Brexit D-day looms for sterling traders

Summary

-

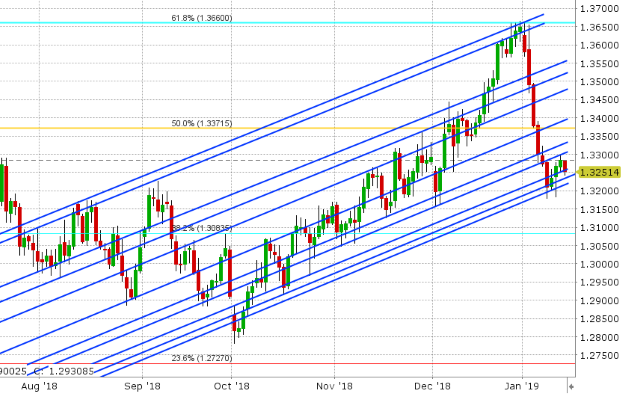

USDCAD: Dollar/CAD continues to meander in the 1.3250-1.3300 range this morning as competing flows leave the market a bit directionless. We’re seeing some broad demand for USD out of Europe (more below), but this is getting cancelled out by even stronger demand for CAD (especially on the crosses). February crude oil prices remain trapped in the 50.50-51.50 range. US core PPI for December was just released -0.1% MoM vs +0.2% expected, and +2.7% YoY vs +2.9% expected. We think the market may leak lower here if it cannot recover from the weak PPI figures and regain the 1.3250s. Otherwise, expect more range trading in the mid to high 1.32s.

-

EURUSD: The Euro has fallen lower this morning to test support in the 1.1410-20s. We see today’s move coming from a technical rejection of the 1.1490 area in overnight trade, the continued “buy-the-dip” price action we’re seeing in USDCNH, and fears that German growth will contract in 2019. The angst comes as Germany reported 1.5% GDP growth for all of 2018 this morning (weakest year since 2013) and this headline adds to last week’s dismal German Industrial Production figures. With the market now back below the 1.1450s, the sellers are technically back in charge near term, but we think buyers will attempt a bounce today.

-

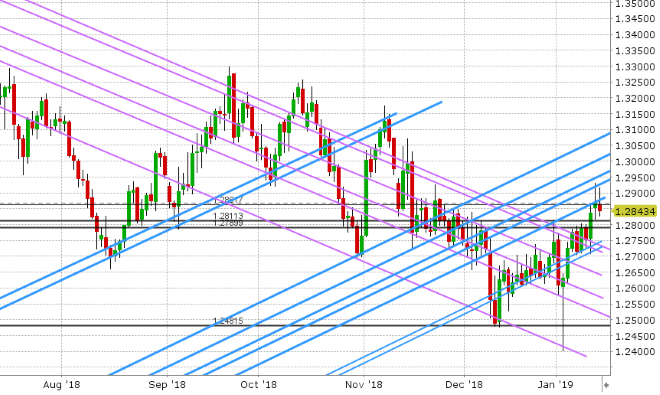

GBPUSD: Sterling news flow is stealing the spotlight this morning as traders gear up for a volatile afternoon of price action, which is expected leading up to and following the meaningful Brexit vote before UK Parliament. The exact vote time has still not been announced, but set aside the 2-4pmET time slot if you trade the pound. Option traders are pricing in significant volatility today if we look at overnight break-evens (160pts). GBPUSD is currently trading with a negative tone after chart support in the 1.2870s gave way during early London trade. Theresa May is expected to lose today’s vote, and so we think the “margin of defeat” will likely play into trader psychology (in other words, how badly does she lose?). If it’s not so bad, perhaps we’ll get a GBP bid. If it’s a landslide defeat, queue the sellers once again. Given the significant volatility priced into the options market today, we think chart support is realistically 1.2710-40 and resistance is 1.2960-1.3030.

-

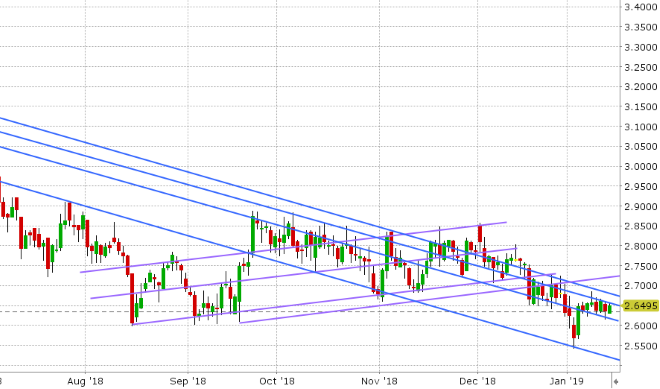

AUDUSD: The Aussie bounced higher yesterday as we might have thought, but the market ran into resistance at the 0.7220s. If we combine this with copper prices hitting resistance overnight and the EURUSD and GBPUSD selling we’ve been seeing today, it’s not surprising to see AUDUSD weaker heading into NY trade this morning. We think the focus may now turn, unfortunately though, on a hunt for buyers in the 0.7150-0.7180 area.

-

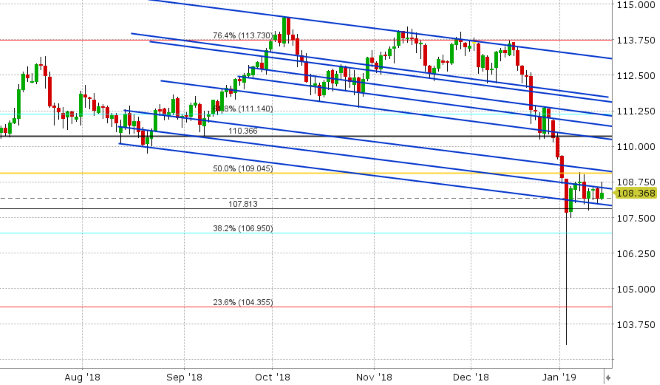

USDJPY: Dollar/yen successfully bounced off trend-line support at the 108.00 level yesterday, and it’s getting some more help today from the Shanghai Composite’s and the S&P’s positive response to another round of Chinese stimulus, announced overnight. More here: https://www.reuters.com/article/us-china-economy/china-signals-more-stimulus-as-economic-slowdown-deepens-idUSKCN1P9090. While this may be good news for risk sentiment today, the S&Ps have since slipped back down and USDJPY is trading back below chart resistance in the 108.50s. We think a close above the 108.50s will invite buyers into the 109 level, but we’d need the S&Ps to recover higher too. Failure to close above the 108.50s will likely lead to further choppy price action in the 108.00-108.50 range.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

February Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.