Broader USD extends recovery after bullish closing patterns on Friday. GBP bid on positive Brexit headlines. Traders eyeing record US bond issuance on tap for this week.

Summary

-

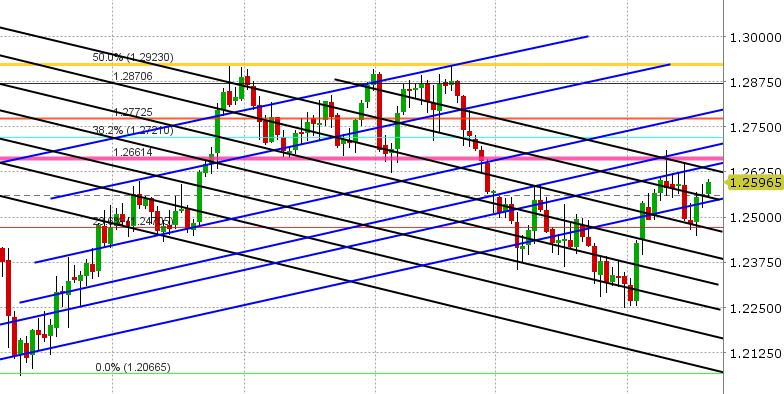

USDCAD: Dollar/CAD extended higher in holiday trade yesterday, and this came after the market scored a bullish outside reversal higher on Friday. Chart resistance at 1.2540-1.2560 gave way yesterday and the market has rallied further overnight after testing the level in Asian trade. Technically speaking, Friday’s closing pattern and yesterday’s follow through opens the door to further gains for USDCAD today. A broad USD rally is supportive of this setup at this hour. It’s going to be quiet start to a holiday shortened week for North American economic data. We’ll get the FOMC minutes (from the January 31st meeting) tomorrow, Canadian Dec Retail Sales on Thursday and Canadian Jan CPI on Friday. Support today is 1.2540-1.2560. Resistance 1.2630-1.2645.

-

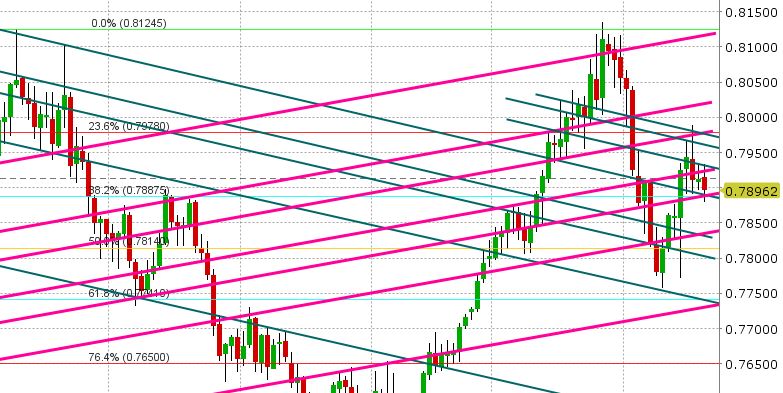

AUDUSD: The Aussie has had a lackluster start to the week after a bearish reversal lower on Friday. Yesterday’s trade saw the market struggle in a tight range, with the 0.7925-0.9735 level resisting and the 0.7885-0.7900 level supporting. This range-bound activity continued overnight, but with a negative tone, as the broader USD recovers further. It’s going to be a very quiet week for Australian and US data, with just the FOMC minutes and the Australian Wage Price Index tomorrow. Options will likely be a factor again this week, with traders talking about a 3.3bln AUD expiry at 0.7950 for tomorrow’s NY cut. Copper is down 2% from Friday’s close, and that’s not helping AUDUSD here. We think AUDUSD holds 0.7885-0.7900 today, but will remain range-bound. It’s interesting to note the purge in futures positioning in the week ending Feb 13 (CFTC COT). The move from 0.7900 down to 0.7750 and back up to 0.7850 shook out both longs and shorts to the tune 26k contracts (which is rather large for the AUD contract).

-

EURUSD: Traders are piling in on the short side in EURUSD after the bearish outside reversal pattern recorded on Friday. Yesterday’s holiday session saw the 1.2370s tested and while the market bounced off the level into the London close, traders in Asia and Europe have been quick to sell EURs again today. The market is now testing the next support zone, which is 1.2325-1.2350. EURJPY, while quiet, is struggling to regain the 132.50s. USDCNH has broken back above 6.32 (mid-channel resistance). USDJPY broke through 106.40 in thin trade yesterday, and hasn’t looked back. All this, combined with the overhang from Friday’s bearish reversal, is not helping EURUSD this morning. There’s very little on the US and European economic calendar this week. The German ZEW survey came in mixed overnight and wasn’t a market mover. There’s the FOMC minutes tomorrow and then the German IFO survey on Thursday. There’s a 1.1bln EUR option expiry at 1.2390-1.2400 today, but we don’t really see that being a factor unless the 1.2360s give way in the next hour. We think EURUSD holds and perhaps recovers off 1.2325-1.2350 today, but there won’t be much momentum to it. We would also watch US yields this week as the US Treasury will be auctioning off a quarter trillion in new bonds (record for one week). We think strong anticipated demand for this supply of US paper is underpinning the USD a little bit to start the week, which makes the results of these auctions important (any disappointment in uptake will likely see USD sellers emerge). China is back from the Lunar New Year holidays on Thursday.

