CAD hit on another dovish BOC rate hold. USD broadly bid. US payrolls in focus for tomorrow.

Summary

-

CME OPEN INTEREST CHANGES 12/6: AUD +1569, GBP -4627, CAD -3484, EUR +6627, JPY +774

-

USDCAD: The Bank of Canada gave the market another dovish hold on interest rates yesterday, and essentially repeated that they will “continue to be cautious” on rate moves. In a somewhat disappointing development for USD bears (CAD bulls), the BOC didn’t make any reference to last Friday’s stellar Canadian jobs report, and instead repeated “despite rising employment and participation rates, other indicators point to ongoing slack in the labour market.” The key 1.2660 level held going into the announcement, and when the news came out this technical setup allowed the market to quickly trade higher and retrace a good portion of Friday’s move lower. USDCAD now sits well above yesterday’s resistance zone (1.2740-1.2770), which is now support. Next chart resistance is 1.2870-1.2880. The US/CAD 2yr yield spread widened on yesterday’s USDCAD move higher as well, and now sits at +31bp. EURCAD and GBPCAD were bought heavily as well, adding further support to the USDCAD move. We’re expecting USDCAD to trade range-bound to higher today given improving technicals, the lack of chart resistance for another 40pts here and because of a broader USD bid across all markets overnight.

-

AUDUSD: Aussie traders got more bad news overnight with the weaker than expected Australian Oct Trade Balance figures (came in at just +$105M vs +$1400M expected). Combine this with a weakened chart structure (that we talked about yesterday) and a poor NY close on the charts and traders found it easier to just keep selling. Some traders are attributing some of the AUD weakness to gold and silver prices, which have now broken below key support levels. Iron ore prices fell another 4% yesterday. Copper continues to hold its recent low and the AU/US 2yr yield spread is holding at -2bp. AUDUSD is currently attacking key support at 0.7510-0.7520 (this is trendline channel support and the 76.4% Fibo retracement of the May-Sep rally). We feel the path of least resistance for AUDUSD is lower here given Tuesday’s technical chart failure. Chart resistance today is 0.7540-60. Reuters is reporting an option barrier at 0.7500 and an 400mln+ AUD option expiry today at 0.7500. .

-

EURUSD: Euro/dollar continues to drift from one daily option expiry to the next as traders await the key event risk of the week in US payrolls tomorrow. Cross flows, on net, were a negative influence yesterday. Option traders are reporting some easing of the EUR call bias in recent sessions, and Reuters reports a sizable 6mth call seller overnight. The US/GE 10yr yield spread remains firm at +203bp (EURUSD negative) and we have a broad based USD bid across all markets today. EURUSD is currently testing trendline channel support in the 1.2770-80 area. If the market cannot hold, we could see further selling into the 1.1750s (38.2% Fibo of the Sep-Nov down move) or the 1.1720s (Nov lows). Option expiries will be at play again today with 2.7bln EUR rolling off between 1.1750-1.1800 today. It’s interesting to note EUR position accumulation of 13k+ futures contracts in the last 48hrs ahead of the big number tomorrow.

-

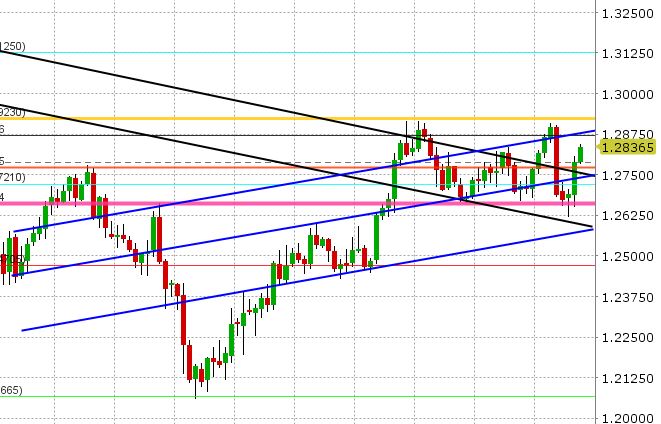

GBPUSD: It’s been a bit of a roller coaster ride in sterling overnight, with a little bit of stop hunting earlier above 1.3400, and then some stop hunting bid side as the UK foreign minister Johnson spoke briefly on Brexit amongst other things, but didn’t confirm EU Juncker’s earlier remarks about a possible deadline extension on the Brexit divorce bill. This week’s action has definitely been a reality check for GBPUSD traders. Dips are being bought on Brexit optimism and rallies are being sold whenever we get actual headlines (which continue to be mixed and full of uncertainty). Technically speaking, the overnight spike below 1.3350 and subsequent recovery back up towards the 1.34 level is positive (potential inverted hammer reversal). A firm NY close back above 1.3410-20 would confirm this pattern. Until then, tread carefully.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.