China calmly responds to US accusations

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- China’s Hua Chunying says Pompeo “cannot present any evidence”.

- “We urge the U.S. to stop…stop thinking it can use tariffs as a weapon”.

- PBOC sets weaker than expected USDCNY fix. Helps CNH and AUD bounce.

- EURUSD continues fall on weak technicals + weak German Industrial Orders data.

- Horrible UK Construction PMI leads GBPUSD on way to confirming bearish head & shoulders pattern.

- US ADP Employment Report misses expectations, 20.24M jobs lost in April vs 20.05M.

- USDJPY lagging on EURJPY cross sales. Japanese markets re-open tonight following Golden Week.

- Tomorrow features BOE meeting at 2amET, US Jobless Claims + huge EURUSD option expiry.

ANALYSIS

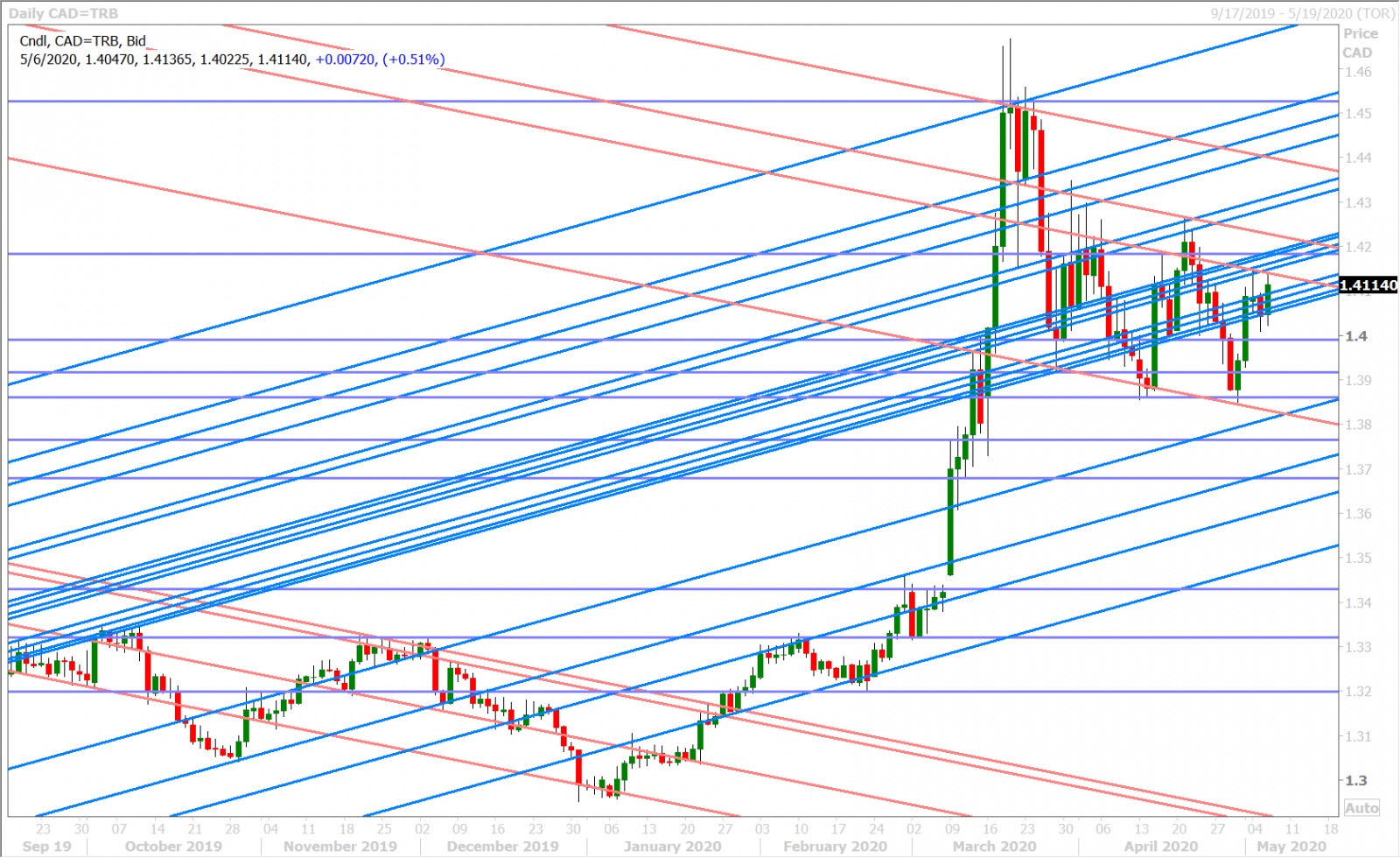

USDCAD

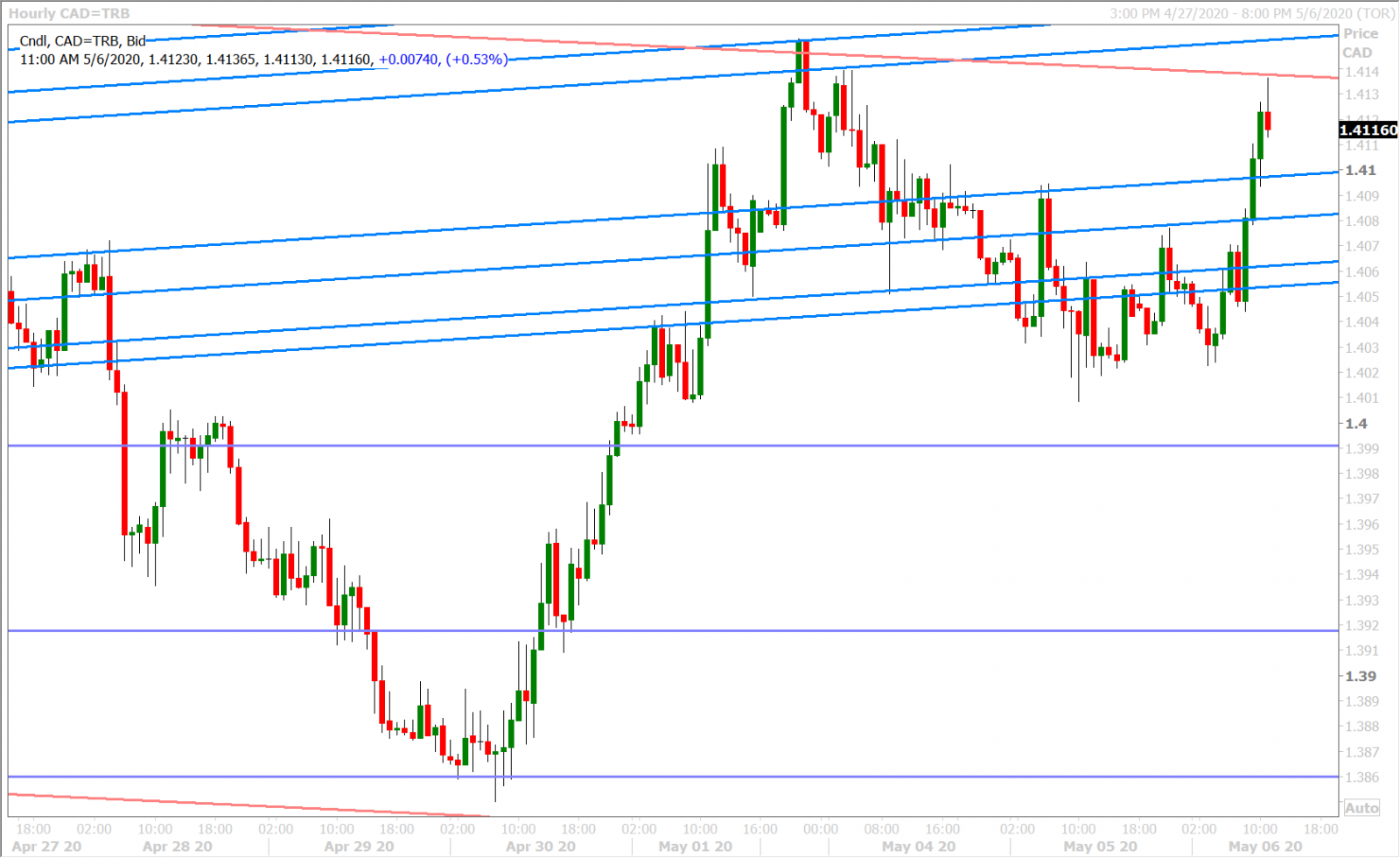

The broader USD traded with a mixed tone during the overnight session today. It struggled versus the Chinese yuan and other commodity currencies as China re-opened for business with little fanfare on the “Trade War 2.0” front, but it gained versus the euro and the pound following weak data points out of both regions. Dollar/CAD traders continued to battle it out overnight around yesterday’s upward sloping chart support in the 1.4040s (now in the 1.4050-60s) after the market regained this level into the NY close.

