Broader USD extends gains following upbeat testimony from the Fed's Powell. Weak UK CPI/political turmoil sees GBPUSD trade to new swing lows. Powell speech before House panel + Fed's Beige Book on deck for today.

Summary

-

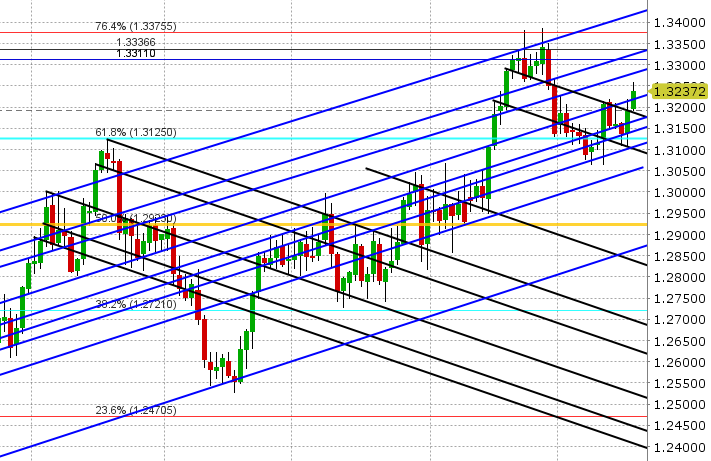

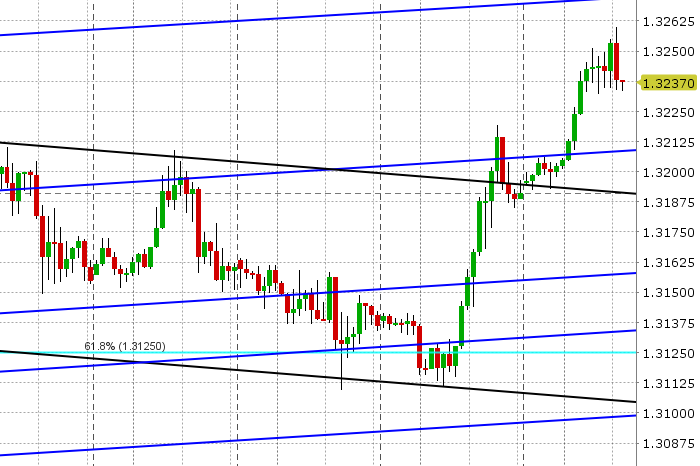

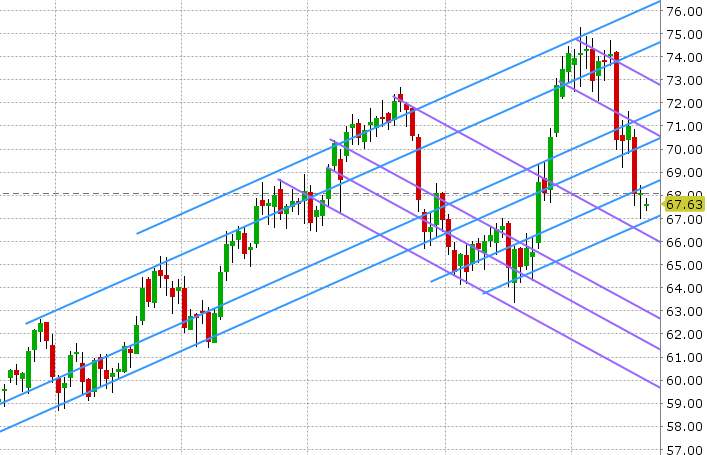

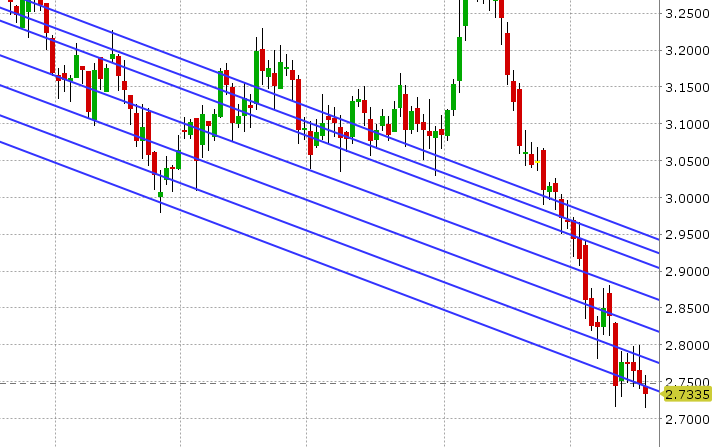

USDCAD: Dollar/CAD is extending gains this morning after broad based USD strength yesterday saw traders attack trend-line resistance in the 1.3210s. Powell’s testimony was the catalyst for the move higher, as the Fed chairman spoke positively about the economy and reiterated the need for gradual rate hikes when speaking before the US Senate Banking Committee. Bearish NY closes for EURUSD, GBPUSD and AUDUSD yesterday added to the broad USD strength going into Asia overnight, and so we’ve seen USDCAD breach the 1.3210s in search of the next upside resistance level (which we would argue is the 1.3270s). Today’s North American session features US June Housing Starts and Building Permits (both just released below expectations), followed by Powell “Round 2” at 10amET (this time he speaks before a House of Representatives panel), the weekly DOE oil inventory report (10:30amET) and then the Fed’s Beige Book report at 2pmET. We think USDCAD recedes here a bit but will find support on dips. August crude oil is remarkably quiet this morning following yesterday’s August option expiry. Traders are expecting a draw of 3.5M barrels in today’s inventory report.

-

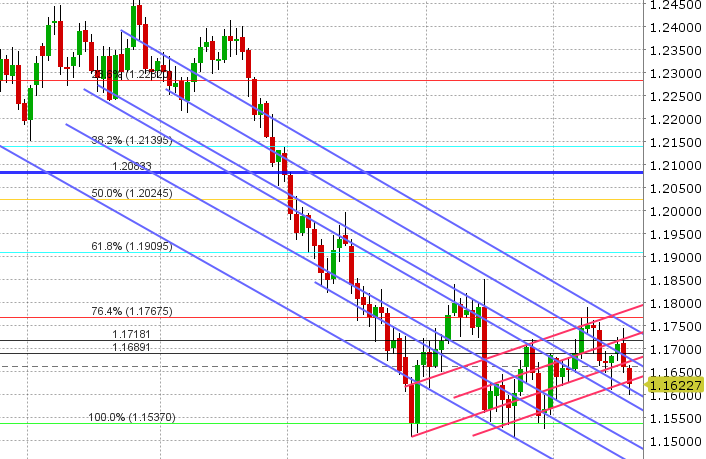

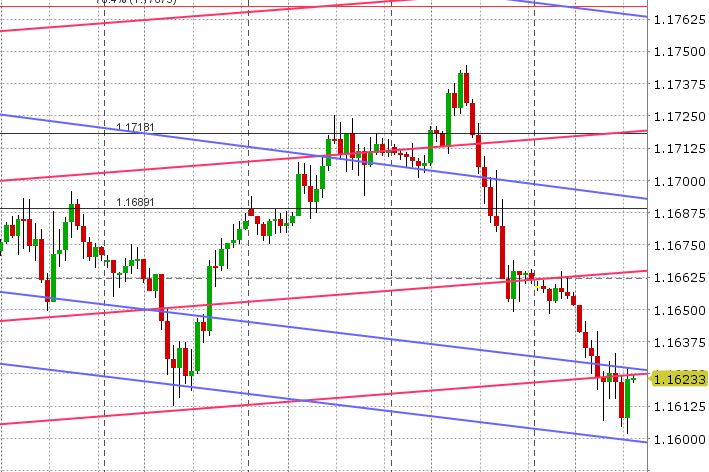

EURUSD: Euro/dollar is extending losses this morning after hawkish comments from the Fed’s Powell led to a bearish outside day being logged on the charts yesterday. An attempt was made to regain the 1.1660s support level in Asian trade, but this failed quickly and allowed traders to take the path of least resistance lower. USDCNH then broke above the 6.7250-6.73 level without any comments from China’s PBOC (recall they were quite vocal about the exchange rate the last time we traded this high). Combine this with some profit taking in EURJPY and yet more pressure on GBPUSD around the 4am hour and we have the market scrambling for support now in the low 1.16s. While we could see a bounce here today because of trend-line support at 1.1600 and 2blnEUR+ of options rolling off around 1.1610-30 level, we think EURUSD will be sold on rallies at this point given the swift change in technicals.

