Canadian employment report in focus. GBP getting crushed as Brexit worries now trump hawkish BOE. Option expiries in play for EUR and AUD.

Summary

-

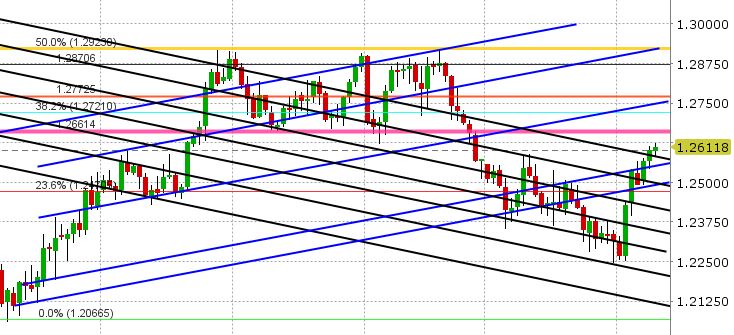

USDCAD: All eyes are on the Canadian employment report this morning, with traders expecting just 10k news jobs in January after stellar results in November and December. USDCAD closed NY trading above 1.2585-1.2595 yesterday, which was positive from a technical perspective. The door is now open for a rally to 1.2650 should the Canadian employment report come out weaker than expected. Should the number beat expectations, we would not be surprised to see the market break 1.2585-1.2595 to the downside and test 1.2540-50 (the next support level). The broader USD is trading mixed so far today. Option traders are pricing in about a 100pt range today in USDCAD if we look at overnight ATM straddle pricing.

-

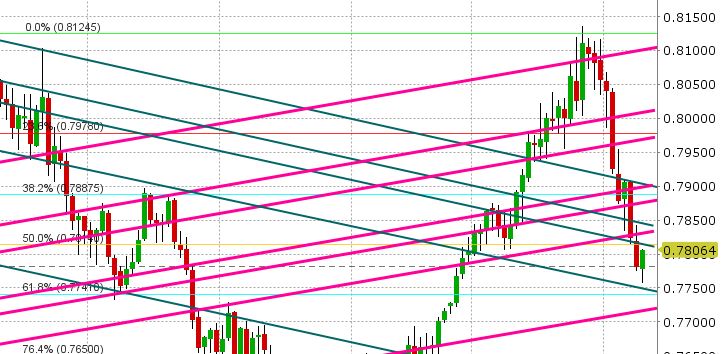

AUDUSD: The Aussie is coasting this morning after a rough week of trade. Yesterday’s attempt to reverse higher in early NY trading fizzled quickly as AUDUSD got smacked back down when trading back into the 0.7815-0.7825 zone. EURUSD failed in its reversal attempt too, and that pressured AUDUSD as well. The market tested 0.7760 in Asia overnight (very close to the next support level of 0.7750 that we mentioned yesterday), and it’s come back to breakeven in European trade, but there’s not much momentum behind the bounce. A huge option expiry is in play this morning (2.75bln AUD at 0.7800 rolling off at 10amET), and will likely keep us bid going into it. The release of the RBA’s Quarterly Statement on Monetary Policy overnight was a dovish development. While the central bank trimmed its unemployment rate, it pushed back its expectation for 2%+ inflation until mid 2020. Combine this with Governor Lowe’s comments yesterday about not seeing a strong case for rate hikes, and we have a dovish rate outlook for the foreseeable future here (AUDUSD bearish). Copper couldn’t muster any recovery yesterday as the broader USD remained bid, and it’s leaking lower again today. There’s not much support on the March copper chart until the mid 3.03s, which again doesn’t bode well for AUDUSD.

-

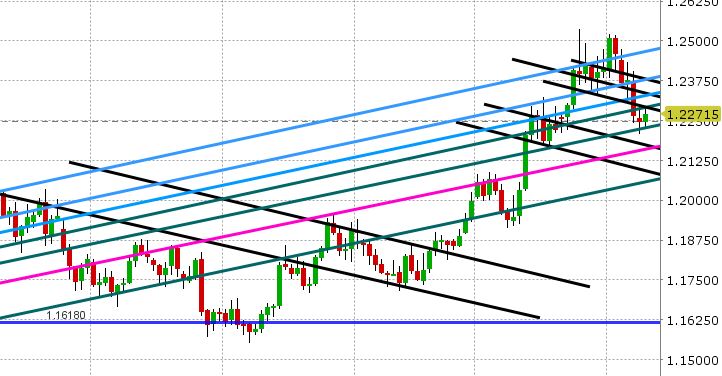

EURUSD: The Euro is trading mixed so far today. Yesterday’s attempted reversal off the 1.2220s failed when the market rallied back to 1.2275, and the market has been wandering between these two levels ever since. Reuters is reporting a 1.2bln EUR option expiry at 1.2200 today, which could add some pressure into 10amET. EURJPY is reasserting it’s influence in the last 24hrs as the EURUSD’s reversal failed yesterday right when EURJPY resumed its plunge lower. The cross attempted a recovery higher in early European trade today and is now lower once again (and EURUSD is following suit). USDCNH had a freakish drop around 2am this morning, but it had little impact on the broader USD. We’re hearing rumors of possible intervention here from the Chinese authorities to stem selling on the Shanghai index.

-

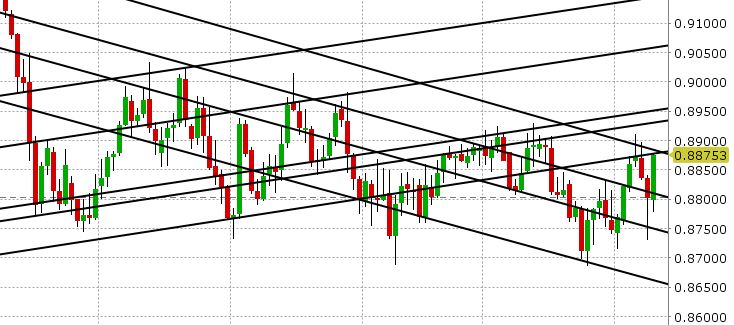

GBPUSD: Sterling is getting crushed this morning after a very poor NY close yesterday, some soggy UK trade/industrial production data, and now some tough talk from the EU’s Barnier on Brexit. Barnier said there are still substantial disagreements over the transition period, and that a transition is not a given if disagreements persist. GBPUSD is now down over 200 points from yesterday’s post BOE highs, and is testing some trend-line support in the 1.3820s. EURGBP put in a strong NY close yesterday (closing back above 0.8800), and this is allowing the cross to rally further this morning. The 0.8870-0.8890 level looks like it might cap activity near-term, so perhaps GBPUSD finds a bid shortly, but the momentum in not in the favor of GBP at this hour.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

EUR/GBP Chart

USD/CNH Chart

h3 style="text-decoration:underline;"> March Copper

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.