CAD in focus today with Cdn CPI/Retail Sales on deck. EURUSD techs improve. BOJ keeps monetary policy unchanged.

Summary

-

ECONOMIC DATA UPDATE: US Existing Home sales came in at 5.81M, better than expectations and +5.6% MoM for November. The Canadian Wholesale Trade number blew away expectations, coming in at +1.5% vs. +0.5% for October. Today we get Canadian Nov CPI (expected +2.0% YoY), Canadian Oct Retail Sales (expected +0.3% MoM), Final read on US Q3 GDP (expected +3.3% QoQ), US PCE Index (+1.4% QoQ), and US Philly Fed survey for Dec (expected +20.8). All these numbers are out at 8:30amET.

-

UPCOMING CENTRAL BANK SPEAK: The BOE’s Governor Carney didn’t say much at all in UK parliament yesterday. The Bank of Japan kept monetary policy unchanged overnight (as the market expected) and governor Kuroda sounded dovish as usual in his post-meeting press conference. The BOJ remains focused on its 2% inflation target and will consider further easing if momentum towards that target wanes. The BOJ also firmly believes their monetary stimulus has helped the Japanese economy.

-

USDCAD: Wednesday’s chart failure for USDCAD in the low 1.29s definitely cast a shadow over trading yesterday as the market couldn’t find buyers. We also saw selling right after the release of the much better than expected Canadian Wholesale trade numbers (which is usually not a market mover). So USDCAD enters NY trading today a little battered. There’s some light support in the 1.2820s, but better support at 1.2770-90. Resistance today comes in at 1.2860-70, then 1.2910-20. It’s going to be a big 24hrs for Canadian data, with CPI and Retail Sales at 8:30am today and Canadian GDP at 8:30am tomorrow. EURCAD and GBPCAD are getting sold aggressively as we speak, and this is not helping USDCAD. The US/CA 2yr yield spread is getting sold this morning too, now all the way back down to +21bp. It’s very much a range trade ahead of the slew of Canadian and US economic data today at 8:30, and we could very well see both ends of the recent range tested.

-

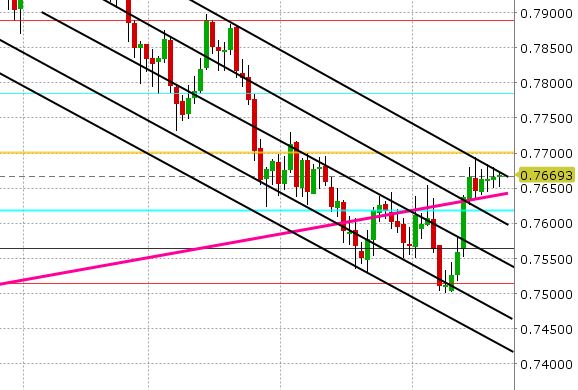

AUDUSD: There’s very little going on in Aussie in the last 24hrs, as the market remains well supported technically. Copper had another spectacular rally yesterday, now up 11 days in a row. The AU/US 2yr yield spread remains firm at +12bp, and of course, there’s still that massive option expiry at 0.7700 for Friday. All this continues to underpin AUDUSD. Trend-line resistance continues to cap trade for now and support for today is 0.7640-0.7650.

-

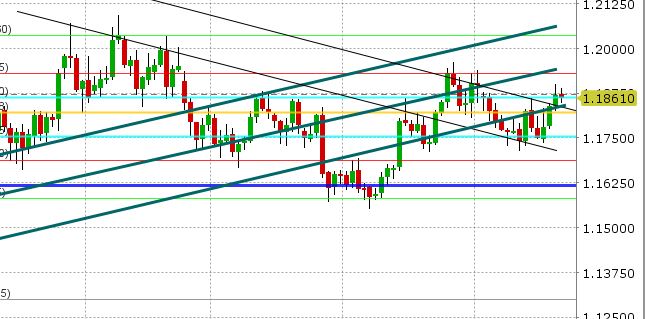

EURUSD: Euro/dollar broke out to the upside yesterday, which was not surprising given the positive technical, and correlative developments we’ve talked about so far this week. It is interesting to note that the Dec 4th Sunday opening gap (also reported a few times here) was filled perfectly and then acted as a new resistance level. EURUSD is now consolidated off those new highs, but it has strong support technically at 1.1860, then 1.1825-1.1850 (trend-line and Fibo support). In other words, that thick zone of resistance we mentioned yesterday in now support because the market managed to trade above it. Reuters is reported sizable option expiries again today, with over 3bln EUR going off between 1.1835-1.1880. The US/GE 10yr yield spread is steady yet again at +207bp, as German bunds yields have shot higher alongside US yields. We continue to call EURUSD range-bound to higher, but would note EURGBP and EURJPY stalling a bit here after recent gains, which could mean EURUSD stalls a bit too.

-

GBPUSD: There’s not much going on in sterling either as the market continues to consolidate and create an even tighter range as the holidays approach. Trend-line support (1.3330s) held yet again overnight. Continue to watch for Brexit headlines. We get the final read on UK Q3 GDP tomorrow morning at 4:30am (+1.5% expected).

-

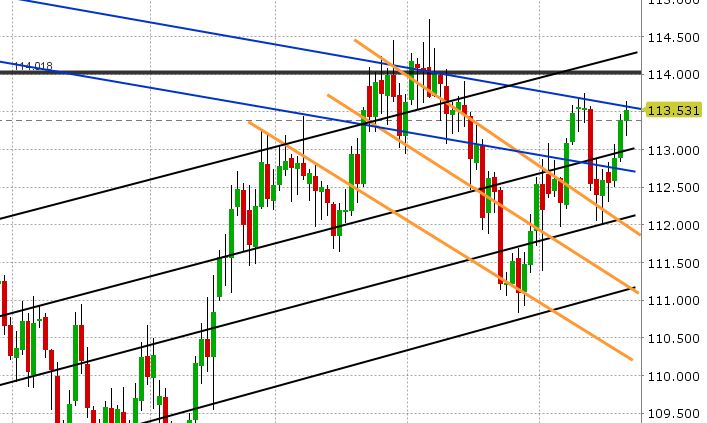

USDJPY: So the BOJ stood pat on monetary policy overnight. There were no surprises in Kuroda’s press conference afterwards, and so USDJPY extended higher. Technicals allowed for the move higher as well and last week’s dip low (post Fed announcement) has now been wiped out. USDJPY is stalling a bit now at trend-line chart resistance in the 113.50s. US yields have stalled a bit too, after their recent run up. EURJPY is also struggling a bit at its new cycle highs. We’re thinking we might see a slight pull-back here in USDJPY given recent gains

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.