-

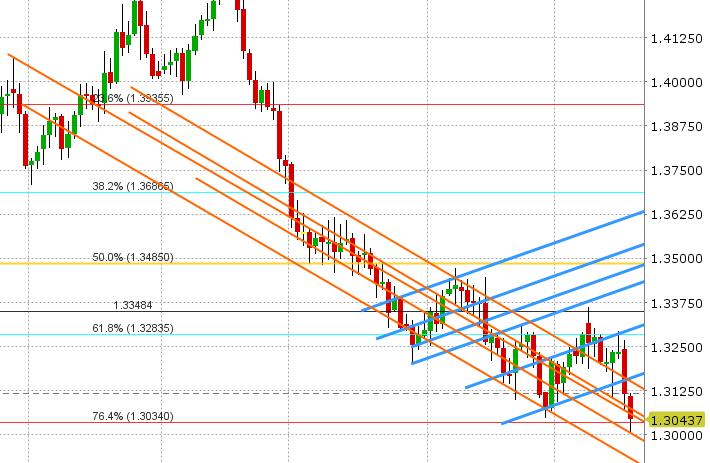

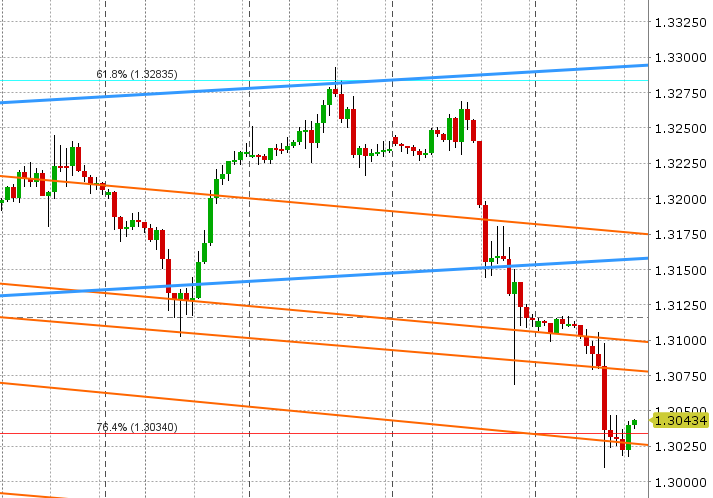

GBPUSD:Sterling is collapsing to new swing lows today following weaker than expected UK CPI numbers for June (+2.4% YoY vs. +2.6%), reported earlier this morning. Today’s move follows yesterday’s cascade lower in GBPUSD on fears of Theresa May’s leadership being threatened once again. While the UK PM narrowly avoid defeat on the customs union vote (more here: https://inews.co.uk/news/brexit/theresa-may-survives-ultra-tight-brexit-vote-on-uk-joining-a-customs-union/), the damage was done to the charts, and it’s not surprising to see GBPUSD lower again following weak data. While the market has found some support now in the 1.3030 area as EURUSD finds a bid and EURGBP hesitates with a breakout higher, the longer term downward trend has reasserted itself quickly here and so we see continued pressure to sell sterling on rallies. Resistance today is 1.3070, 1.3100, then 1.3150.

