Broader USD steady ahead of FOMC meeting. GBP lags on in-line UK CPI + Brexit amendment vote antics. EUR bid but large option expiry looms below.

Summary

-

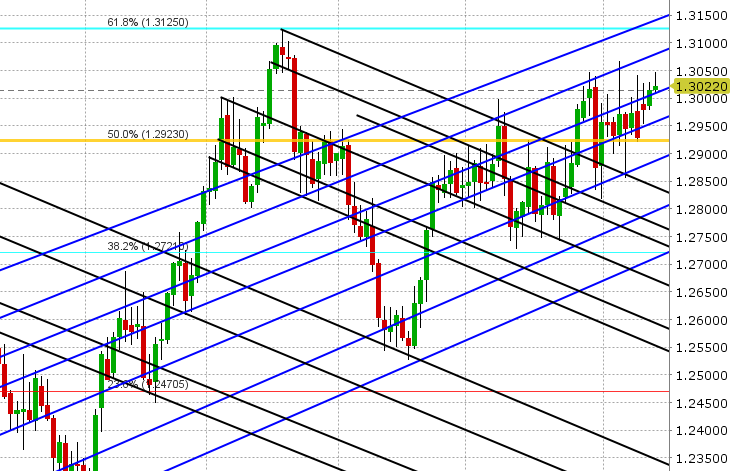

USDCAD: Dollar/CAD is trading higher yet again this morning, but the gains have been marginal as all markets settle into a lull ahead of the FOMC meeting later today. Yesterday’s price action was muted as well, with US CPI coming in as expected and the only move coming from a Dow Jones article that hinted at press conferences to follow EVERY Fed meeting going forward. This got some USD longs excited as it technically makes more rates hikes this year feasible, but again the broad USD move higher wasn’t anything to write home about. The FOMC announcement will come at 2pmET today, followed by a press conference at 2:30pmET. Traders are largely expecting a hike of 25bp, and so the focus will be on Jerome Powell’s tone as usual when he speaks to reporters. USDCAD remains in good technical shape at this hour because the pair continues to trade above the key trend-line support at the 1.3000 level. July crude oil is softer this morning after a bearish API inventory report late yesterday and headlines that Russia is willing to increase production to 2016 levels. We get the weekly DOE inventory report at 10:30amET today. Today’s calendar also features US PPI at 8:30amET. A hawkish hike today from the Fed could very easily see the markets make a run for the 1.3070s, while a dovish hike will likely see traders attack chart support and Sunday’s opening gap in the 1.2940-50 area.

-

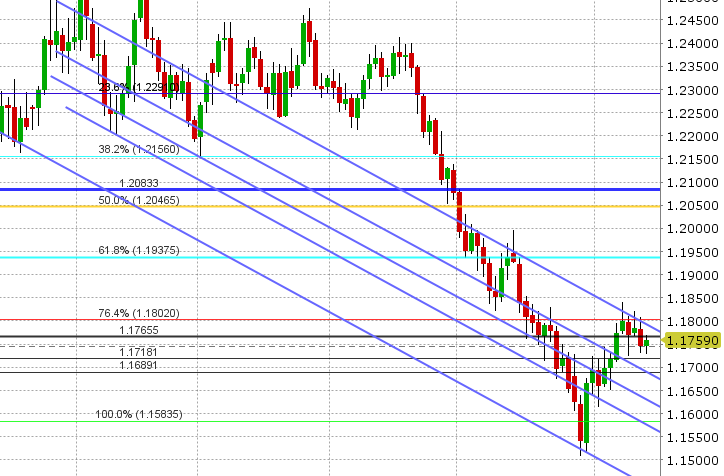

EURUSD: Euro/dollar was looking a little shaky yesterday afternoon after the Dow Jones article came out because chart support in the 1.1750-60s was being put to the test. This left the market with a mediocre NY close, but Italian assets are behaving themselves again today and so we’ve bounced marginally. Italy sold 3,7 and 30yr debt today and the auctions went fairly well. We also got some EUR positive comments from the alleged euro-skeptic Paolo Savona (“if you want a single market, you must have a single currency”...”there is no plan B, I’ve never asked to leave the euro”). Eurozone Industrial Production missed expectations while Q1 Employment beat expectations, but markets are largely ignoring these 2nd tier releases. Next up is US PPI, a large option expiry at 1.1700-1.1720 today (4.5blnEUR+), and then of course the Fed meeting. A hawkish hike will likely see EURUSD drop to the high 1.16s, while a dovish hike will likely see the market take a run at the 1.1800-1.1815 level...above which there is not much chart resistance at this point.

