Deal reached between UK&EU on phase 1 of Brexit divorce. US Payrolls report up next.

Summary

-

CME OPEN INTEREST CHANGES 12/7: AUD +8731, GBP +4095, CAD -3187, EUR +16514, JPY -5065

-

USDCAD: It’s been a quiet 24hrs for USDCAD traders. The market drifted higher yesterday as expected and it stalled at the bottom of the 1.2870-1.2880 resistance zone we mentioned. All eyes this morning will be on the US payrolls report, with the markets expecting 195k jobs to have been created in November. Average hourly earnings will be another closely watched figure as usual, with traders expected +2.7% YoY and +0.3% MoM. The US/CA 2yr yield spread remains firm at +31bp. EURCAD and GBPCAD cross flows have been a drag on USDCAD so far today, with everything going on in GBPUSD and EURGBP this morning (see GBPUSD commentary below). CAD futures traders have been liquidating positions all week ahead of the number this morning. Support today comes in at 1.2800-1.2810, then 1.2750-70. Resistance now 1.2870-1.2880, then 1.2920s. A firm close above the 1.29s would be very bullish technically. While we remain cautious on USDCAD ahead of the traditionally volatile US payrolls number, we continue to note improving technicals and the lack of significant resistance overhead.

-

AUDUSD: While not much has gone on overnight in AUDUSD, we had another poor NY close yesterday on the charts. The Aussie now sits at its lowest point since June, and it’s currently sitting below every support level on our charts (which is not good technically). The AU/US 2yr yield spread has flipped positive by the slightest of margins, which is a minor support today. Base and precious metals prices have stopped going down for the time being. All eyes for AUDUSD traders will be on US payrolls here as well, with the net AUD long position hoping for disappointing figure. We’ve noted a sizable buildup in positions (+15k contracts) from AUD futures traders this week leading into the numbers today (suggests new short positions give the recent weakness in prices). Support today comes in 0.7460-70. Resistance 0.7520s, then 0.7540-60.

-

EURUSD: It’s been a slow and painful drip lower this week for EURUSD traders. The US/GE 10yr yield spread has perked up to +207bp and EURGBP continues to get slammed whenever GBP traders get excited about the progress of Brexit negotiations. Technically speaking, the market is starting to get into a little trouble here now. We now sit below channel support (1.1780s) and below the 38.2% Fibo in the 1.1750s (that we talked about yesterday. EUR futures traders piled into new positions yesterday, with open interest up +16k contracts). With open interest up now almost 30k this week, it’s obvious bets are being placed ahead of today’s US payrolls number. A pop in prices back above the 1.1780s would be technical positive (above 1.1820 would be even better). There’s not much support on the charts here until the 1.1660-1.1680 region, so watch out below if you’re still long.

-

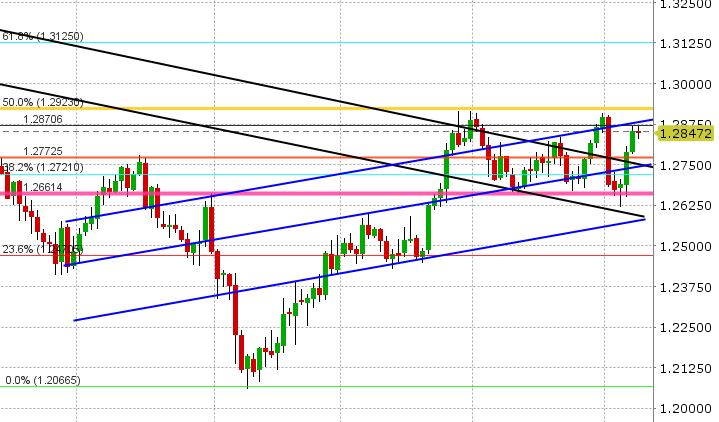

GBPUSD: GBPUSD traders built upon the very strong NY close yesterday (potential bullish inverted hammer pattern turned into a bullish outside day), driving sterling back into the low 1.35s overnight. All this came as rumors flew around yesterday of an imminent Brexit deal (Northern Ireland’s DUP on the phone with Theresa May again, and Theresa May flying out to Brussels early this morning). Traders got their confirmation this morning at a press conference where both Theresa May and the EU’s Juncker announced that they have formally agreed on a Brexit divorce bill somewhere between 40-60bln EUR and a formal recommendation to the European Commission that talks progress to Phase 2. So it’s a deal, but not really, in our opinion. It’s progress but more of a mutual back-slapping exercise to show the world they’re at least doing something. The final Brexit divorce bill has not yet been finalized. The UK wants really wants it closer to 40bln EUR. The Irish said this morning that Theresa May is jumping the gun as the Northern Ireland “hard border” issue is still not resolved. GBPUSD traders woke up to this “reality check” post the May/Juncker press conference earlier today and starting selling again. Next up will be US payrolls. Support lies at 1.3390-1.3400. Resistance today for the NY session is 1.3450-60, then 1.3490.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.