Coronavirus fears escalate again overnight. US & Canadian job reports up next.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- New international cases aboard quarantined Diamond Princess cruise liner jumps to 61.

- Singapore has raised its Disease Outbreak Response System condition to orange from yellow.

- USDCNH move above 7.0000 leads risk-off move, which in turn hurt commodity currencies CAD and AUD.

- Germany reports another bad manufacturing number for December, Output -3.5% vs -0.2% exp.

- RBA’s Lowe and SOMP cannot help AUDUSD stem risk-off flows

- Traders expecting +160k new jobs in the US and +15k new jobs in Canada last month.

ANALYSIS

USDCAD

Global markets are displaying broad risk-off tones this morning as the coronavirus news flow gets increasingly more negative. There are now 61 confirmed “international” cases aboard the quarantined Diamond Princess cruise liner that’s been moored in Yokohama for two weeks. Singapore has raised its Disease Outbreak Response System condition to orange from yellow (on par with SARS), after three new cases with no known China links have been detected. Confirmed cases in China now stand at 31,161 while deaths are at 636. The Chinese January trade data report has now been cancelled because of the coronavirus, local copper traders have just declared “force majeure”, and Toyota has announced it will keep its Chinese factories closed for at least another week. It certainly feels like this could be another freaky Friday for markets as traders cast serious doubts on China’s ability to return to work next week. On the immediate docket however are the US and Canadian employment reports for January, out at 8:30amET. Expectations are as follows:

US Non-Farm Payrolls: +160k

US Wage Growth: +0.3% MoM and +3.0% YoY

US Unemployment Rate: 3.5%

Canadian Employment Change: +15k

Canadian Unemployment Rate: 5.6%

Dollar/CAD has edged back above the 1.3300 mark as today’s risk-off tone hits the yuan and commodity currencies as usual. We think the 1.3350s (early September 2019 highs) would be the next logical upside target for the market should we get strong US and weak Canadian data. The opposite outcome however (weak US and strong Canadian data) would likely mark a near term top for USDCAD as we’d see a reversal back below 1.3300, which could then put serious pressure on the 1.3270s support level.

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

Euro/dollar finally succumbed to the weight of its poor technical chart structure in NY trade yesterday, and it appears traders are finally paying attention to the “hard” German manufacturing data, which is not getting any better. Yesterday saw the release of a very poor Industrial Orders number for December, and today it was reported that German Industrial Output also came in way below expectations for the final month of 2019 (-3.5% vs -0.2%). This has now seen EURUSD slump to its next chart support level in the 1.0950s. This level will very much be the pivot for price action heading into the US NFPs in our opinion.

EURUSD HOURLY

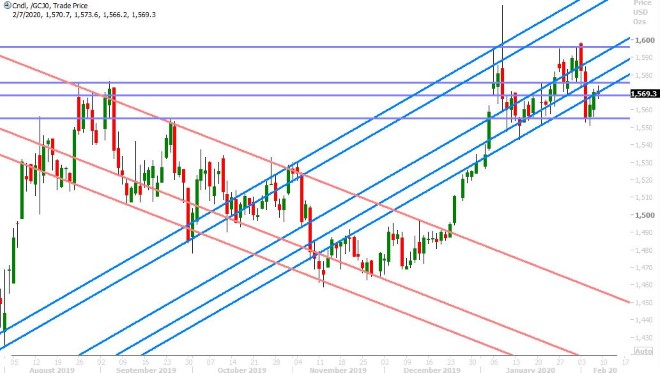

APRIL GOLD DAILY

GBPUSD

Sterling recorded a poor NY close yesterday by virtue of prices closing firmly below the 1.2960 support level, and while this should be precipitating more sellers to come into the market, we think what we’re seeing here this morning is the typical reluctance to add to positions ahead of the US Non-Farm Payrolls release. A weak number could hockey-stick save GBPUSD and get the market firmly back above the 1.2960s whereas a strong number could cause some panicky long liquidations from the funds which could easily target the 1.28 handle.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

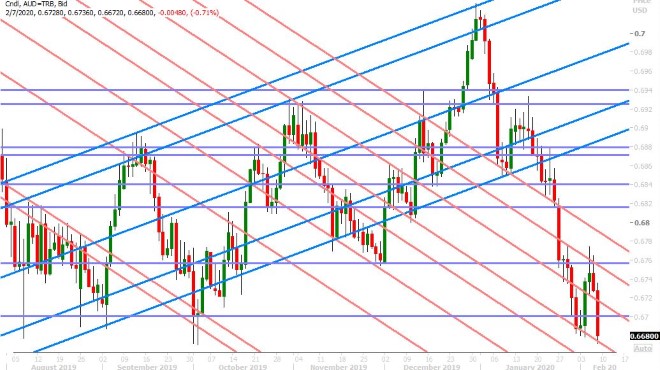

The Australian dollar is not having fun time of it today as USDCNH breaches the 7.0000 level again on escalating coronavirus fears. Some relatively upbeat comments and economic forecasts out of RBA Governor Lowe and the SOMP last night has long been forgotten as the markets re-price for China not returning to some sense of normal next week. Chart support in the 0.6670s has now been swiftly retested and we think only a weak US NFP number can save this market here.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is naturally pulling back a tad this morning amid the negative overnight news flow. The US Non-Farm Payrolls report is eagerly awaited up next at 8:30amET. A strong report should see traders attack the early January highs in the 110.10s whereas a weak report we likely see recent buyers take profit, which could see the market retest the 109.40-50s.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.