China slowly returning back to work, but markets yet not convinced worst of virus is behind us

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Chinese government eases some travel and work restrictions, urges millions to gradual return to work.

- PBOC announces 300bln special lending facility for banks with orders to “issue loans quickly”.

- WHO’s Tedros finally admits “we may only be seeing the tip of the iceberg” with regard to the coronavirus.

- Over 40k cases now confirmed in China with 908 dead. Chinese billionaire Guo Wengui says deaths are way higher.

- Global risk sentiment more muted now after upbeat Asian session, helping USDCAD re-attack Friday’s highs.

- AUDUSD pulls back of 0.6700 highs. EURUSD breaks 1.0950s support. GBPUSD bounces on rumored 1.2850 option barrier defense.

- Leveraged funds pile into EURUSD and AUDUSD shorts, stay short USDCAD despite losses.

- This week’s calendar features two speeches from Jerome Powell + more Fed-speak, US CPI, US Retail Sales, US Industrial Production.

ANALYSIS

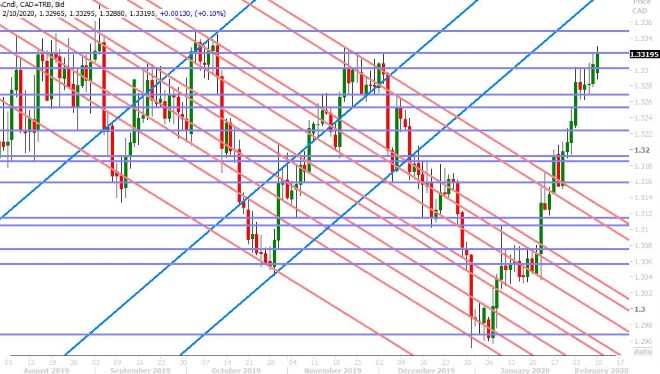

USDCAD

There was a cautiously optimistic tone to global markets last night after the Chinese government encouraged millions of people to gradually return to work today. President Xi Jinping was also seen in public for the first time since the coronavirus crisis broke out; which we think is also helping to improve the optics of a national effort to desperately try and return things back to normal to China. The PBOC announced the first batch of special lending programs (300bln yuan) for banks, who have in turn be ordered to “issue loans quickly” to businesses that have been affected by the coronavirus. China’s Ministry of Finance confirmed on Saturday that it has allocated $10bln to efforts to contain the outbreak and President Xi said the government will take measures to prevent large-scale layoffs. The Shanghai Composite responded positively to all these headlines by closing 0.5% higher. The Chinese yuan rallied as well and we think today’s better than expected January CPI figures out of China helped with this (+5.4% YoY vs +4.9%). The S&P futures, crude oil prices, US yields and commodity currencies all traded moderately higher as well during Asian trade, dragging USDCAD a touch below the 1.3300 level.

Some of this optimism is now being tempered back however as fringe reporting shows no sign of the coronavirus outbreak slowing down. There are now over 40k confirmed infections in China, with 908 deaths (which now surpassed the SARS death toll). There are now 66 new cases aboard the quarantined Diamond Princess cruise ship docked at Yokohama with 3k+ passengers. WHO Director General Tedros Ghebreyesus said ominously over the weekend that “we may only be seeing the tip of the iceberg” and we wonder too how many eyes tuned into Chinese billionaire Guo Wengui over the weekend and his shocking revelations about the how bad things really are in China. More here from CCN.

The tone to global markets is now more guarded as NY trade gets underway. US yields are trading back near their session lows, the Chinese yuan and the Australian dollar have slipped lower again, and USDCAD is once again challenging Friday’s highs in the 1.3320s. Canada reported a moderately better than expected Housing Starts figure for January this morning (213.2k vs 205k), but traders seem more focused on potential coronavirus and OPEC+ updates at this hour.

The latest COT report released from the CFTC late Friday showed the leveraged funds adding modestly to their net short USDCAD position during the week ending February 4th. We’re surprised that this speculative short length hasn’t come down more given the market’s recent breakout to a new uptrend on January 29th, and so we think these losing positions could add fuel to USDCAD’s rally at some point.

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

Euro/dollar has finally broken chart support in the 1.0950s this morning as the risk mood turns sour once again. The funds at CME piled back into short positions during the week ending February 4th, bringing their net short EURUSD position back to the level it was near the market’s September 2019 lows. This week’s economic calendar is relatively quieter and more back end loaded, with US January CPI out on Thursday and German Q4 flash GDP, US January Retail Sales and US Industrial Production all out on Friday. We'll get plenty of Fed-speak before then though, including two speeches from chairman Powell on capitol hill (Tuesday & Wednesday). We think EURUSD will continue to struggle here.