-

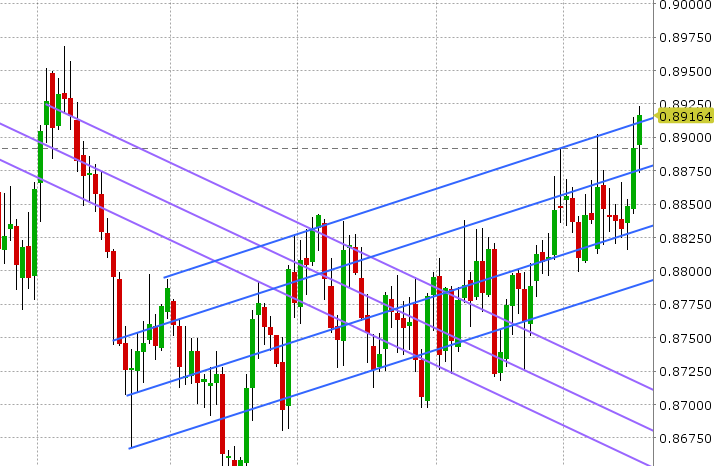

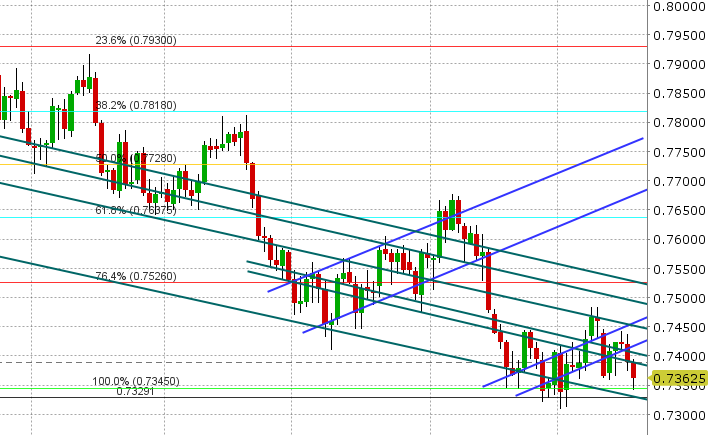

AUDUSD: The Aussie is trading weaker this morning as well, following EURUSD lower overnight after AUDUSD lost the 0.7390s in NY trade yesterday. Copper is trading lower again too, and is testing last week’s low. Some horizontal support in the 0.7340s and some weaker than expected Housing Starts (just out), is helping the market bounce now however, and we have another large option expiry at the 0.7400 level today (~1blnAUD) that might help the cause. We think AUDUSD consolidates today and possibly sees short covering ahead of Powell’s second speech before the House and the Australian employment report out later tonight (9:30pmET). Traders are expecting +17k jobs for June.

-

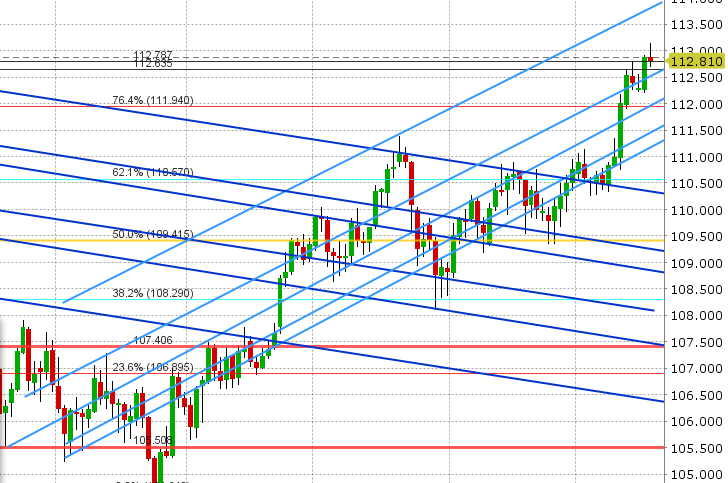

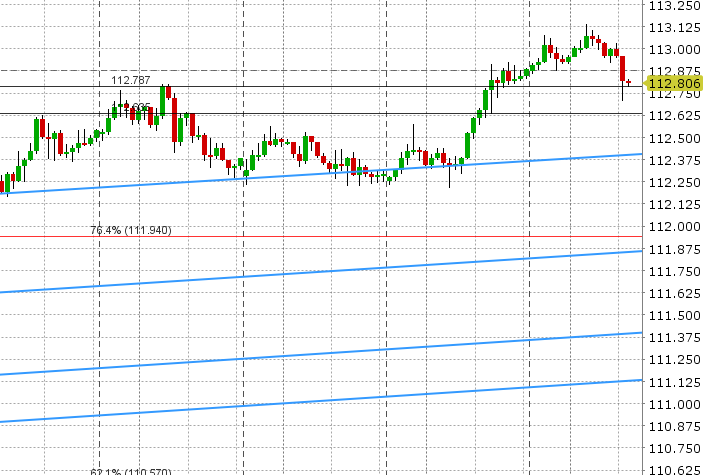

USDJPY:Dollar/yen extended higher in overnight trade, following a strong rally back above the 112.50s yesterday. The psychological 113 level was breached to the upside on a couple of occasions, but sellers have hit the market. We’ve also just seen a wave of broad JPY cross selling come in now as the broader USD backs off its daily high. While it’s not surprising to see some profit taking here from USD longs, we still support on dips to 112.60.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

August Crude Oil Daily

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.