Dismal Chinese trade data sours risk sentiment to start week

Summary

-

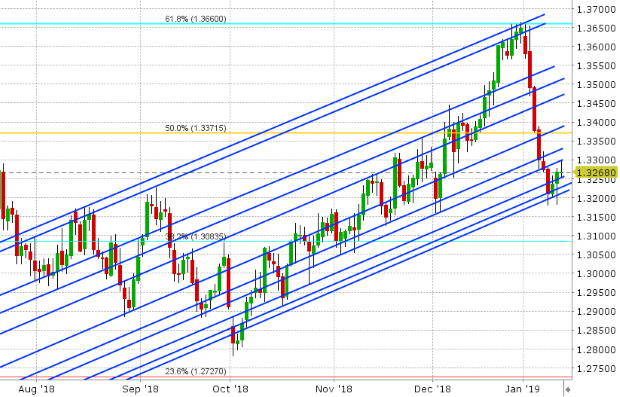

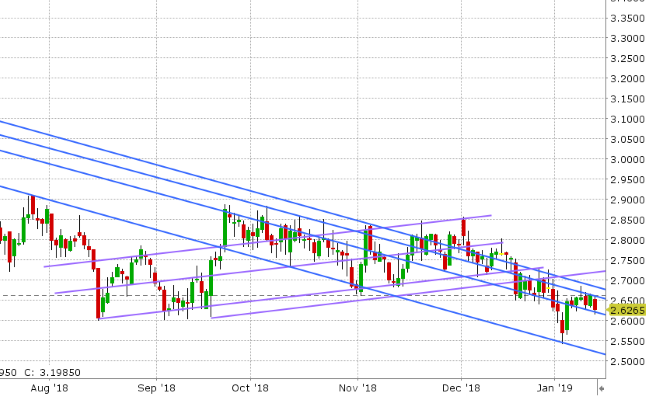

USDCAD: Dollar/CAD is starting the week with a moderate bid as global markets react to the dismal Chinese trade data reported last night. Exports for December fell 4.4% YoY vs +3.0% expected and (perhaps what is more worrisome) imports plunged 7.6% YoY vs +5.0% expected. These headlines led to selling in the S&Ps and Nikkei overnight, weakness in the Aussie and oil prices, demand for the JPY, and buying in the broader USD. Some of that is being dialed back as USDCAD hits trend-line resistance in the 1.3290s and February crude finds support in the 50.50s. This week’s economic is on the lighter side; with US PPI out tomorrow, the Fed’s Beige Book on Wednesday, US Housing Starts on Thursday, and Canadian CPI out Friday. The US government shutdown continues, so we’re still not getting updates from the CFTC as to how funds are positioned in the futures market. Liquidation of positions continued for a 4th day in a row on Friday however, and we suspect this was a little bit of USDCAD short covering in combination with selling from longs who didn’t get a chance to sell higher up. We think USDCAD coasts on this quiet Monday until we get some catalysts to push us outside the 1.3250-1.3300 range.

-

EURUSD: Euro/dollar is slipping marginally lower this morning as the USD trades broadly higher and USDCNH successfully retests Friday’s lows. We think the headline from the PBOC on Friday morning (about the Chinese being concerned about Yuan strength) was the impetus for EURUSD weakness and we think the large option expiry at 1.1500 had a magnetizing effect on prices after that. Today’s poor Chinese trade data and some weak Eurozone Industrial Production data is not helping the demand for EUR this morning, but all that being said, we think it’s quite positive that EURUSD continues to hold chart support in the 1.1450s for the time being. This week’s European calendar is rather light as well. Aside from a speech from ECB President Mario Draghi tomorrow, the only notable releases are the German and Eurozone CPI figures for December, and the Italian Industrial Order numbers for November. We think EURUSD takes a stab to the upside today after markets shake off some China worries.

-

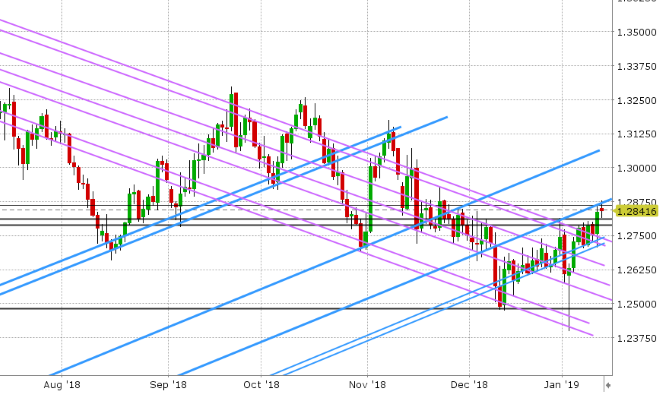

GBPUSD: Sterling is bucking the broad USD bid this morning as Theresa May spoke on Brexit at an event in Stoke. While it doesn’t appear the UK is going to get the legal assurances from the EU that it wants regarding the Irish backstop, Theresa May has reiterated that her Brexit deal is the only path forward that honors the 2016 referendum. The market appears to be focusing on chatter today that a delay of Brexit (extension of Article 50) or a 2nd referendum that cancels Brexit all together would be GBP positive. While we wouldn’t argue with that, we think the week is still young, and Jeremy Corbyn’s threat to table a no-confidence motion on Wednesday (following almost certain defeat for Theresa May tomorrow) would introduce a whole new set of risks that the market hasn’t discounted yet. Trend-line resistance in the 1.2860-70s is capping prices as we head into NY trading today, and support remains in the 1.2810-20 area. The exact time of tomorrow’s Brexit vote in Parliament has yet to be set, but it is expected to take place somewhere between 2pm and 4pmET. The UK reports its December CPI figures on Wednesday and December Retail Sales data on Friday.

-

AUDUSD: The Aussie is pulling back this today, as one might expect, following the weak Chinese trade figures reported last night. Trend-line support in the 0.7180s was tested and has held so far. Chart resistance at the 0.7220 remains in force, following the PBOC headlines from Friday. The Australian calendar is very quiet this week, with just the Westpac Consumer Confidence data out on Wednesday night ET. We think the market can bounce higher today if the S&P futures and copper prices can shake off today’s China headlines.

-

USDJPY: It’s been a relatively quiet overnight session for Japanese news flow as Japan is closed today for the Coming-of-Age Day holiday, and so USDJPY has followed the S&P futures lower in reaction to the weak Chinese trade figures so far today. Some trend-line support at the 108.00 level is helping to stem the selling here however, and we think the market could very well bounce back here. Japan reports it November Machine Order data tomorrow. The BOJ’s Kuroda is expected to give a speech at 10:20pmET on Wednesday night

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

February Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.