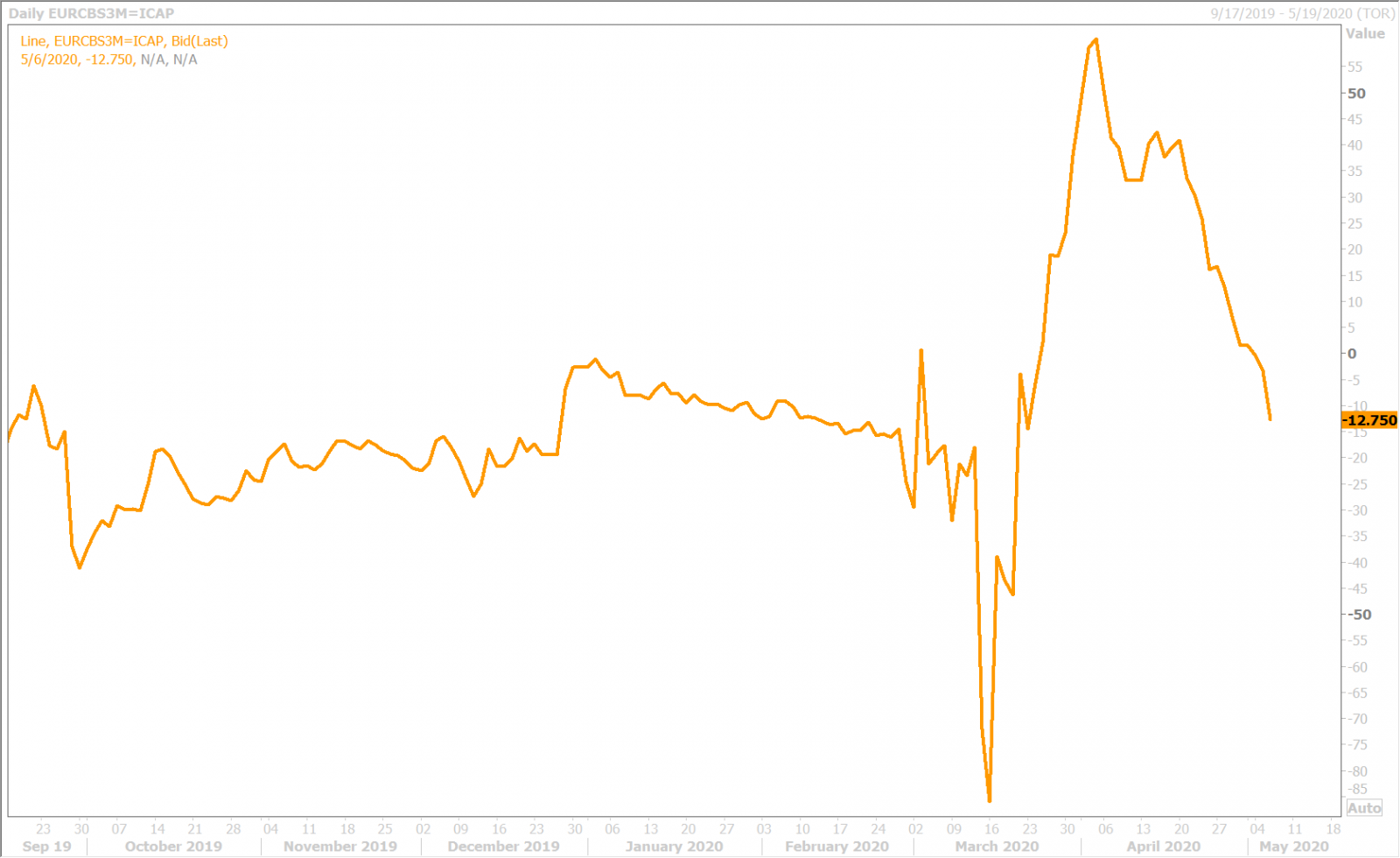

The US reported a weaker than expected ADP Employment Report for April shortly after the NY open this morning (20.24M jobs lost vs 20.05M expected), and this brought about some broad, safe-haven, USD buying which saw USDCAD break above yesterday’s chart resistance in the 1.4090s. The S&P futures have slipped off their session highs and the June WTI futures contract is now trading down 6% after being up 2% earlier. The 3-month EURUSD cross currency basis swap continued to widen over the course of trading in Europe this morning (now at -12.75bp), which is another reason to be on guard for more USD buying.

The daily chart structure for USDCAD, while still technically neutral at this point, continues to show signs that an upside break could be coming. The 1.4050-60s have held and the 1.4090s have given way. There’s still a lot of wood to chop overhead (in terms of chart resistance from the 1.4150s to the 1.4230s), but we think there’s still a very real risk of US/China relations deteriorating at some point…not to mention the increasingly worsening signs of USD funding stress.