-

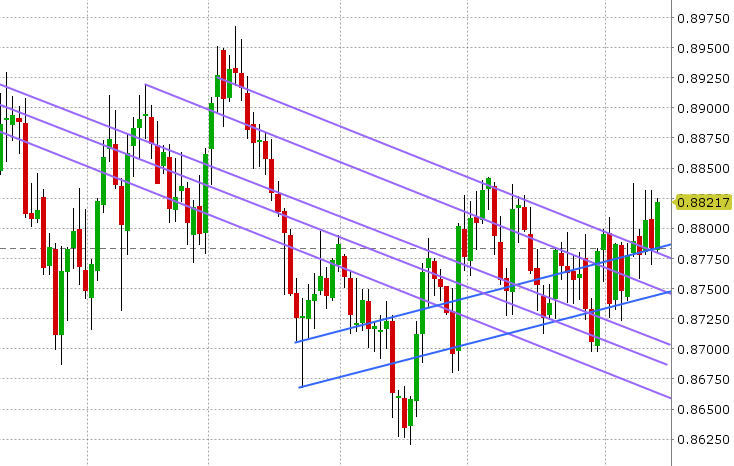

GBPUSD: Sterling is the laggard this morning as the UK reported in-line CPI for May and Theresa May is facing some blowback after yesterday’s last minute antics which led to a successful House of Commons vote to save her Brexit agenda. More here: https://www.thesun.co.uk/news/6514660/brexit-chaos-leavers-remainers-veto-no-deal-theresa-may/. GBPUSD rejected the 1.3415 level again yesterday in the aftermath of the vote, and the market has given back all gains and broke chart support in the 1.3350s overnight. Some buyers have stepped in at the next support level, which is 1.3310, but the bounce is lacking momentum at this hour. EURGBP has been all over the map in the last few days, but is once again near the top of its recent range. We think the cross still has legs should the 0.8790s hold.

-

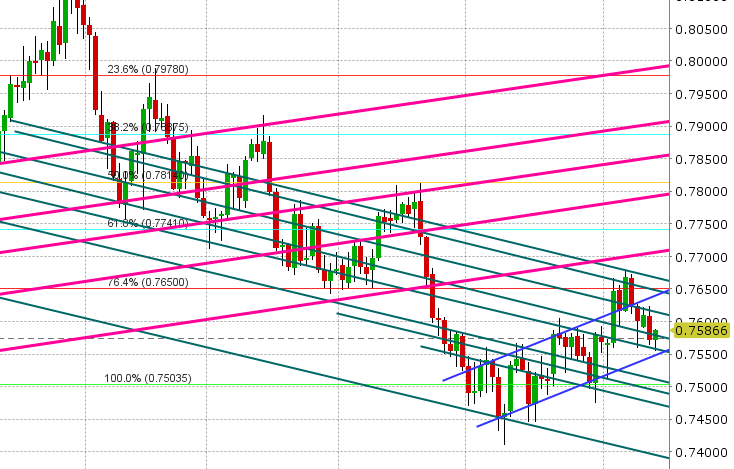

AUDUSD: The Aussie took it on chin yesterday when EURUSD declined, and the move lower took out chart support in the 0.7580s. Buyers have stepped in overnight however at the next support level (0.7560s), and we’re now trying to regain the 0.7580s once again. The RBA’s Lowe spoke last night (more here: https://www.rba.gov.au/speeches/2018/sp-gov-2018-06-13.html) but the speech offered no surprises for markets and so was largely shrugged off. We think AUDUSD follows the broad USD reaction to the Fed meeting today.

-

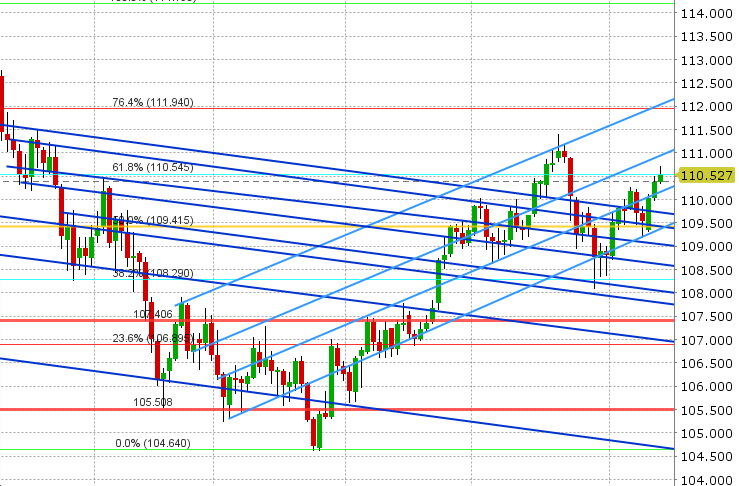

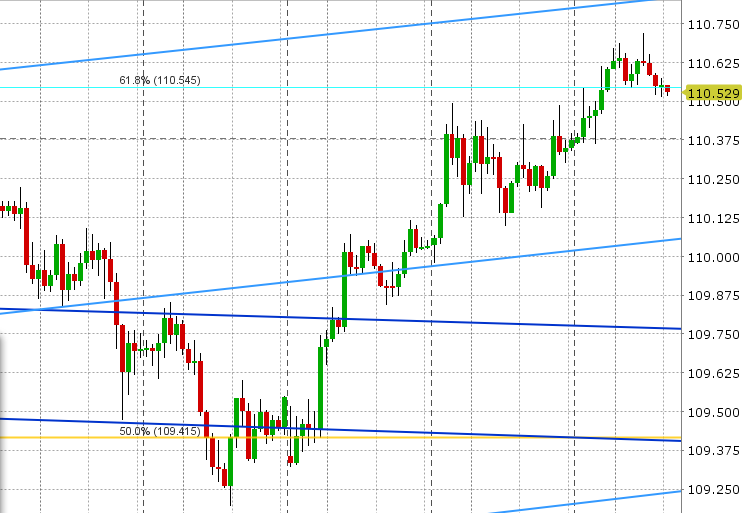

USDJPY:Dollar/yen is inching higher again this morning and traders are currently testing Fibonacci chart resistance in the 110.50s. US equity futures and US yields are not doing much at this hour ahead of FOMC meeting today. Given how far apart near term support and resistance are on the USDJPY chart (110.10 and 110.90), we think today’s range could potentially be large as the Fed announces its latest decision on rates.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.