Broad bout of risk aversion hits markets ahead of G7 meeting. CAD traders await Cdn jobs numbers. JPY and USD broadly higher.

Summary

-

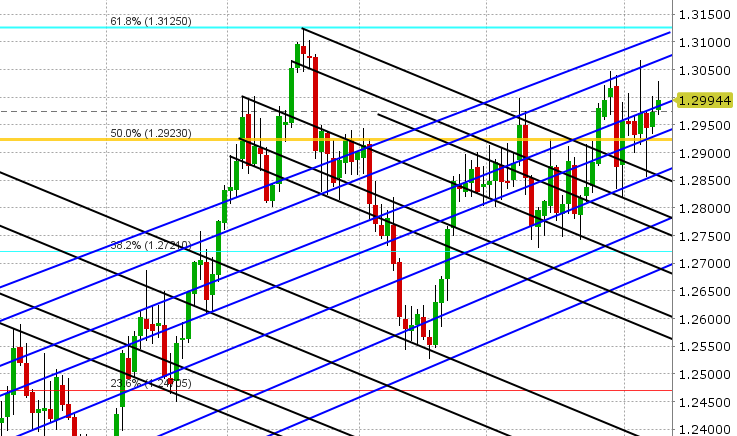

USDCAD: Dollar/CAD has broken above trend-line resistance in the 1.2980s as a broad bout of risk aversion hits markets globally this morning. Call it trade rhetoric angst leading up to G7 summit (ie. Trump), a warning from AAPL about new parts orders, continued selling in emerging markets, the IMF bailout in Argentina, renewed selling in Italian assets...but stocks everywhere are in the red this morning, bond yields are trading higher, the JPY is being bought and the broader USD is strong across the board. USDCAD traders have even more to think about, as Canada reports Housing Starts and Employment figures for May at 8:30amET. Markets are expecting +23k jobs created, 5.8% on the unemployment rate, +3.2% YoY on hourly earnings, and +220k on Housing Starts. Should we get negative numbers, expect USDCAD to surge as there’s very little chart resistance until the 1.3070s. Should the numbers surprise to the upside, expect the 1.2980s (support) to give way and the 1.2925-40 level to be the next stop. Next support after that is 1.2875. There are also some large option expiries in play today as well (1.2bln+ between the 1.2960-70 strikes and another 1.2bln at the 1.3000 strike). These roll off at 10amET.

-

EURUSD: Euro/dollar has been a colossal disappointment for longs this morning after a weak NY close yesterday (market closed below support at 1.1800). This allowed for selling when the “risk-off” mood took hold in early European trading. EURJPY has sold off violently after failing to close above 130 yesterday. EURGBP has been absolutely crushed since breaking out early yesterday as well (now goes down as a failed breakout). There’s even talk of emerging market central banks leaning on the market here as they hedge USD sales from recent FX interventions. The German trade balance figures for April came in mixed today while Industrial Production missed expectations (-1% MoM vs +0.3% expected). Support in EURUSD today checks in at 1.1700-1.1720.

-

GBPUSD: Sterling has been trading in a range-bound pattern since topping out near-term yesterday. The false breakout and subsequent collapse in EURGBP is helping GBPUSD stay above trend-line support in the 1.3380s amid the bout of global risk aversion this morning. Expect the trade to quickly focus on headlines leading up to the G7 summit in Quebec.

-

AUDUSD: The Aussie is getting crushed today after weak NY close yesterday sowed the seeds, similar to EURUSD. We closed below chart support in the 0.7620s and could not recover in Asian trade overnight. When everything started to sell off in early European trade, so did the AUD and it’s been a stair step fall down to the 0.7580s (first support) and then the 0.7560s (next support). AUDUSD traders continue to ignore copper prices for the most part, with today’s price action being another example of that. We think so goes the CAD, so goes the AUD near term. The Aussie is showing a increased sensitivity to the global trade tension rhetoric. Therefore, we’d pay close attention to G7 headlines today and this weekend.

-

USDJPY:The yen has been the biggest beneficiary of the moves to reduce risk globally this morning. Yesterday’s suspicious intra-day flash crash in US yields damaged the USDJPY chart (piercing support in the 109.80s) and while the market bounced off the 109.50s and higher going into Asian trade, the market could not regain the 109.80s and so traders found it easier to resume selling. That selling picked up steam as the Nikkei, global equities and DM bond yields sold off. Chart support in the 109.40s gave way over the last hour but the market is trying to regain the level as we write. It’s all going to be about the G7 today given the lack of scheduled economic data for the US.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.