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

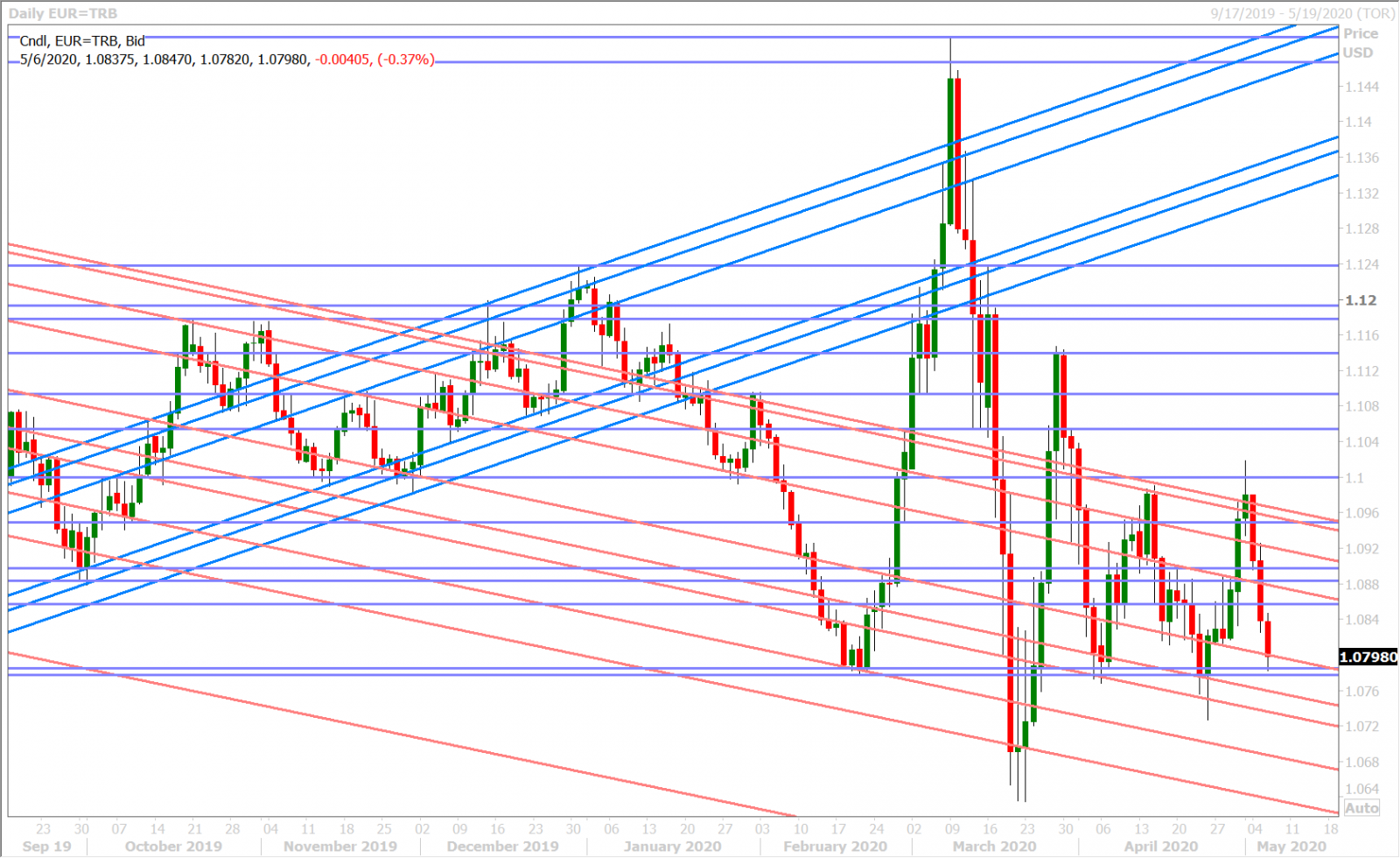

EURUSD

Euro/dollar slumped all the way back down to its April lows in the 1.0790s this morning. Yesterday’s depressing NY close was a negative precursor, as traders smacked down buyer attempts to regain the 1.0880s and then the 1.0850s. Germany’s much weaker than expected Industrial Orders figures for March (-15.6% MoM vs -10.0%) seems like it got the ball rolling for more EUR sales this morning and we think GBPUSD’s swift fall through 1.2400 exacerbated the move lower in EURUSD. Talk of option-related hedging flows are also making the rounds this morning, as over 5blnEUR in expiries will occur around the 1.0800 strike tomorrow morning at 10amET.

