Broader risk appetite recedes a bit as US yields back up 4bp.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Traders awaiting the next US/China headline amid quiet economic calendar.

- US yet to confirm willingness to drop some tariffs against China.

- Fed’s Evans says monetary policy is “not that far off the neutral rate”.

- Fed’s Williams to speak at 9:30amET. Fed’s Harker at 3:15pmET.

- Weekly EIA oil inventory report out at 10:30amET. Traders expecting +1.515M barrels.

- German Industrial Orders (Sep) beat expectations, +1.3% MoM vs +0.1%.

- German Services PMI (Oct) beats expectations, 51.6 vs 51.2.

- UK election session officially begins. BOE meets at 7amET tomorrow morning.

ANALYSIS

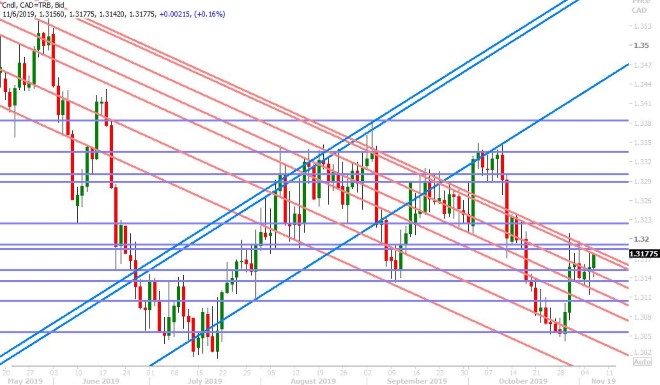

USDCAD

Dollar/CAD is trading mildly higher with the broader USD this morning as global markets appear slightly nervous about the next US/China trade headline. While yesterday’s better than expected US Non-Manufacturing ISM number extended this week’s “risk rally”, we have yet to receive confirmation from the US that they will indeed remove some tariffs against China. Today’s North American calendar will be void of any major economic releases, but we will hear from the Fed’s Williams (9:30amET) and Harker (3:15pmET). The Fed’s Evans spoke over the 8am hour but touted the FOMC party line (no news here in our opinion). The EIA will also release its weekly oil inventory report at 10:30amET, with traders expecting a build of 1.515M barrels following last night’s bearish API survey (+4.26M barrels vs +1.5M expected).

The chart technicals for USDCAD are looking mixed to slightly higher today. We think the funds (who remain net short the market) would've liked to have seen a NY close below the 1.3120s yesterday, but since the upside breakout in US yields drove the USD broadly higher we think they may start worrying about the 1.3190 resistance level again heading into Friday’s Canadian employment report.

USDCAD DAILY

USDCAD HOURLY

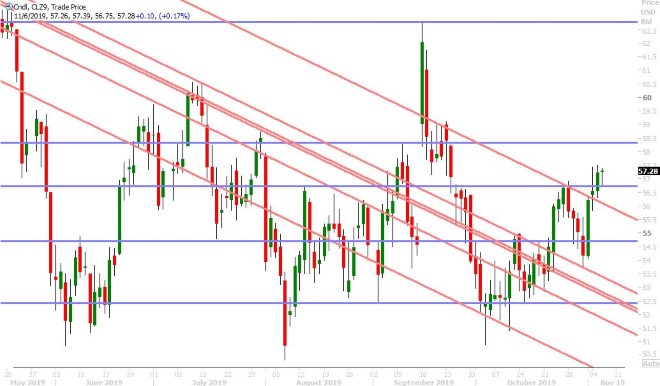

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar got pummeled yesterday, with yesterday’s US yield breakout to 1.87% (following the upbeat US Services ISM report) adding insult to injury for the pairing. Buyers appeared at trend-line chart support in the 1.1060s however during late NY trade and this level held up in Asia despite the PBOC setting its daily USDCNY fix at its lowest level since August 8th. This morning’s better than expected German Industrial Orders and Services PMI reports are getting talked about (+1.3% MoM vs +0.1% and 51.6 vs 51.2), but we can’t say we’re seeing traders tripping over themselves with excitement to buy EUR here. The damage done to the EURUSD chart technicals so far this week has been significant and the US news flow has been too positive (so much so that bond markets are not expecting anything for a change from the Fed on December 11th). We think EURUSD will continue to struggle here, unless we get some sort of negative surprise on the US front that will re-invigorate the “Fed rate cut trade”.

