Dovish BOJ fails to bring by USDJPY buyers. Sterling touches 1.40. CAD traders on NAFTA watch.

Summary

-

USDCAD: The range trade continues for USDCAD as traders await NAFTA headlines, but there was a bid tone in overnight trade as the broader USD traded higher. Support today remains in the 1.2430s, while resistance is still 1.2500-1.2510. A break above resistance would invite a test of the next trend-line resistance level (1.2540s) and possibly higher, whereas a break below support would invite more selling. EURCAD and GBPCAD are struggling a bit today, but it’s not at all surprising given recent gains in those crosses. The US/CA 2yr yield spread remains firm at +26bp despite recent weakness in USDCAD, which. With the broader USD attempting to bottom again today (against EUR, AUD, and GBP) and the risk of negative sounding NAFTA headlines on deck for this week, we feel the path of least resistance could be higher. However, the overhead resistance we mentioned must break first.

-

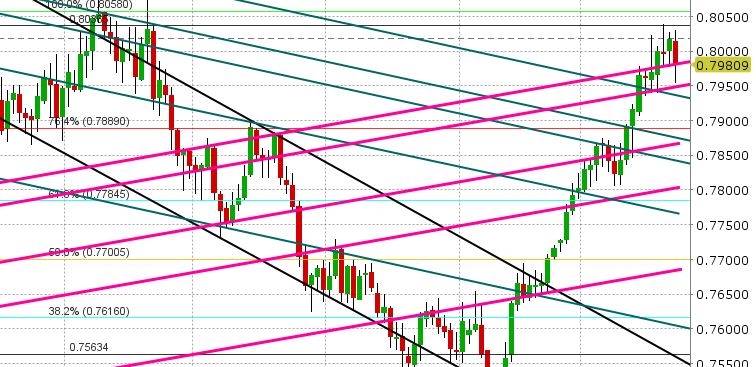

AUDUSD: The Aussie is having a rough overnight session as base metal prices (iron ore and copper) get crushed. Metal traders are citing record inventories in China and weak demand. Combine this with a broad based USD bid that emerged around the same time metals starting selling off, and you have the recipe for a weaker AUDUSD. Trend-line support in the 0.7970-0.7980s has broken, putting 0.7940-0.7950 on the radar in our opinion. Reuters is also re-running the report of a sizable option expiry at 0.7900 on Jan 29th (which could act as a magnet on prices if we see some more selling here). While today’s overnight move puts a dent in the AUDUSD chart, the bulls still have momentum on their side. A quick recovery back above the 0.7980s would keep the rally intact. Even a strong bounce off support in the 0.7940-0.7950 would be healthy for this rally in our opinion.

