Canadian GDP and Raw Material Prices beat expectations

Summary

-

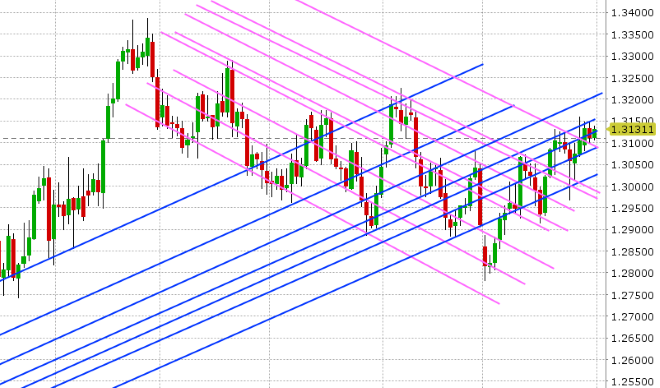

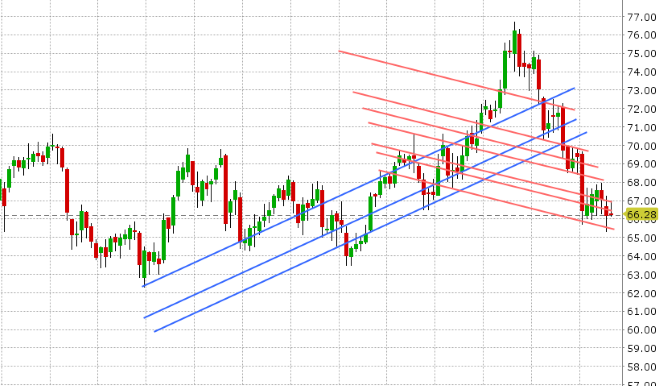

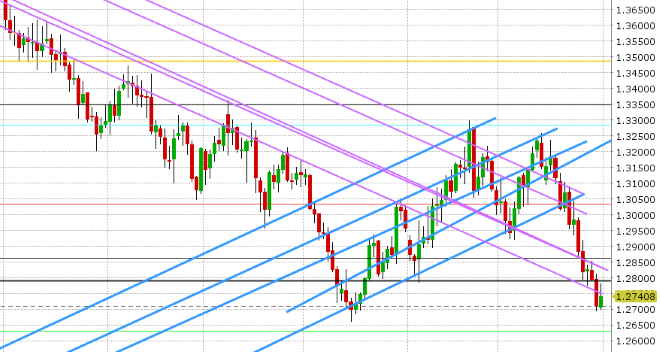

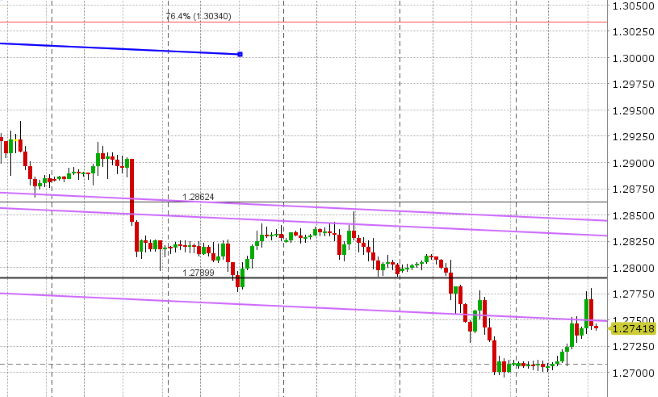

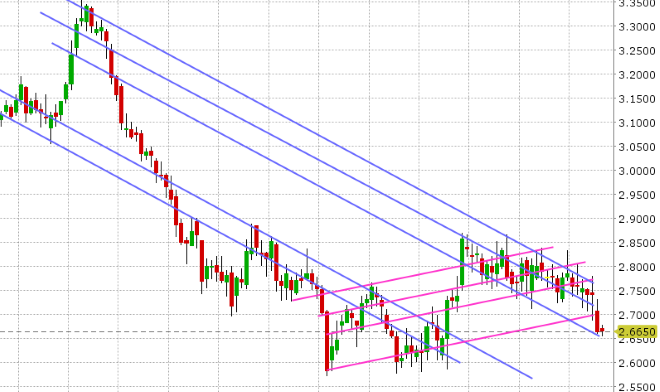

USDCAD: Bank of Canada Governor Stephen Poloz spoke before the House of Commons finance committee late yesterday and while his comments were a repeat of the most recent BoC announcement, traders focused on the hawkish tone and pulled USDCAD lower into the NY close. A slew of economic has just been released after an otherwise quiet overnight session. The US ADP employment report for October was just released +227k vs expectations of +189k. Canadian Raw Material Prices for September grew 0.1% MoM vs flat expected. Finally, Canadian GDP for August came in at +0.1% MoM vs flat expected. Chicago PMI is up next at 9:45amET (traders expecting +60), and then we’ll get the weekly EIA oil inventory data at 10:30amET (traders expecting a build of 3.67M barrels). Stephen Poloz will take the mic again later today (4:15pmET), but this time in front of the Standing Senate Committee on Banking, Trade and Commerce. With USDCAD probing below and quickly regaining the 1.3120s amidst the data releases, we think the market could drift higher here. December crude continues to drift off the 67 handle which capped prices in overnight trade.