EURUSD DAILY

EURUSD HOURLY

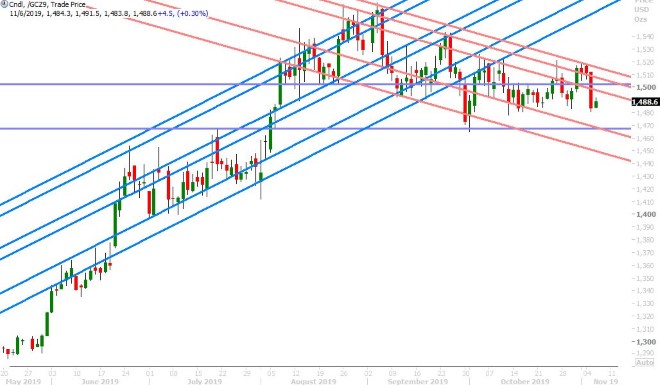

DEC GOLD DAILY

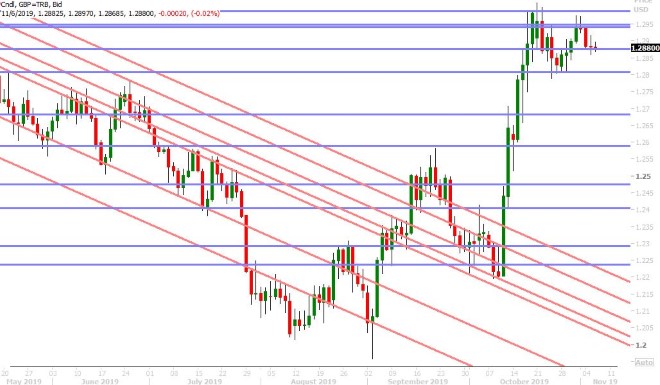

GBPUSD

Sterling is following EURUSD mildly higher this morning, and we think the market’s ability to close back above the 1.2870s by the NY close is helping with that. The UK’s general election campaign officially began today with the dissolution of parliament. More here from the CBC. We think the pound’s fortunes, all else being equal, will continue to ebb and flow with the prospects of a stronger result for the UK Tory party on Dec 12th. A stronger Tory party will make it easier for PM Boris Johnson to finally pass his Brexit Withdrawal Agreement Bill (GBP positive) whereas a hung parliament (with no clear majority one way or another) will bring us right back to square one with regard to Brexit negotiations (GBP negative). The Bank of England announces it latest monetary policy decision at 7amET tomorrow morning, with no changes to interest rates expected.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is getting help today from some broad, but mild, USD sales in London trade. We also think USDCNH’s inability to breach yesterday’s European lows in the 6.9880s, on the back of last night's lower USDCNY fixing, is helping. The market continues to flip-flop on both sides of the 0.6895 level however as we enter NY trade for today and it feels like the market is on guard for something negative on the US/China trade front. Australia reports its September Trade Balance tonight at 7:30pmET (which shouldn’t be a market mover). What may be more interesting is tonight's release of China’s import/export data for October (exact time unknown).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

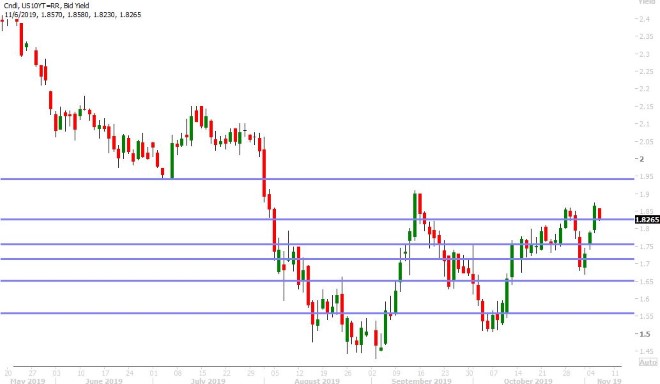

Dollar/yen is pulling back mildly this morning as US 10yr yields back up 4bp from yesterday’s session highs and USDCNH continues to hold 6.9880s support. You could say there’s a lack of trade optimism out there today or slight trepidation because we’re not getting confirmation that the US will drop some tariffs against China. What is becoming abundantly clear is that the “risk rally” needs to be continually fed with positive news. We’re not sure where that comes from today, but all eyes will be on the newswires as usual. Over 1.4blnUSD of options expire between the 108.75 and 109.00 strikes this morning at 10amET, which could be adding a little bit of weight to the market here.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.