EURUSD HOURLY

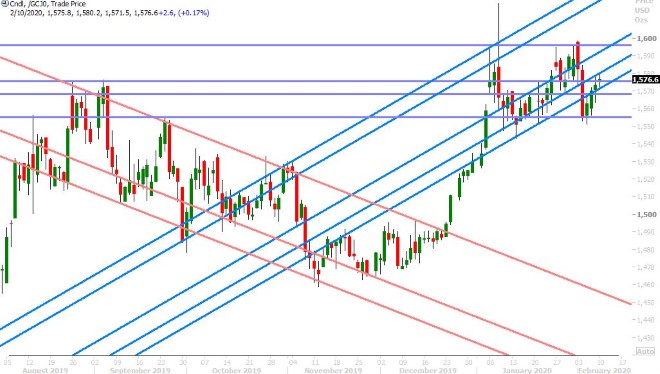

APRIL GOLD DAILY

GBPUSD

Sterling is seeing a mild bounce this morning as Reuters reports 1.2850 barrier options as “in play”. This followed some “seller failure” below the 1.2880s this morning and is leading some to speculate that dealer hedging of this option structure is behind the spot market’s bounce. This is difficult to verify however but it appears this is all traders have to go by this morning as UK economic news flow is non-existent. This all changes tomorrow however when the UK reports its December figures for GDP, Industrial Output, Manufacturing Output, and Trade. The reports come out all at 4:30amET and traders are very much expecting MoM upticks in this “hard” data, after the recent uptick in the UK “soft” PMI data. The funds remain net long GBPUSD as of February 4th, but they have continued to scale back on this net positioning for the 3rd week in a row.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

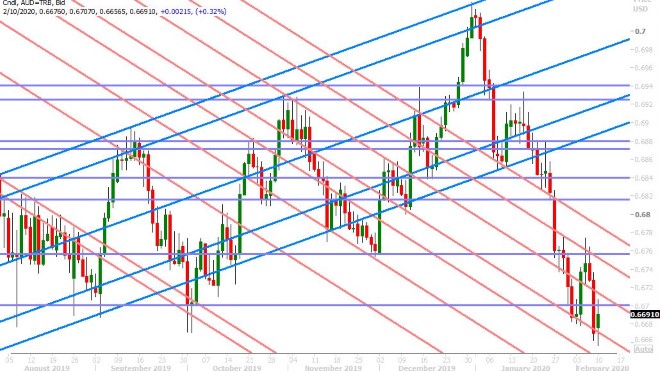

AUDUSD

The Australian dollar enjoyed a bit of a relief rally in Asia last night as traders initially bought the state-supported “China back to work” narrative, but we can feel the coronavirus skepticism start to creep back in here as NY trade gets underway. The US 10yr yield has just breached its Friday lows and the off-shore Chinese yuan has given up half of its overnight gains. Australia will report its January NAB survey tonight at 7:30pmET, but with no other major Australian data releases set for this week we think this will leave traders focused on the US calendar and of course, coronavirus updates. The leveraged funds at CME scrambled back into short positions during the week ending February 4th, and we suspect they used AUDUSD’s RBA-driven bounce up to the mid-67s to re-accumulate.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

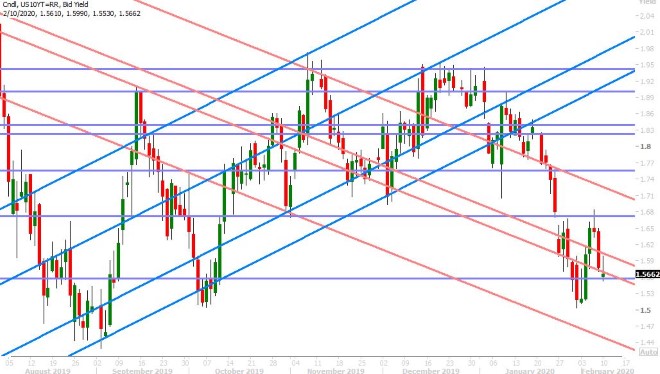

USDJPY

Dollar/yen recorded a rather mixed NY close on Friday and we think today’s post-Asia coronavirus skepticism is adding to the market’s directionless tone here this morning. The funds were busy adding new short USDJPY positions during the week ending February 4th, which tells us they’re not believing last week’s positive US data and Chinese stimulus narratives. We think the market’s attention could switch to Jerome Powell’s upcoming testimony on capitol hill this week if the coronavirus headlines don’t get demonstrable worse. We see near-term support at 109.50-60 and near-term resistance at 110.00.

USDJPY DAILY

USDJPY HOURLY

US 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.