-

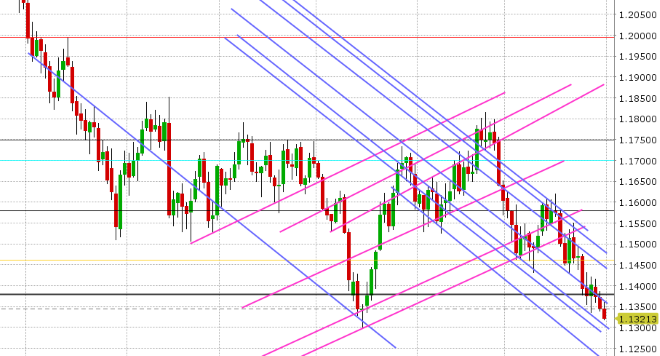

EURUSD: Euro/dollar continues to struggle after yesterday’s bounce fizzled into the NY options expiry, which just so happened to also be overhead chart resistance at the 1.1380s. The market pulled back for rest of the day, leaving the closing pattern miserable for Asian traders to digest. Some buyers stepped up in early European trade when Italian assets opened higher, but a wave of volatility has entered the fray since as Italian bonds pull back a bit, and traders digest a flush out in the EURGBP cross. Today is also a SOMA day; a day when the Fed’s bond portfolio shrinks. Today’s liquidity drain will be the 2nd largest to date (22.9blnUSD) and history suggests that SOMA days provide a lift to the USD broadly. Markets largely ignored today’s weak German Retail Sales (Sep) and in-line Eurozone CPI figures (Oct). Over 1.2blnEUR in options expire between 1.1350-1.1360 this morning. We think EURUSD continues to struggle here, especially in light of the beat on the ADP jobs report.

-

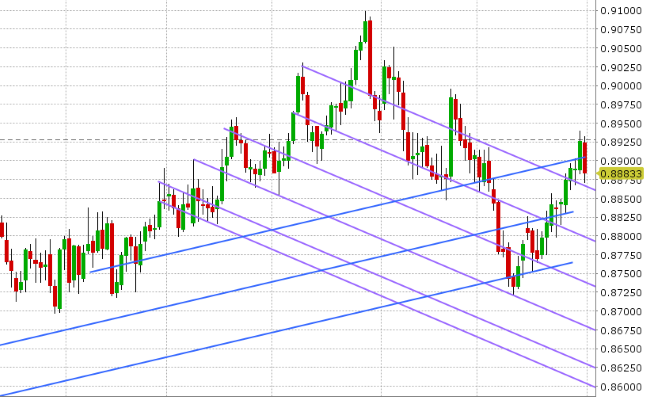

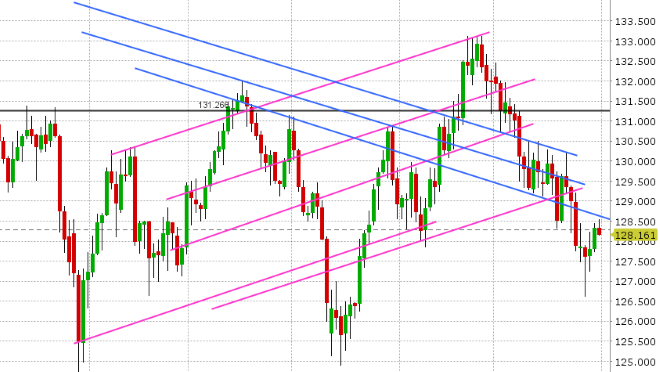

GBPUSD: Sterling is bid for a change this morning, and while we can’t point to a specific economic/Brexit headline out of the UK, we would note the EURGBP cross is getting crushed today. After breaking out yesterday above the 0.8905 mark yesterday and rallying 35pts higher, the cross has completely fell apart and has plunged 50pts lower this morning. Does somebody know something positive on the Brexit front or about what’s to come out of the Bank of England’s interest rate decision tomorrow? We’ll continue to dig for answers today, but for the time being one has to respect the regain of 1.2750 support on the GBPUSD chart. While we may see a pullback to retest the level here, the upward move here stalls the downward momentum a bit. We have over 1.3blnGBP in options expiring at 1.2800-1.2810, which may also attract prices into 10amET, but the ADP beat is helping the USD broadly here.