EURUSD DAILY

EURUSD HOURLY

3-MONTH EURUSD CROSS CURRENCY BASIS SWAP DAILY

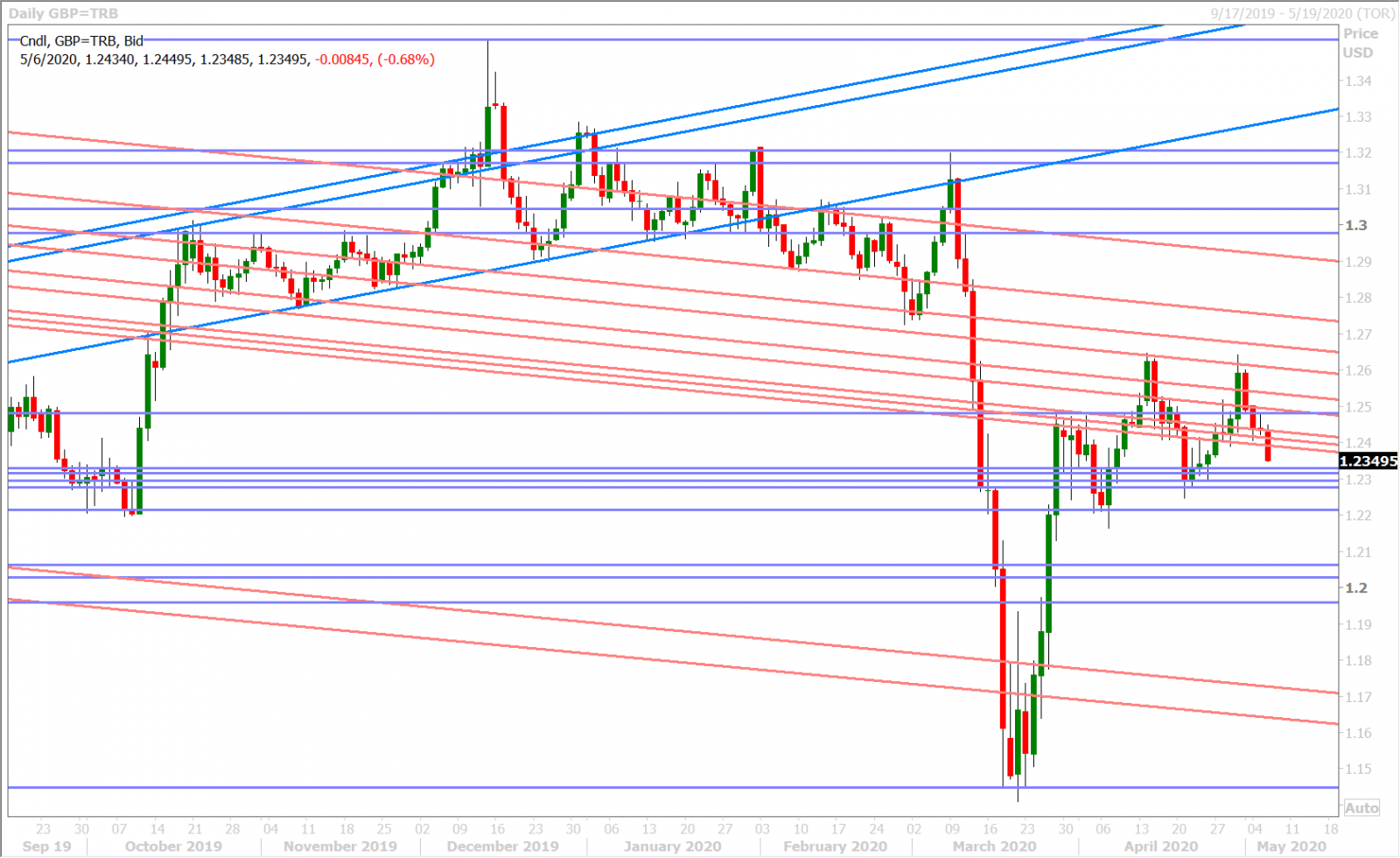

GBPUSD

Sterling is not looking in great shape this morning. The sellers kept GBPUSD below the 1.2480-1.2500 zone in NY trade yesterday, and this morning’s horrible April Construction PMI number out of the UK (8.2 vs 22.0 expected) knocked the market below the 1.2390s we’ve been focused on since Monday. We think that a NY close below the 1.2390s will add validity to the bearish head & shoulders pattern we started talking about on April 28. The negative pattern got delayed a week, but could re-take shape if sterling closes poorly today.