-

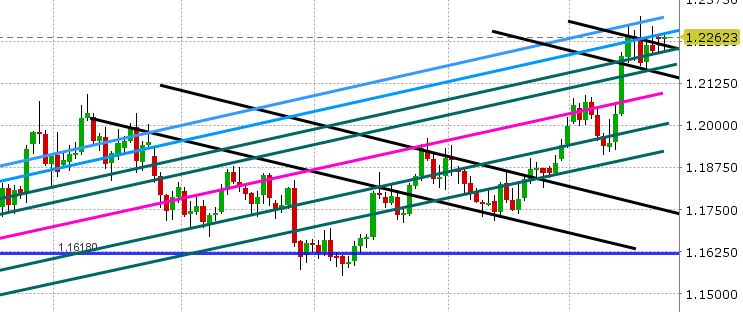

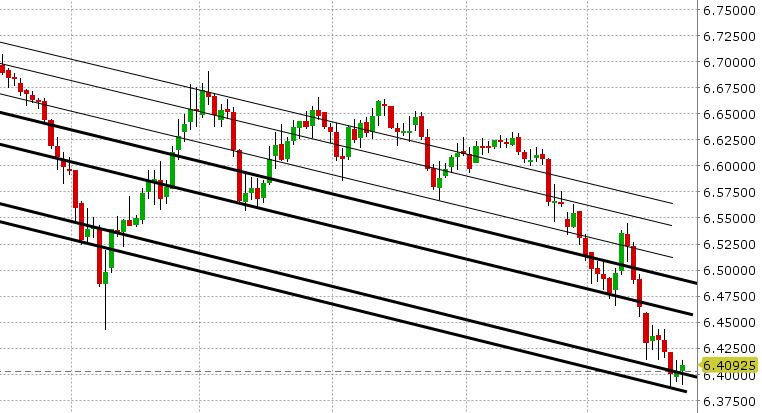

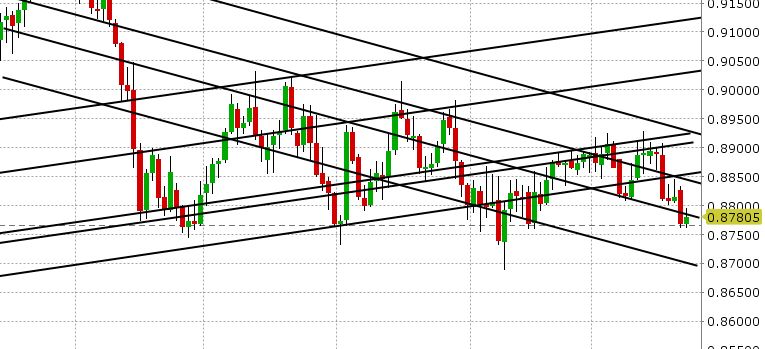

EURUSD: The Euro is doing a whole lot of nothing so far today as traders appeared focus on the big event (ECB) on Thursday. The German ZEW survey came out better than expectations on both the current and expectations indexes, but there was barely any market reaction. Trump announced tariffs on solar products and washing machines, triggering negative responses out of China and South Korea overnight, but this is not really moving the broader USD either. USDCNH has regained the 6.40 handle again after taking losses around the PBOC fix last night (this is mildly bearish EURUSD). Technically speaking, EURUSD is a bit stuck here between trend-line support in the 1.2220s and upward sloping trend-line resistance, which today comes in at 1.2270. A strong move above or below this range would see the market get more directional. EURGBP is attempting a bounce today after another awful session yesterday. The trade today is being capped by the trend-line support level the market broke through (0.8780s). EURJPY is also seeing some selling, after failing to break the NY highs in the 136.10-20 area on two attempts.

-

GBPUSD: Sterling traders took the market above the psychological 1.40 level on two brief attempts overnight, but this has failed as USDCNH caught a bid and EURUSD languished. GBPUSD came off 50 pts rather quickly but the 1.3920s are supporting for now (trend-line support). We feel this is the new key level to watch, as GBPUSD longs really only have support levels to trade against (in the absence of significant resistance overhead). We get the UK employment numbers tomorrow at 4:30am.

-

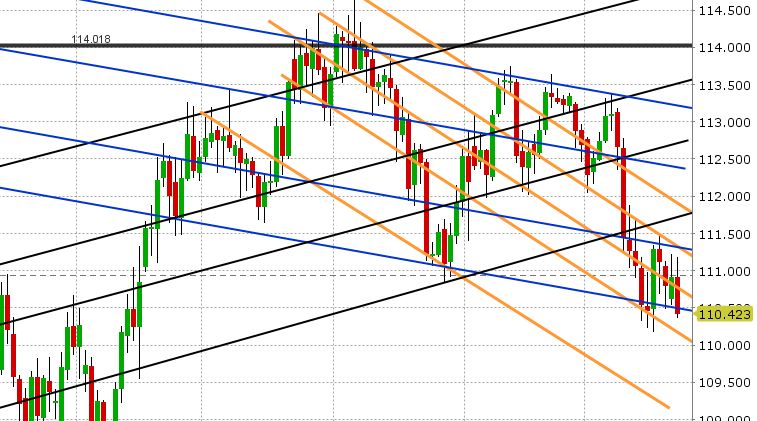

USDJPY: The Bank of Japan was the focus for FX traders overnight. Monetary policy was kept unchanged and governor Kuroda was very dovish as usual in his commentary. He reiterated the 2% inflation target, the need for continued stimulus, and more importantly the fact that the BOJ’s main objective is YCC (yield curve control or the price on 10yr JGBs), not the actual purchase amounts of JGBs on a day-to-day basis. Kuroda also downplayed the recent USDJPY lower, saying it was more due to USD weakness caused by the strong EURUSD. All this was an attempt to throw cold water on BOJ taper speculation, and while USDJPY caught a bid shortly after the BOJ headlines crossed, the market ran into chart resistance again at yesterday’s NY high and has see steady selling ever since. The market technicals for USDJPY were looking better after yesterday’s resolution to the US government shutdown, with USDJPY breaking above resistance at 110.85-110.90, but all that has been erased now with the market testing trend-line support at 110.50 once again. This is not a great set-up for USDJPY, especially considering the entrenching USD long (JPY short) that continues to lose money. US 10yr yields are softer overnight, now trading at 2.62.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

EUR/GBP Chart

March Copper

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.