Canada not exempt from steel tariffs. EUR mixed after busy weekend. Traders eyeing four central bank meetings this week.

Summary

-

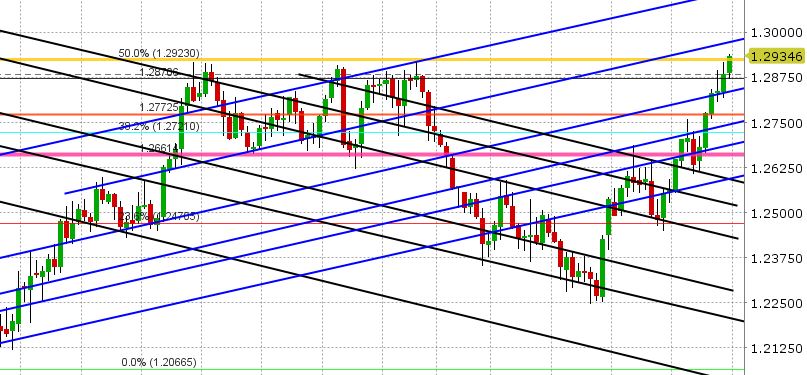

USDCAD: So it turns out there will be no exemptions to the US steel tariffs according to a WSJ report over the weekend that cited a senior White House official. Combine this with a tweet from Trump just now about how these tariffs “will only come off [for Canada] if new & fair NAFTA agreement is signed”, and USDCAD is understandably extending Friday’s gains to start the week. Wednesday’s reversal pattern on the charts has been cancelled by Friday’s close, and traders are now eyeing resistance levels once again. The market has just broken through the 1.2920s, which is huge horizontal weekly resistance level, and this now opens the door to further gains (next resistance is 1.2975-1.3000. The North American calendar is light today, with just US Services ISM at 10amET (markets expecting 59). The calendar gets more exciting later in the week, with the Bank of Canada interest rate decision on Wednesday, Canadian Housing Starts on Thursday and then the employment reports for both Canada and the US on Friday. USDCAD traders will also be paying close attention to the broader USD’s response to central bank interest rate decisions from Australia’s RBA (tonight), the ECB (Thursday) and the BOJ (Friday). We think USDCAD maintains its upward bias here until we see signs of buyer failure at chart resistance levels.

-

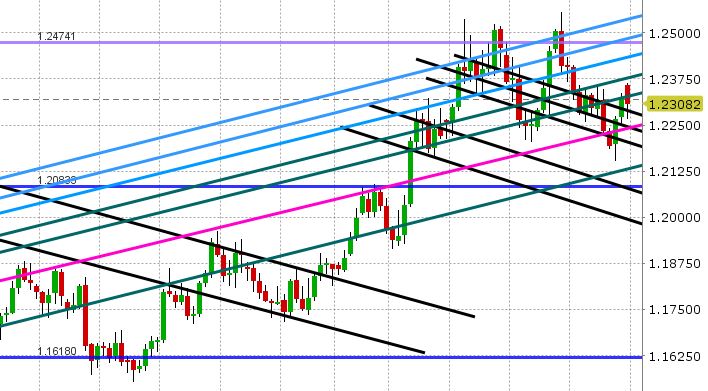

EURUSD: The Euro is starting the week mixed after a busy weekend of news. The German SPD vote confirmed Merkel’s coalition government and removed a lot of uncertainty. This, along with Friday’s closing pattern above chart resistance, allowed EURUSD to gap higher at the Sunday open. However, all eyes then turned on the Italian exit polls from this weekend’s election and the stronger than expected performance from the anti-establishment, Euro-sceptic, MS5 Party. While we wouldn’t read too much into Italian politics as a driver for EURUSD in the near to medium term, the election result does reaffirm the growing trend of populism in Europe, which could dampen growth prospects for the region if not addressed. EURUSD is now settling back into a range ahead of the US Services ISM number at 10am. Support is 1.2280, then 1.2250-60. Resistance today is 1.2330-40, then 1.2375. The European calendar is light up until Thursday, where the main event is the next ECB meeting and Mario Draghi’s press conference. Traders are not expecting any changes to interest rates or the bond buying program, but as always they’ll be paying close attention to Draghi’s comments on inflation and growth. EURJPY rebounded strongly off 1.2950 in early European trade today. If the cross can close firmly back above 130.50, that would bode well for EURUSD near term. USDCNH remaining below 6.3450 is another EUR supportive factor.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Chart

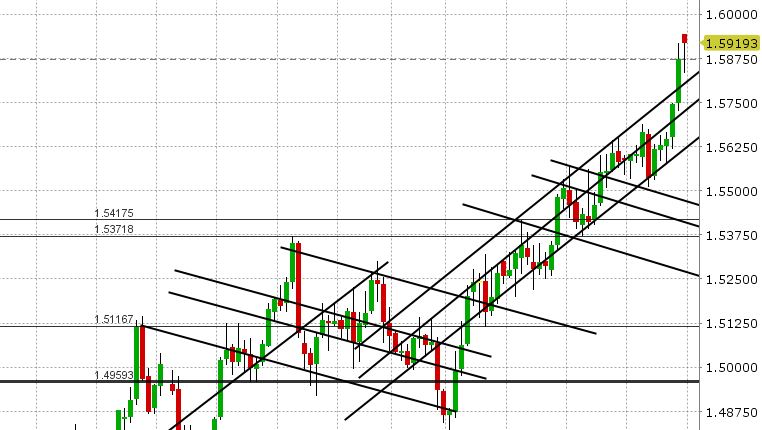

EUR/CAD Chart

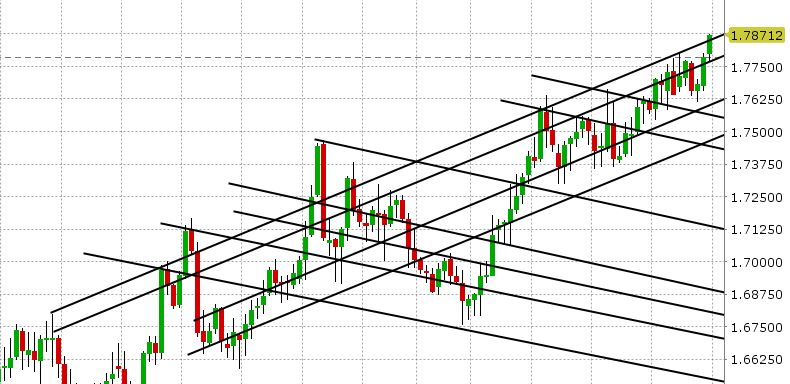

GBP/CAD Chart

EUR/USD Chart

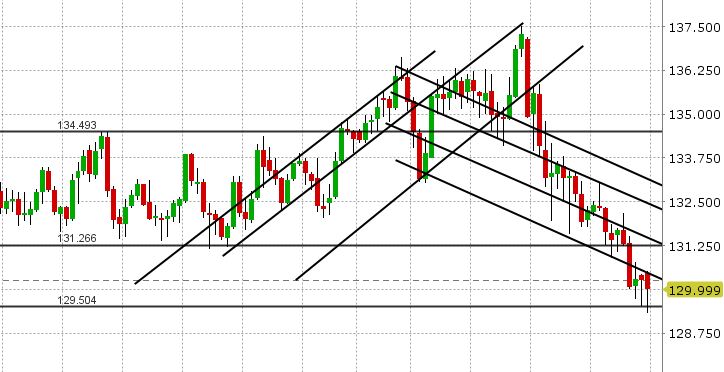

EUR/JPY Chart

USD/CNH Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.