The Bank of England will announce its latest decision on monetary policy tomorrow, but recall that their press release will be released 5 hours earlier than usual at 2amET. The official explanation delivered last week was that this was so the BOE could release its Monetary Policy Report, which will contain detailed economic projections, at the same time as the monetary policy decision. Some traders are speculating that the adjusted timing means a big announcement is coming, but we’re not seeing obvious signs of this in overnight ATM option volatility pricing in GBPUSD.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

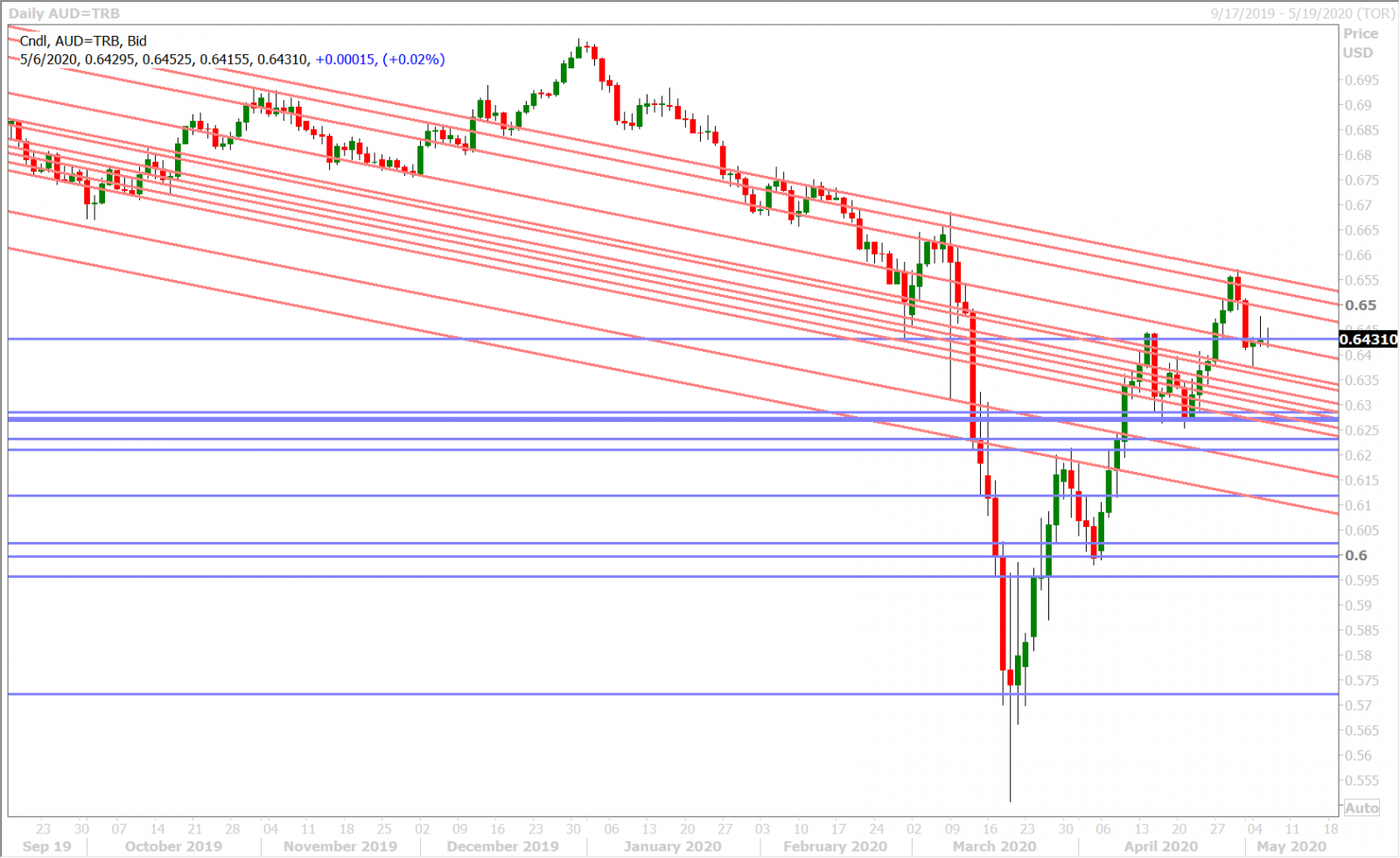

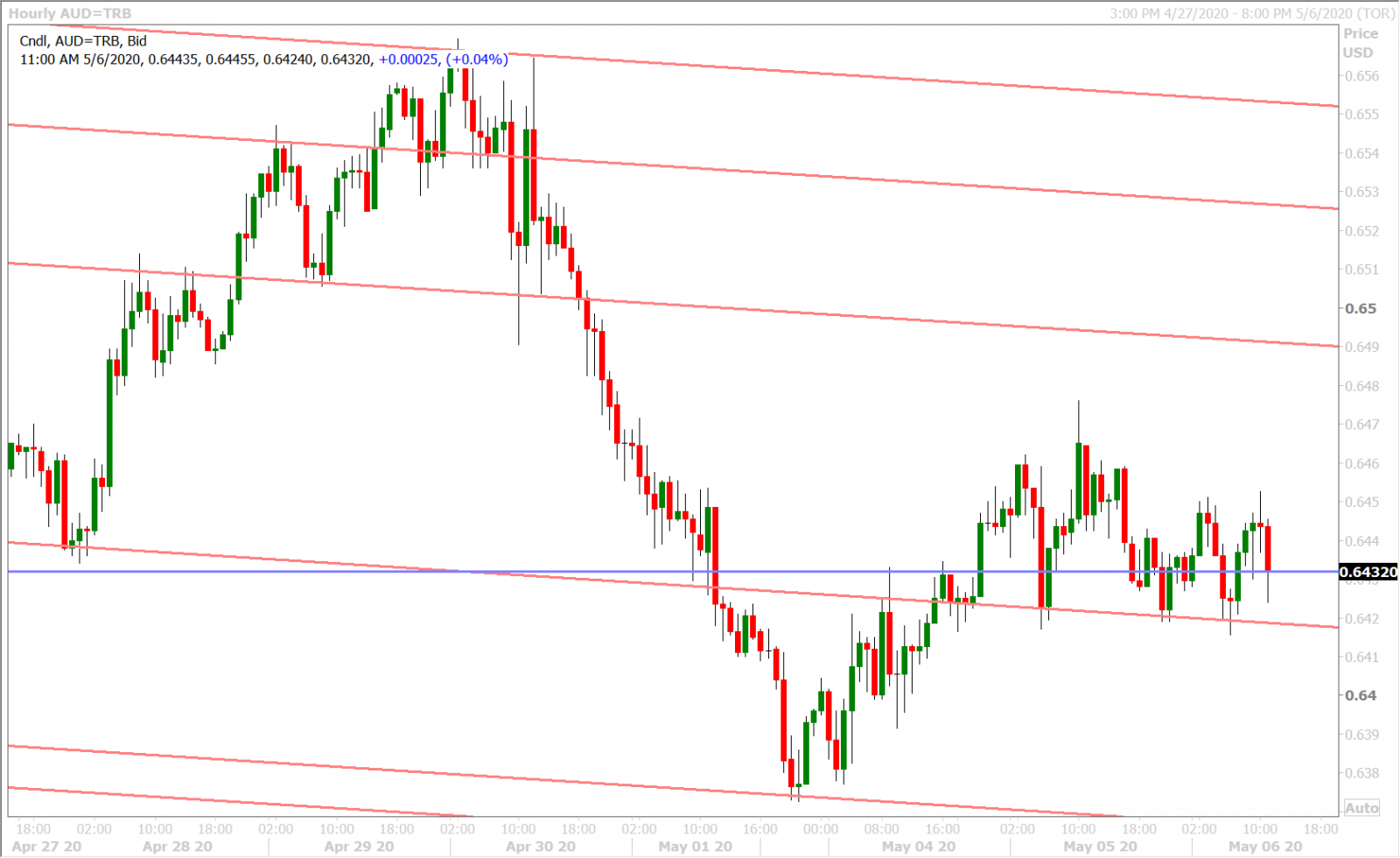

AUDUSD

The Aussie’s crawl higher yesterday ultimately got derailed by EURUSD’s fall back below 1.0850 and by the late-day sell-off in the S&Ps, but AUDUSD buyers were found once again overnight at familiar chart support in the 0.6420-30s. While some mildly better than expected Australian Retail Sales figures for March were released (+8.5% MoM vs +8.2% expected), this was already foreshadowed via the preliminary report released on April 22. We think the AUD’s relative bid today is largely the result of US/China tensions NOT deteriorating in a meaningful way overnight.

While Chinese foreign ministry spokesperson Hua Chunying said the US doesn’t have any evidence to prove that the coronavirus originated in a Wuhan lab, we felt he expressed China’s position in a rather calm and measured tone. What is more, the PBOC set its daily USDCNY fix below market expectations last night, which is proof that China is not threatening retaliation for the time being. Here are some of the more notable quotes from Hua Chunying:

“I think this matter should be handed to scientists and medical professionals, and not politicians who lie for their own domestic political ends”

“Mr. Pompeo repeatedly spoke up but he cannot present any evidence. How can he? Because he doesn’t have any,”

“We urge the U.S. to stop … shifting the focus to China,”

“…the claims about China’s so-called concealment of epidemic situation, delay of notification, and profit from epidemic situation are purely nonsense…”

