CAD cross selling destroys USDCAD chart yesterday. China tariff news/commodity rout helping USDCAD recover today. All eyes now on US reaction.

Summary

-

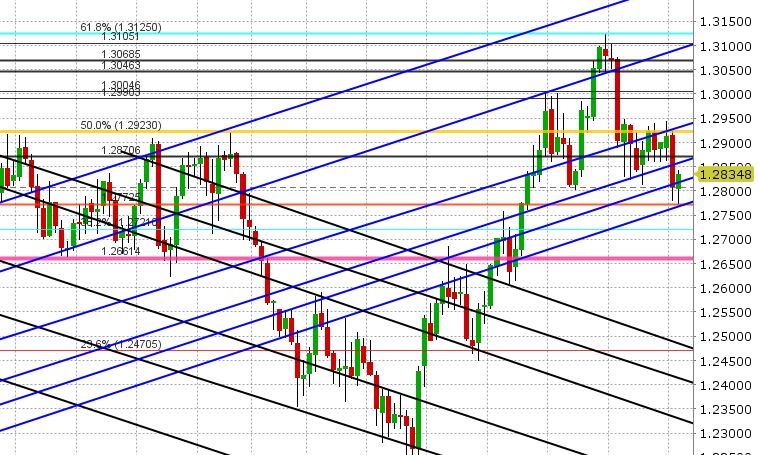

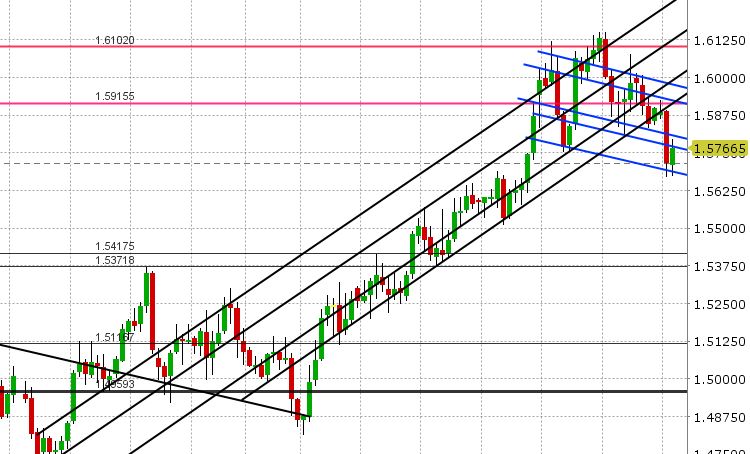

USDCAD: It was a very rough day for USDCAD yesterday as the CAD crosses (EURCAD and GBPCAD) got hammered. While one could argue Trump’s desire to see NAFTA negotiations resolved in two weeks is ambitious, the initial bid to CAD late Monday (as a result of the headline) was enough to cause further technical damage to the charts for USDCAD, EURCAD, GBPCAD, and so we would argue yesterday’s move was more technically driven. The move lower in USDCAD accelerated with the break below 1.2870. Then we saw a swift move through the next support level of 1.2845-50 and a failed attempt to regain the level about an hour later (another negative). This opened the door for a move lower to the next support level at 1.2810-15. This level then gave way too amid even steeper CAD cross selling, and attempt was made to regain the 1.2815 going into the NY close but it failed too. The negative NY close allowed for further selling overnight. The next support level in the 1.2770s was tested, and then we got another round of retaliatory tariff news out of China that’s been killing commodities and hurting commodity currencies since the start of European trading. China announced reciprocal tariffs on $50bln of US goods, including aircraft, cars, corn, cotton, chemicals, plastic products, but more importantly US soybeans (which is a massive US export). While none of these tariffs have effective start dates yet, there’s talk this morning of an all-out trade war in trading circles, which is causing a bit of “risk off” fear in markets. (S&Ps -1.6%, VIX +13%, Copper -2.5%, Soybeans -4%, Crude -1.5%), which traditionally helps USDCAD as well. All eyes today will now be focused on the US administration (will they escalate this again or will they start to negotiate). Trump just tweeted saying “We are not in a trade war”, so we’ll see how this unfolds. The US ADP figures were just released (+241k for March vs. +210 expected), but nobody’s paying attention to that right now. USDCAD has now regained the 1.2815 level easily, which will have traders focused on resistance now in the 1.2850s. The broader USD rally, in the wake of the China news, is starting to tire out a bit here however, so today could end up being a 1.2815-1.2850 range trade. We’ll also be watching the CAD crosses today to see if they can recover a bit technically (would help USDCAD). Today’s data releases will see US Services ISM for March at 10amET, and the DOE crude oil inventory data at 10:30amET.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/CAD Daily Chart

GBP/CAD Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.