CAD traders eyeing Bank of Canada rate decision

Summary

-

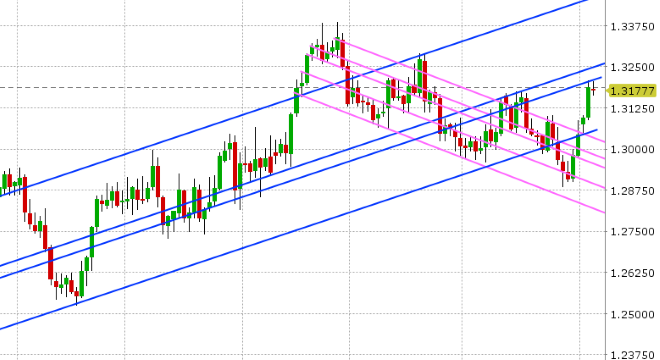

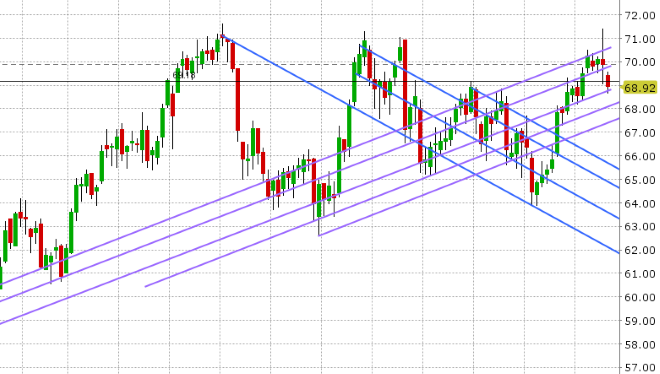

USDCAD: Dollar/CAD made it to chart resistance at the 1.32 mark fairly easily during yesterday’s NY trade, but then the market stalled when EURUSD bounced. An attempt was made to break above this same level in early European trade today, but it has failed as well, and so there’s a negative tone to USDCAD coming into NY trade this morning. Today is expected to be quite eventful, with the US and Canadian Trade Balance figures out shortly, followed by the Bank of Canada rate decision at 10amET, where market participants are expecting a hawkish hold. NAFTA talks between the US and Canada are also set to resume today. October crude oil is trading down over 1% this morning, after completing a bearish outside day pattern yesterday. While a lot of this is tropical storm Gordon premium coming out the market as the forecast improves, the weaker chart technicals are supportive to USDCAD.

-

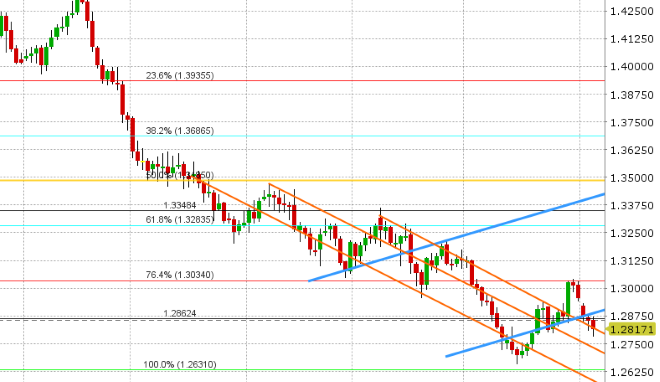

EURUSD: Euro/dollar has had a choppy 24hrs of trade and enters NY trade this morning with a neutral tone. Yesterday’s ISM beat took the market below trend-line support in the 1.1530s, but the market quickly recovered. A further contraction in the BTP/Bund spread on positive Italian budget headlines finally helped as well. Overnight action saw EURUSD recede back to yesterday’s lows following continued selling in the EM FX space, but we’ve bounced once again. Aside from the US Trade Balance figures, today’s calendar features three Fed speakers in and around the NY close (Williams at 3pm, Kashkari at 4pm, Bostic at 6:30pm). We think EURUSD drifts higher into today’s option expiry at 1.1625 (1.3blnEUR), but we’re not expected much else given the range bound technicals at this point.

-

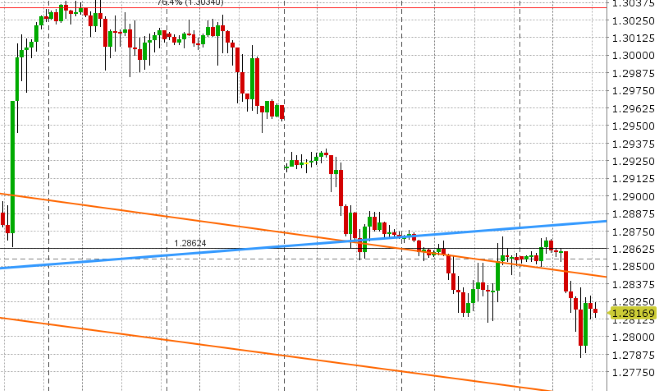

GBPUSD: Sterling is underperforming this morning, after today’s wave of broad USD buying in Europe took the market back below the 1.2850 support level it regained in late NY trade yesterday. The UK Markit Services PMI beat expectations, but the market is still struggling to find a consistent bid. Over 1blnGBP in options expire at the 1.2850 strike this morning, so we wouldn’t be surprised to see an upward drift into10amET.