-

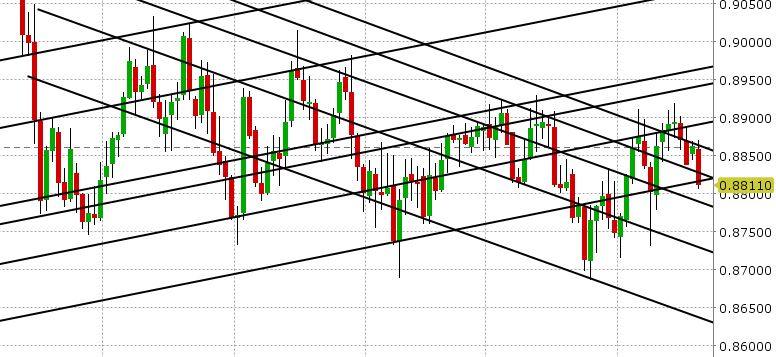

GBPUSD: Sterling has been on a bit of a roller coaster ride since Friday’s close. While Friday’s closing pattern wasn’t as negative as the pattern for EURUSD, the GBP had a hard time countering the broader USD strength yesterday. The market regained the 1.4010 support level going into the London close, but then gave it back in early Asian trade overnight. When support in the 1.3960-70s gave way, we saw further selling and then suddenly a report circulated from Business Insider saying the EU parliament wants to negotiate “privileged” single market access for the UK post Brexit. This gave us some immediate volatility...up to 1.3980, then back to 1.3950, then up again now towards 1.40 again. One can debate the merits of this article, but traders have been buying GBP across the board since. This is even more apparent on the EURGBP cross, which has plunged back into the low 0.88s. We think GBPUSD extends the positive momentum from this morning’s headlines, and tests resistance at 1.4010-1.4025 at some point today. A close today above 1.4040 would do much to restore the upward momentum GBPUSD had early last week. There are a few things to watch out for this week in the UK. The UK employment figures are out tomorrow. Four BOE members will be speaking tomorrow as well, including Governor Carney, at 9amET in London. Finally, we get Q4 UK GDP on Thursday.

-

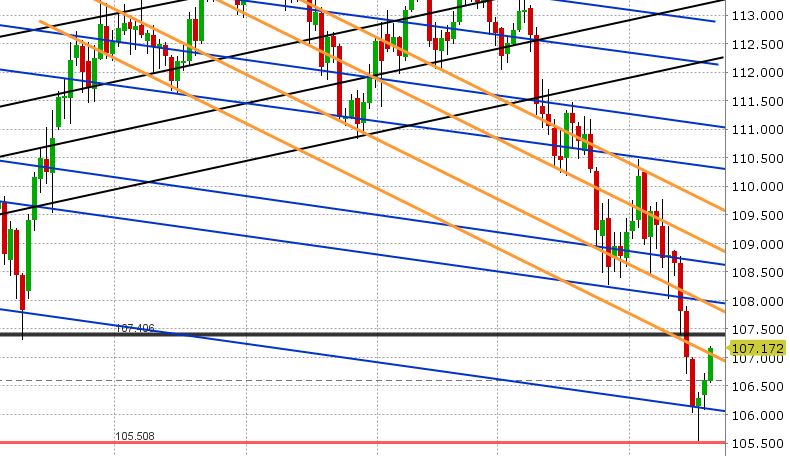

USDJPY: The recovery in Dollar/yen continues as the 106.40 resistance level gave way in quiet holiday trade yesterday. The market is now testing downward sloping trend-line resistance at 107.00-107.15. The latest read on futures market positioning as of Feb 13 (released on Friday), shows a market that still hasn’t capitulated on its entrenched USD long (JPY short) position. In fact, the net long went up slightly as USD longs added in the move from 109.50 down to the mid 107s! US stock futures are slightly softer to start the week and US 10 yr yields are back at 2.90, but this is not having much effect this morning. USDJPY continues to trade in its own world at the moment, but we have pay attention, because it’s been driving the broader USD lately.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

EUR/GBP Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.