for Canada. This week’s holiday shortened calendar is a busy one, with the US ISM numbers for August out today, US & Canadian trade figures for July out tomorrow along with the Bank of Canada’s rate decision. NAFTA talks also resume on Wednesday. Thursday sees the US ADP employment and the US Services ISM numbers for August, Canadian Building Permits for July, and a speech from the BoC’s Wilkins. Friday features the job reports for both the US and Canada. Finally, there’s a litany of Fed speak this week, with Evans, Williams, Kashkari, Bostic, Rosengren, Mester, and Kaplan all taking the mic. With USDCAD breaking above and holding the 1.3040s in late NY trade Friday, we think the market has legs to extend further towards the 1.32 handle. October crude oil is up 2% this morning, but this has more to do with tropical storm Gordon threatening Gulf oil rigs. The net long USD (short CAD) position at CME declined slightly in the week ending Aug 28 as longs liquidated and shorts added on the move down to 1.2900.

-

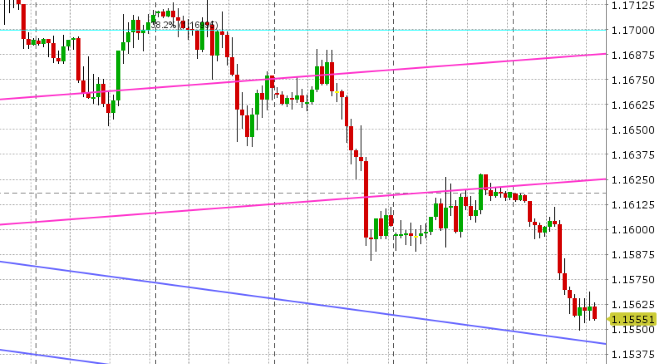

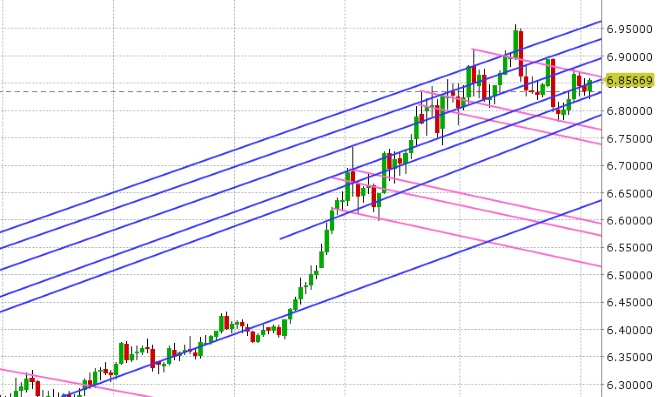

EURUSD: Euro/dollar is off to a rough start this week as the world buys USD broadly. Friday’s poor NY close, Fitch’s downgrade of Italian debt and the markets inability to regain the 1.1620s during holiday trade yesterday was technically negative. Italian bond spreads (one of the culprits behind recent EUR weakness) have come in a bit today (+275bp) with deputy PM Salvini saying Italy would not breach EU budget rules, but this doesn’t appear to be helping EUR sentiment at the moment. USDCNH is also well bid after an attempt to break below the 6.83s failed (rumor has it a Chinese state owned bank was buying size in 1 month CNH forwards). Emerging market FX moves definitely appear to be the drivers today, but we think traders should continue to monitor Italian politics. This week’s European calendar is fairly innocuous, with the Markit Service PMIs, Eurozone Retail Sales and a speech from the ECB’s Praet out tomorrow, followed by German July Factory Orders on Thursday. The week rounds up with the German Industrial Production and Trade Balance figures on Friday, followed by the Eurozone GDP figures for Q2. The funds liquidated both longs and shorts during the week ending Aug 28, but the longs more so, leaving the net position slightly more short than the week before. We think EURUSD struggles for support here, and perhaps tests a little lower from here (1.1530-40). Tomorrow's large option expiry at 1.1625 (1.3blnEUR) might attract if the market can gain some traction today.

-

GBPUSD: Sterling is having a tough start to the week as well, with Friday’s poor NY close, yesterday’s weaker than expected UK Markit manufacturing PMI and today’s broad USD strength now completely erasing the Barnier spike higher from last week. Leading Brexiteer MP Rees-Mogg made headlines earlier today when he agreed with the EU’s Barnier that Theresa May’s Brexit plan won’t fly: https://www.politico.eu/article/jacob-rees-mogg-michel-barnier-and-i-agree-may-plan-wont-fly/. With the summer now behind us and lots still to hammer out between the UK and the EU, the focus will turn to this fall’s new November deadline for negotiations. The UK is now 7 months away formally leaving the EU. We think GBPUSD needs to regain the 1.2880s before positive momentum can return. The fund net short position grew further during the week ending Aug 28, and this was largely the result of longs liquidated more than shorts.