-

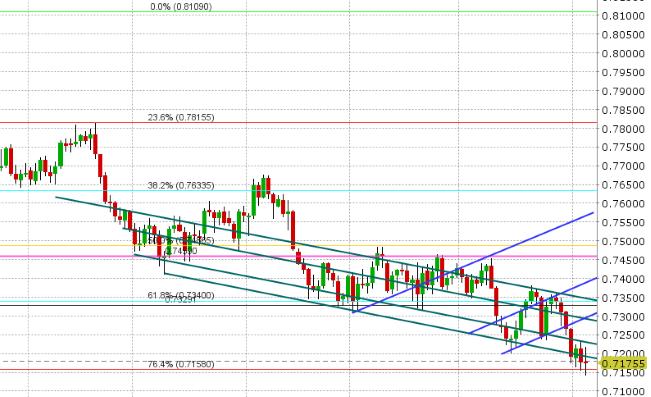

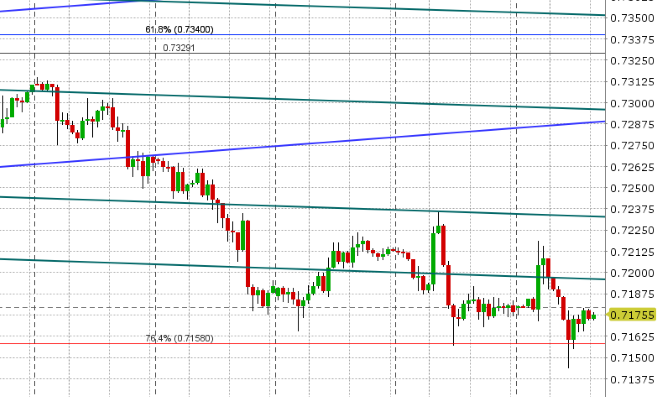

AUDUSD: The Aussie is trading with a neutral tone this morning after another volatile 24hrs. Australian Q2 GDP beat expectations last night, coming in at +0.9% QoQ vs +0.7%, but the gains above 0.7200 quickly fizzled after another wave of EM FX selling drove broad USD strength into early European trade. Fibo support in the 0.7150s was tested again today (like yesterday) and it continues to hold. Today features a rather large option expiry for AUDUSD at the 0.7225 strike (1.6blnAUD). Copper is trading steady.

-

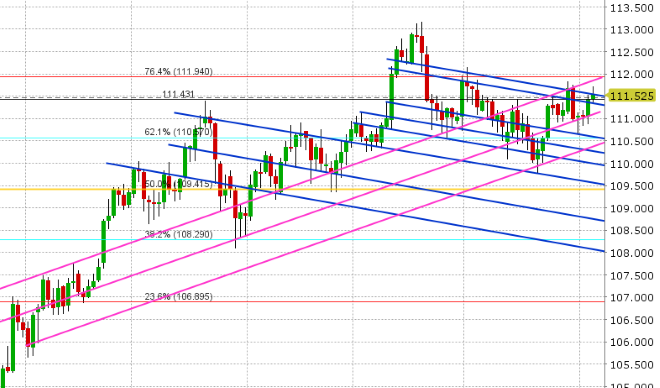

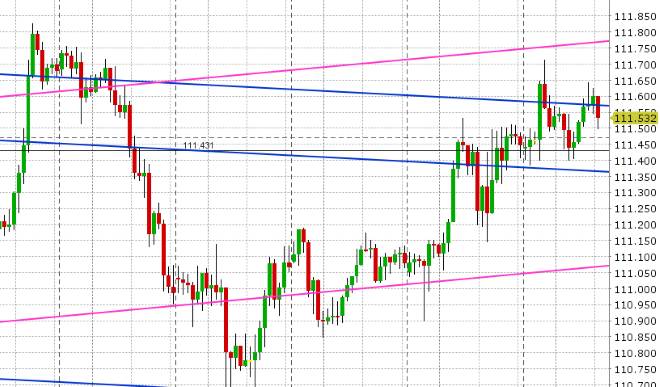

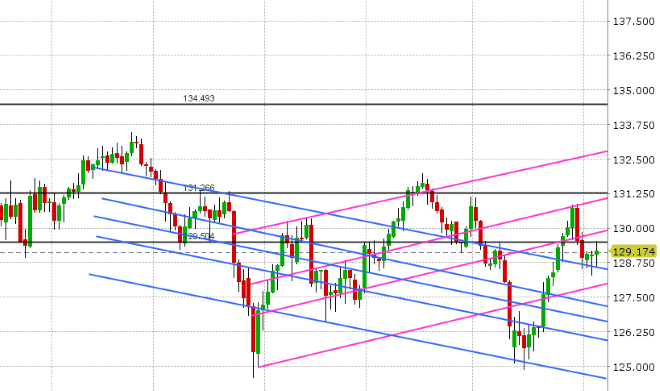

USDJPY: It’s been a slow and steady grind higher for dollar/yen since early NY trade yesterday, with the US treasury yield move back to 2.90 lending the most support, but the market continues to struggle with overhead chart resistance (111.50-60). Today features a small option expiry at 111.50 (800mlnUSD). We’d be watching US yields closely here as the technicals for the 10yr have improved considerably in our opinion. Any breakout back towards the 3% level will likely see USDJPY extend towards 112, and there’s not much resistance on the chart after that.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

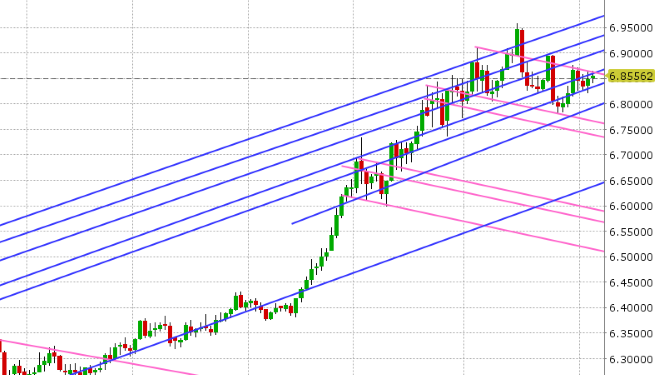

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.