“So the US should stop thinking it can use tariffs as a weapon and a big stick to coerce other countries,”

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

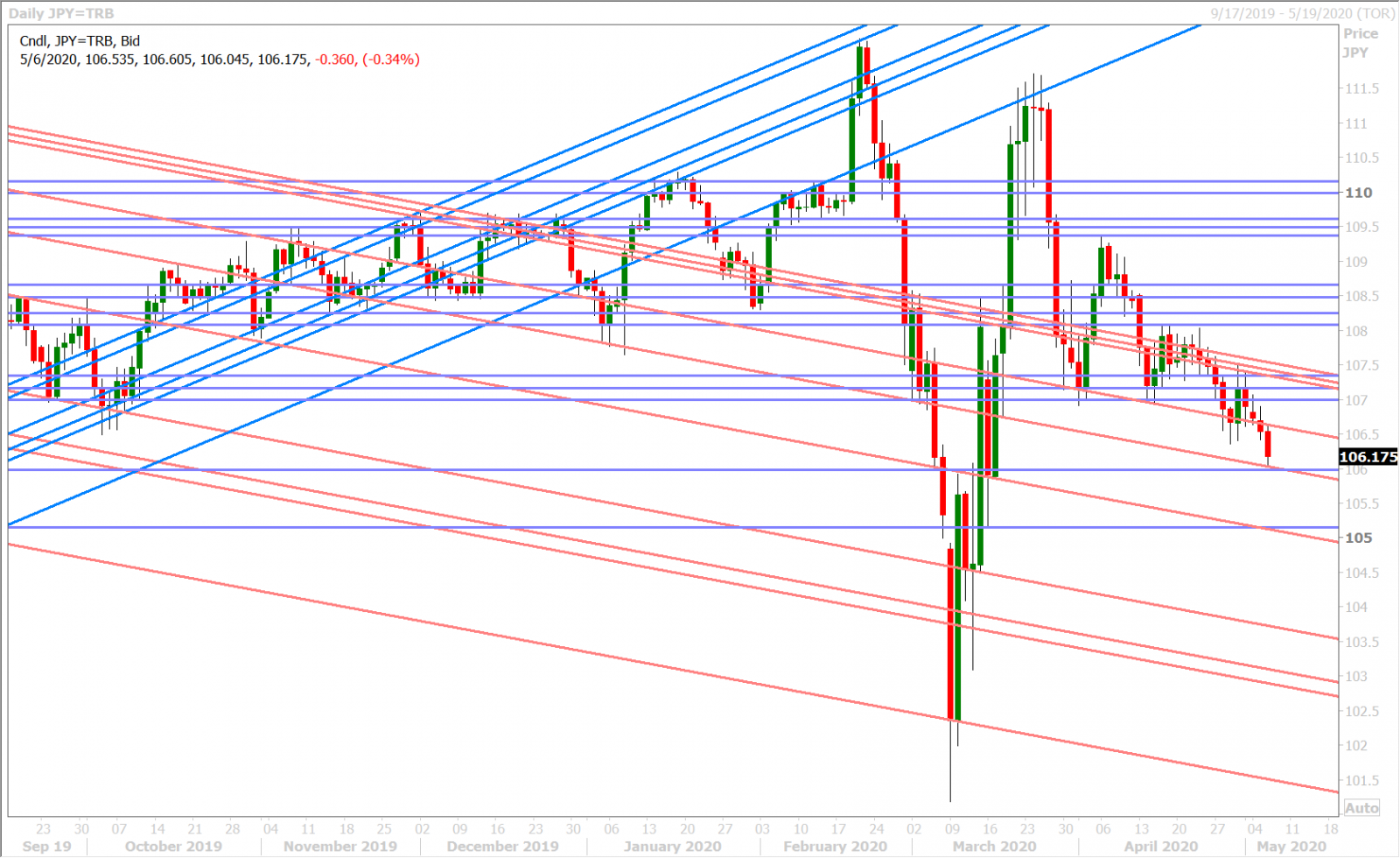

USDJPY

Dollar/yen is slowly falling apart again this morning after traders couldn’t close NY trade yesterday above the pivotal 106.60s level. Market chatter suggests the move lower today has been largely influenced by EURJPY sales, as opposed to a based risk-off factors, as the popular cross rate trips sell stops to trade to new 3-year lows. We see the next major chart support level at 106.00 in USDJPY.

The S&P futures continue to pull back off their overnight highs. The US 10yr yield is challenging upside resistance at the 0.7150% level following a larger than expected quarterly refunding figure released by the US Treasury this morning ($96 billion). Japanese markets will re-open tonight following the Golden Week holidays.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.