-

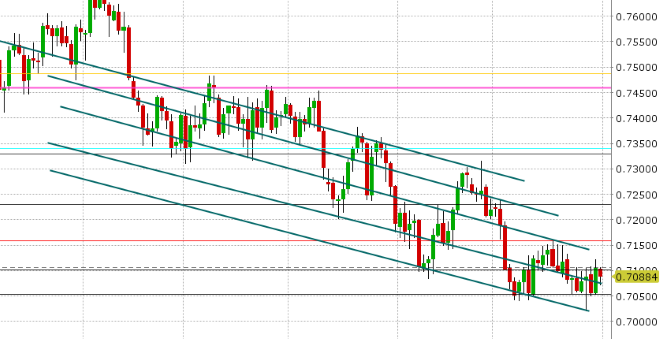

AUDUSD: The Aussie is trading with a lackluster tone this morning around the 0.7100 level, after yesterday’s break above the level fizzled out. We can blame EURUSD and its pullback yesterday, plus copper and gold prices, which continue to recede. Slightly weaker than expected Australian Q3 CPI data, released last night, isn’t helping the tone here today either. That being said, the 0.7080s support level continue to hold for AUDUSD. We think any short covering rally attempts must hinge upon the 0.7050-80 region holding. Australia reports its September Trade Balance tonight at 8:30pmET.

-

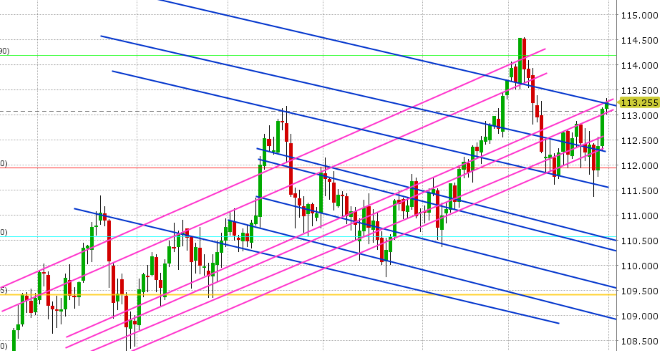

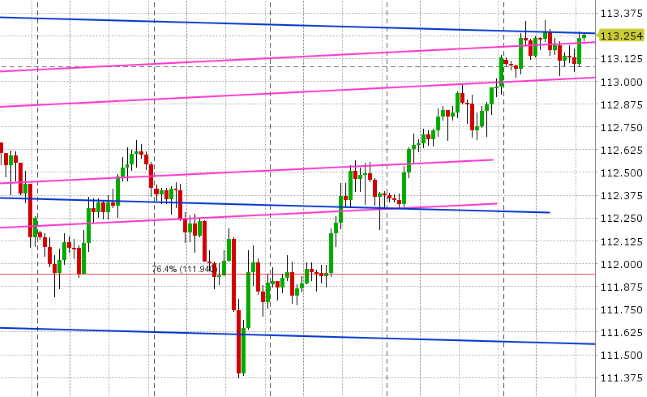

USDJPY: Dollar/yen is up marginally this morning after the Bank of Japan kept monetary policy largely unchanged overnight (as expected). What was notable however was the central bank’s trimming of its 2018 and 2019 inflation forecast, and we feel this helps justify recent USDJPY strength. The BOJ also tweaked its bond buying program again (reducing the frequency of purchases from 5 to 4 days/month, but increasing the amount it can buy in each operation). The JGB market largely ignored this and therefore so should we. Today proved the Bank of Japan is nowhere close to normalizing monetary policy and this should embolden the fund long position here. The market has some hefty chart resistance to deal with today though, as two trend-lines cap in the 113.20s. We also have over 1blnUSD in options expiring at the 113.10 strike this morning.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

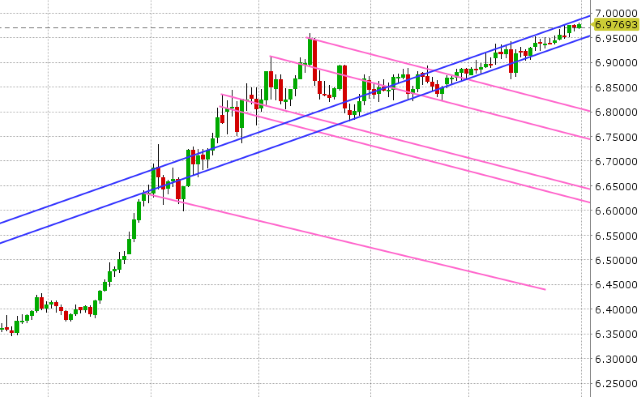

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.