Broader $USD quiet ahead of US Thanksgiving. USDCAD influenced by options/cross sales. USDJPY position liquidation continues

Summary

-

UPCOMING ECONOMIC DATA TODAY: US Oct Durable Goods (expected +0.4%) at 8:30amET. FOMC Minutes (from Nov 1st Fed meeting) at 2pm. TOMORROW: UK Q3 GDP at 4:30amET (+1.5% expected). ECB Minutes (from Oct 26th meeting) at 7amET. Canadian Sep Retail Sales at 8:30amET (+1.0% MoM expected).

-

CENTRAL BANK/POLITICAL SPEAK: Fed’s Yellen doesn’t say much at NYU last night. Reiterates her feeling that the low inflation dynamic is not transitory. The UK’s Chancellor Hammond is presenting the Autumn Budget to Parliament as we speak.

-

CME OPEN INTEREST CHANGES 11/21: AUD +2207, GBP -2048, CAD +844, EUR -5414, JPY -3457

-

US THANKGIVING ON THURSDAY

-

AUDUSD: The Aussie hasn’t done much since the bounce higher yesterday on slightly hawkish (less dovish) comments from the RBA’s Lowe. Resistance at 0.7600 proved formidable yesterday and it should remain so again today. Resistance now 0.7585, then 0.7600, then 0.7615-0.7625. Support 0.7540-50. While yesterday’s bullish engulfing candle is still intact, AUDUSD still technically remains in a downtrend until 0.7625 breaks to the upside. Expect quiet activity for the rest of the week as US traders will be out on holiday and we have no Australian data points or speakers on tap.

-

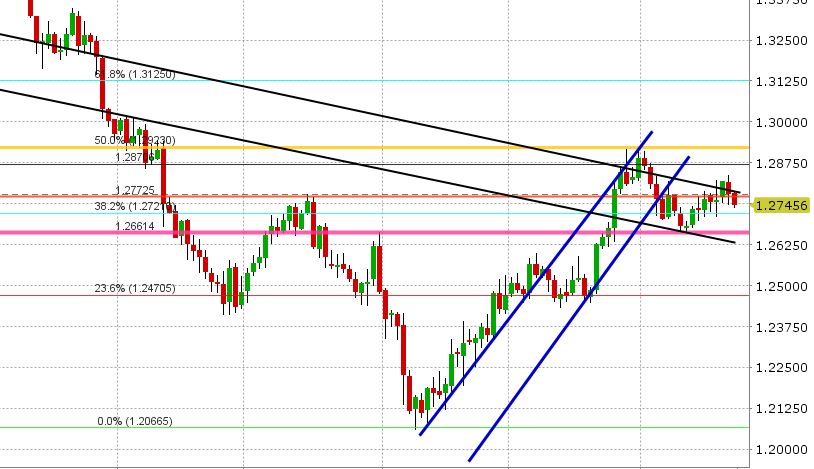

USDCAD: It was a bit of a disappointing day for USDCAD bulls yesterday. The quick look above 1.2830 and the swift pullback (which we noted yesterday) was enough to deter buyers and the EURCAD and GBPCAD cross selling we mentioned picked up steam further. It also feels like yesterday’s massive 1.2750 option expiry was a big influence, because the level acted as a magnet leading up to 10am (the NY cut) and then suddenly the market found a bid again. Technically speaking, yesterday’s action was a bit negative, putting us back below levels we mentioned as support yesterday (those levels are now resistance again)...1.2770s, 1.2790s. The 1.2740-50s have been support so far in London trade. The next support level is 1.2710-20. The latest round of NAFTA talks concluded yesterday with no negative headlines but the major issues remain unresolved. We expect quiet range-bound trade for the remainder of the week and perhaps a little bit of volatility around Canadian Retail Sales tomorrow (because liquidity will be lighter than normal).

-

EURUSD: So the market held the 1.1720s yesterday, which was positive, but it hasn’t done much since. Traders tried a rally in Europe but sellers come in at resistance in the 1.1760s (new upper bound of our downward sloping daily channel). See chart. Expect range bound, pre-holiday trade here as well unless the 1.1710 or 1.1775 gives way. EURGBP buying is trying to be a positive influence for the second day in a row here but it now has resistance to deal with at 0.8890-0.8900. EURJPY just can’t seem to regain the 132s, which is an increasingly negative influence. EUR futures traders liquidated over 5k contracts yesterday while EUR option traders noted steady demand for upside calls. It’s an all-around mix bag right now for EURUSD, hence the range trade.

-

GBPUSD: Very little has gone on with sterling over the last 24hrs, but traders now have a little bit to chew on as the UK’s Hammond just announced weaker than expected growth forecasts for the UK in his budget. GBPUSD is off 30pts, but it’s nothing to write home about. Expect continued range-traded ahead. Support 1.3190-1.3200. Resistance 1.3285.

-

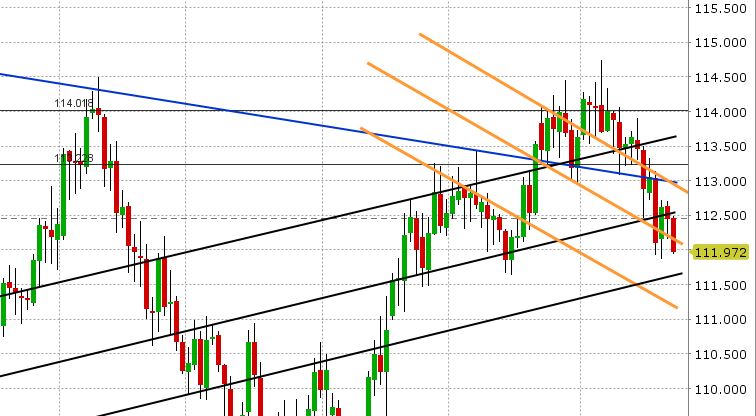

USDJPY: Position adjustment from overextended USD longs (JPY shorts) continues to be the dominant theme in USDJPY right now. Case in point yesterday with yet another purge at CME (open interest now down almost 20k contracts since the middle of last week). All this is occurring despite another record high close for US stocks and firmer US yields, which traditionally correlates to a higher USDJPY. Technically speaking, yesterday’s failure to hold 112.50 level is negative. Support at 112 even is currently holding. Next support comes in at 111.70s. The market has proven this week that it wants to sell rallies (a feeling we have had ever since the “Kuroda” reversal on Nov 6th)

Market Analysis Charts

AUD/USD Chart

USD/CAD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.