Dovish Fed speak sparks broad USD selling yesterday. More Fed officials speaking today, including Powell at noonET

Summary

-

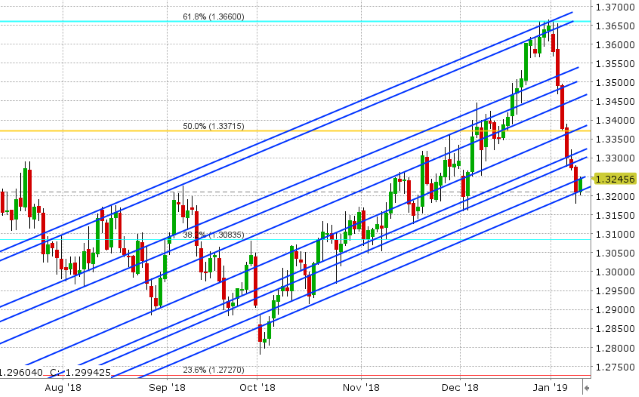

USDCAD: Dollar/CAD is taking a shot at bottoming this morning after yet another poor NY close was recorded yesterday. The impetus for this morning’s uptick appears to be overall disappointment over the communique from China following the latest round of US/China trade negotiations. Reportedly the talks established a “foundation” to resolve the two country’s differences, but China said virtually nothing in the way of details on the key issues at stake. Combine this news with weak Chinese wholesale inflation data reported last night (6th consecutive month of declines) and another tense meeting between Trump/Pelosi/Shumer regarding the ongoing US government shutdown, and we have a bit of a “risk off” trade this morning that is helping the USD more broadly. February crude oil is backing up 1.2% this morning, and USDCAD is trading between two trend-lines (1.3210 and 1.3240). Today’s calendar will be full of Fed speak once again, with Jerome Powell taking the mic at 12pmET before the Economic Club of Washington. Then we’ll get Bullard at 12:40pmET, Evans at 1pmET, Kashkari at 1:20pmET, and Clarida at 5:30pmET. Canada reported better than expected Building Permit data for November this morning. We think a close above the 1.3240 level is now needed to arrest the market’s downward momentum. The Bank of Canada offered no support for USDCAD longs yesterday when it said rates would still need to rise “over time”. This rhetoric countered the downward revisions to their 2019 GDP and inflation forecasts released yesterday in our opinion, and wasn’t dovish enough to cause a meaningful bounce in prices. The liquidation of CAD futures positions continued yesterday to the tune of 4k contracts.

-

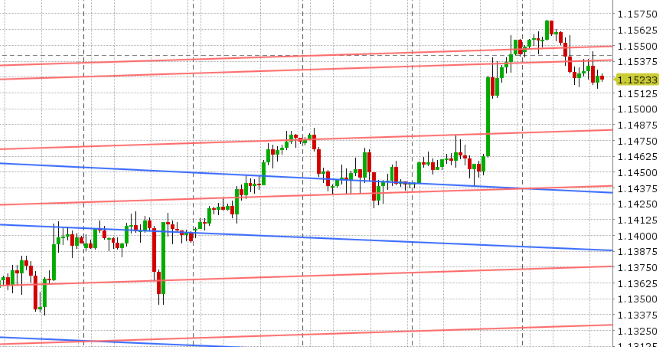

EURUSD: Euro/dollar is pulling back this morning amidst a mild “risk off” tone to markets. We’re now trading back below chart resistance in the 1.1540-50 region after traders tried to probe above the level in Asian trade overnight. Some option expiries around the 1.1500 strike (1.2blnEUR) this morning could also be contributing to the weakness. The Minutes from the last ECB meeting were released earlier, and while they sounded dovish, this didn’t come as a surprise to traders and so the market didn’t move much. France’s much weaker than expected Industrial Output numbers for November are getting some attention though, as the European data set continues to deteriorate. We think EURUSD searches for buyers today after yesterday’s strong breakout higher. Future traders added to positions in size yesterday (for the 2nd day in row), adding almost 14k contracts in open interest.

-

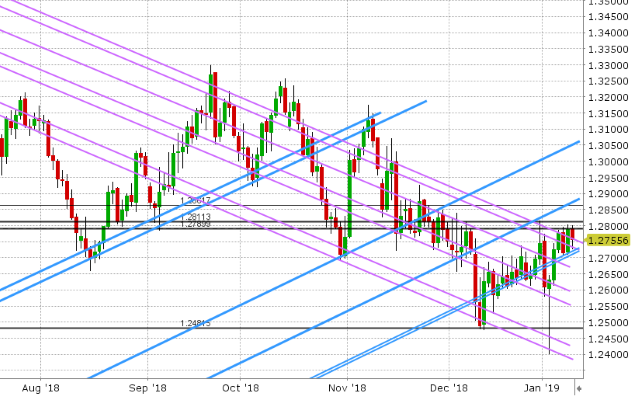

GBPUSD: Sterling is declining today as well as the USD broadly trades higher. Not helping the situation today are calls from Labour Party leader Corbyn for a new election should Theresa May’s Brexit vote be defeated next week. GBPUSD has pulled back to support in the 1.2730s and has since bounced. Futures traders liquidated 1853 contracts yesterday. We think the market could take another shot at the upside here should support hold.

-

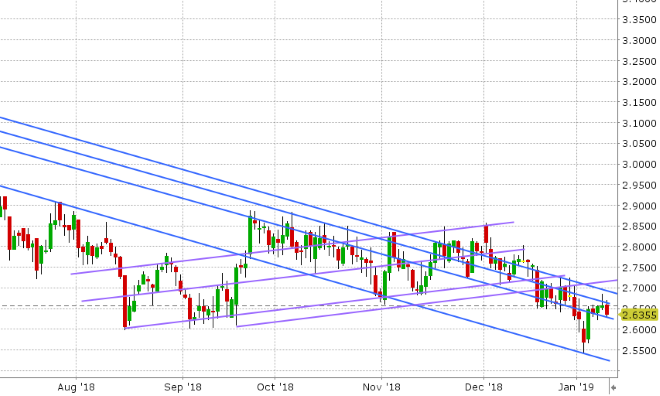

AUDUSD: The Aussie is having a bit of a volatile session so far today. The disappointing update on the US/China trade talks seemed to pull us back off trend-line resistance in the 0.7190s during early Asian trade, but the continued rise in the Chinese yuan (USDCNH falling below 6.8000), seemed to help the market rebound back to its recent highs. March copper futures are rolling over for the session as we write and so, like EURUSD, we think AUDUSD might search for some buyers here now. Over 1blnAUD in option expire between 0.7190 and 0.7220 this morning. Australian dollar futures traders added 5652 contracts in new positions yesterday. Australia reports its November Retail Sales figures tonight.

-

USDJPY: Dollar/yen finally gave up its upward test of chart resistance yesterday after a slew of dovish Fed speak, including cautious rhetoric from the latest FOMC Minutes from Dec 19th, sparked broad selling of USD. We’ve since found some horizontal chart support in the 107.80s as traders gear up for another session of headlines from Fed officials. We think USDJPY will be a little choppy here as US stock traders decide what to do after rejecting chart resistance in the 2590s.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

February Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.