-

AUDUSD: The Aussie has had a volatile start to the week, regaining chart support at the 0.7200 level in holiday trade yesterday after a poor NY close on Friday. The tone of the RBA’s hold on interest rates at 1.5% last night was slightly less dovish than expected, and led to a brief pop into the 0.7230s, but the gains unraveled when chart resistance took hold and a broad wave of USD buying swept across markets in European trade. Copper is getting hammered (-2.4%), gold is down 0.5% and the CNH is trading weaker. Fibo chart support in the 0.7150s has just been tested, but we’re seeing a decent bounce now. We think AUDUSD remains on the defensive sub 0.7230s. This week’s Australian calendar features Q2 GDP tonight at 9:30pm ET and the Australian July Trade Balance figures tomorrow night at 9:30pm ET. The net fund short position at CME shrunk during the week ending Aug 28 as shorts covered.

-

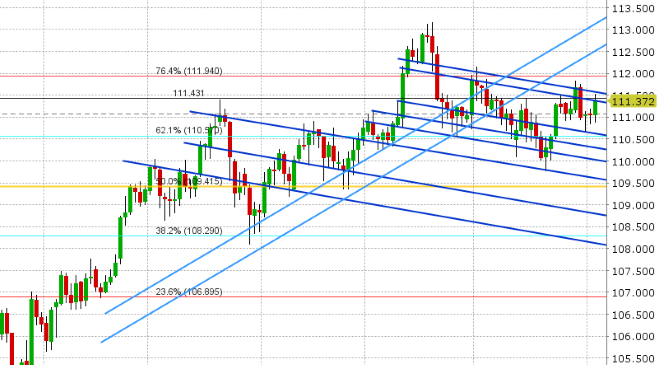

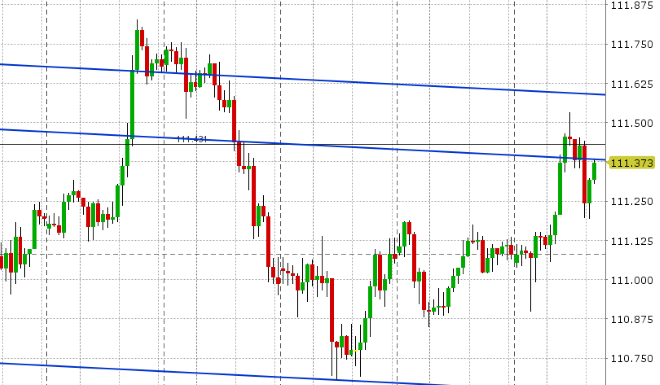

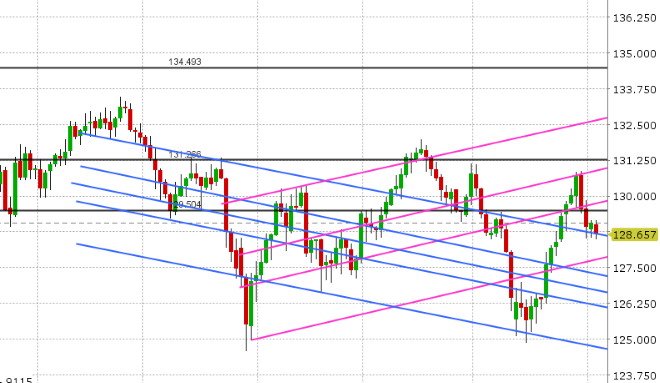

USDJPY: Dollar/yen is starting the week with a decent bid following Friday’s late bounce and today’s extension of a broad USD rally, but the gains are fizzling out now as the market rejects chart resistance in the 111.40s. US equity futures are also trading well off their overnight highs and we’re seeing broad demand for JPY on the crosses. We think USDJPY follows the broader “risk” tone near term.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

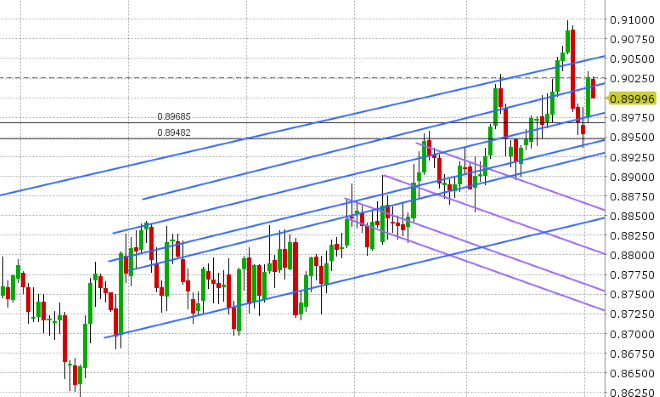

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.